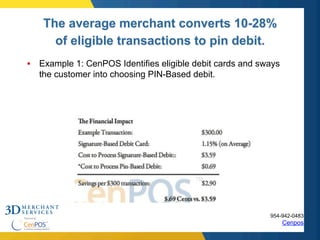

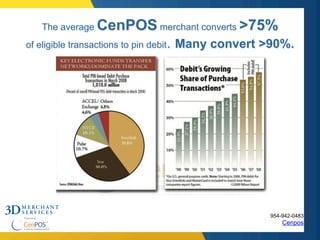

CenPOS is a universal hosted payment solution that processes credit cards, checks, loyalty programs, and alternative payments for mid-size businesses. It aims to reduce costs, control risks, and create efficiencies compared to traditional credit card processing. CenPOS uses an intelligent switch and optimization tools to route transactions via the lowest cost interchange rates and increase the number of pin-based debit conversions from eligible cards.