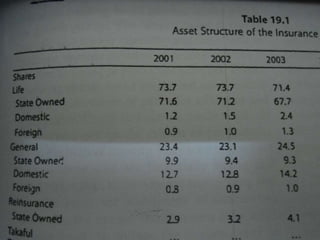

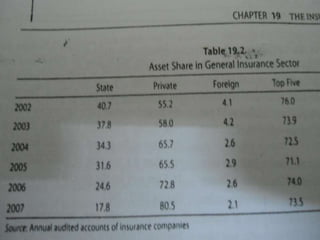

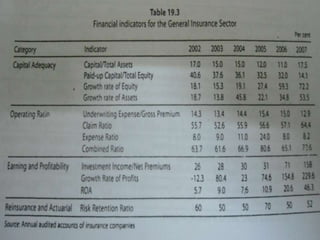

The document summarizes the insurance industry in Pakistan. It discusses the history and types of insurance companies including life insurance companies, general insurance companies, and Takaful insurance companies. It also discusses the performance and growth of the insurance industry from 2002-2007, including increases in assets, capital adequacy ratios, reserves, and profits of insurance companies. The challenges faced by the industry are also mentioned.