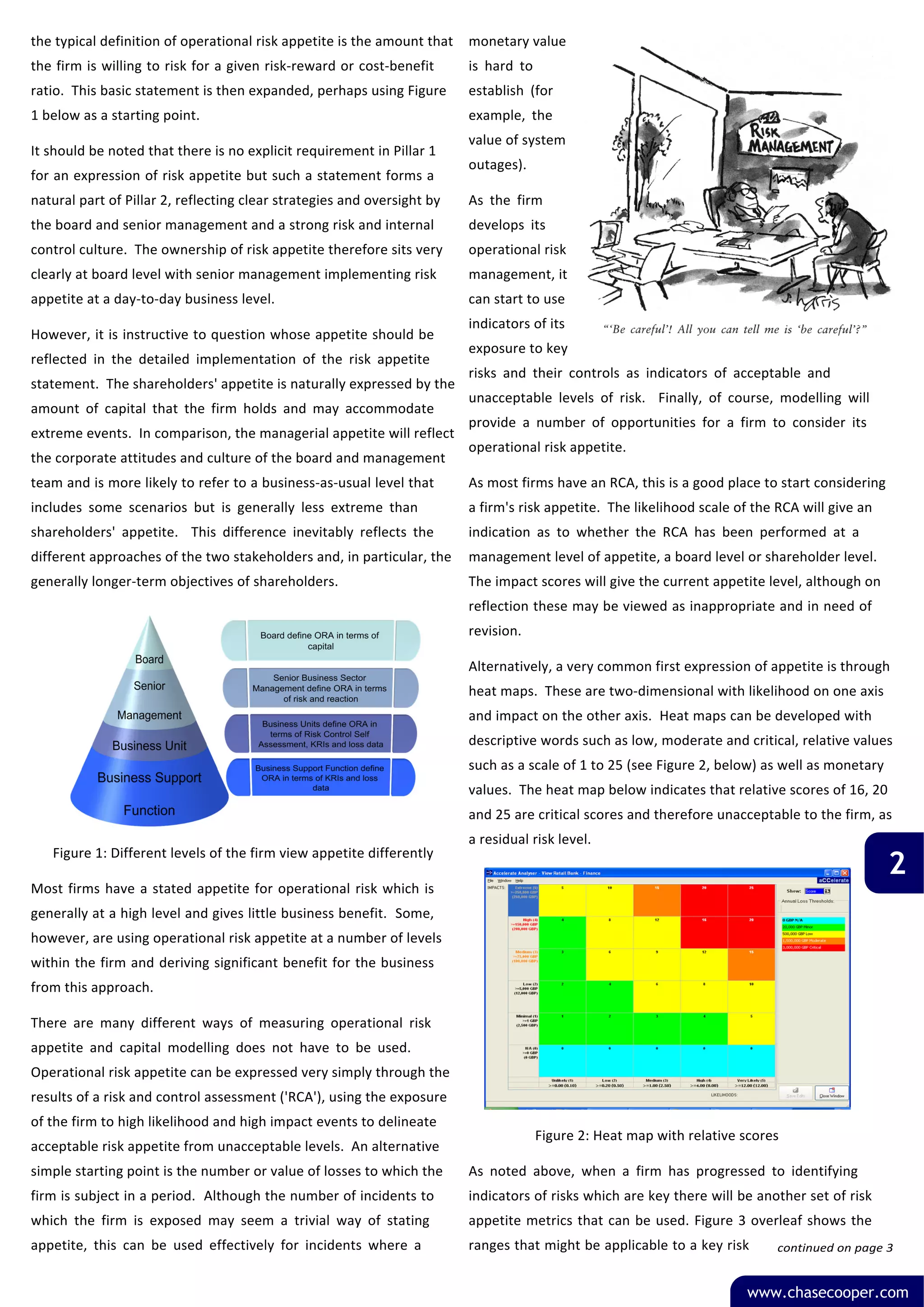

1) Operational risk appetite is a subject of debate as it is difficult to reduce to a single monetary value given its nature is affected by management culture and external factors.

2) A firm's risk appetite should be approved by the board and reflect an acceptable trade-off between risk and returns, commonly defined as the amount of risk a firm is willing to take for a given risk-reward ratio.

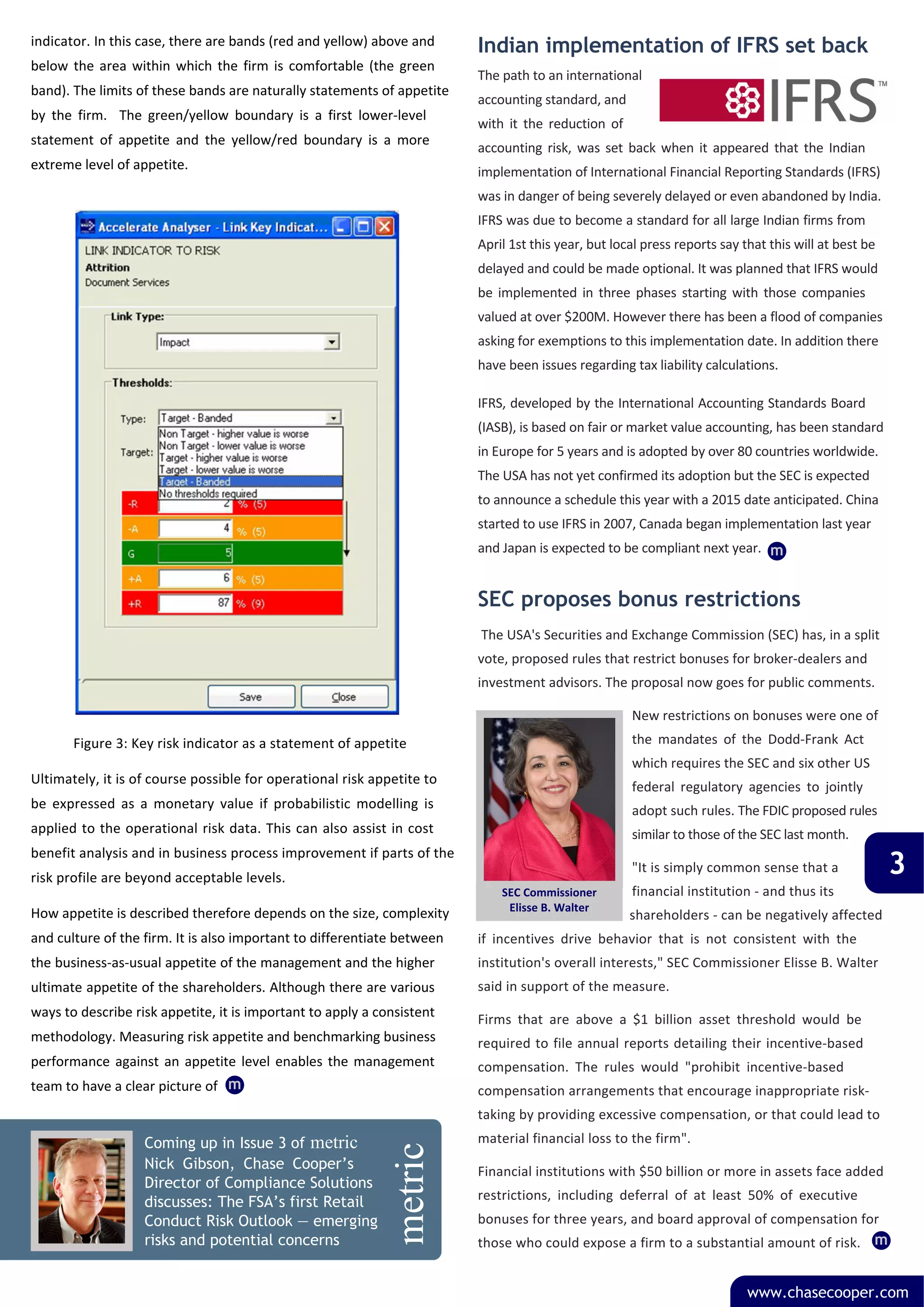

3) Expressing operational risk appetite can start qualitatively through a firm's risk and control assessment likelihood and impact scales, and then develop more quantitatively over time through indicators and modeling.