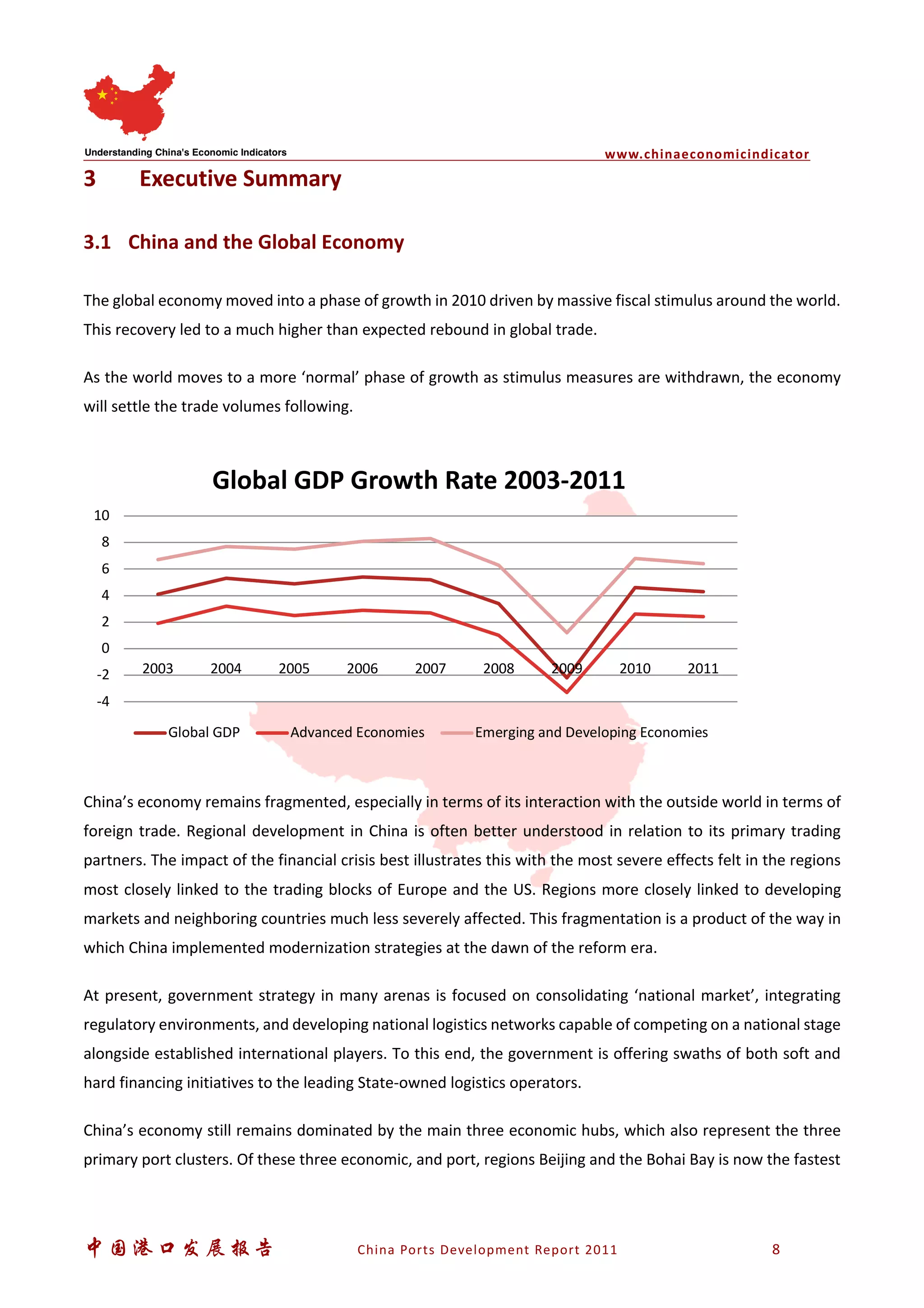

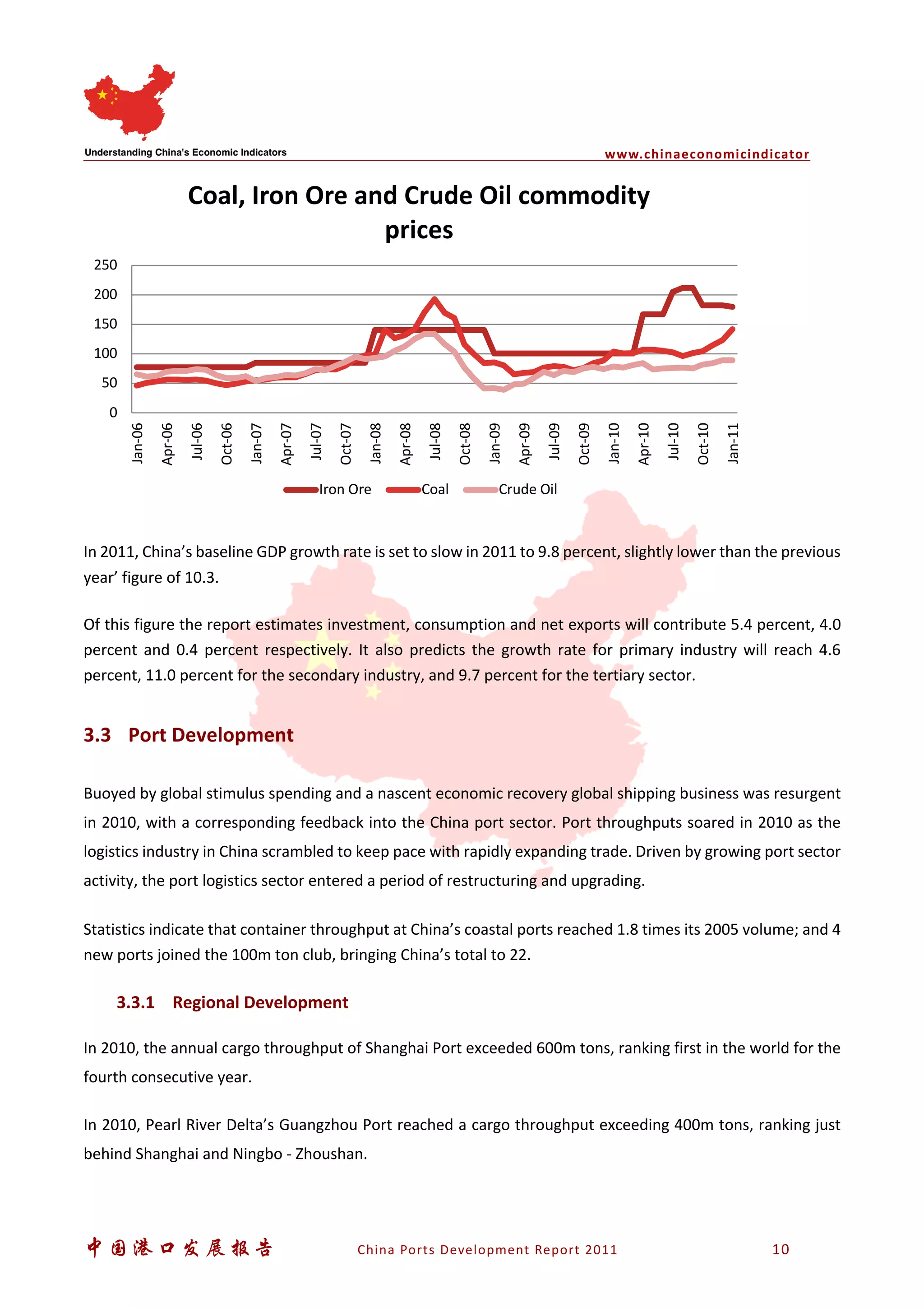

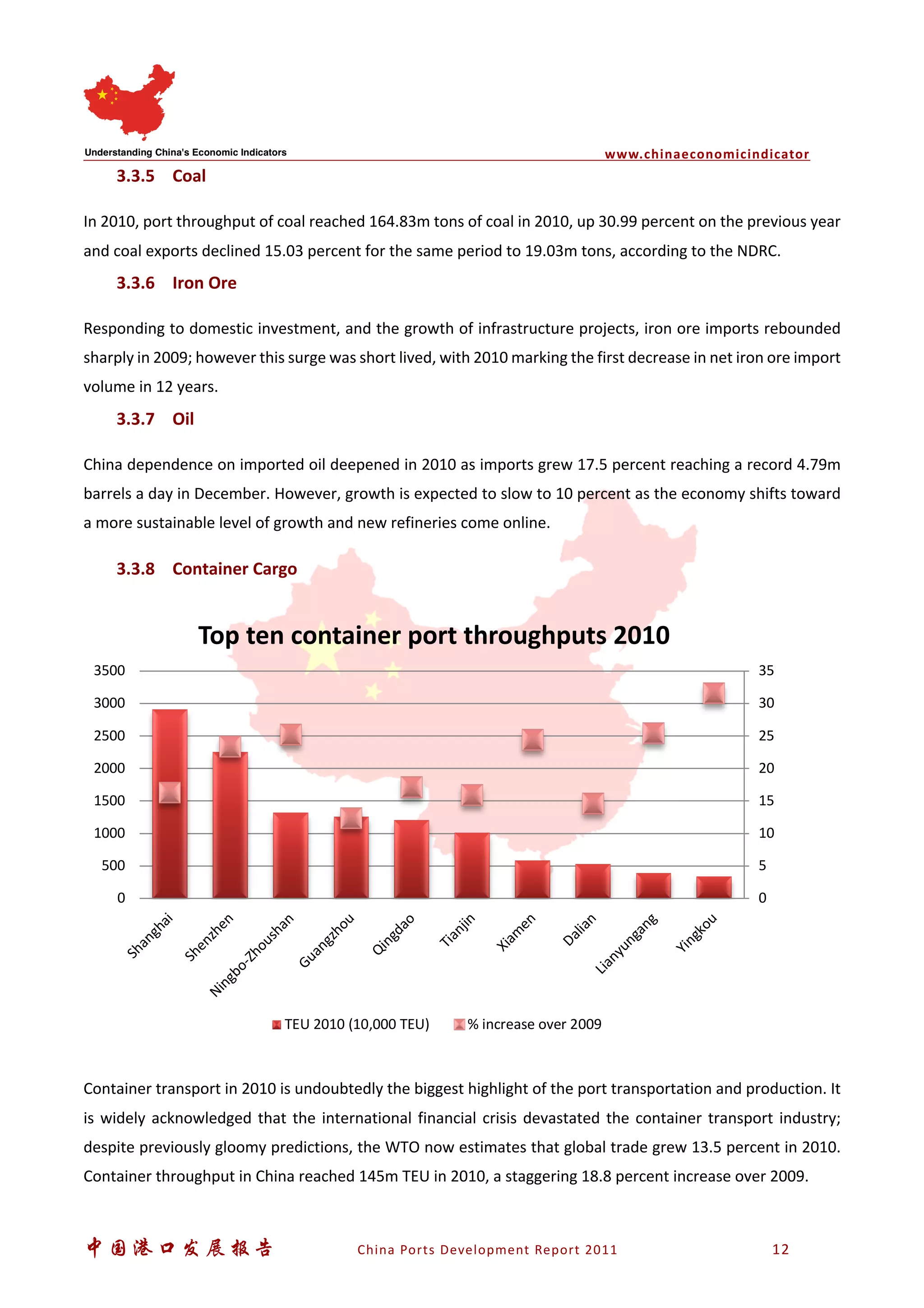

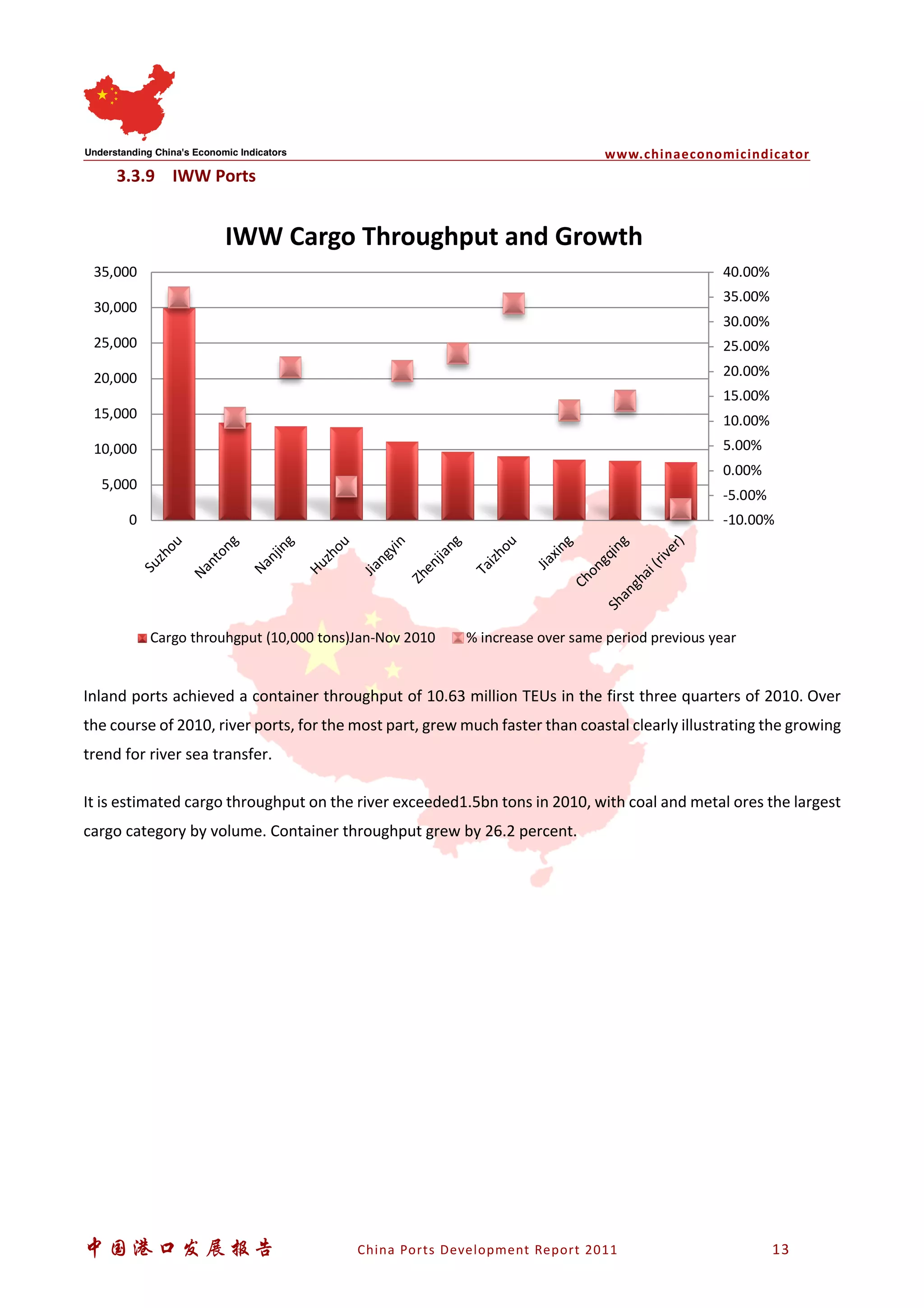

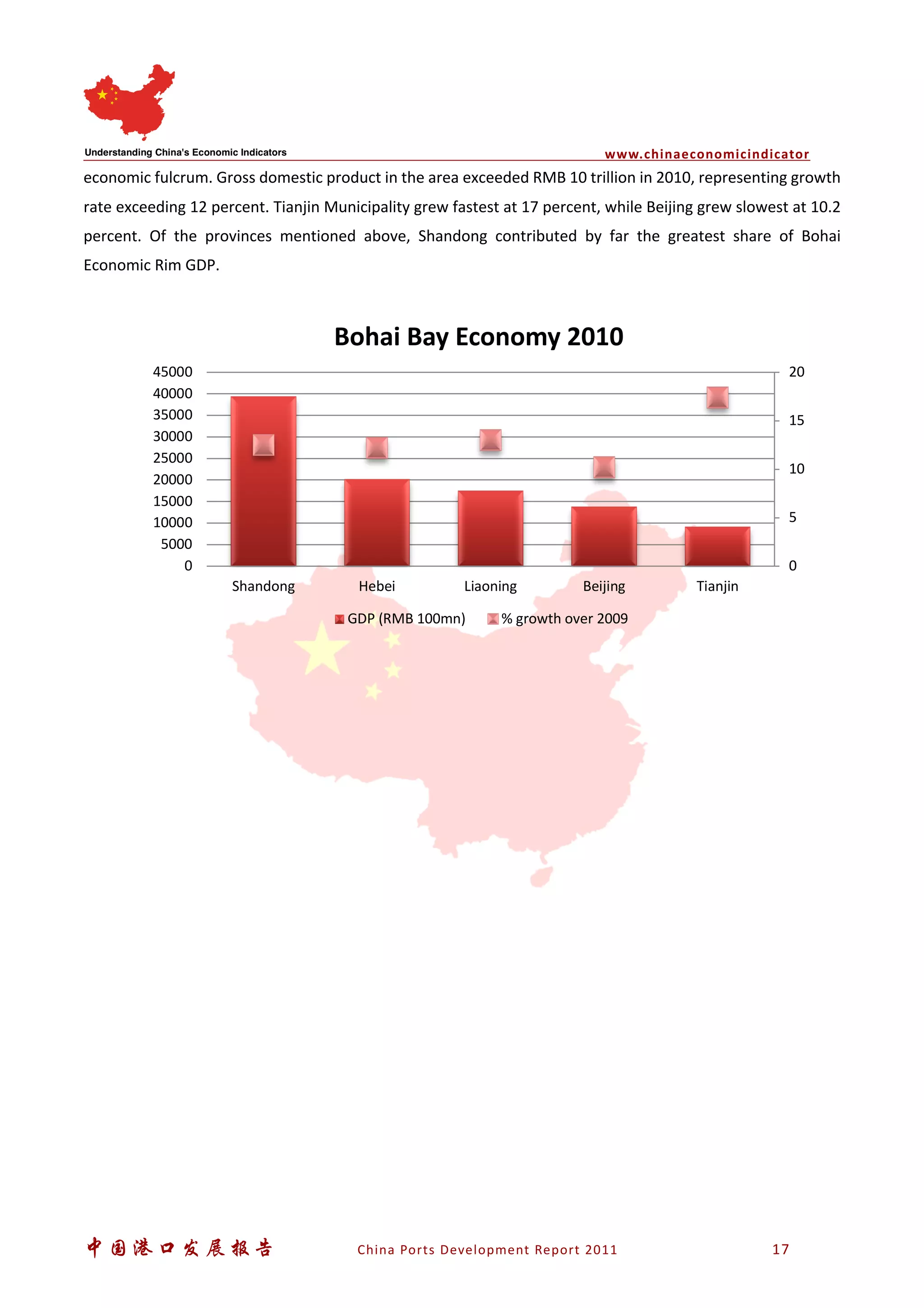

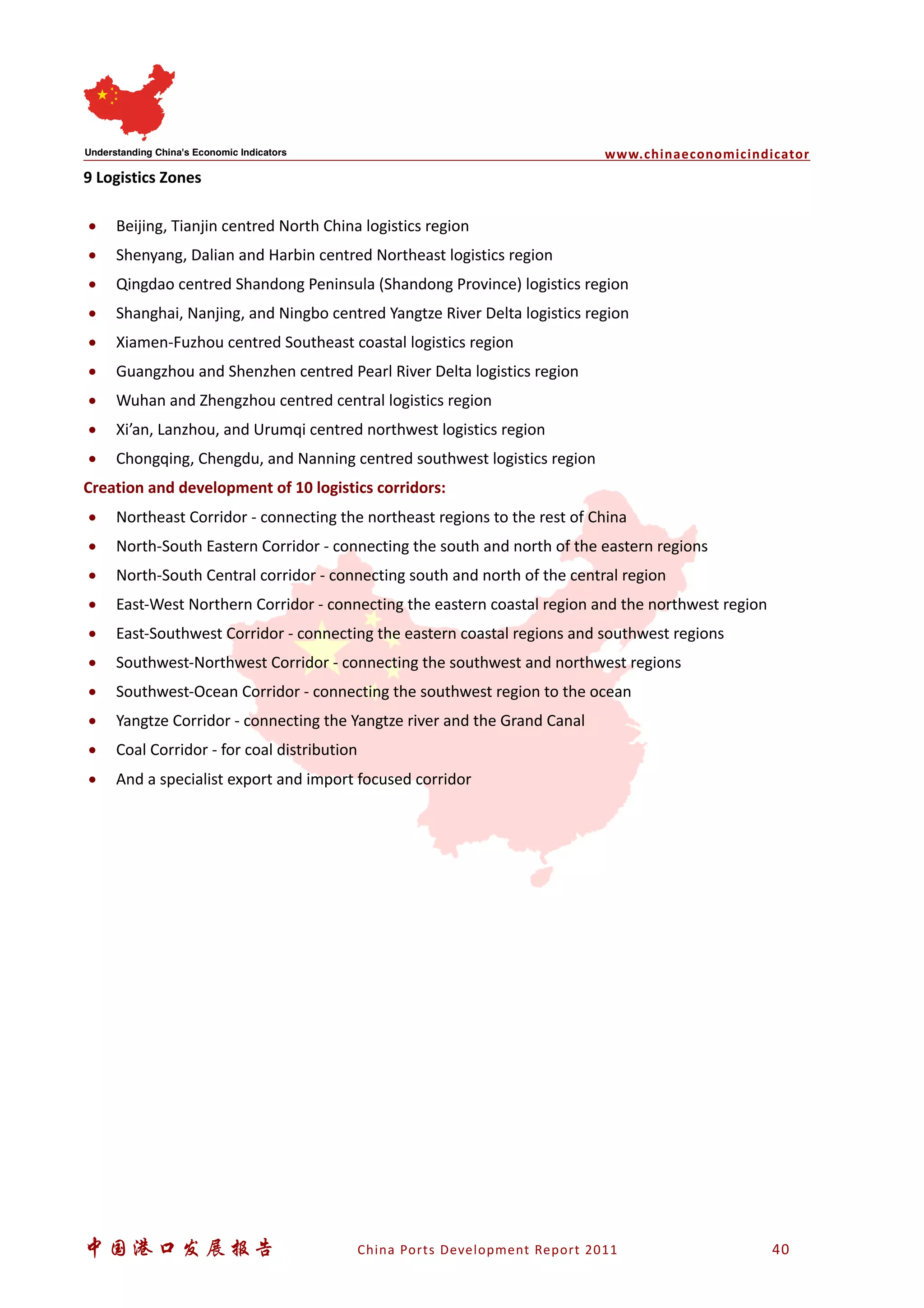

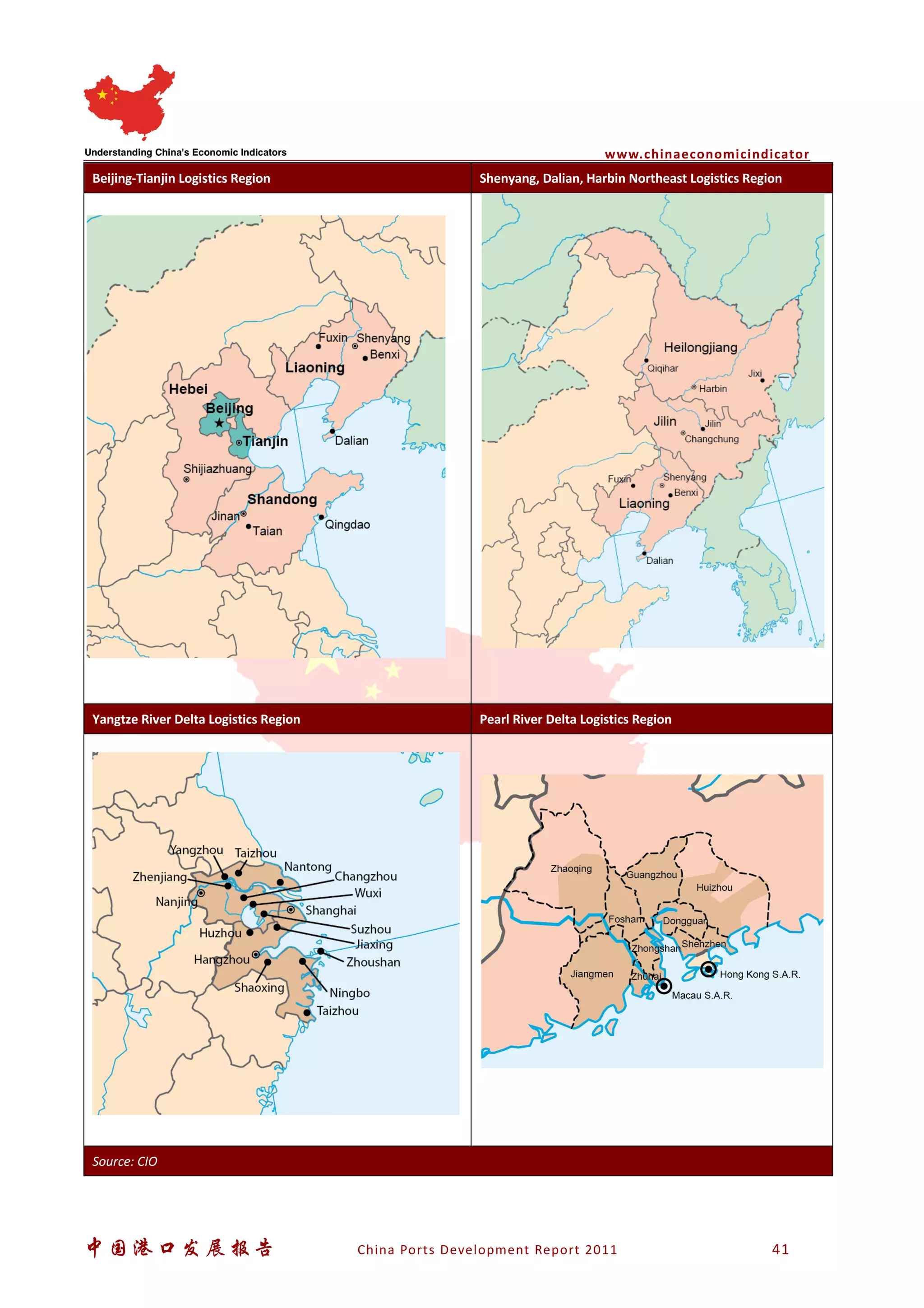

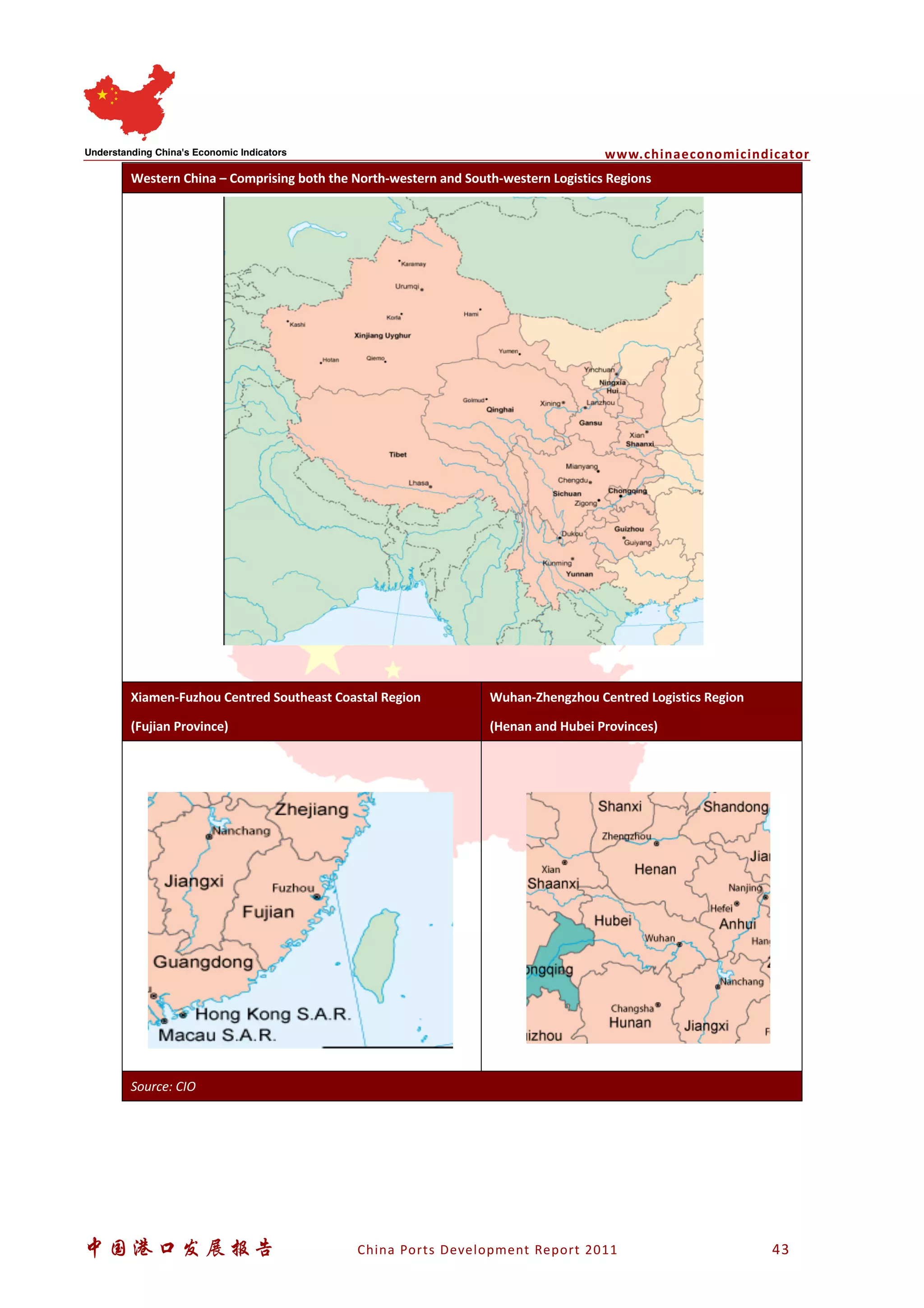

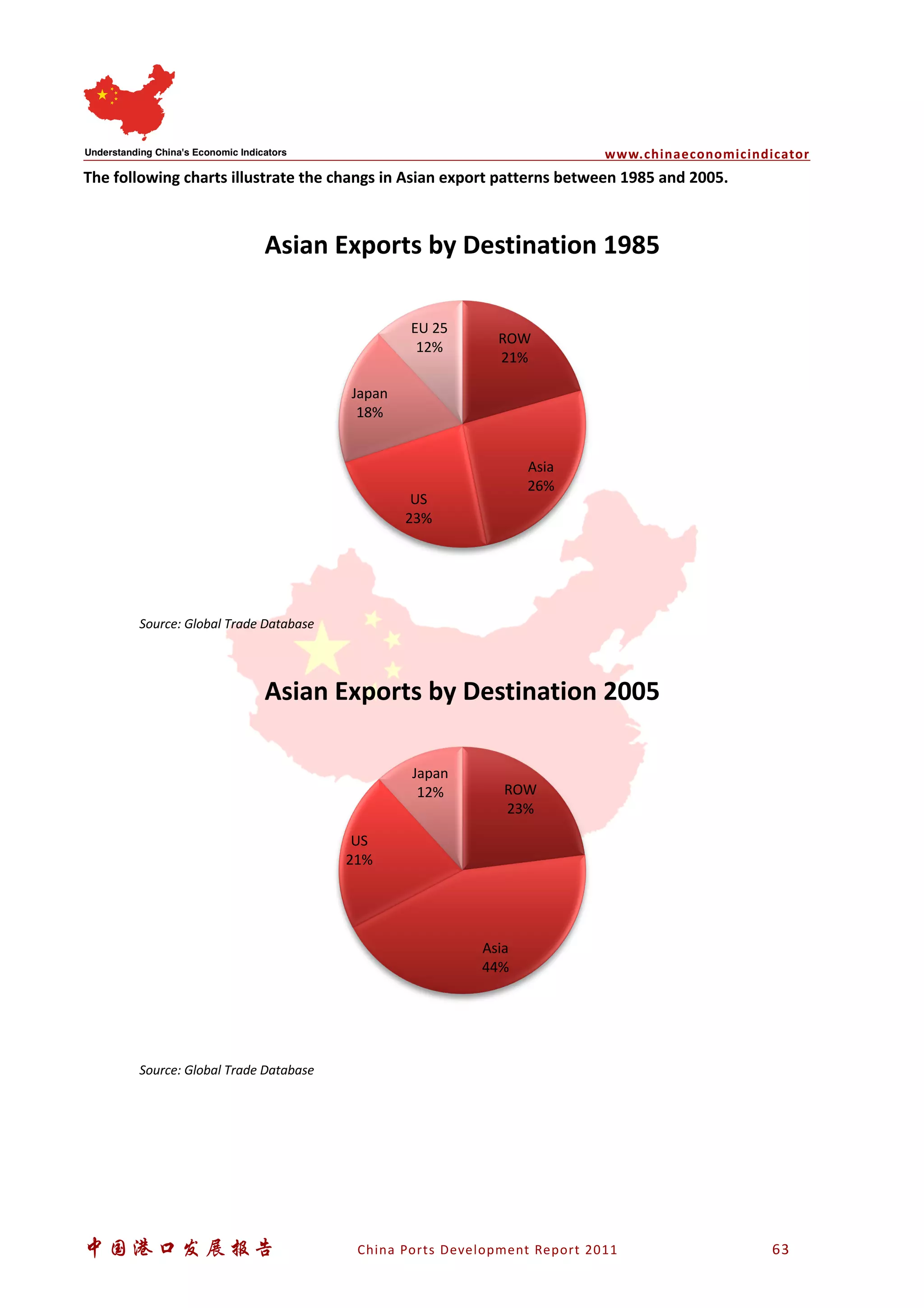

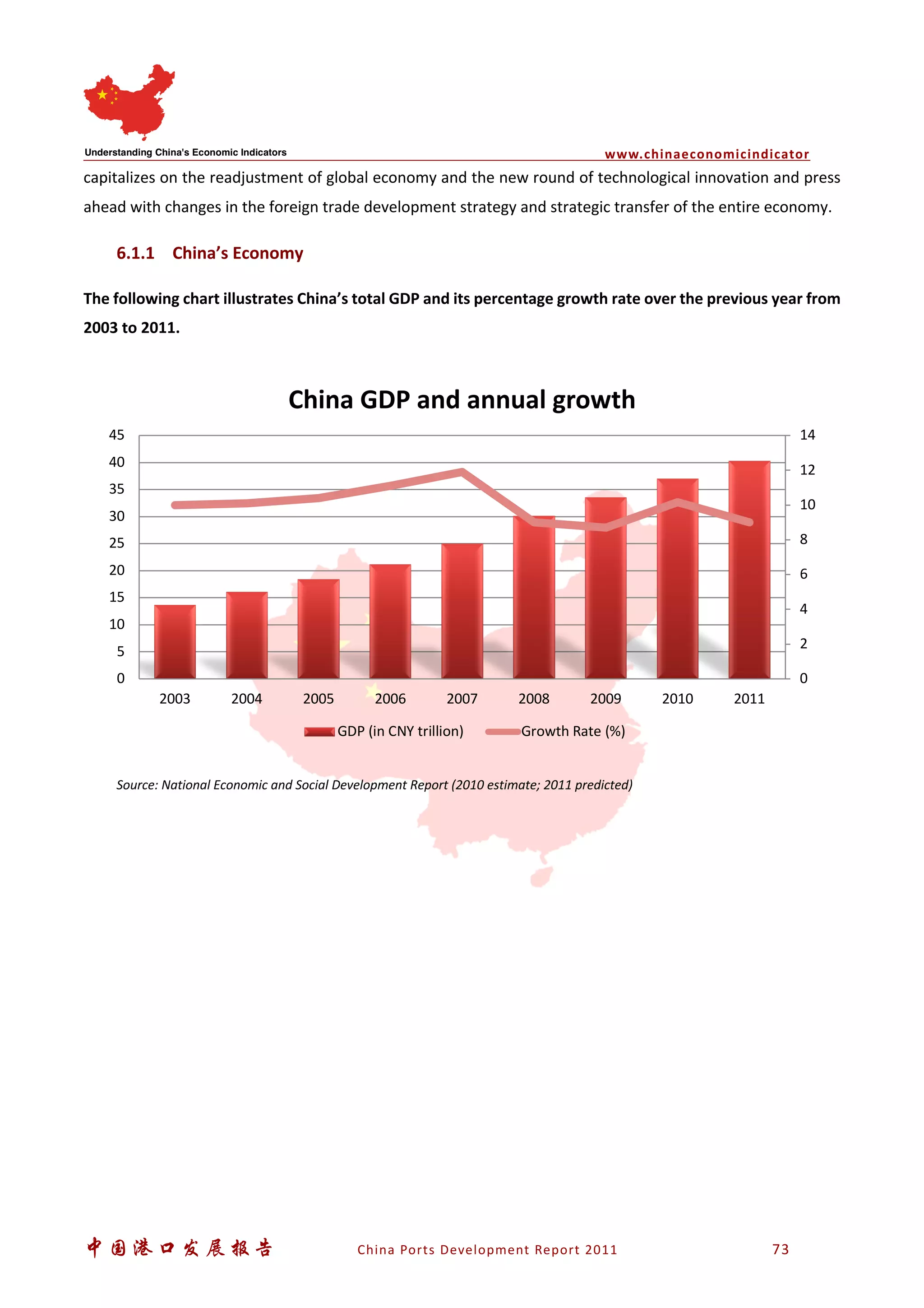

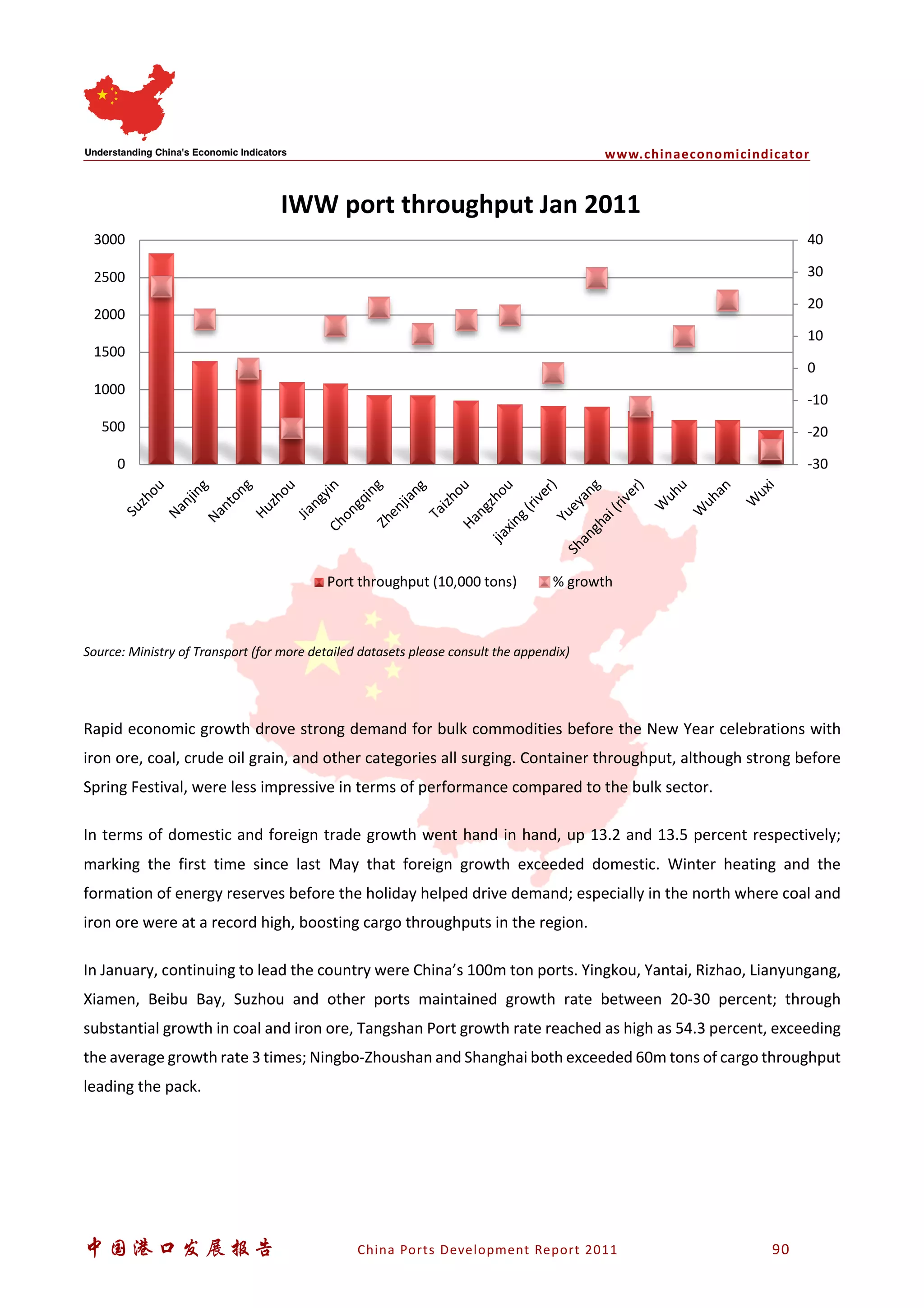

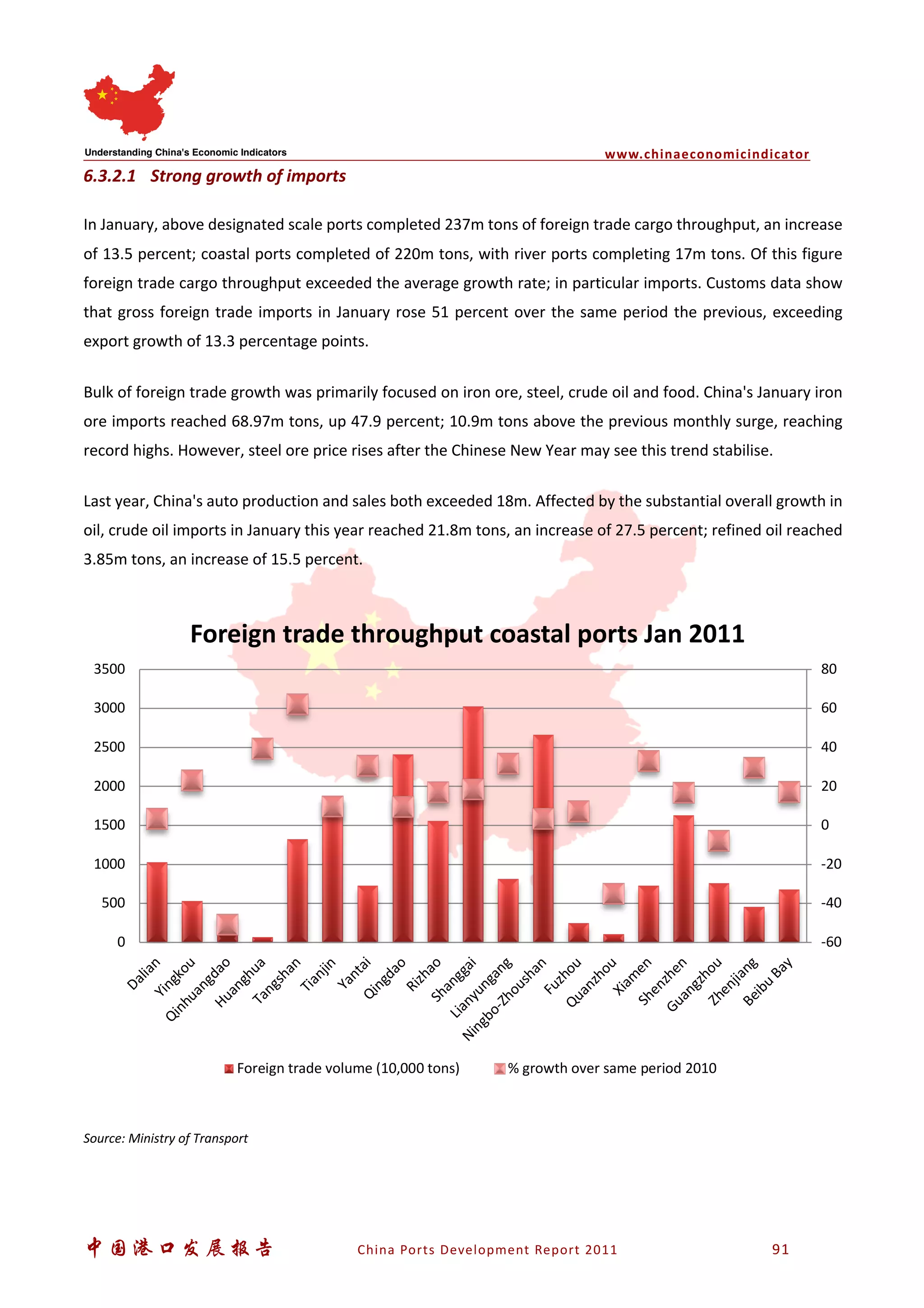

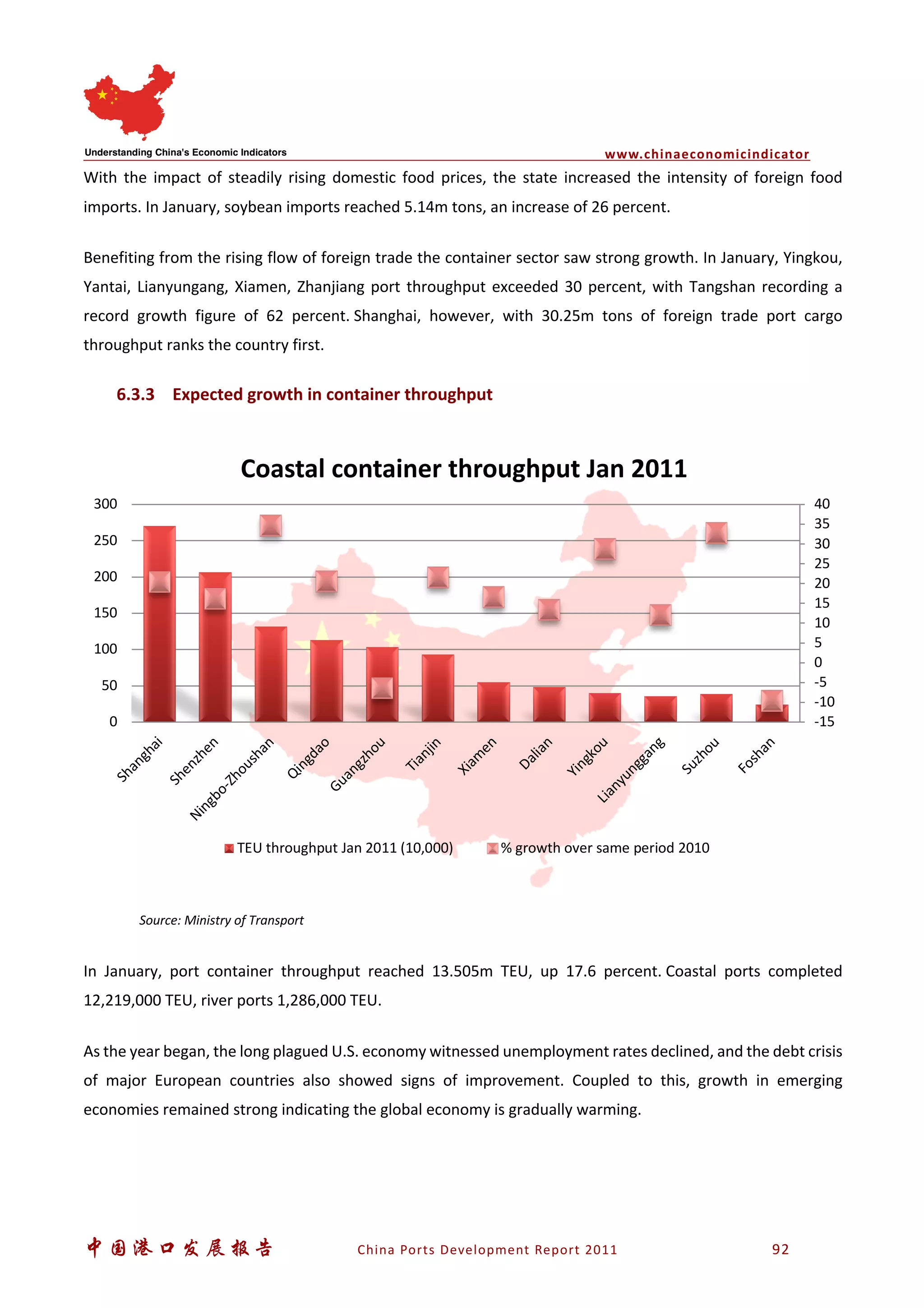

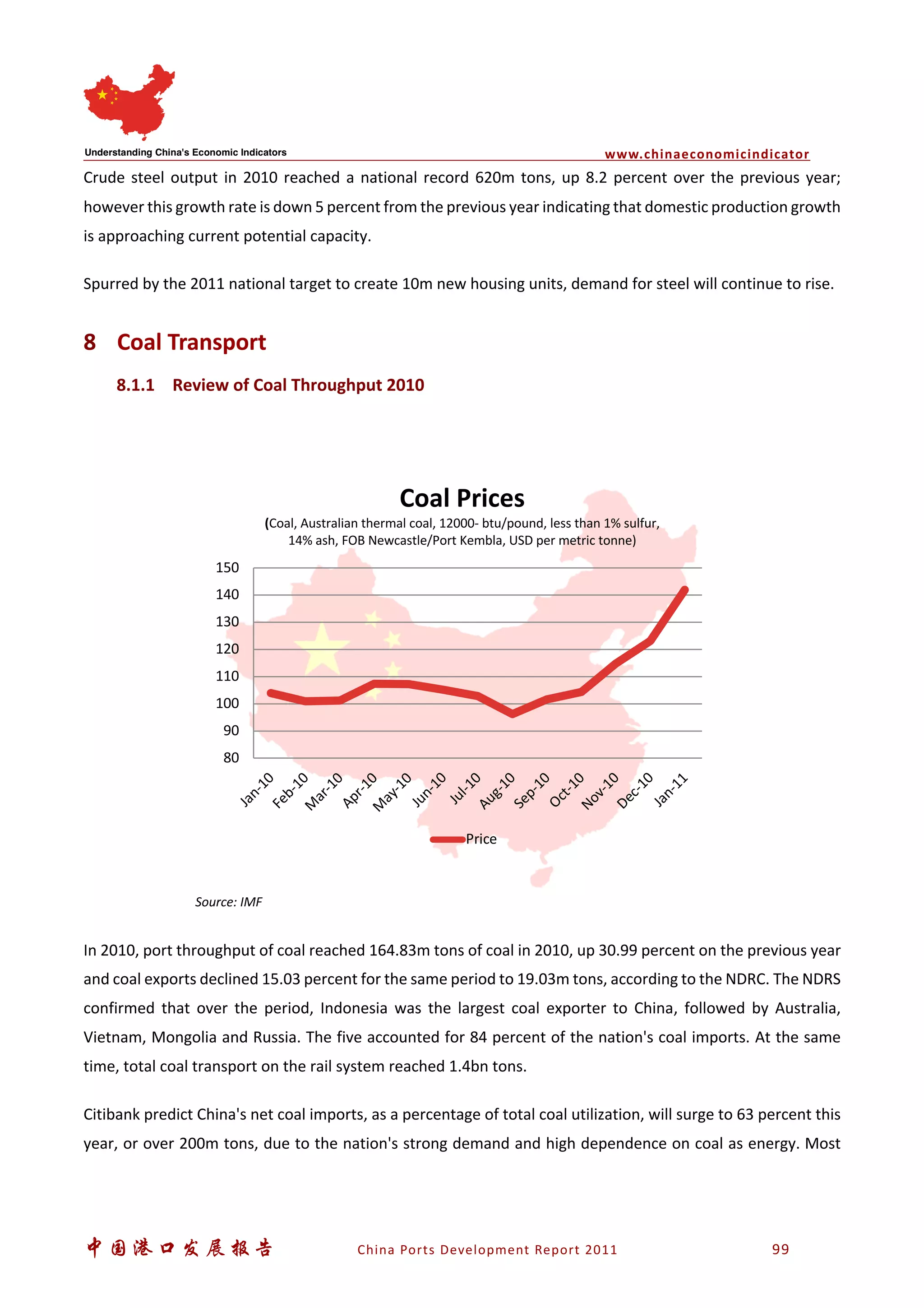

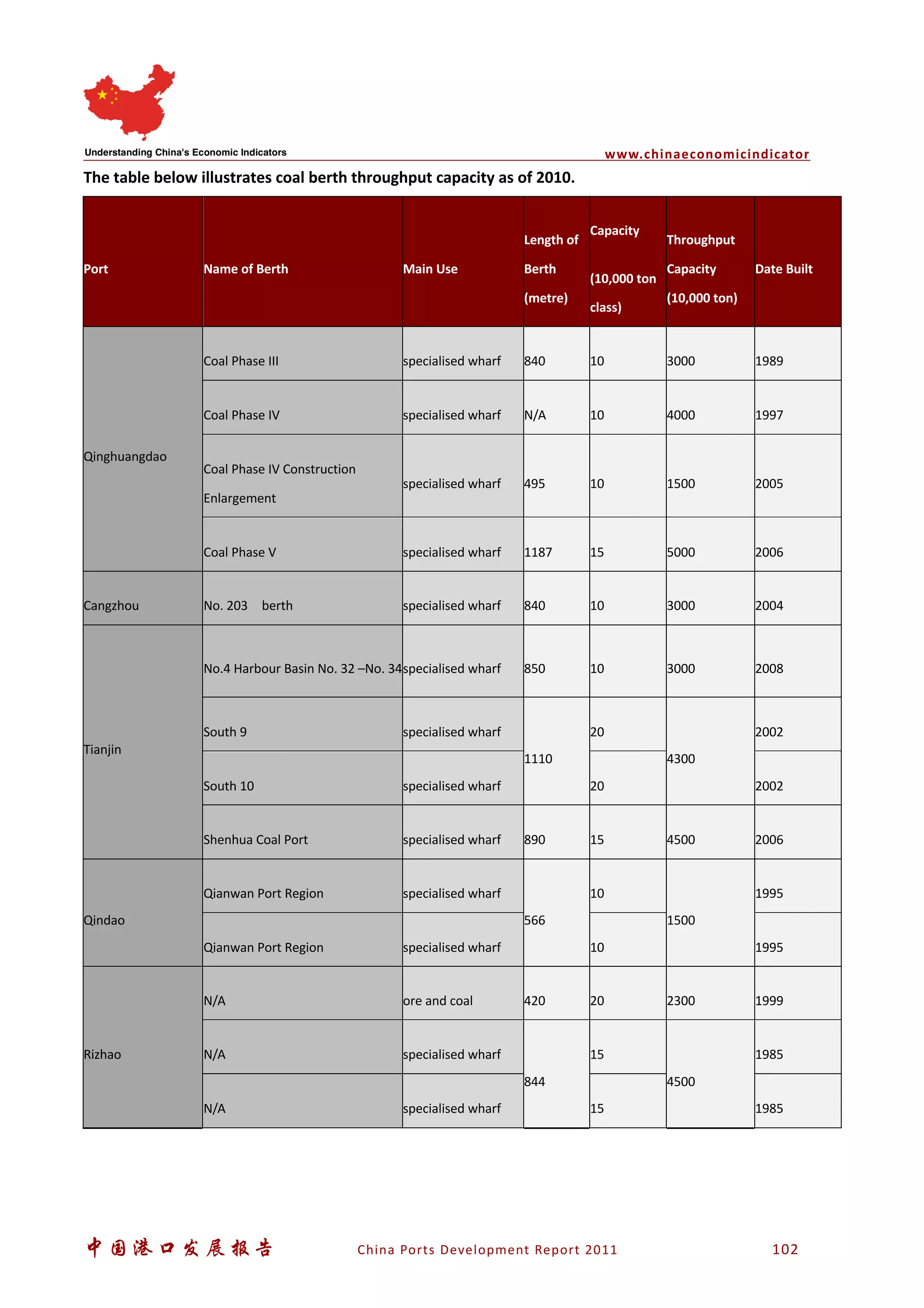

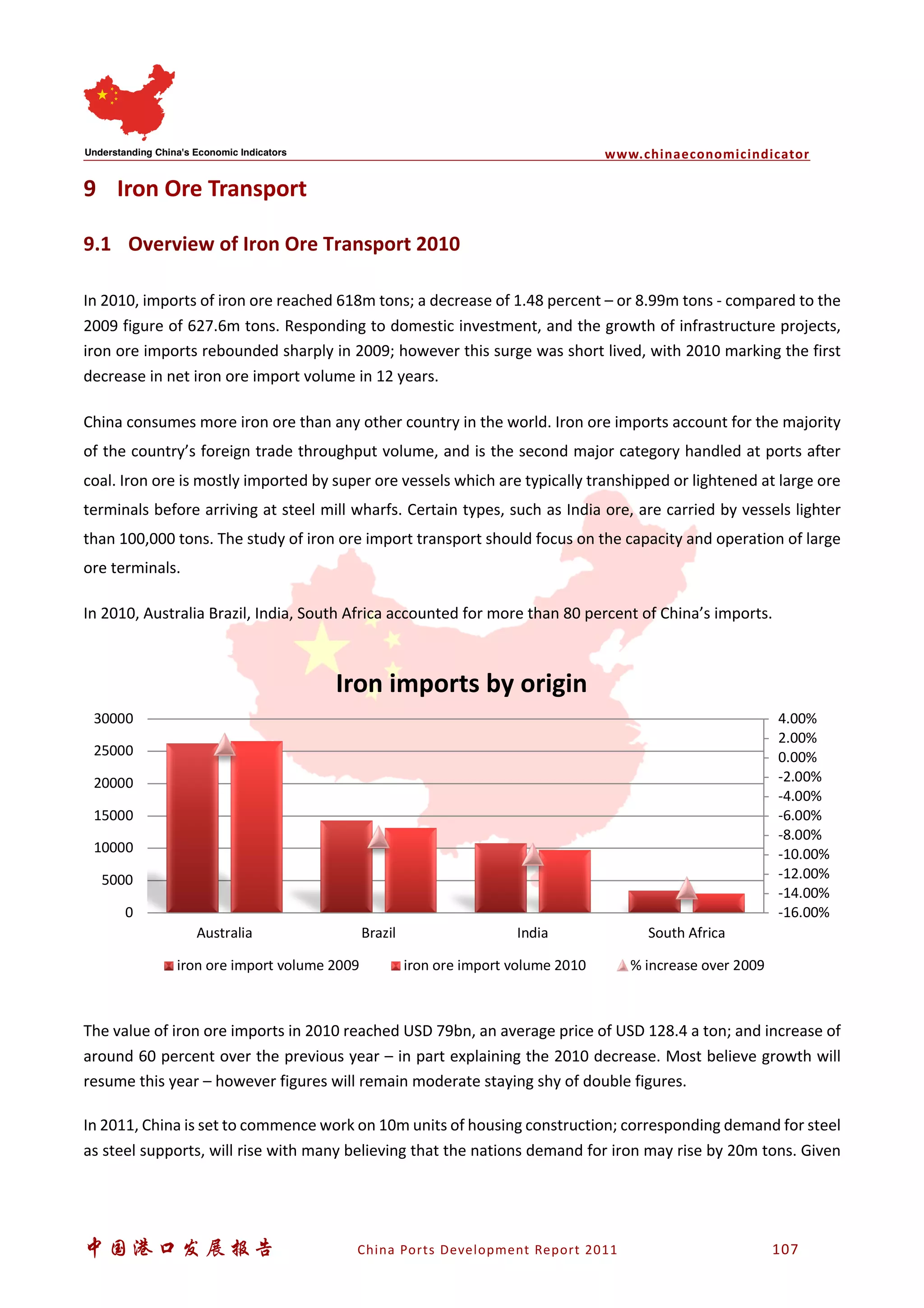

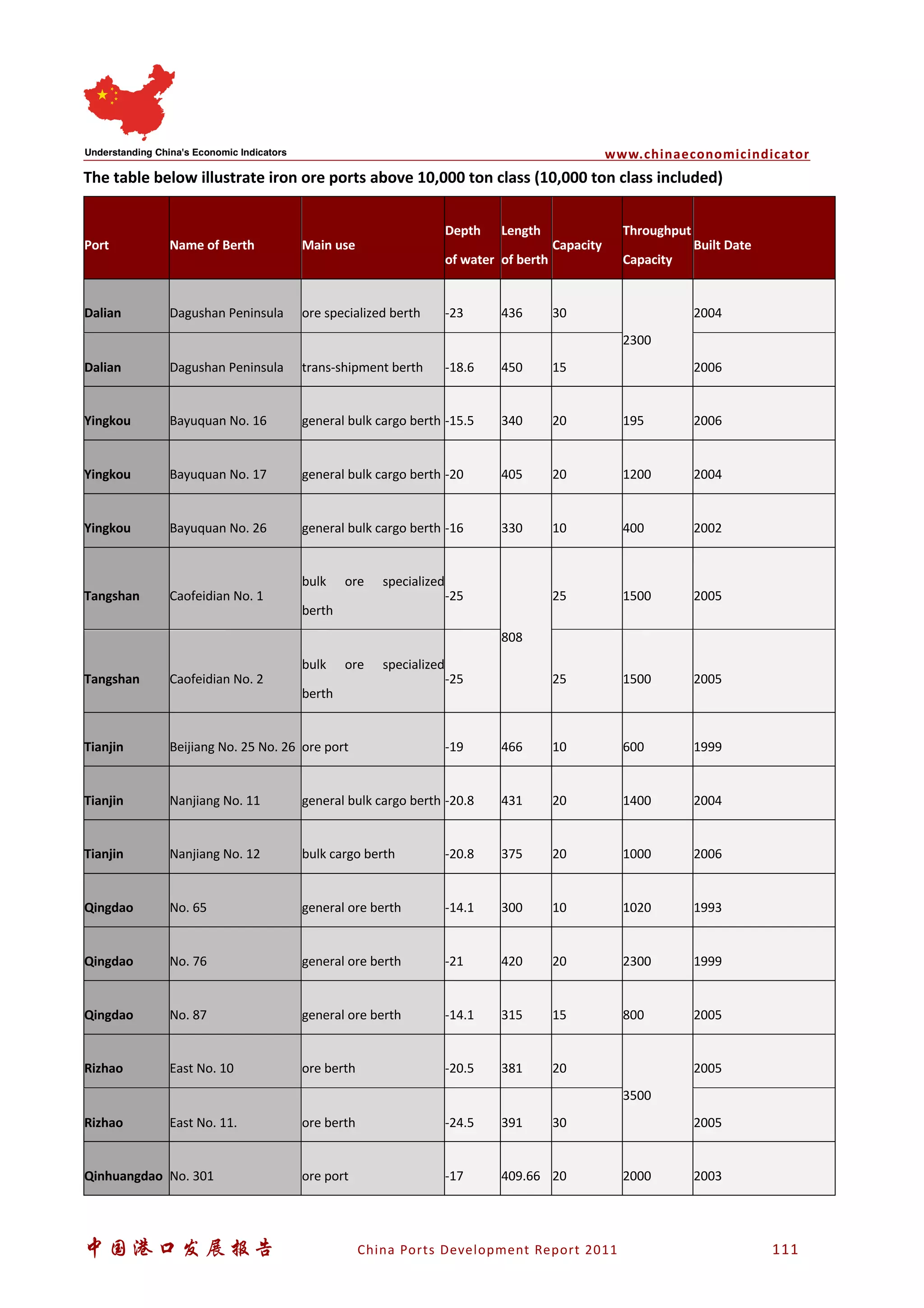

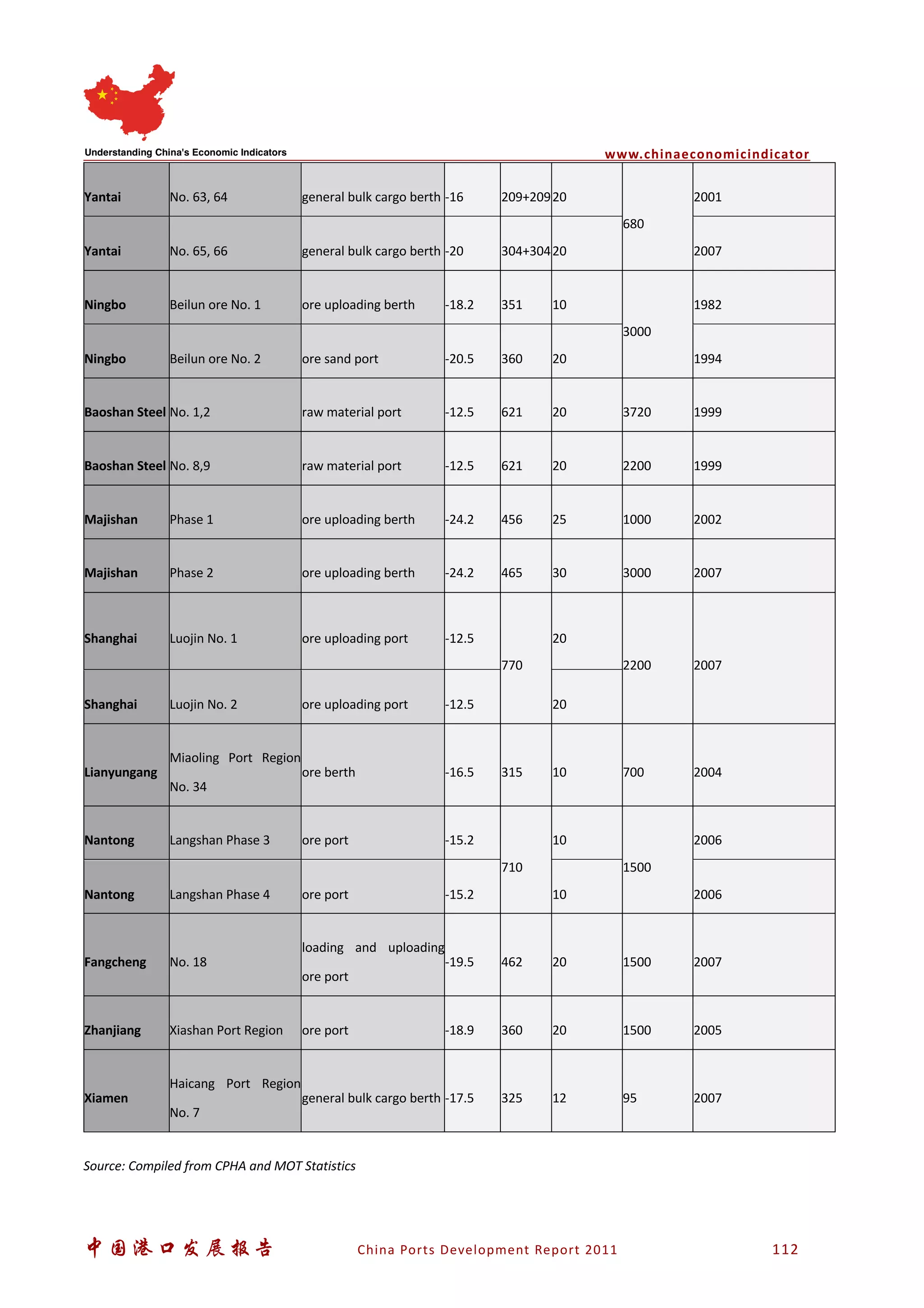

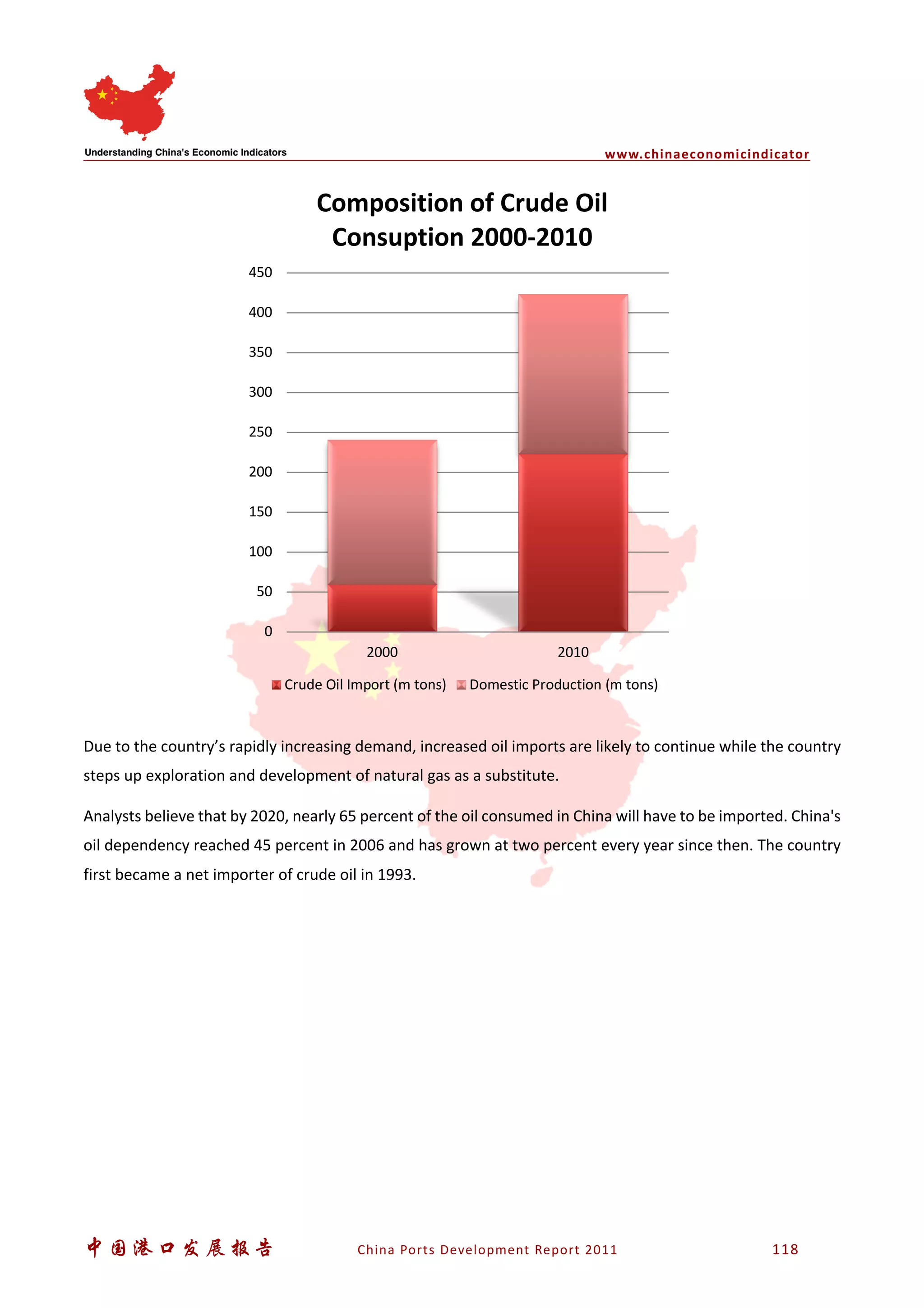

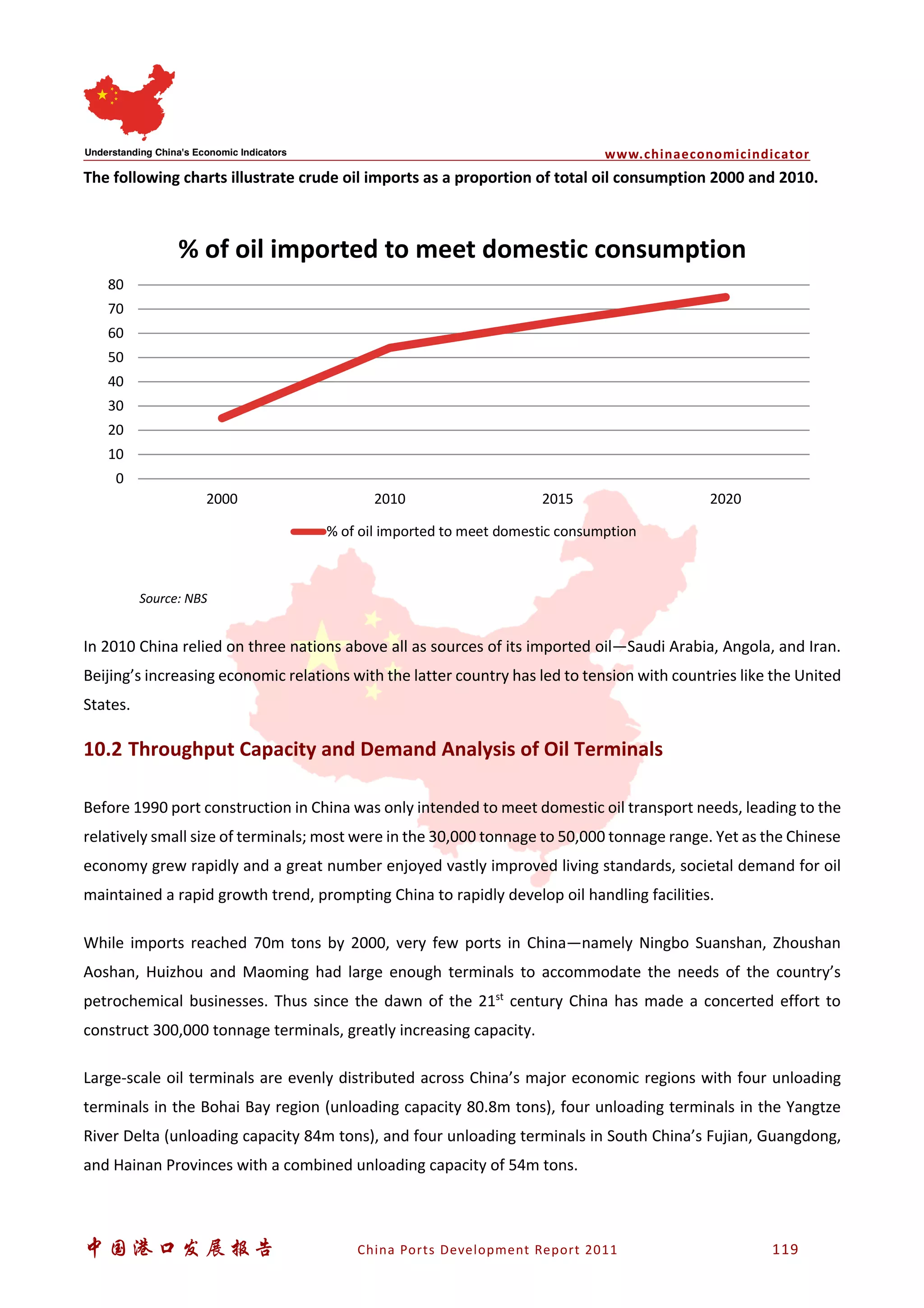

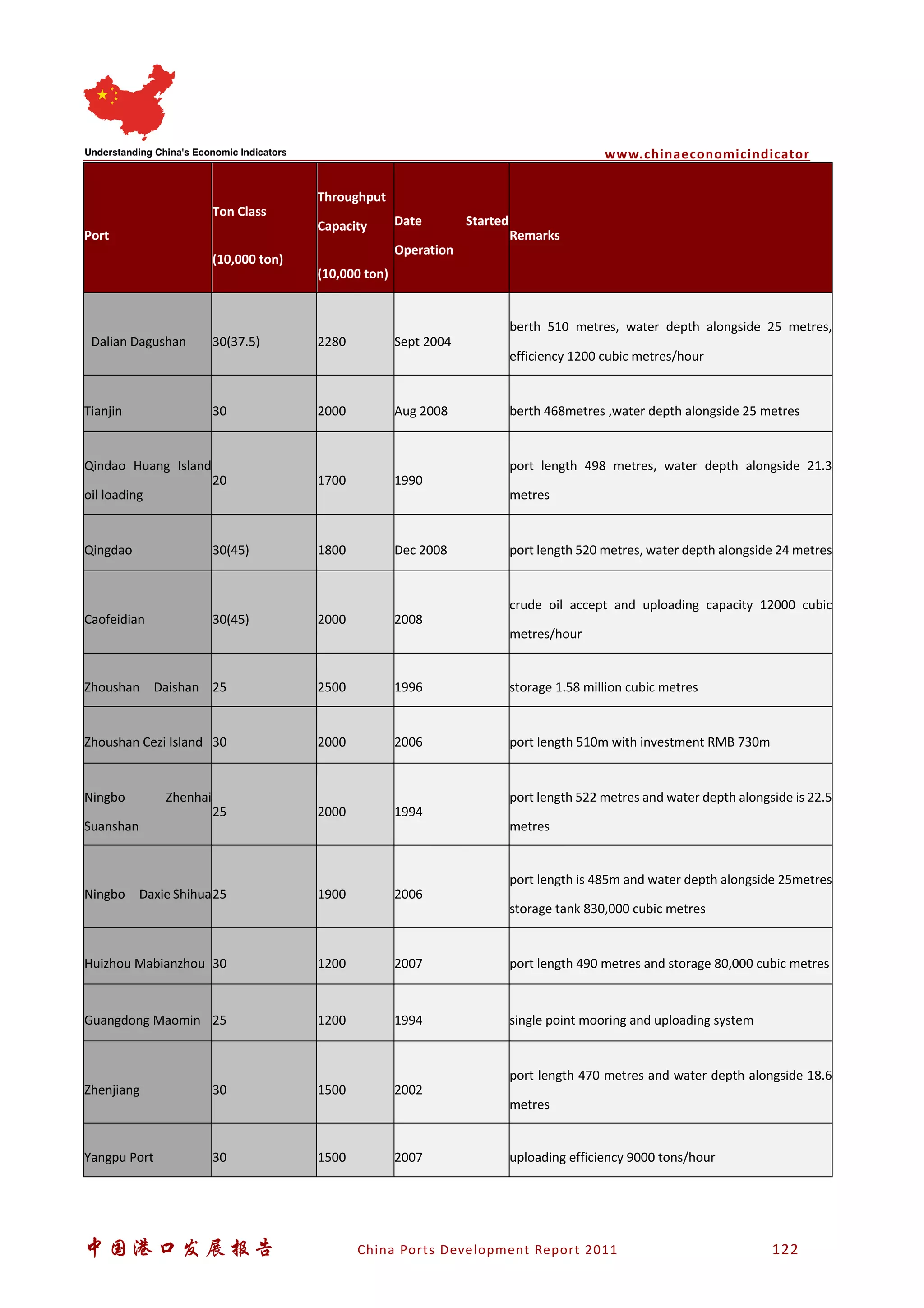

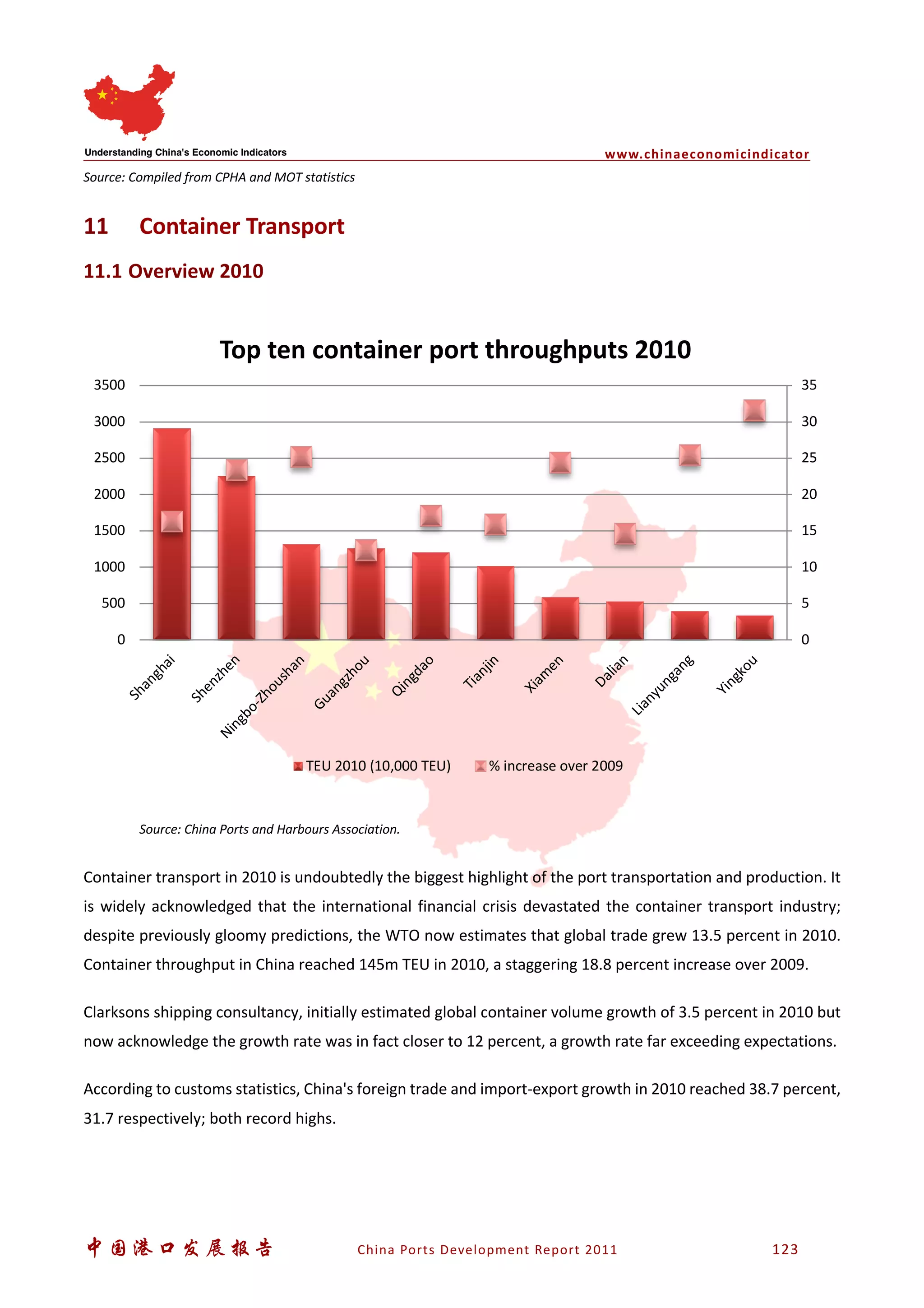

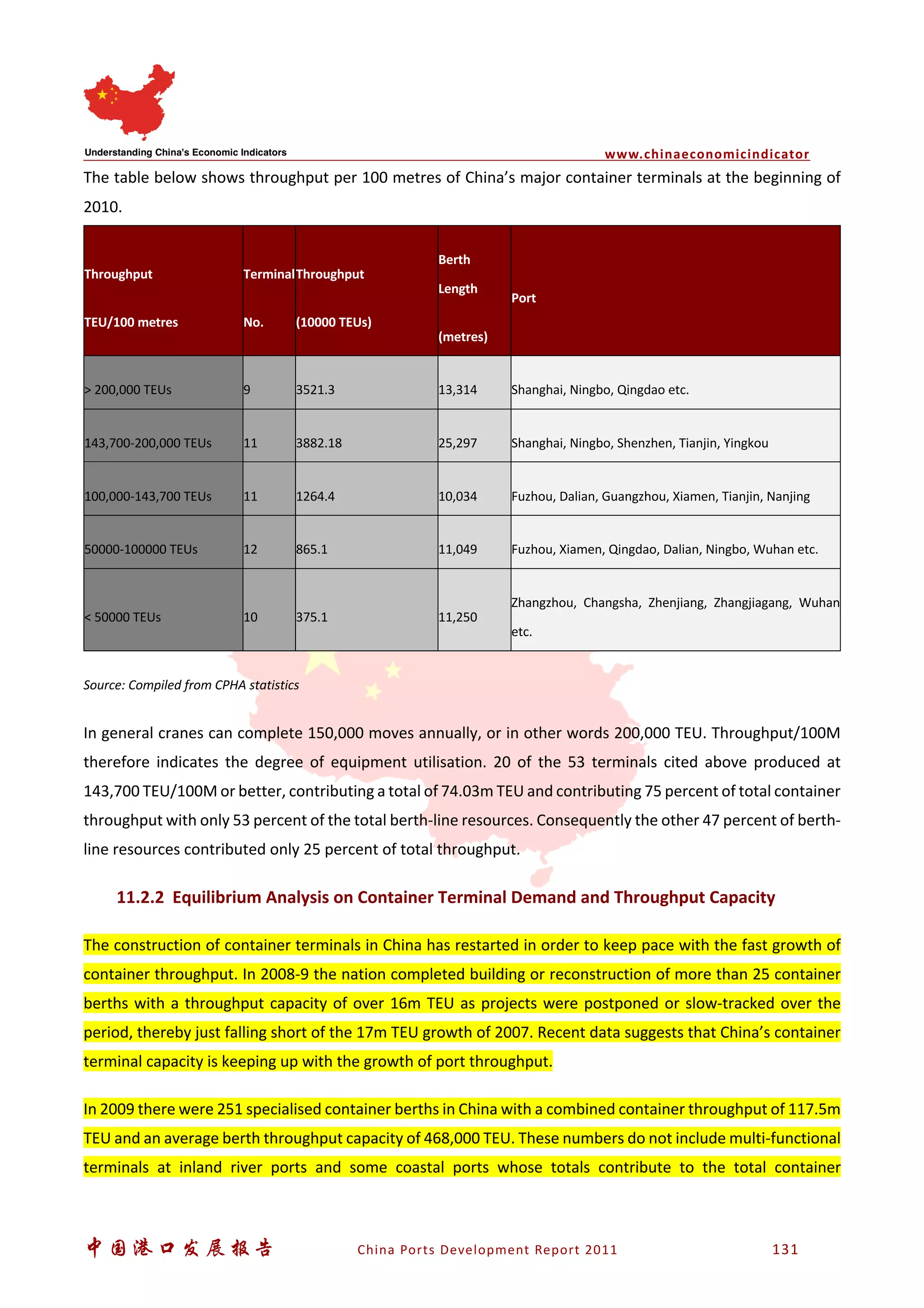

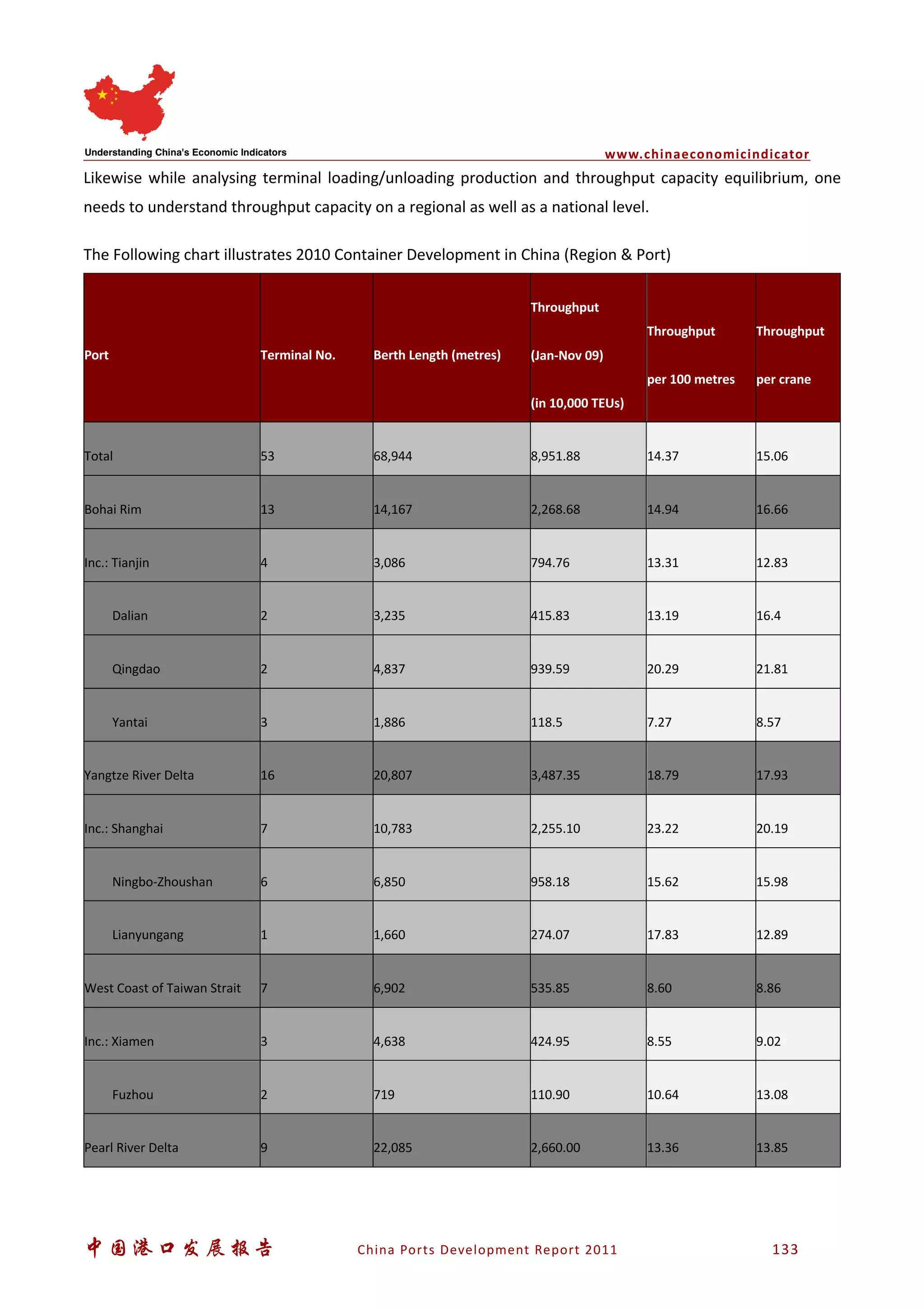

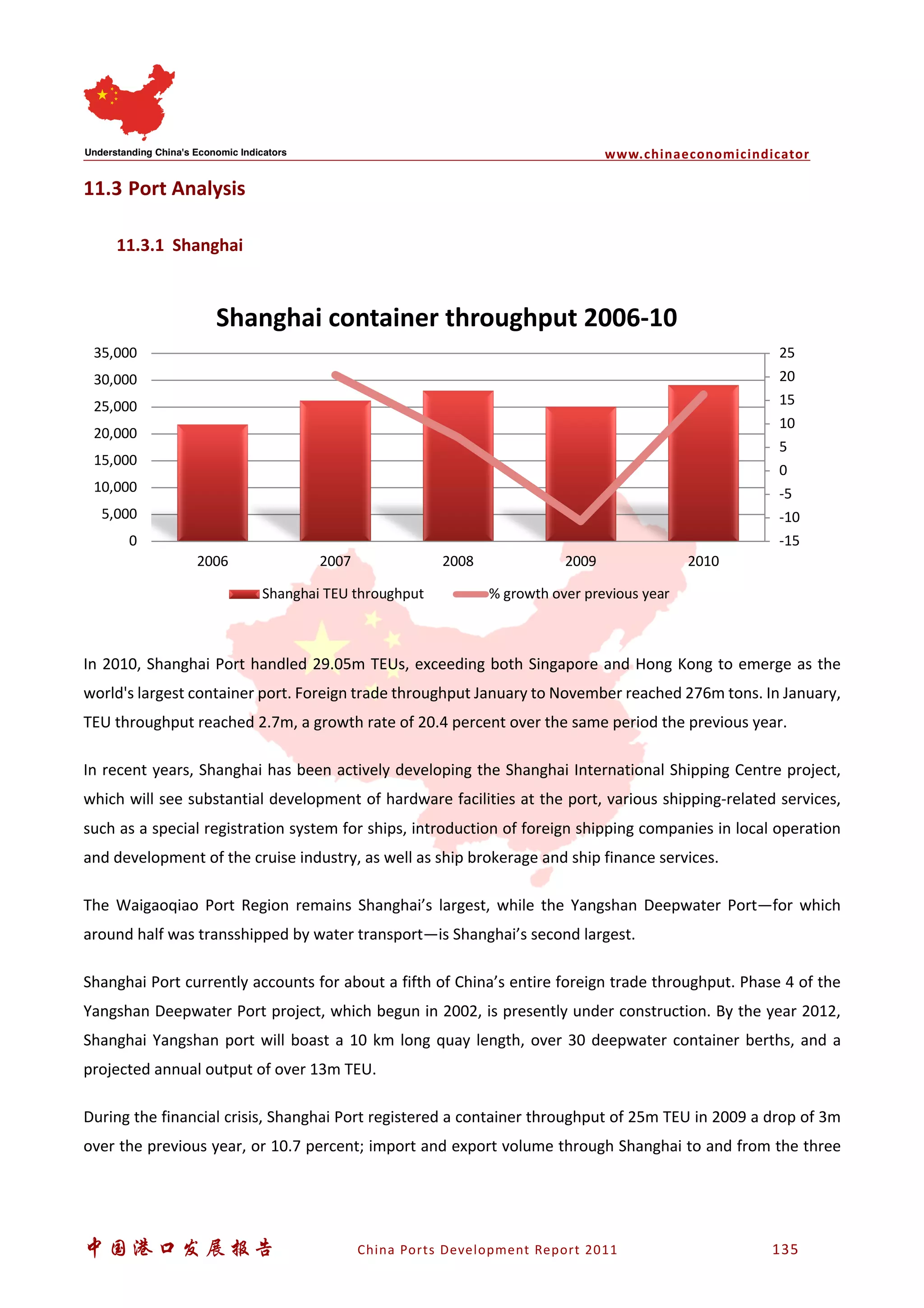

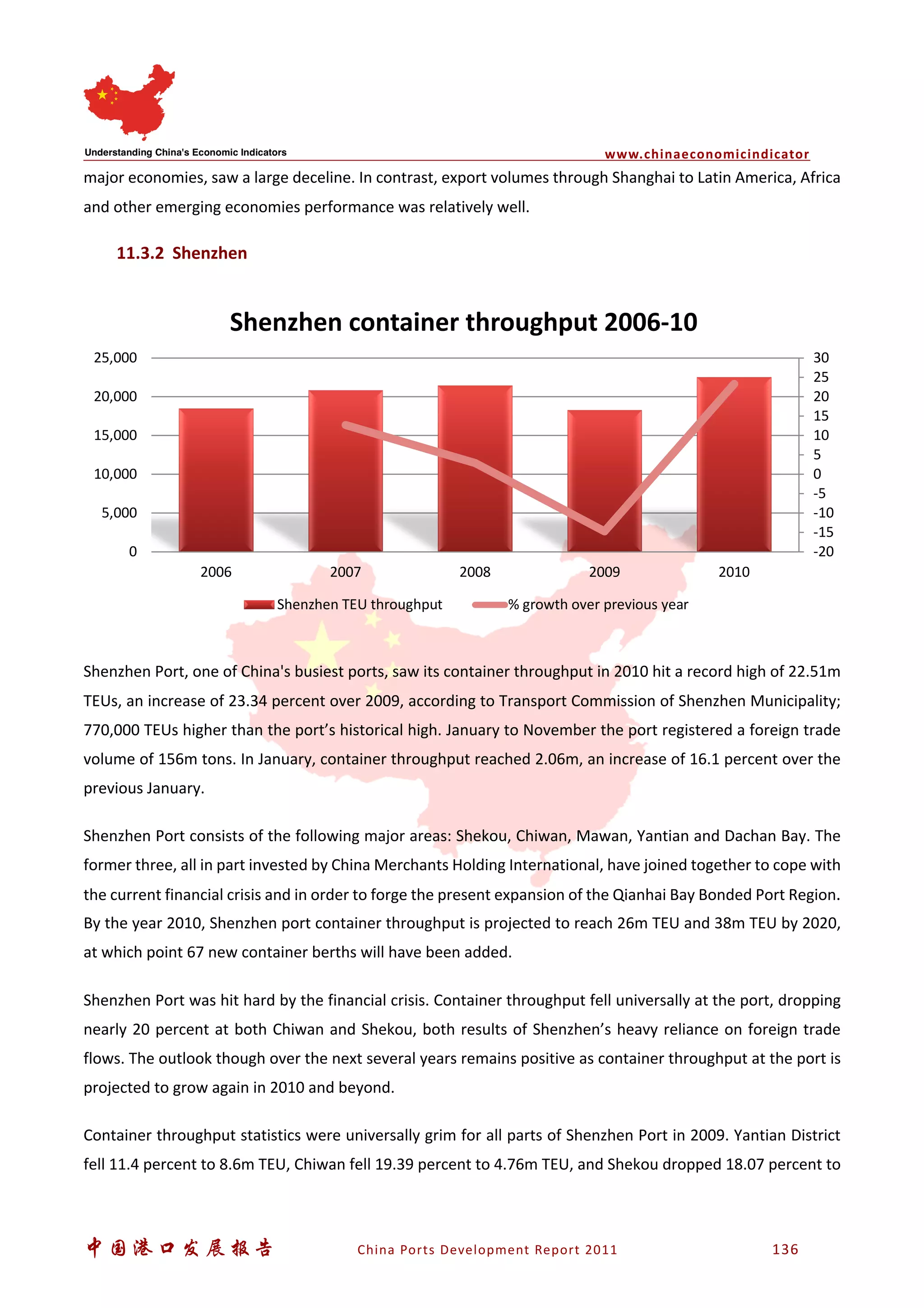

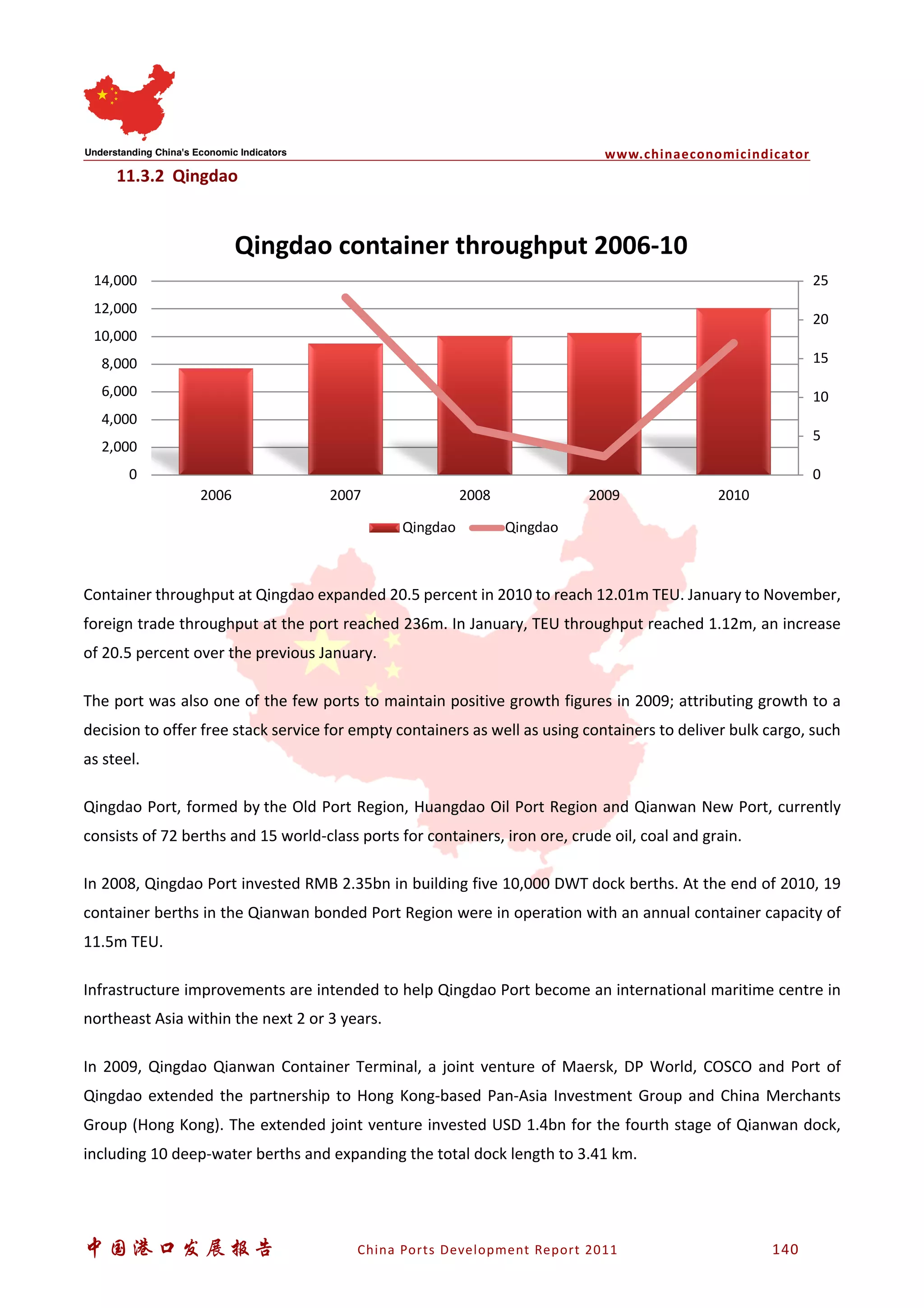

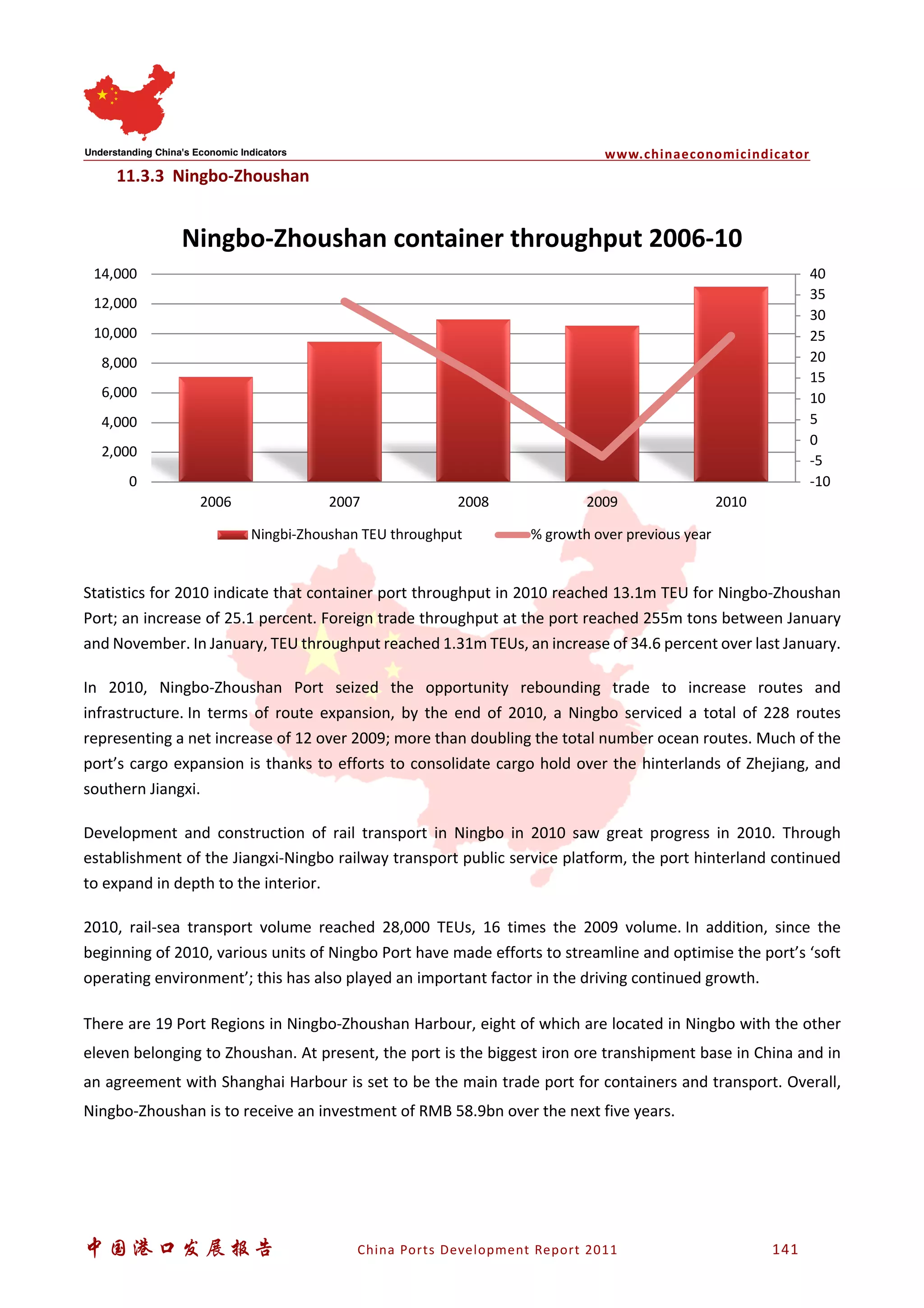

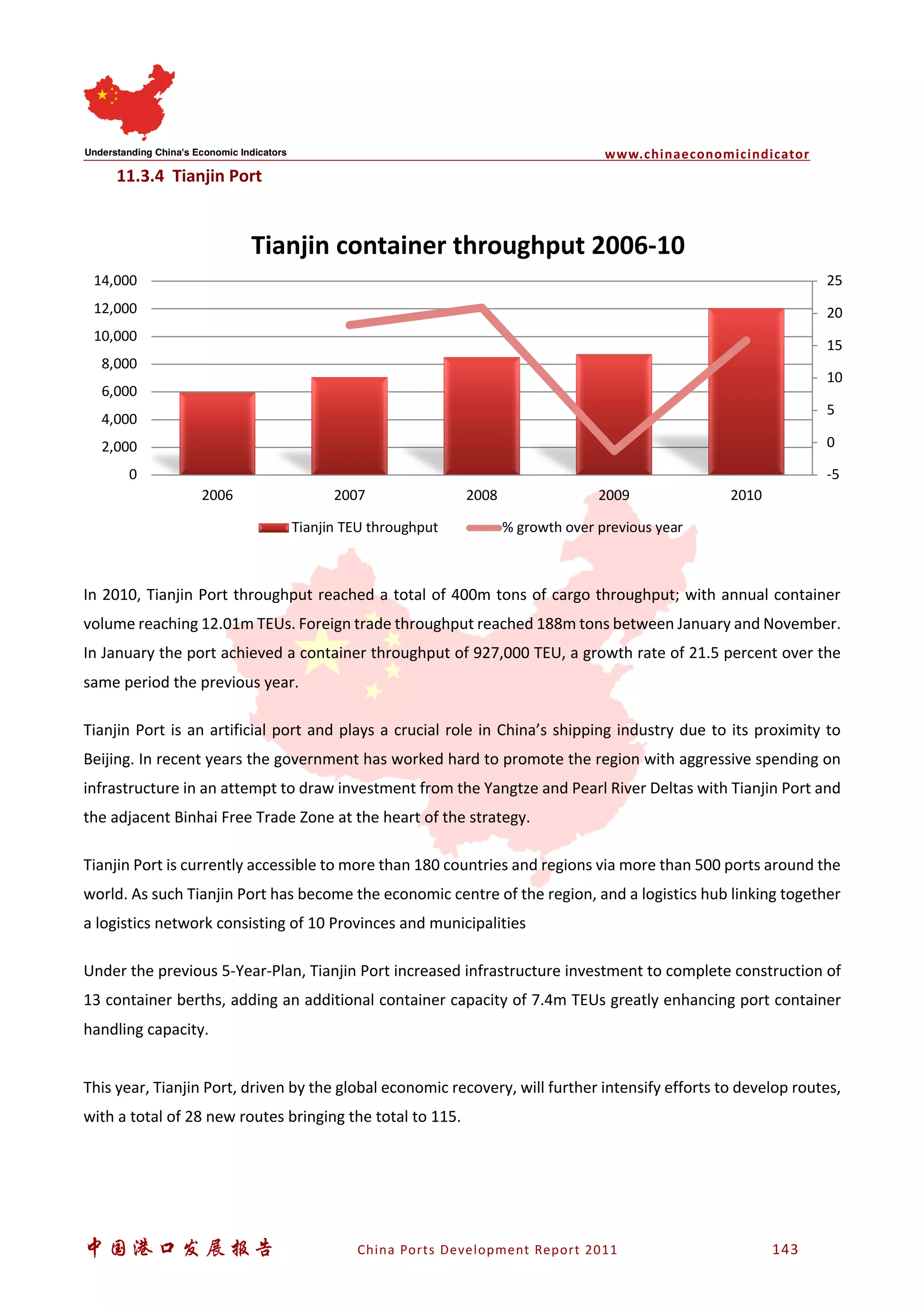

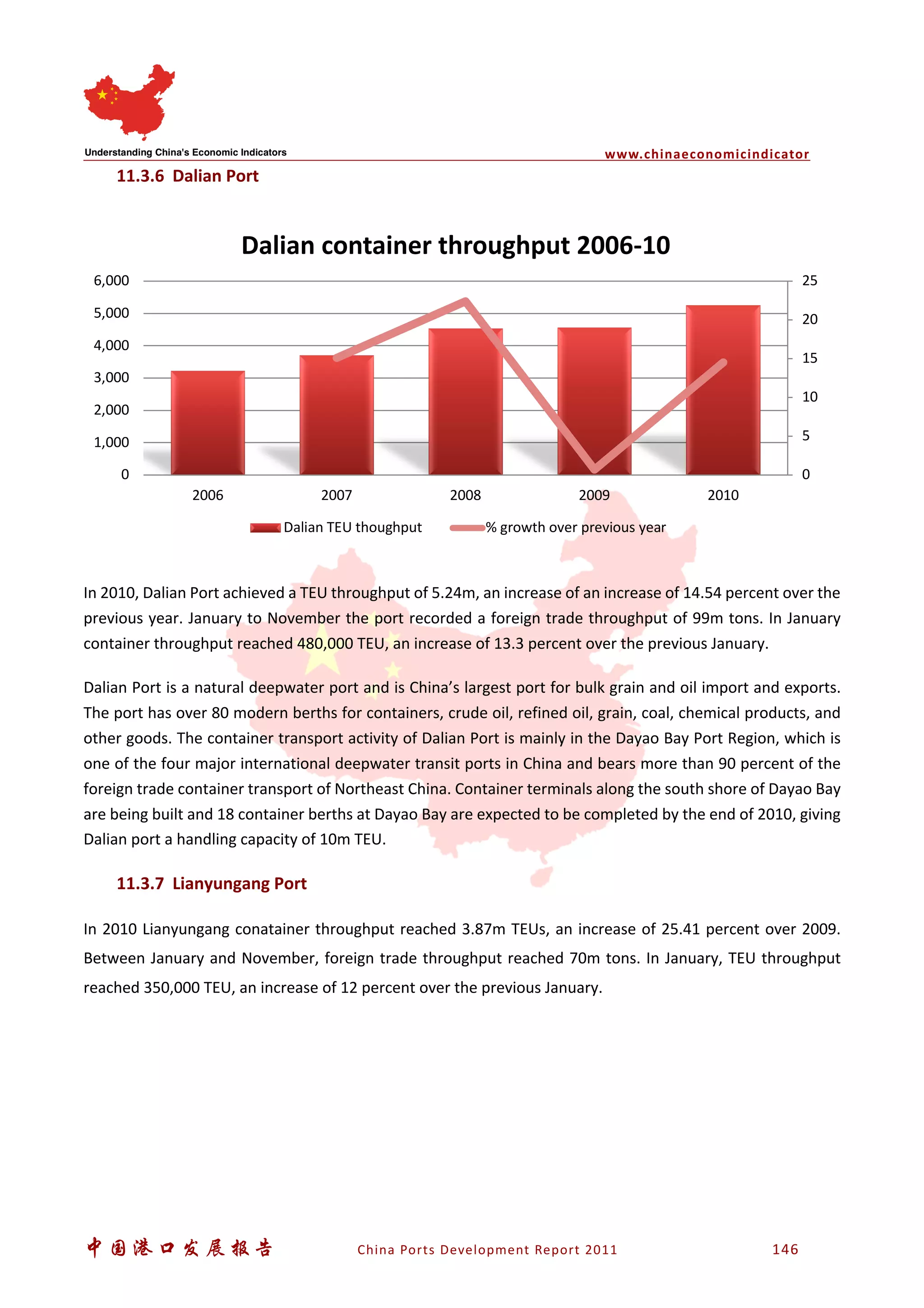

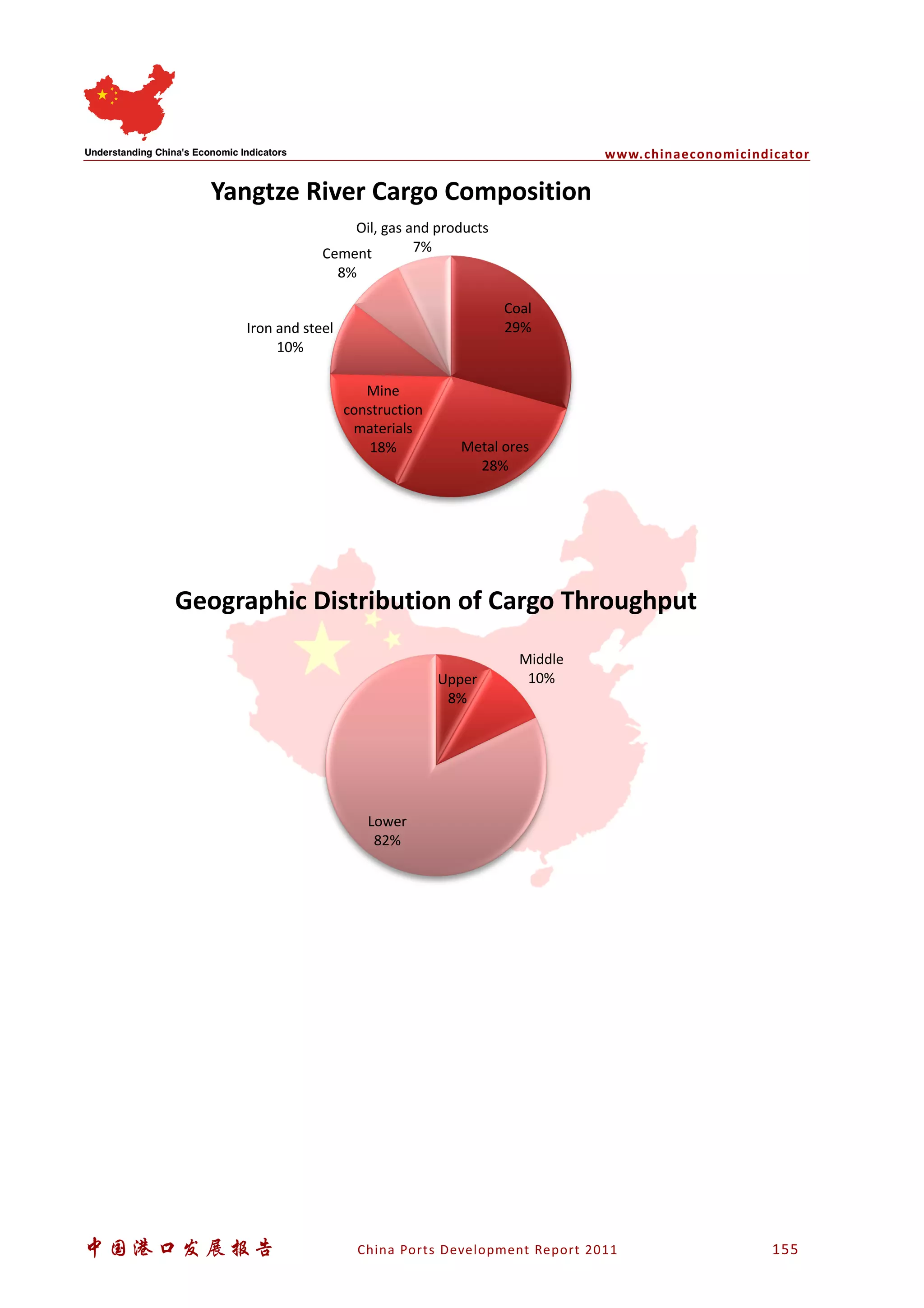

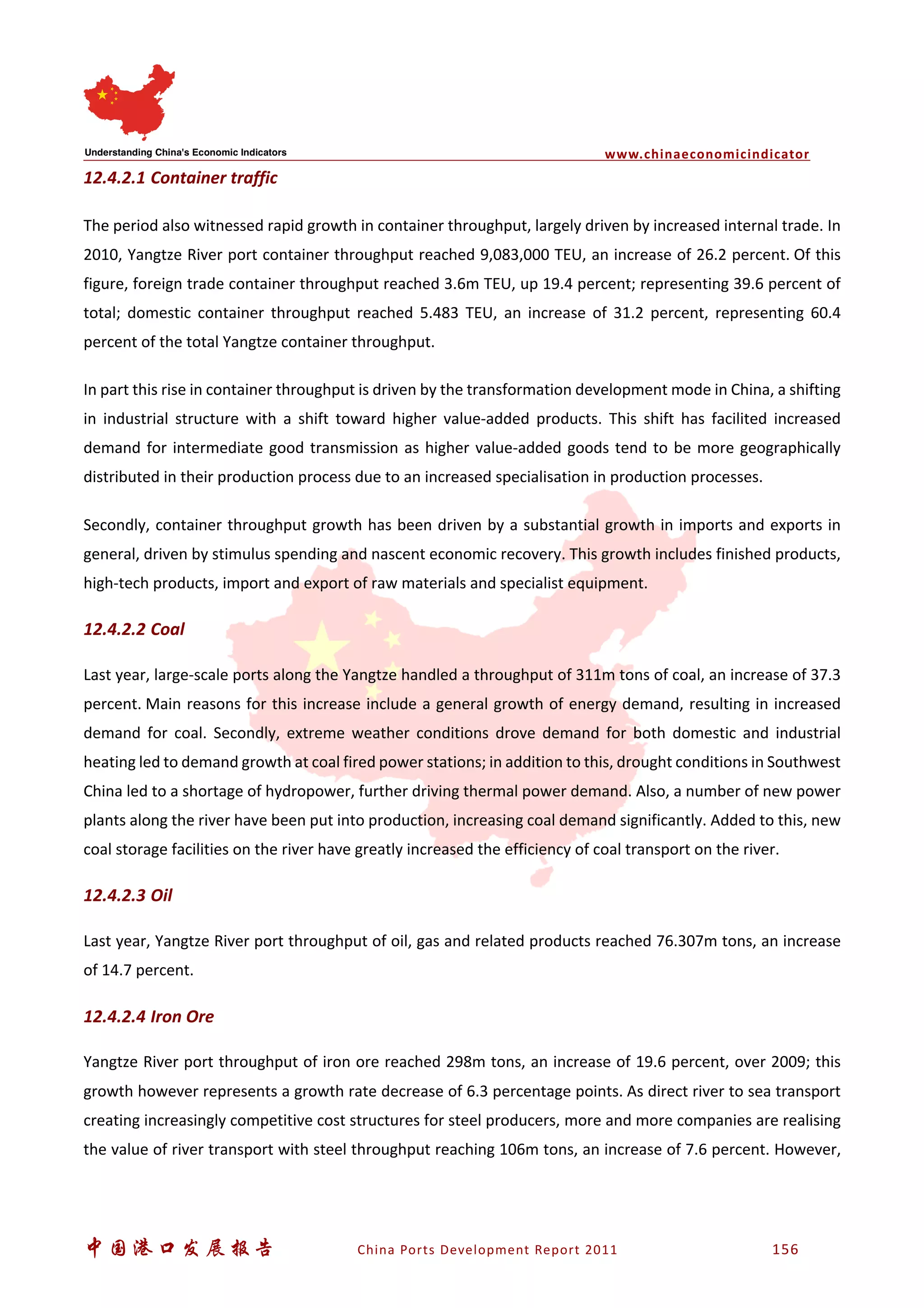

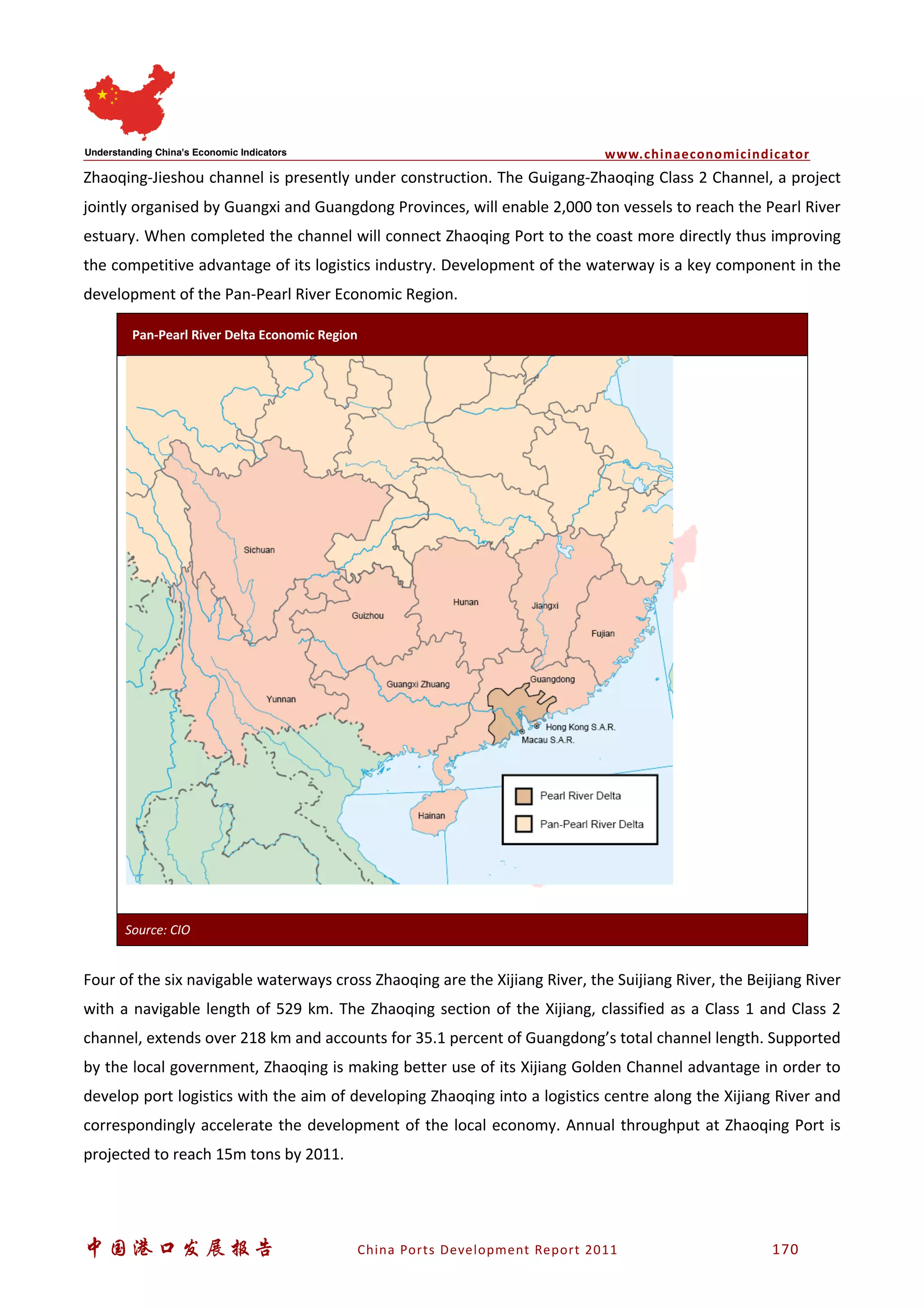

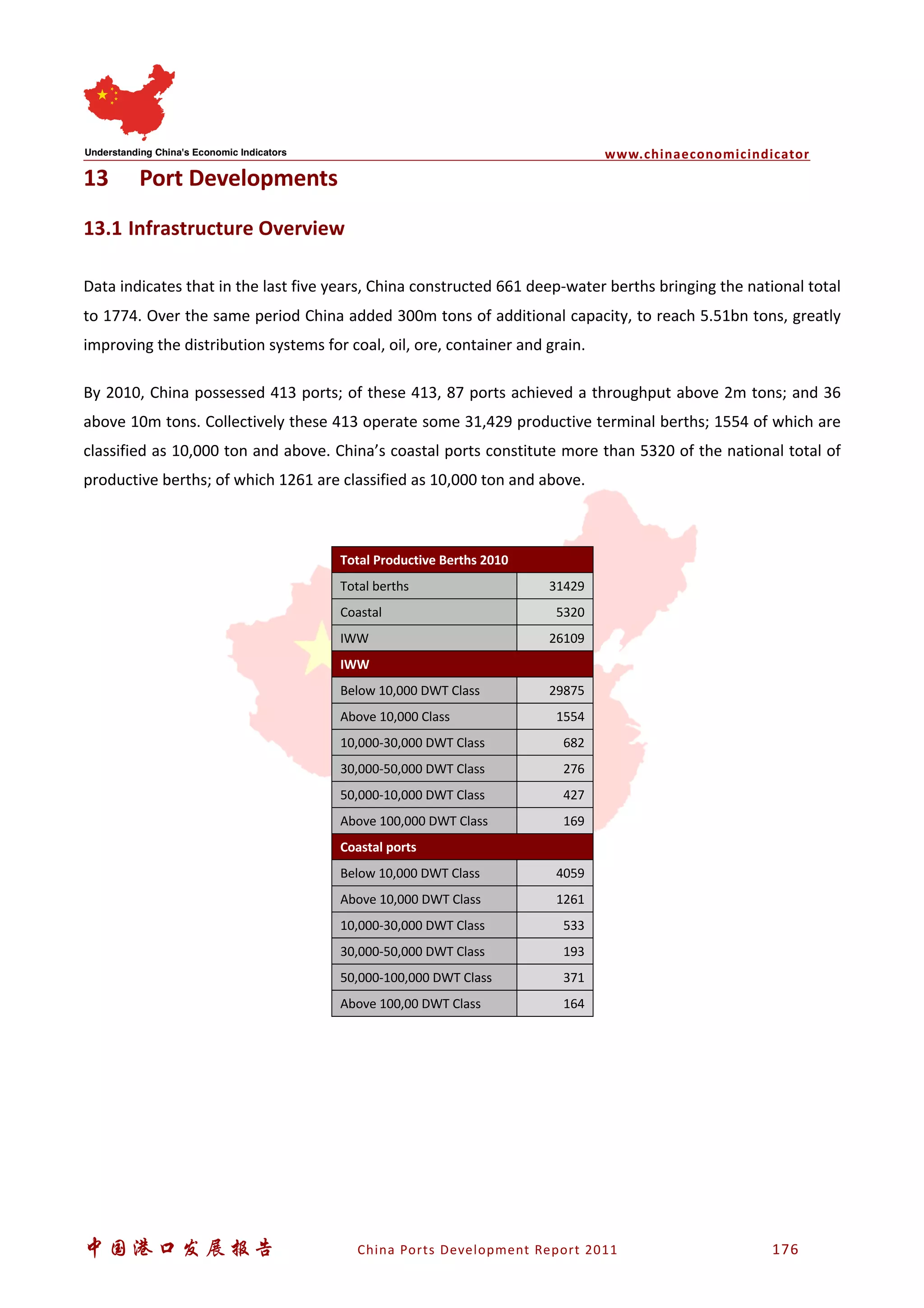

This document provides an executive summary and analysis of port development in China. It discusses China's economic growth and its relationship to the global economy and trade. Key points include China's continued economic growth despite the global financial crisis, its focus on developing national logistics networks, and forecasts for growth in foreign trade and container throughput at Chinese ports in 2011. The report also examines throughput capacity, demand, and development trends for various bulk cargoes and regions in China.