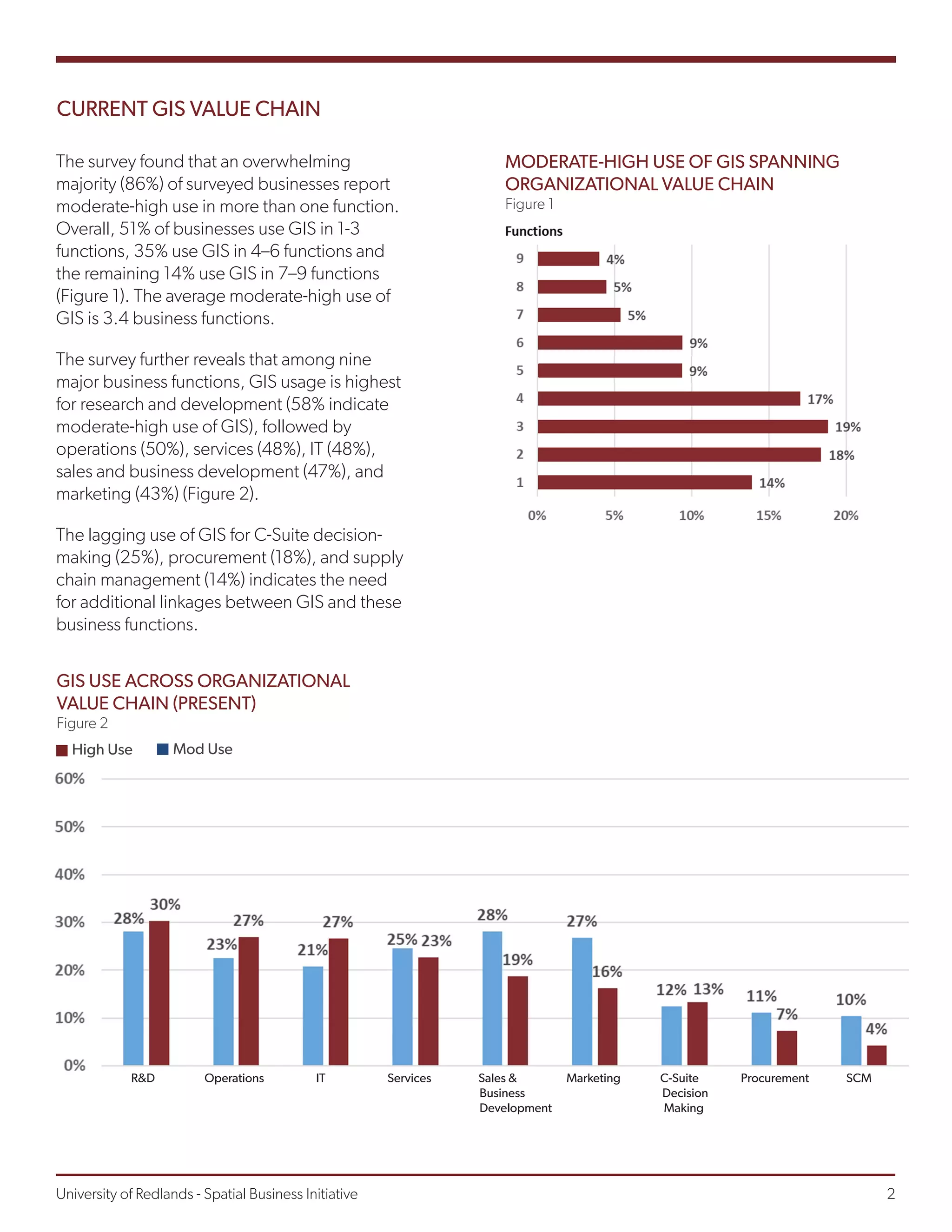

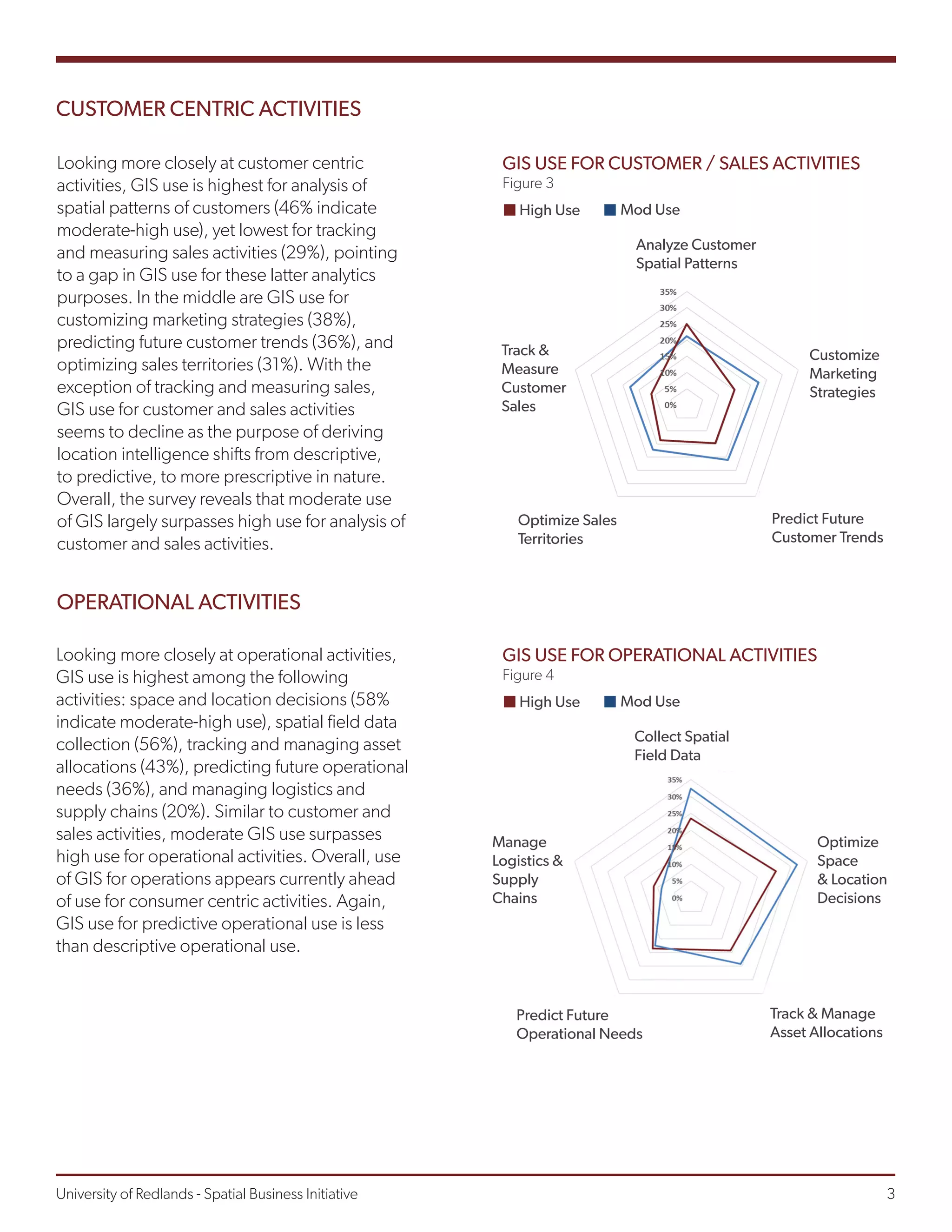

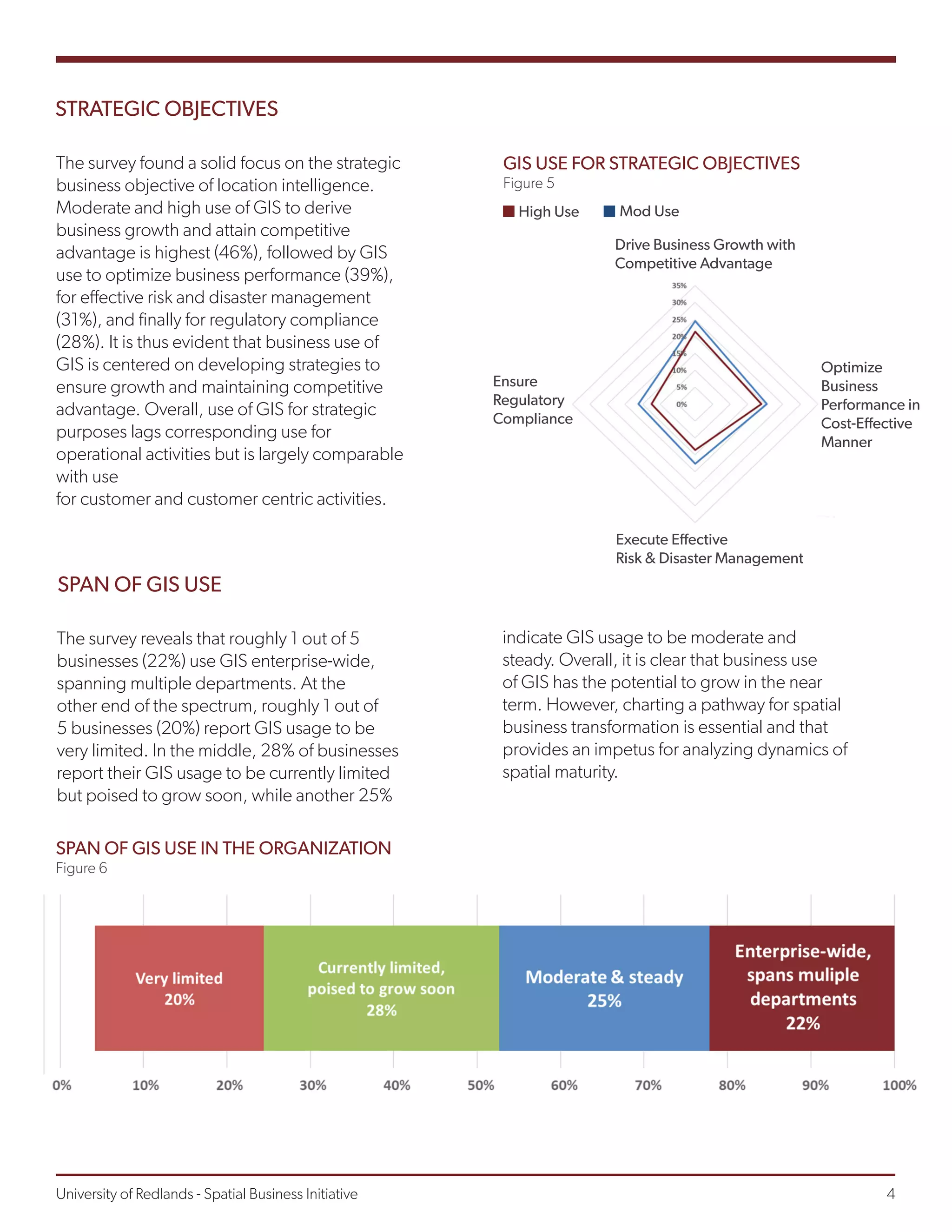

The document discusses the findings of a survey on the use of geographic information systems (GIS) and location analytics in the private sector. Some key findings include:

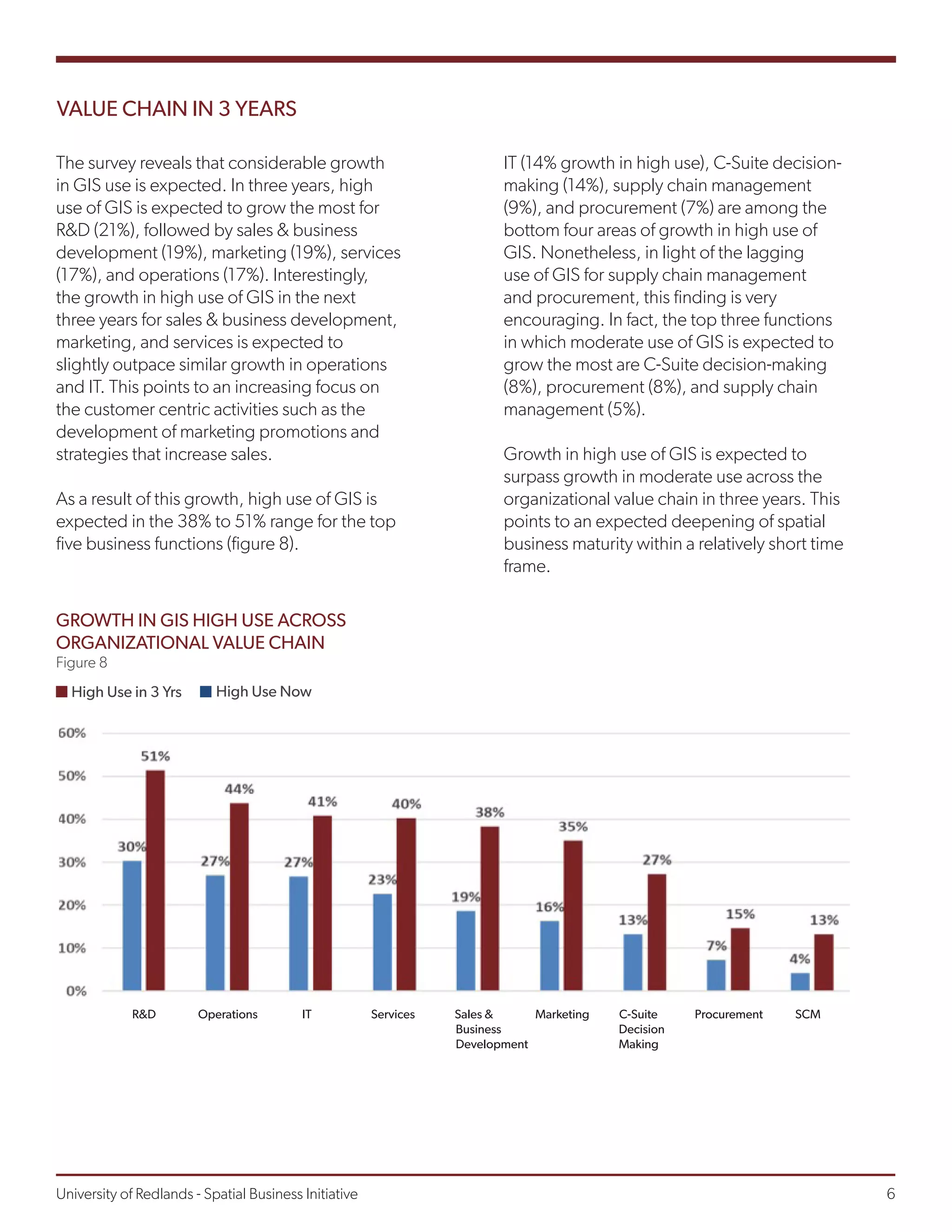

- GIS is used across multiple business functions in most companies, with the highest use in research and development, operations, and services. Use is expected to grow substantially in areas like sales and marketing over the next three years.

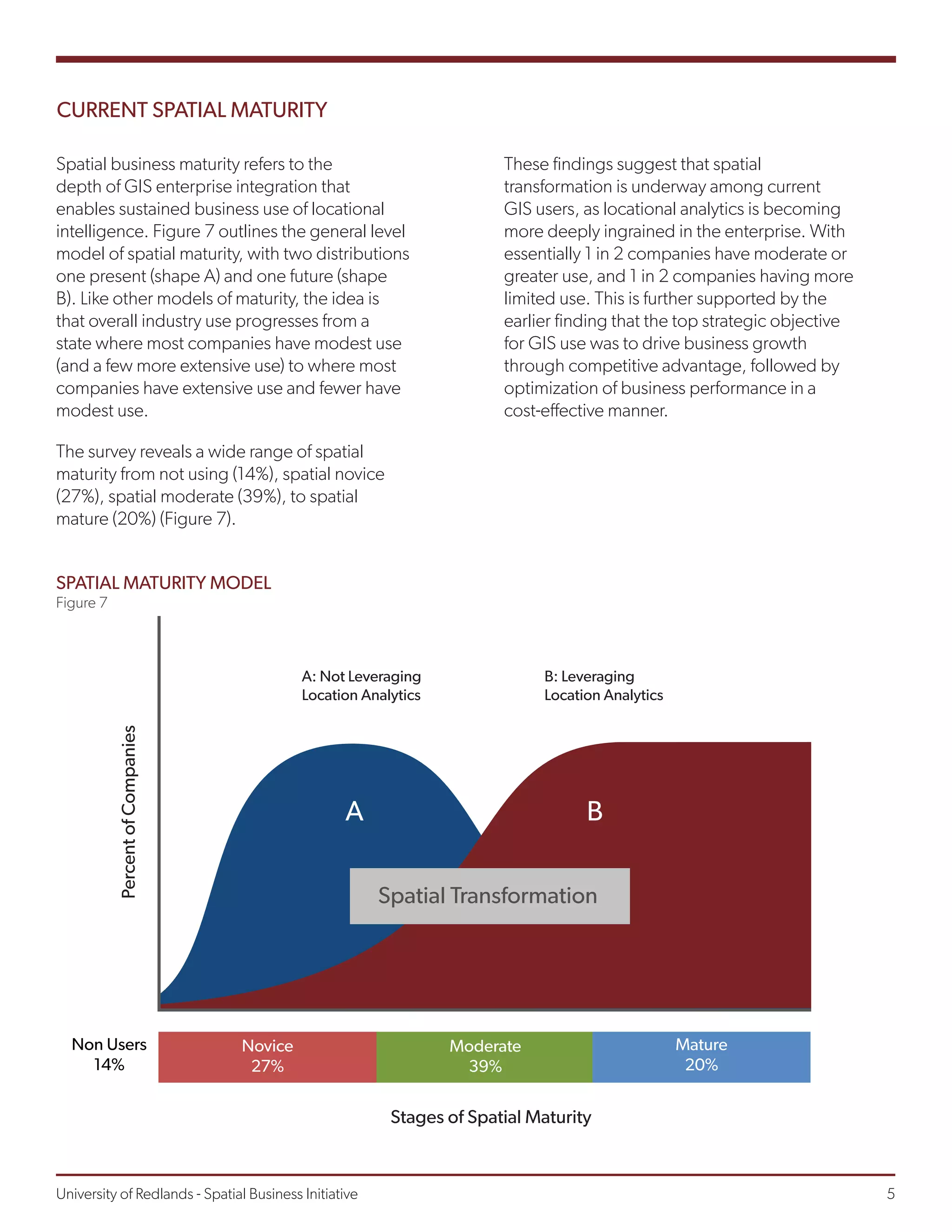

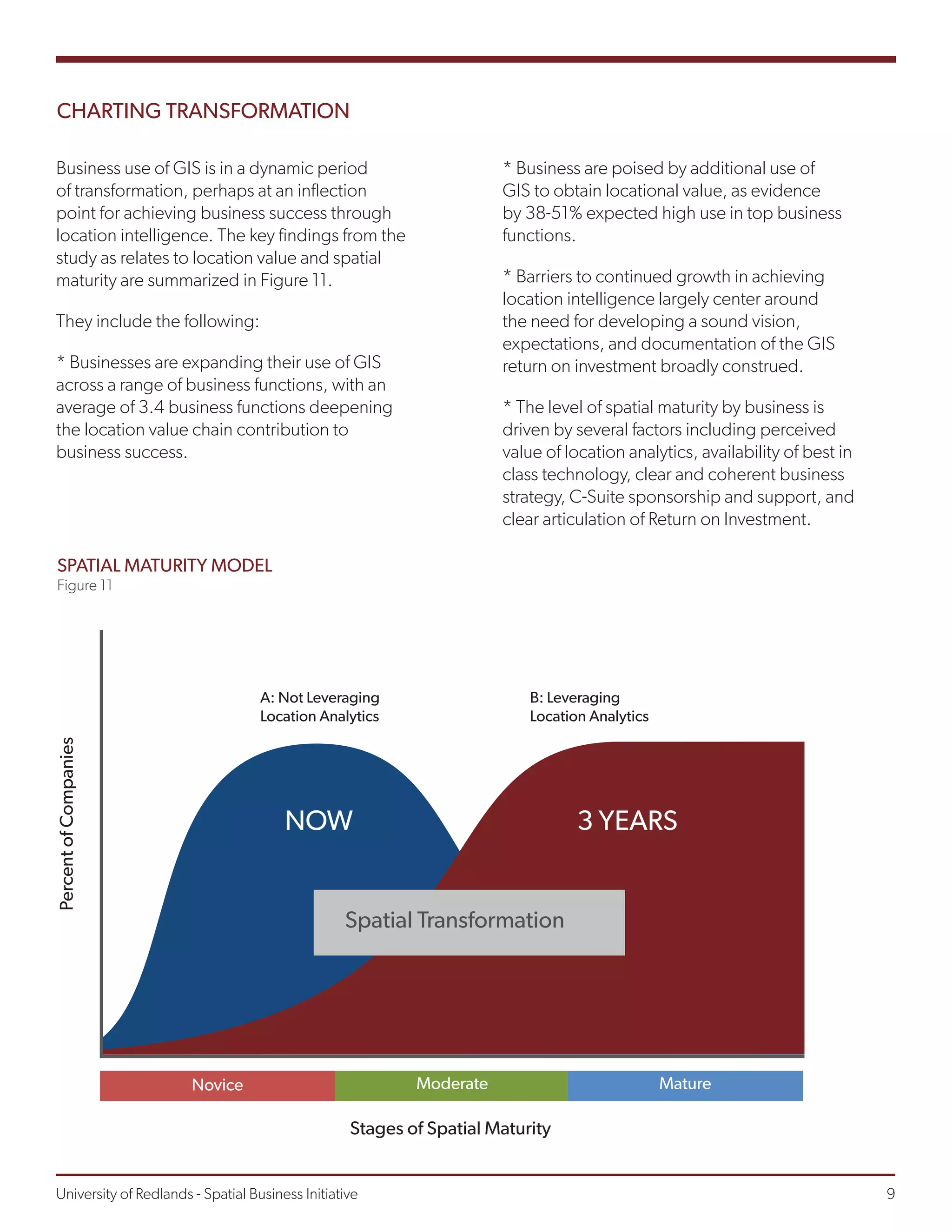

- About a quarter of surveyed companies have achieved high spatial business maturity in their use of location intelligence, while over half have more moderate use. Most companies indicate potential for growth.

- GIS provides value for both customer-focused activities like analyzing customer patterns and optimizing sales, as well as operational activities like facility planning and logistics