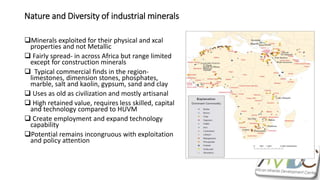

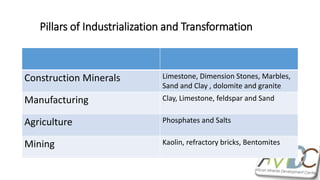

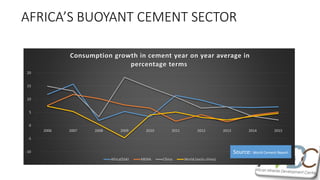

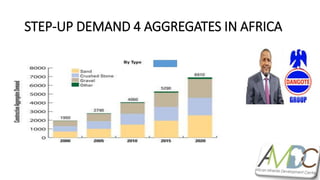

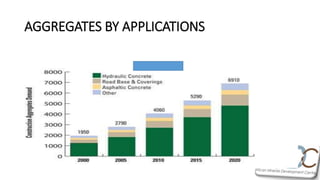

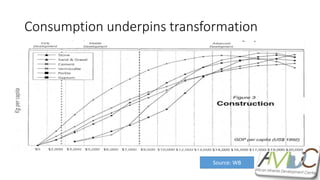

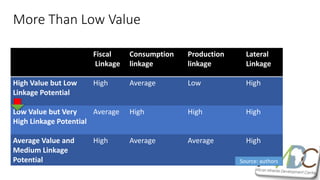

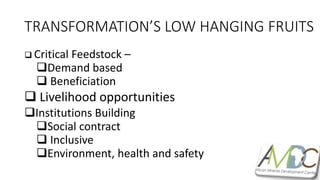

This document discusses how harnessing opportunities in artisanal and small-scale mining (ASM) of industrial minerals can help transform economies. It argues that past interventions have focused mainly on gold and gemstones, neglecting industrial minerals which have greater potential to link with other sectors. Industrial minerals like limestone, sand, and clay are widely found across Africa and can create jobs while supporting construction, manufacturing, and agriculture. The document calls for reframing these "low value" minerals as "neglected development minerals" and establishing supportive policies and institutions to develop them in a way that achieves broad-based sustainable growth.