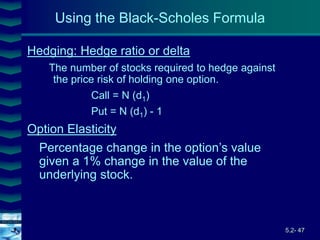

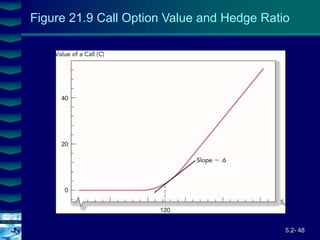

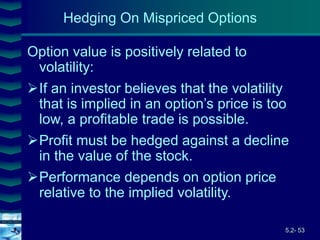

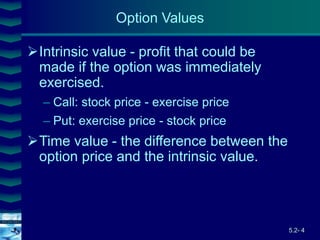

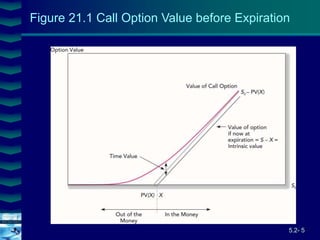

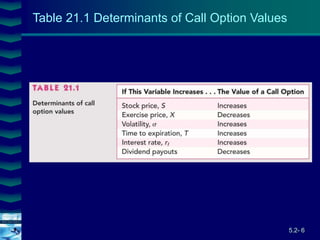

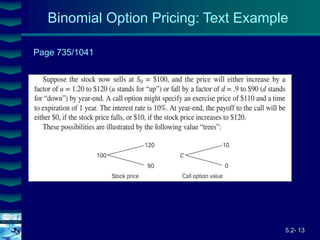

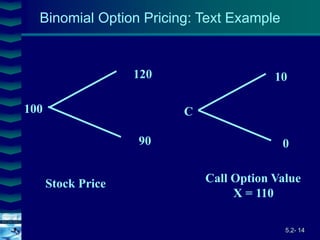

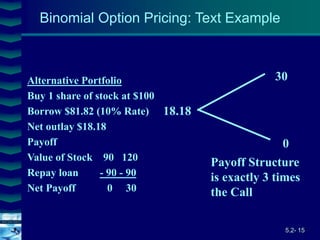

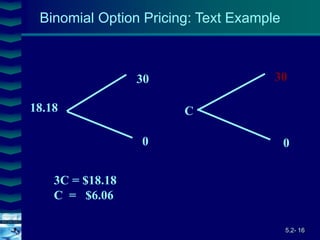

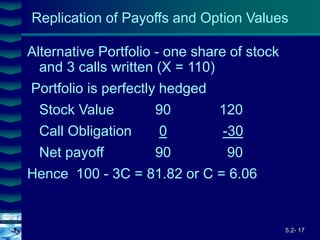

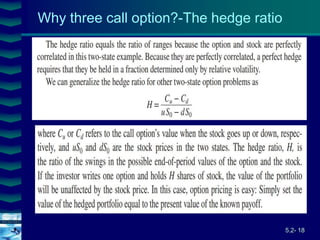

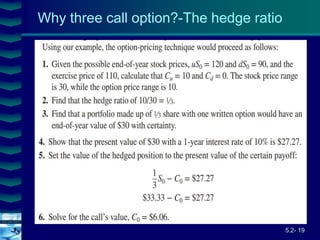

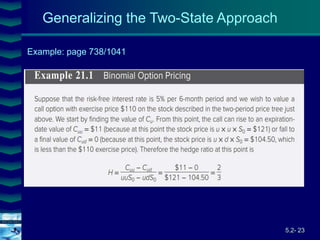

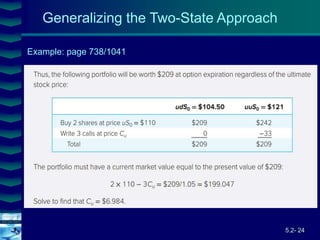

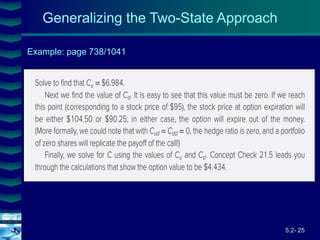

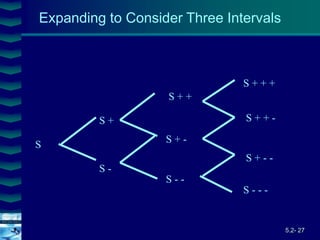

This document covers option valuation and pricing models. It introduces intrinsic and time value of options, restrictions on option values, and binomial and Black-Scholes option pricing models. The binomial model uses a multi-period tree approach to value options while the Black-Scholes model uses a partial differential equation and provides closed-form solutions. Both models require estimates of volatility to determine appropriate hedge ratios. The document also discusses hedging strategies using mispriced options.

![5.2- 33

Cover

image

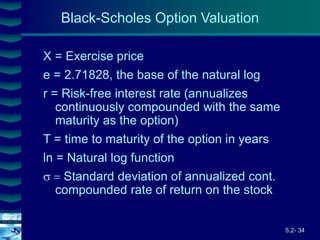

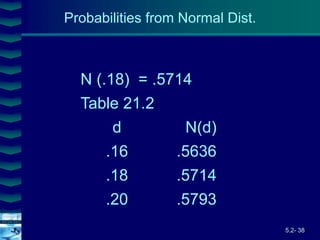

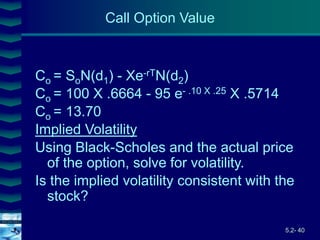

Co = SoN(d1) - Xe-rTN(d2)

d1 = [ln(So/X) + (r + 2/2)T] / (T1/2)

d2 = d1 + (T1/2)

where

Co = Current call option value.

So = Current stock price

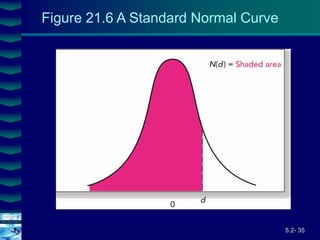

N(d) = probability that a random draw from a

normal dist. will be less than d.

Black-Scholes Option Valuation](https://image.slidesharecdn.com/ch5-2optionvaluationeng-230524025403-a4b26fa8/85/Ch5-2-Option-Valuation-Eng-ppt-33-320.jpg)

![5.2- 36

Cover

image

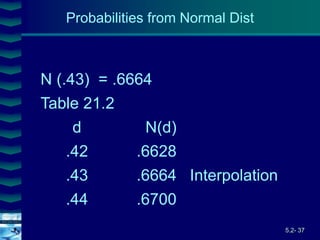

So = 100 X = 95

r = .10 T = .25 (quarter)

= .50

d1 = [ln(100/95) + (.10+(5 2/2))] /

(5 .251/2)

= .43

d2 = .43 + ((5.251/2)

= .18

Call Option Example](https://image.slidesharecdn.com/ch5-2optionvaluationeng-230524025403-a4b26fa8/85/Ch5-2-Option-Valuation-Eng-ppt-36-320.jpg)

![5.2- 45

Cover

image

Put Value Using Black-Scholes

P = Xe-rT [1-N(d2)] - S0 [1-N(d1)]

Using the sample call data

S = 100 r = .10 X = 95 g = .5 T = .25

95e-10x.25(1-.5714)-100(1-.6664) = 6.35](https://image.slidesharecdn.com/ch5-2optionvaluationeng-230524025403-a4b26fa8/85/Ch5-2-Option-Valuation-Eng-ppt-45-320.jpg)