This document discusses various methods for valuing a company, including:

1. The price-earnings (P/E) ratio method, which values a company based on multiplying its earnings per share by an appropriate P/E ratio.

2. The net assets method, which values a company based on the value of its tangible and intangible assets minus its liabilities.

3. Other methods like dividend-based approaches, discounted cash flow analysis, and cash flow-based valuations.

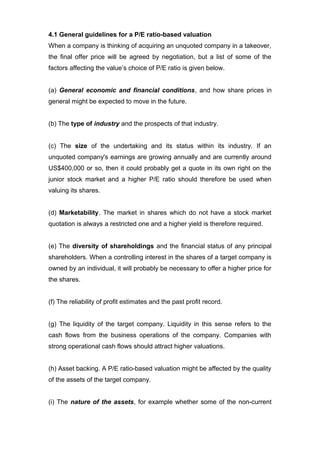

It provides guidelines for determining an appropriate P/E ratio and discusses factors to consider when using the net assets or P/E ratio methods to value an acquisition target.

![It regularly pays 50% of earnings as dividends, and with reinvested earnings

is expected to achieve 5% dividend growth each year. Summarized details of

two listed companies in the same industry as Mackerel are as follows.

Salmon Trout

Gearing (total debt/total equity) 45% 10%

Equity beta 1.50 1.05

The current Treasury bill yield is 7% a year. The average market return is

estimated to be 12%. The new shares will be issued at a discount of 15% to

the estimated post-issue market price, in order to increase the prospects of

success for the share issue. What will the issue price be?

Solution

Using the CAPM, we begin by deciding on a suitable β value for Mackerel's

equity. We shall assume that since Mackerel's gearing is close to Trout's, a β

of 1.05 is appropriate. The cost of Mackerel equity is 7% + [(12 − 7)% × 1.05]

= 12.25%. This can now be used in the dividend growth model. The dividend

this year is 50% of $1,500,000 = $750,000. The total value of Mackerel's

equity is (10.05) (0.1225.05) $750,000 − = $10,862,069

There are 3,000,000 shares, giving a market value per share of $3.62. Since

the shares that are offered to the public will be offered at a discount of about

15% to this value, the share price for the market launch should be about 85%

of $3.62 = $3.08.

7 The discounted future profits method of valuation

The discounted future profits method of share valuation may be appropriate

when one company intends to buy another company and to make further

investments in order to improve profits in the future. The maximum price the

purchasing company should pay is the present value of the future cash flows

resulting from the acquisition.

The future cash flows from the acquisition are:

(a) As cash outflows, the cost of any additional investment in non-current

assets and working capital

(b) As cash inflows, the cash operating profits from the business. Cash

operating profits can be estimated as the operating profit before interest and

tax, plus depreciation charges (since depreciation is not a cash expense).

The valuation might be based on expected future cash flows for a limited

number of future years. This is because:](https://image.slidesharecdn.com/chaptersix-companyvaluationsfm-130127053615-phpapp01/85/Chapter-six-company-valuation-sfm-14-320.jpg)