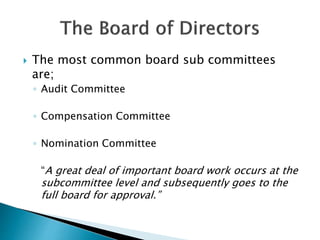

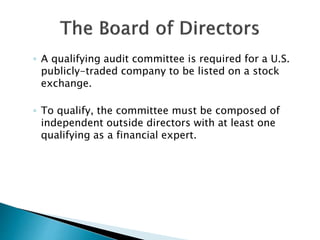

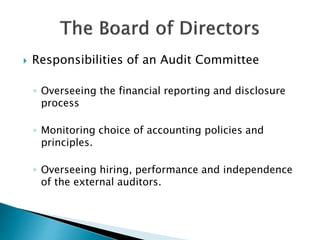

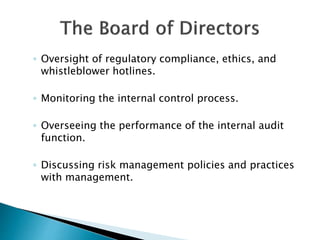

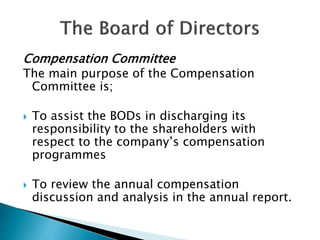

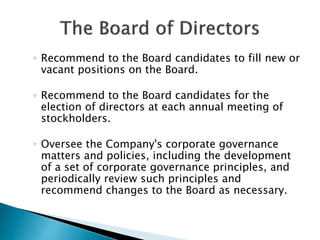

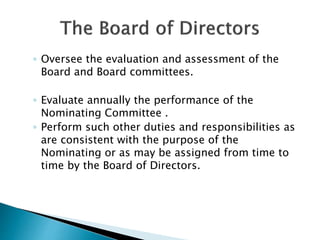

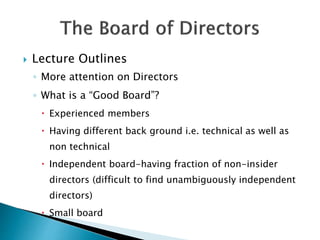

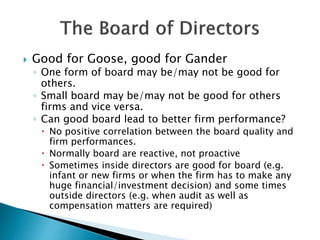

The document discusses boards of directors and what constitutes a good board. It notes that a board's primary functions are to oversee company activities, hire and evaluate management, and safeguard shareholder interests. A good board has experienced members from various backgrounds, includes outside independent directors, and is typically small in size. However, there is no definitive correlation between board quality and firm performance, and what makes a good board depends on the individual company. Potential issues that can arise include lack of independence between outside directors and management and directors being inexperienced or unable to dedicate sufficient time.