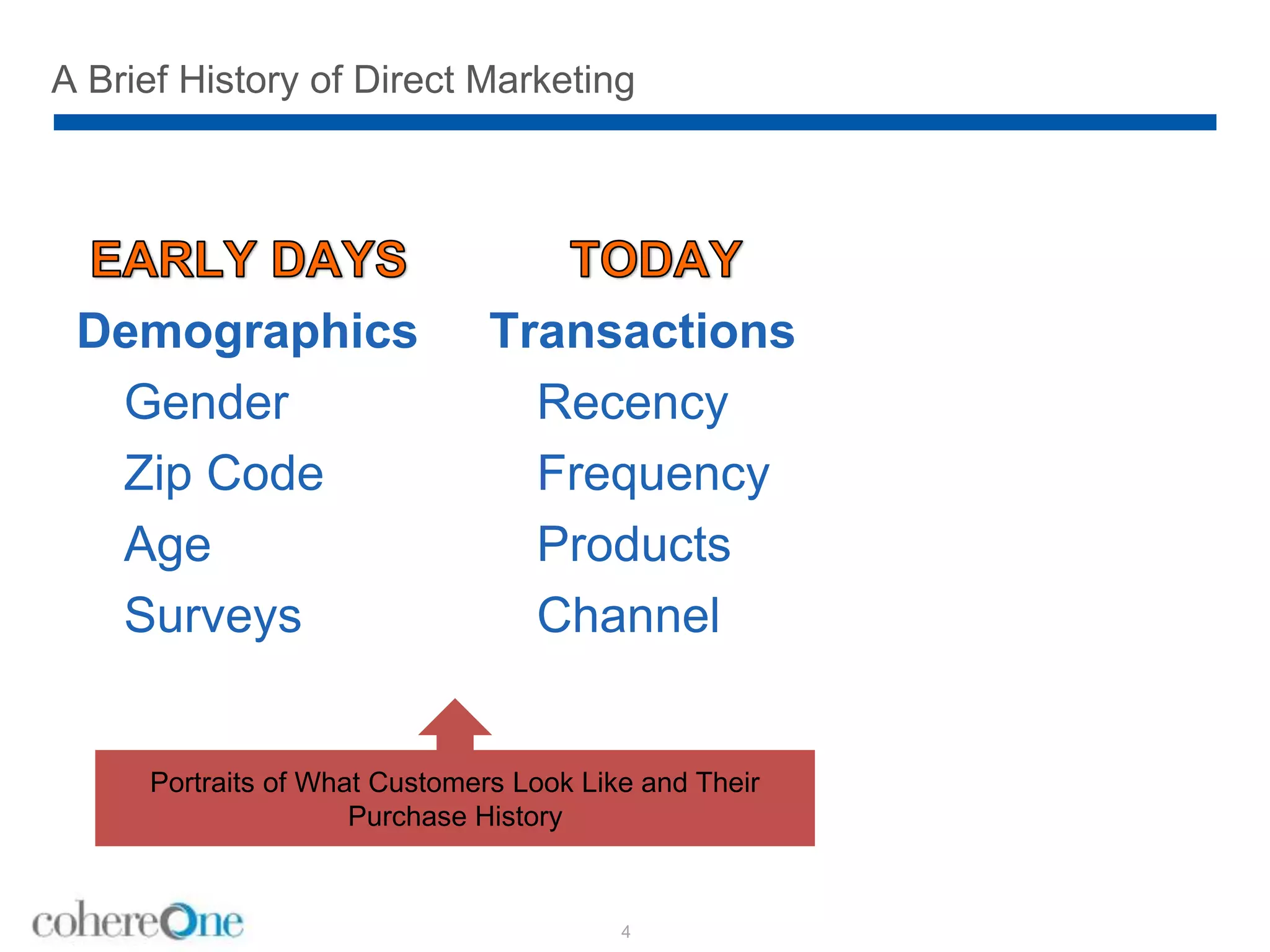

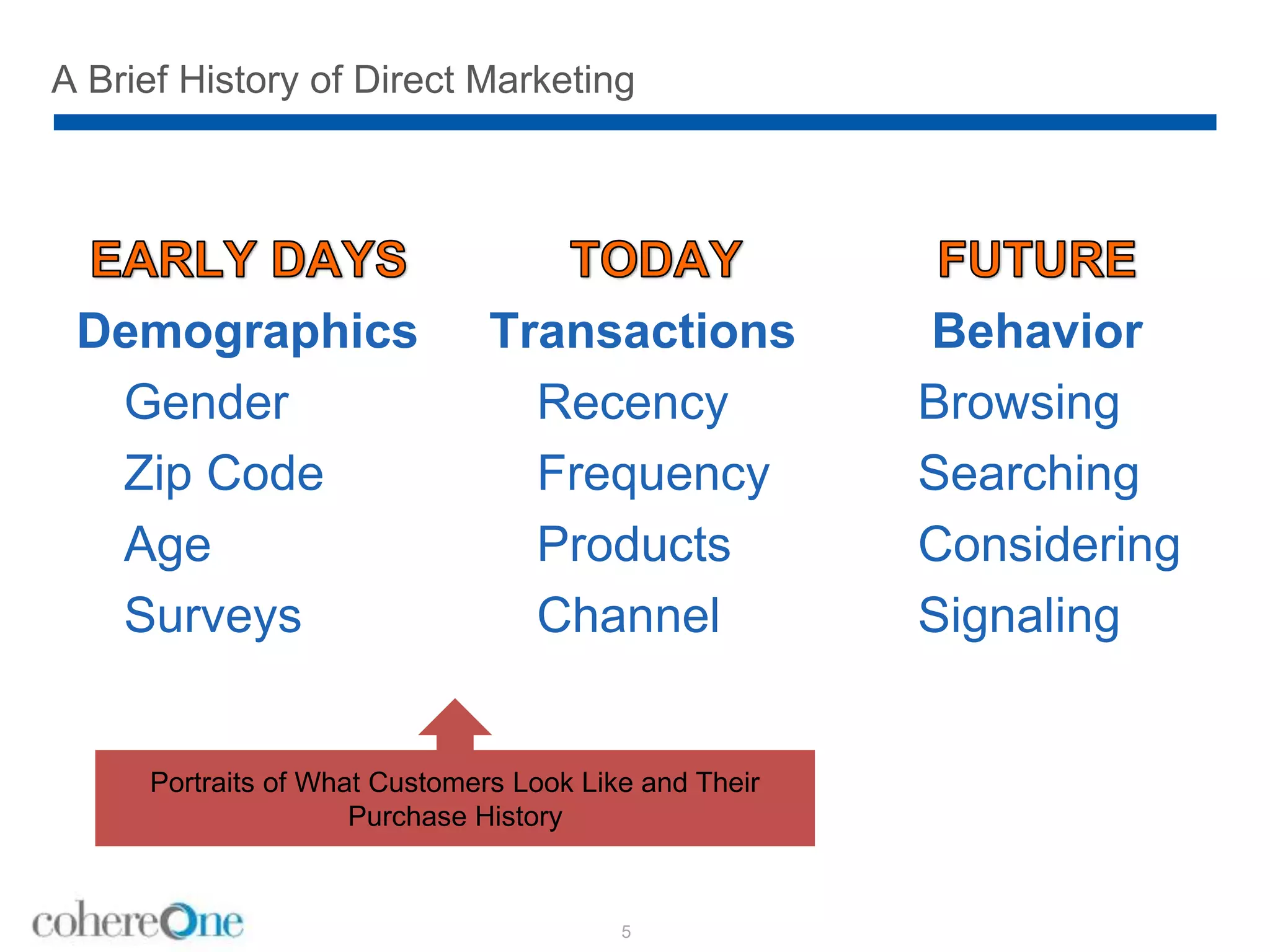

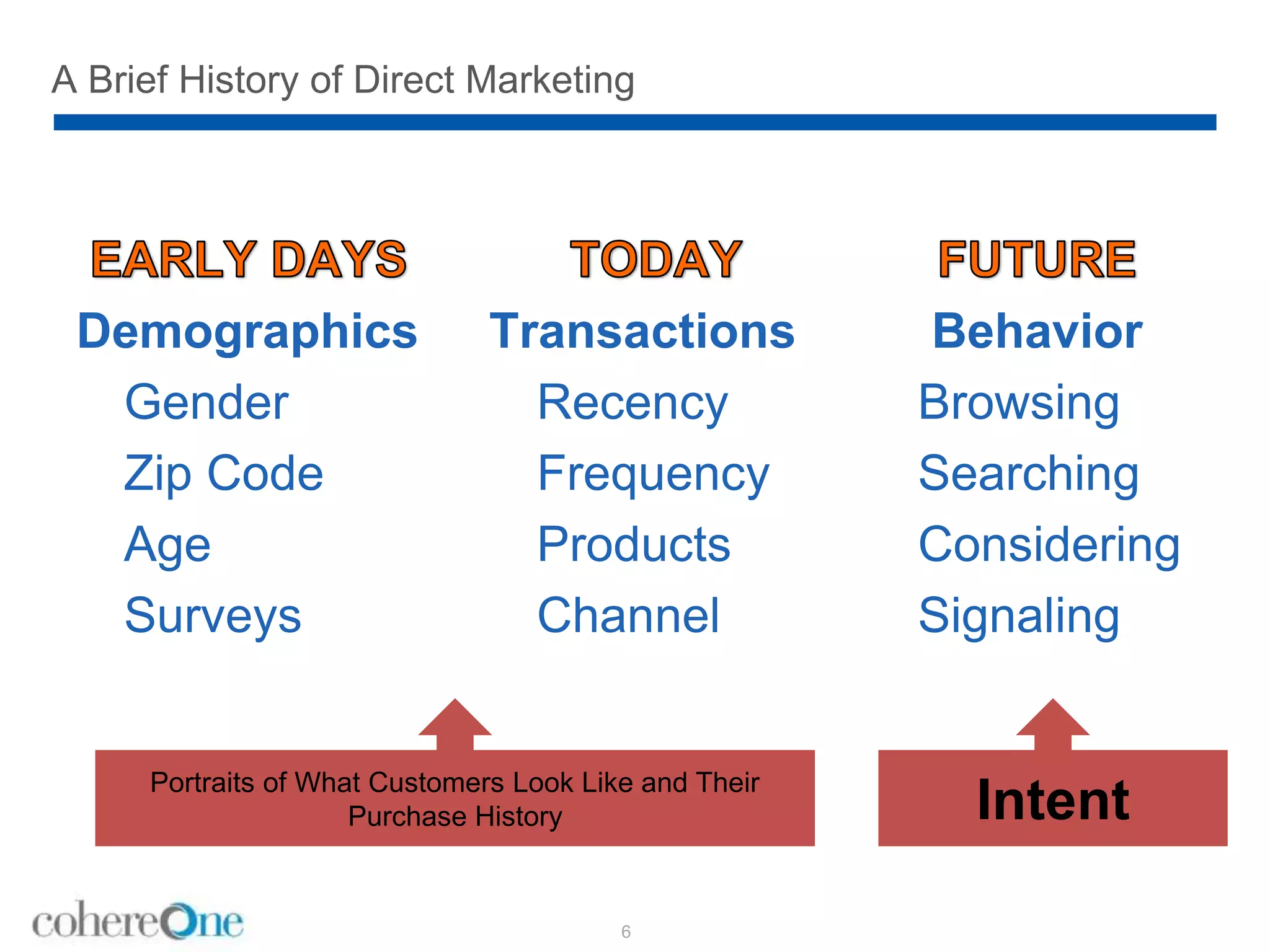

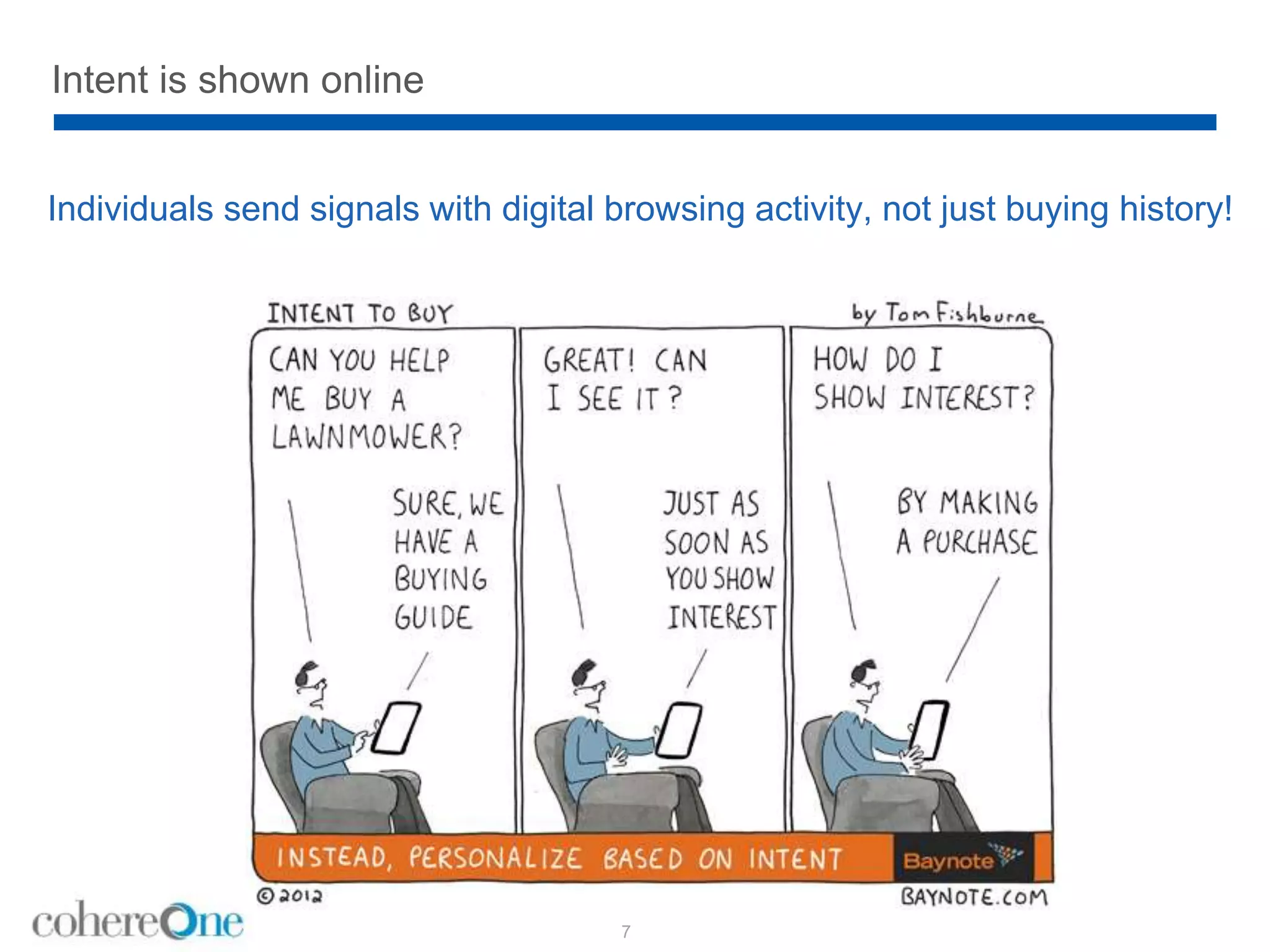

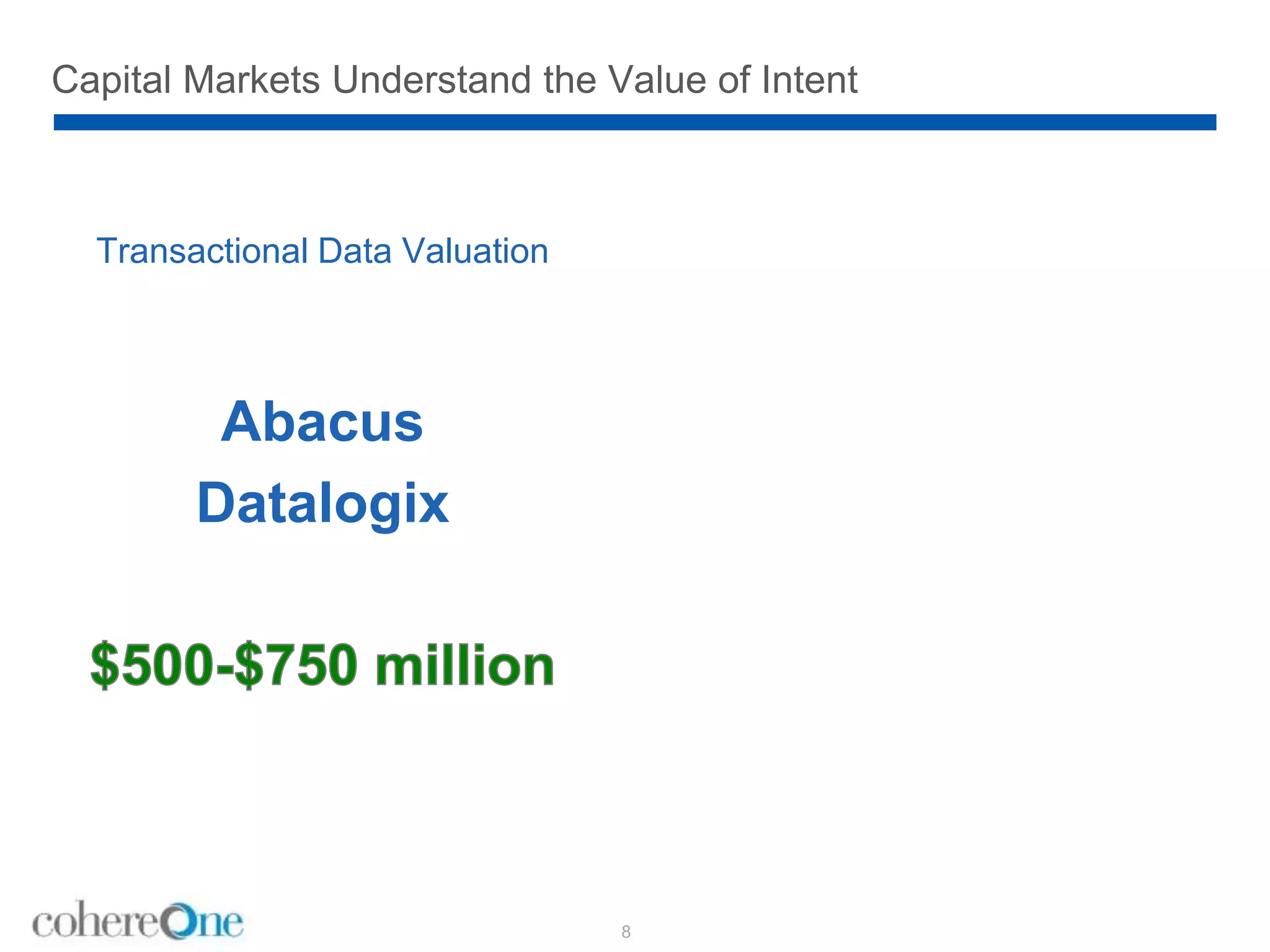

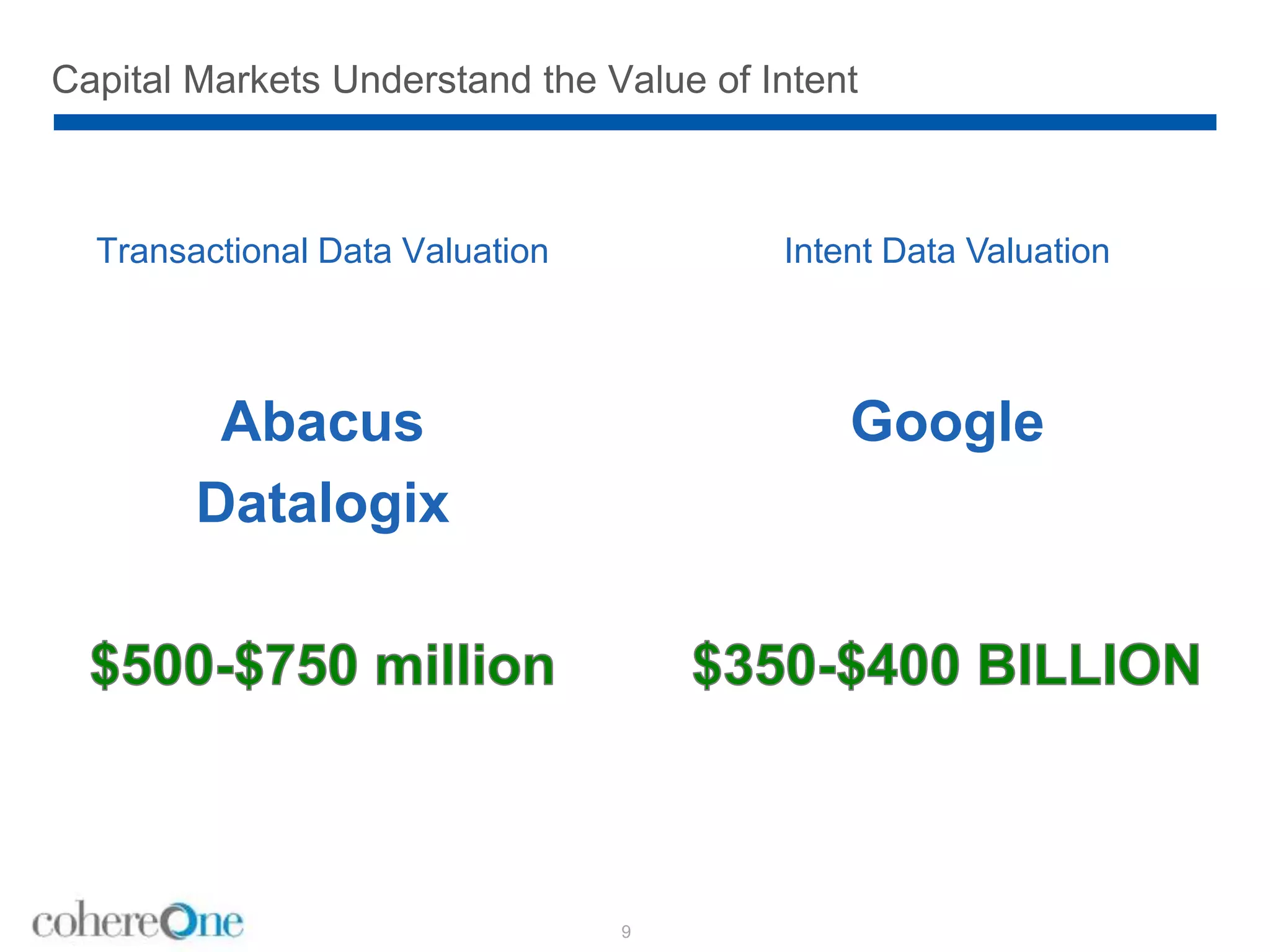

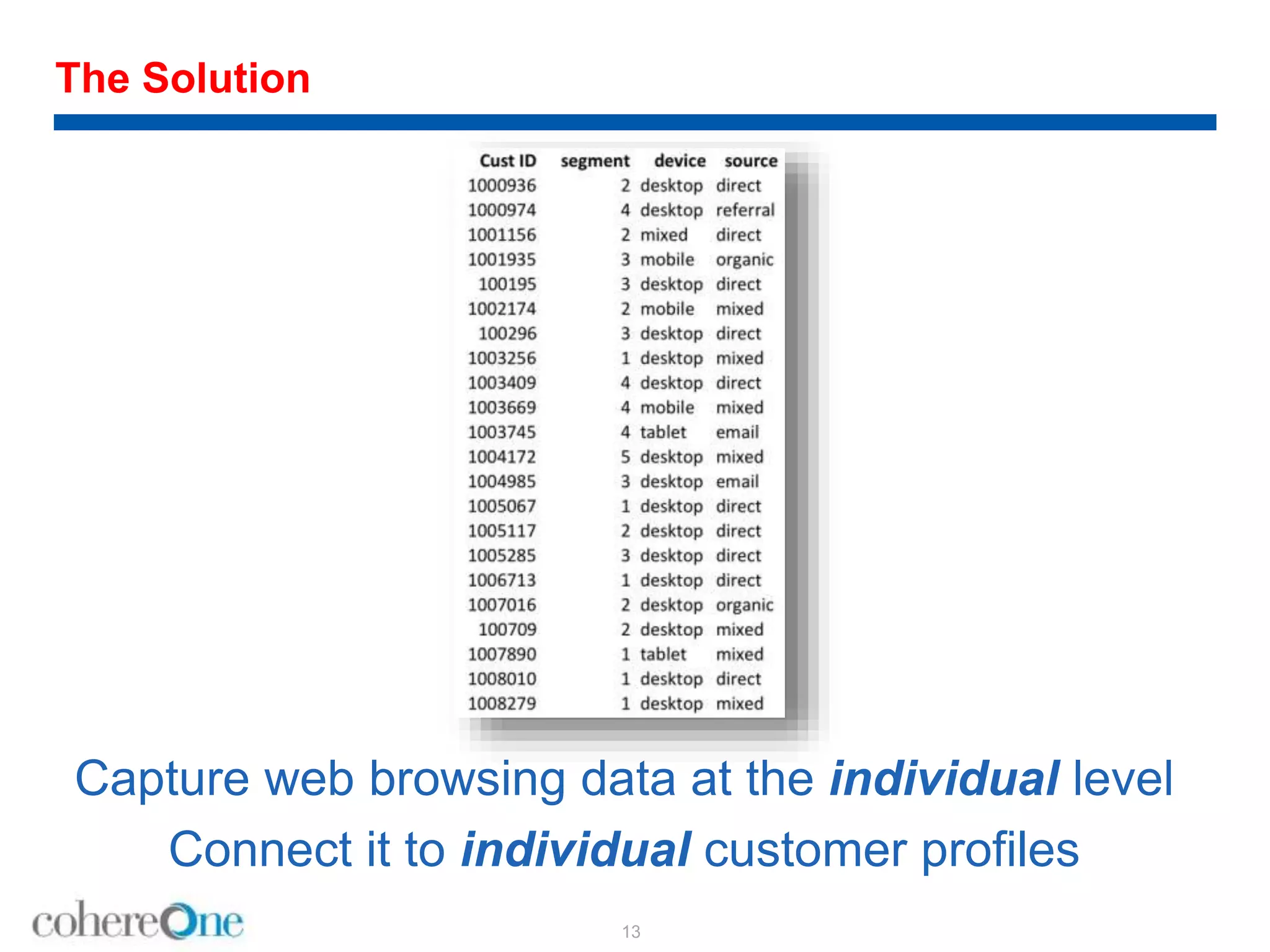

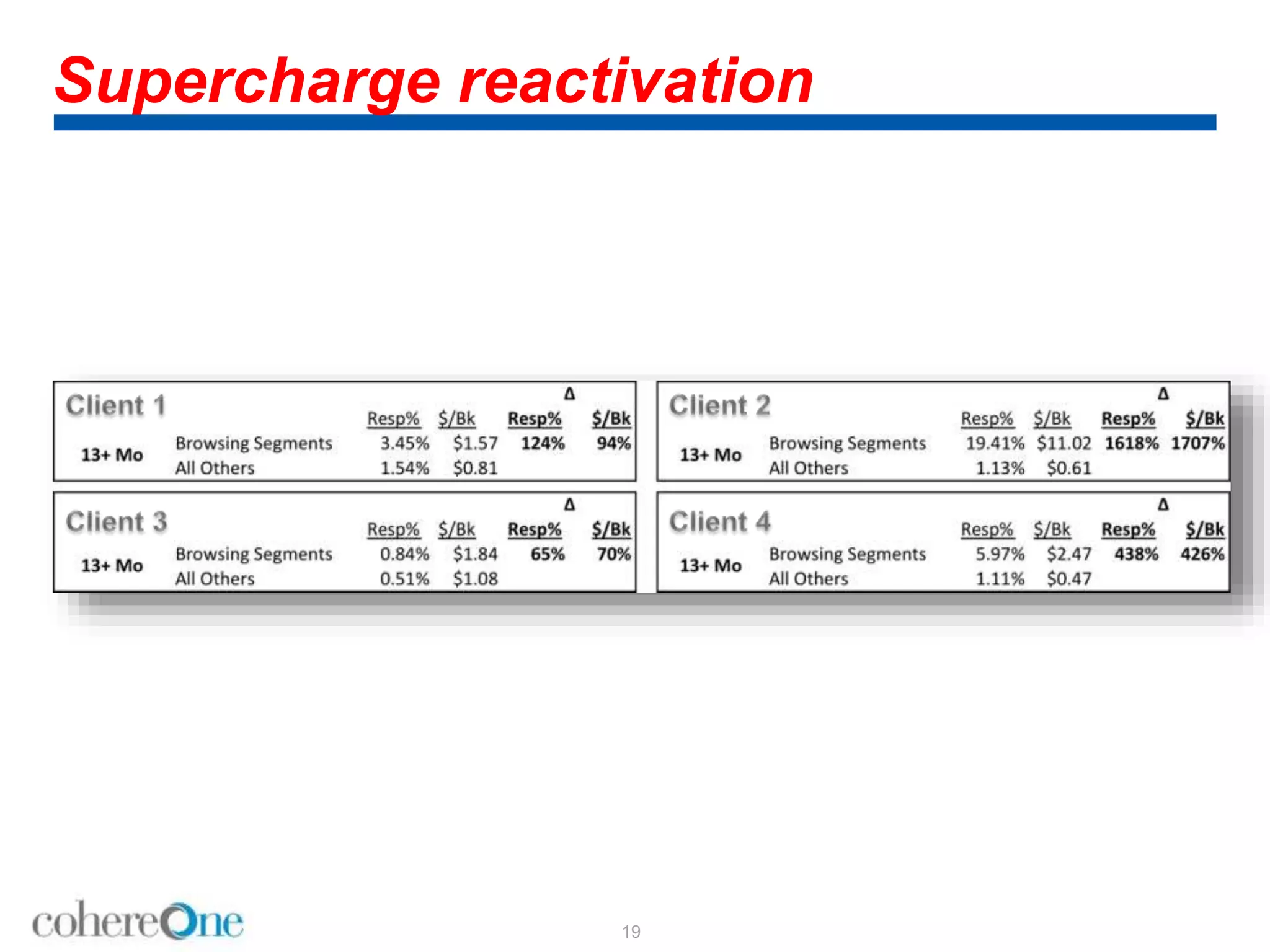

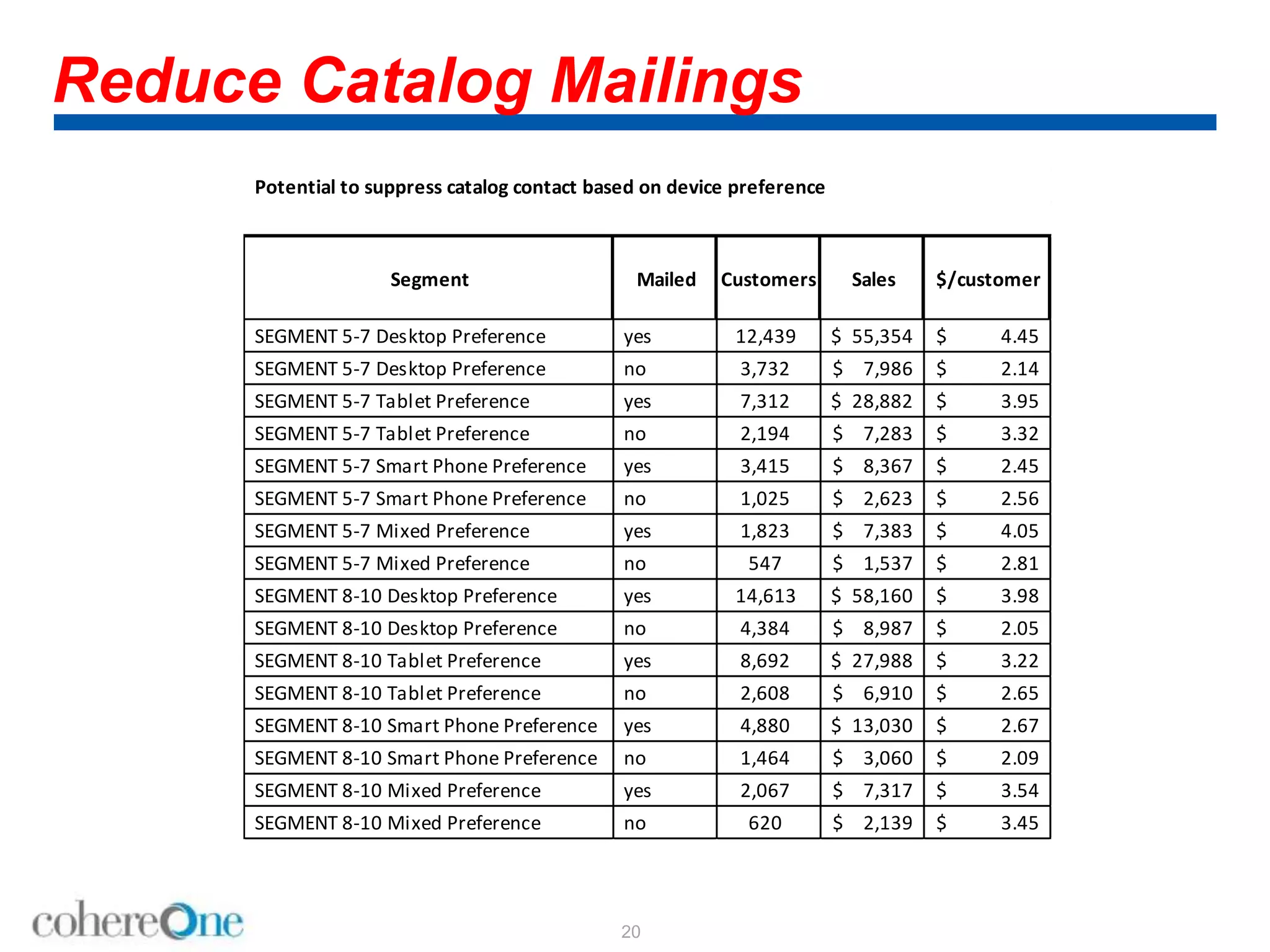

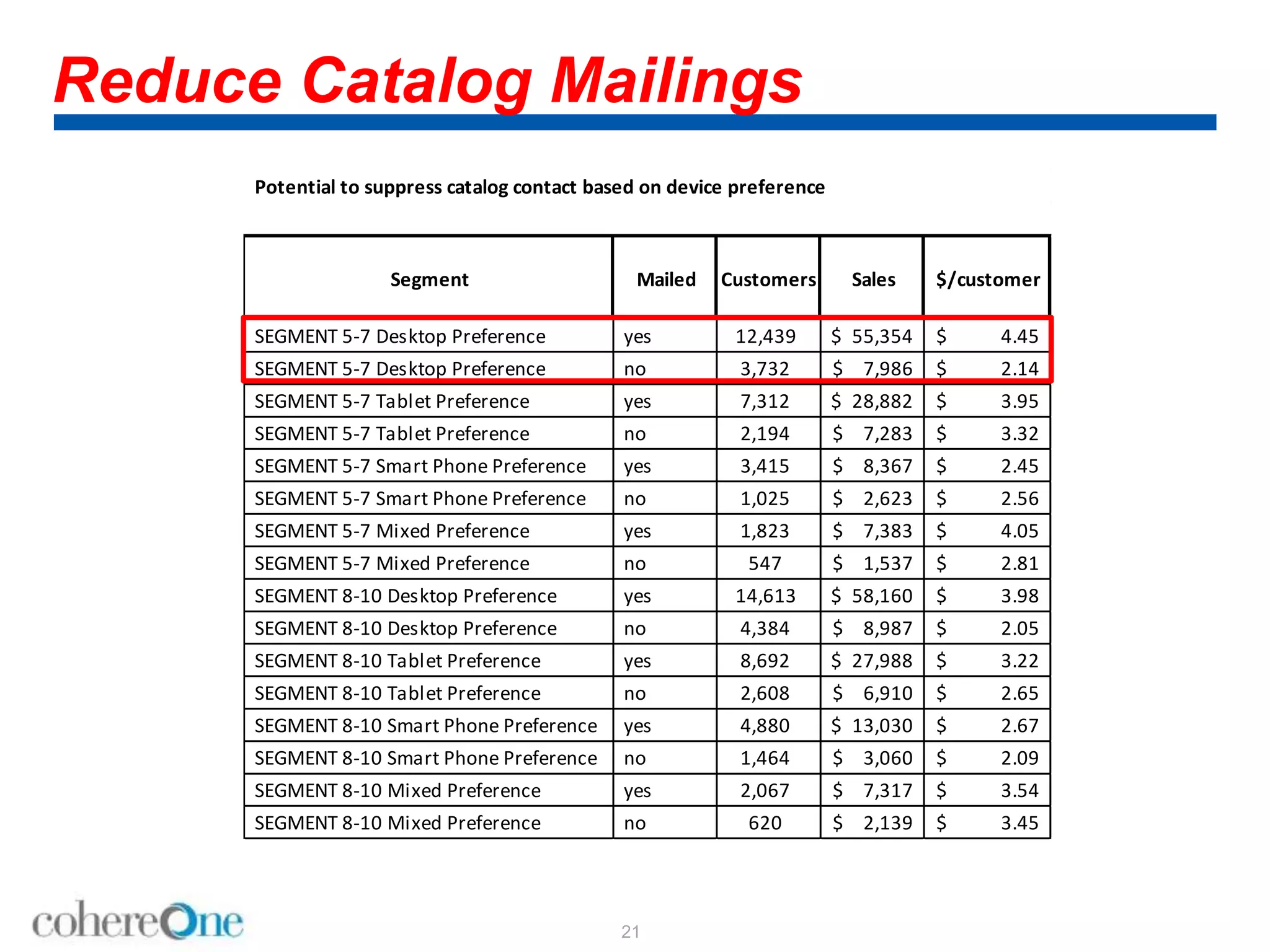

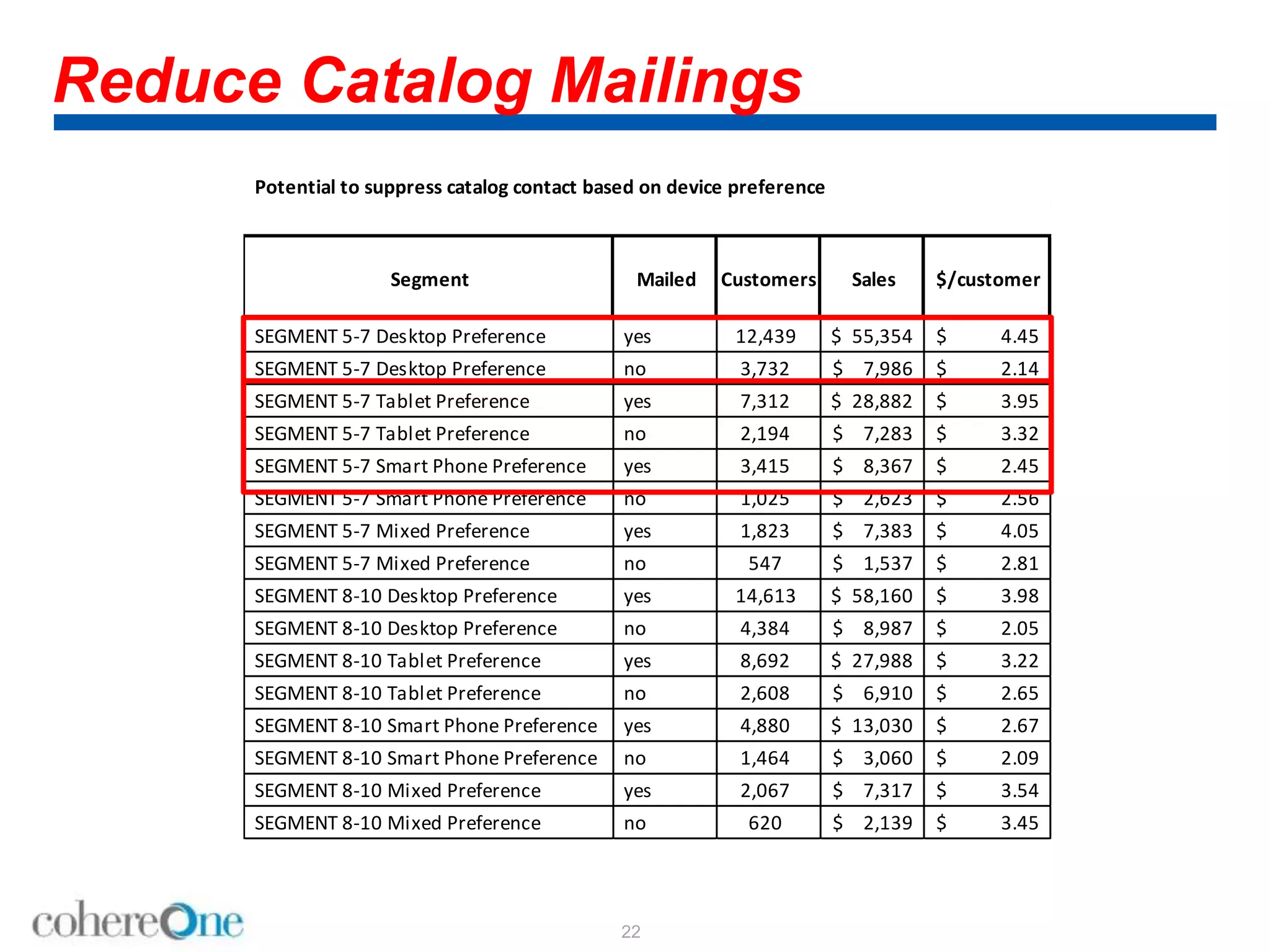

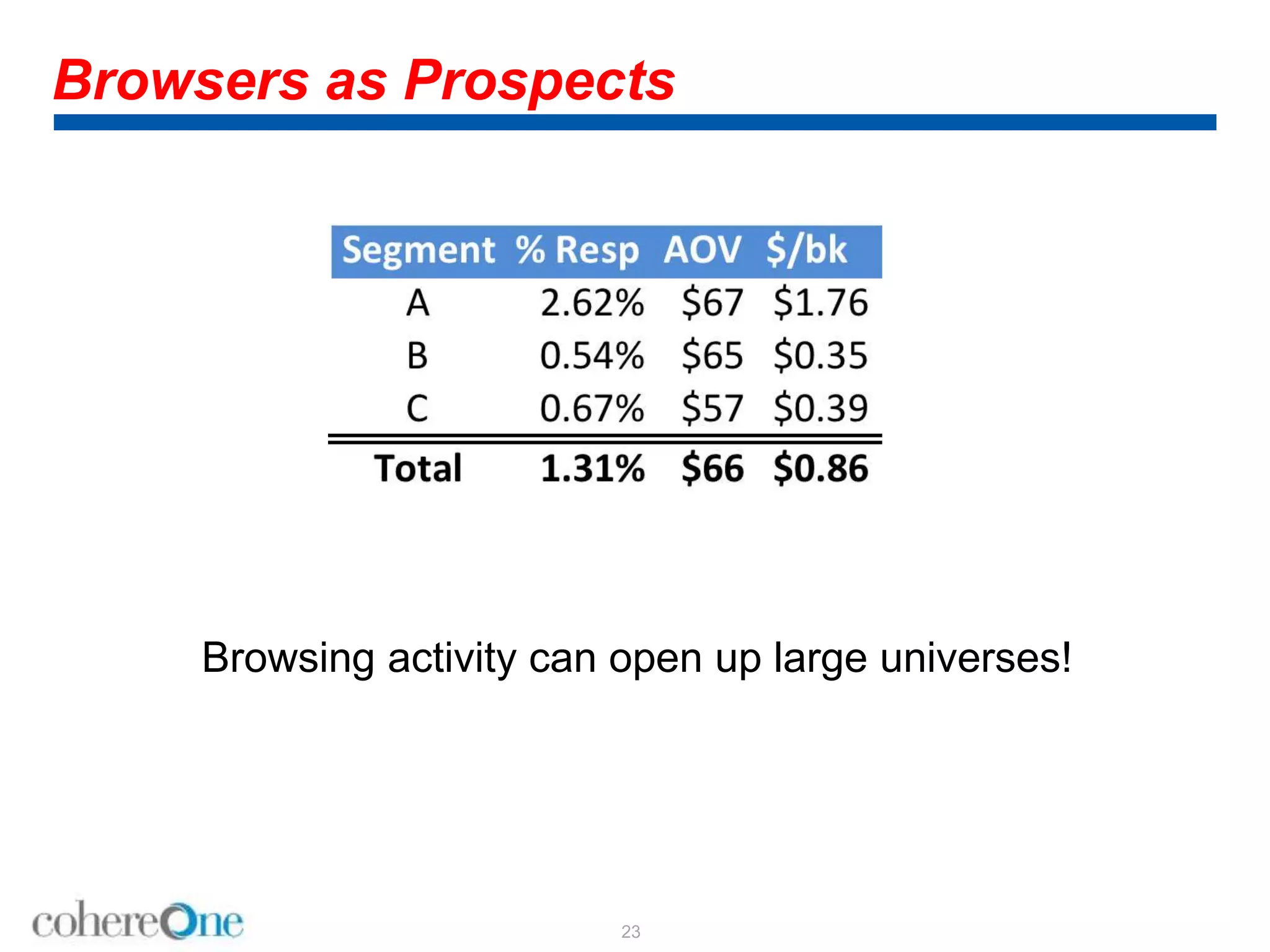

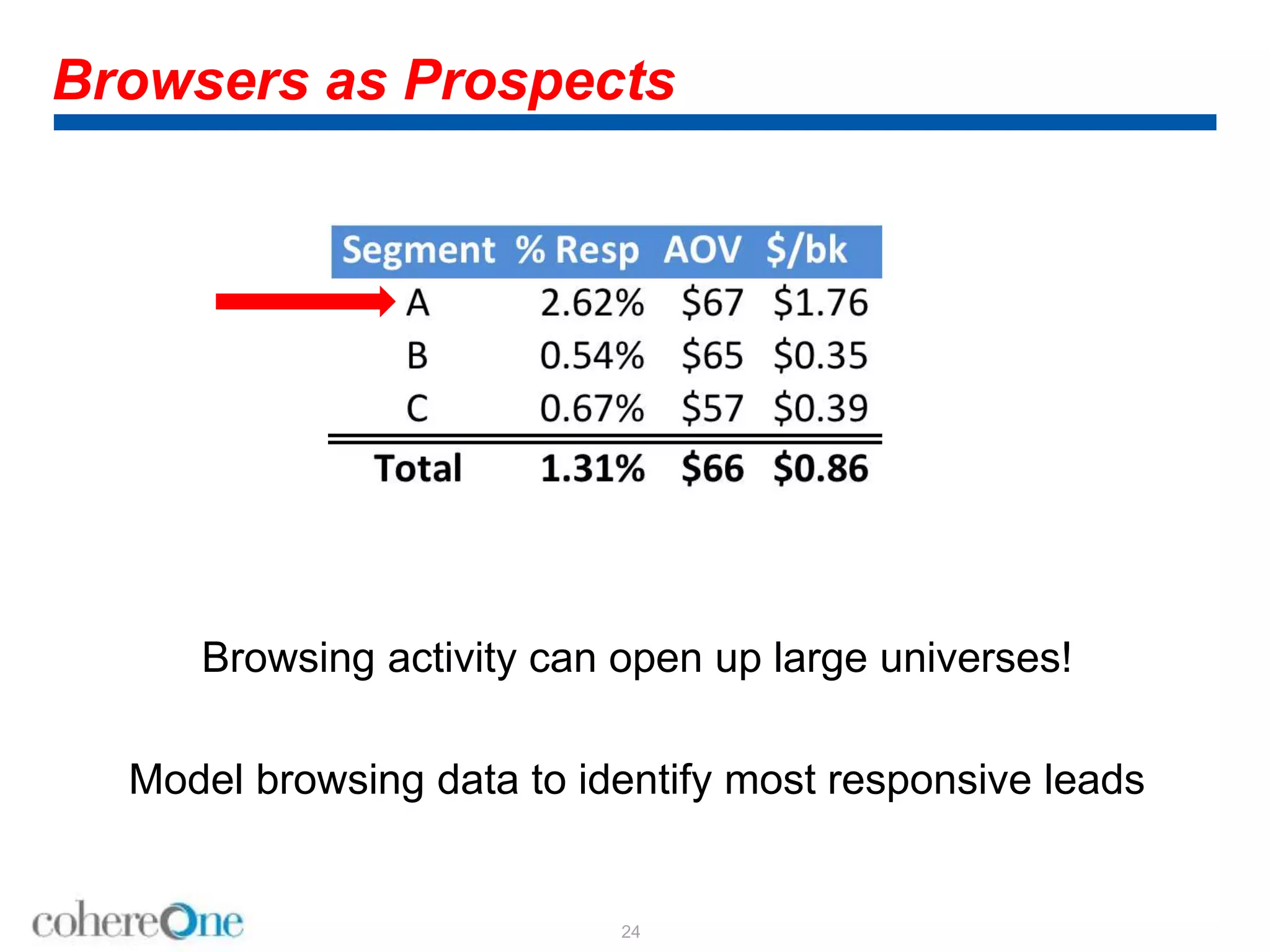

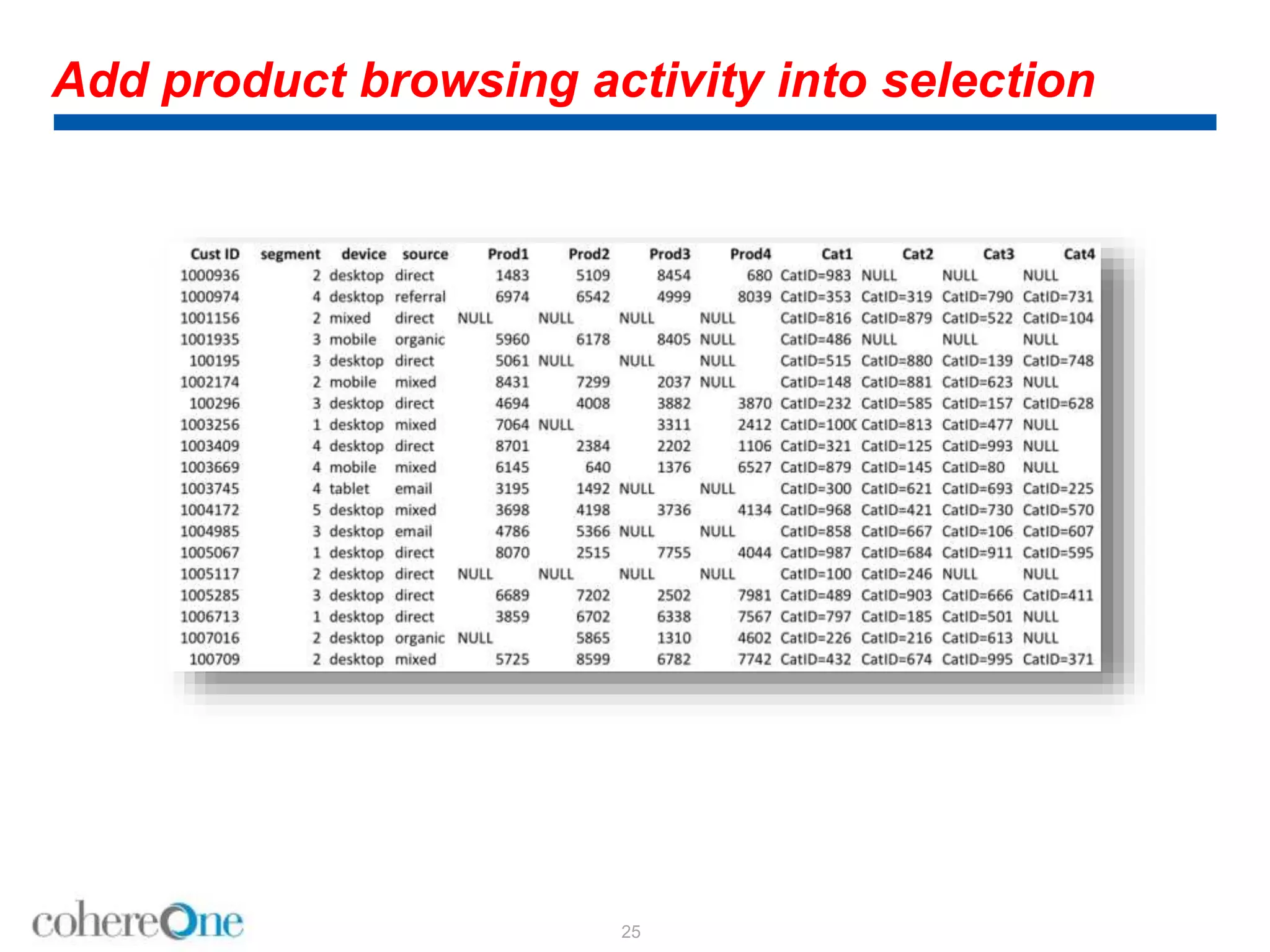

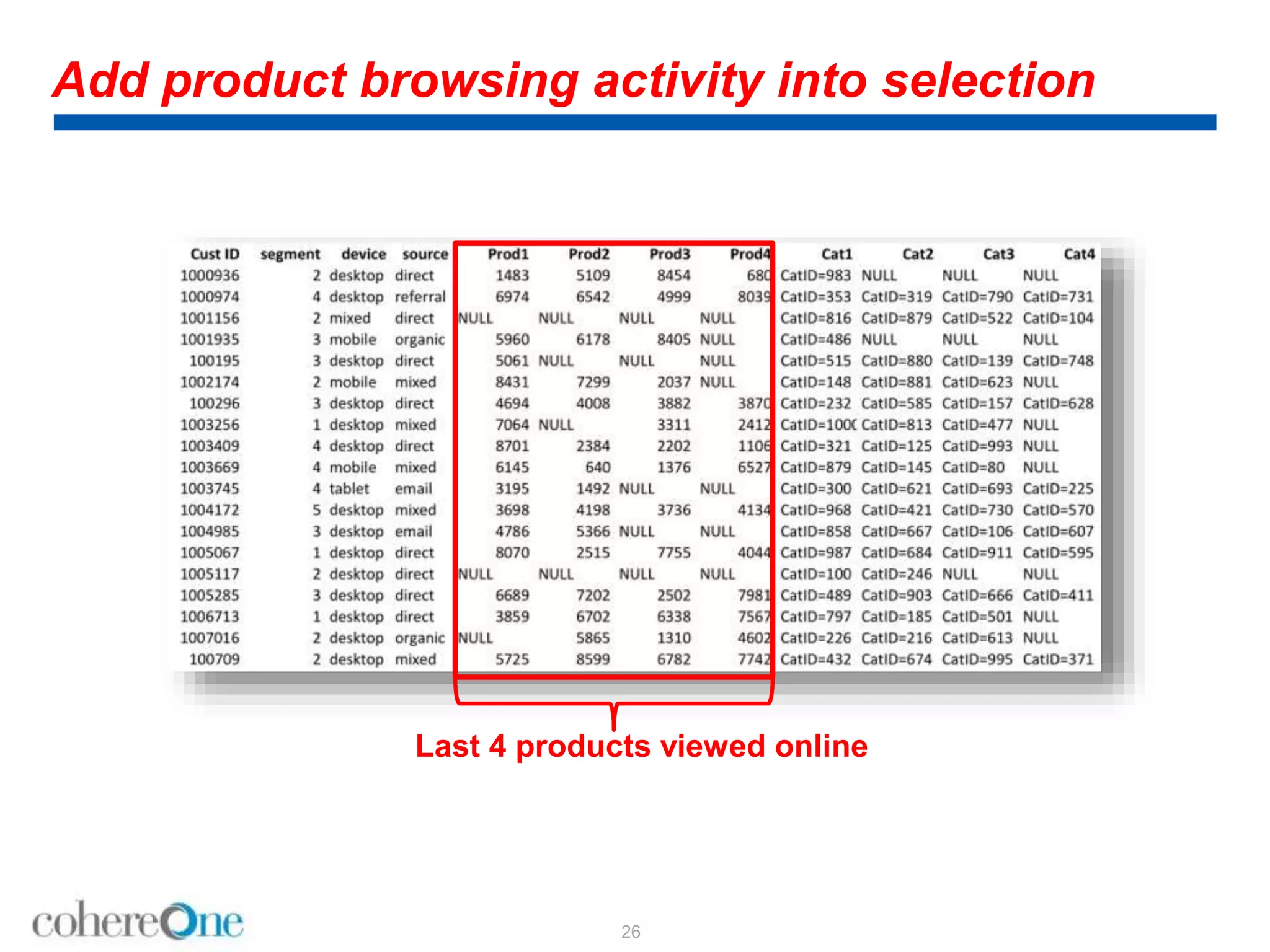

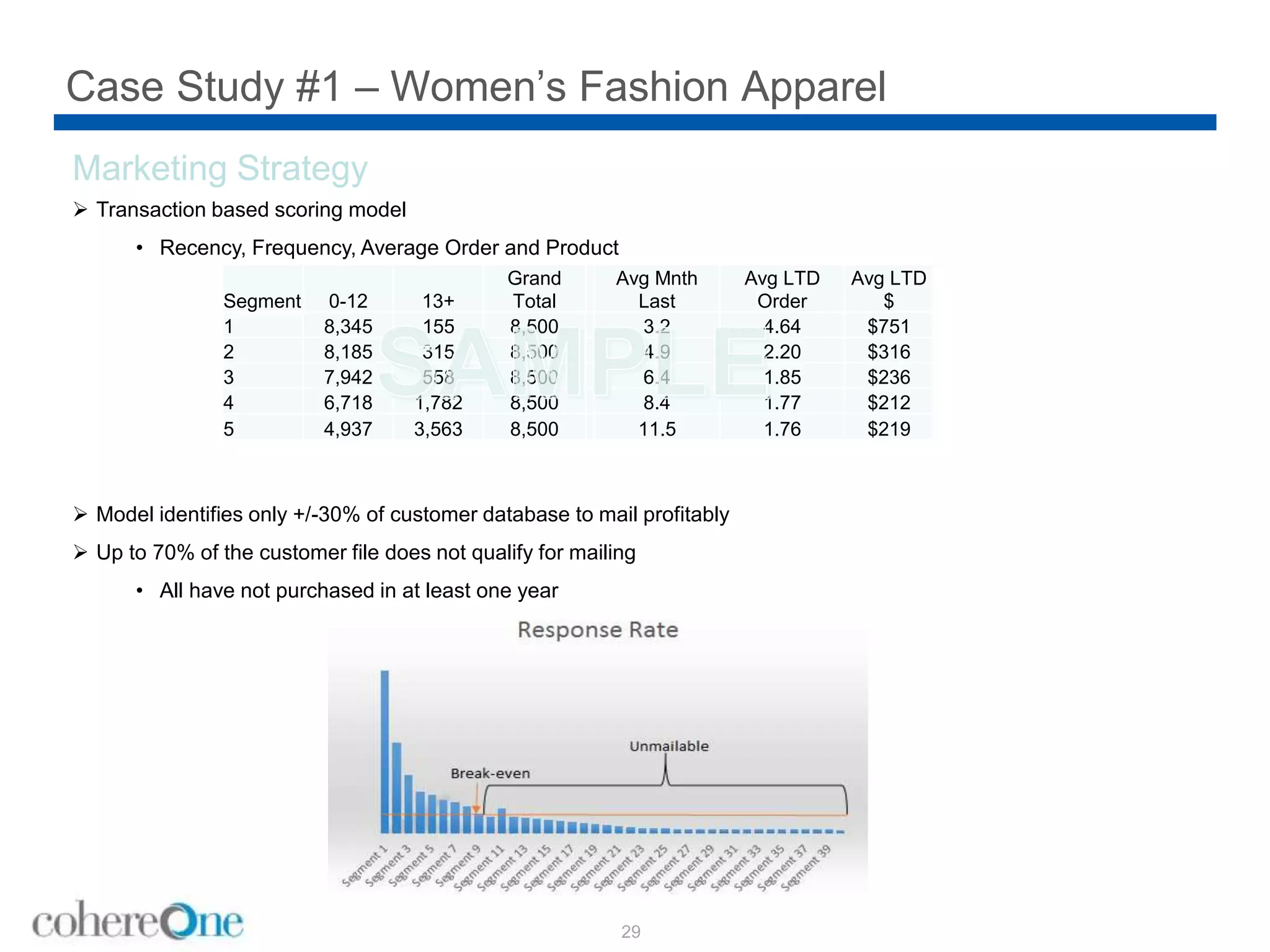

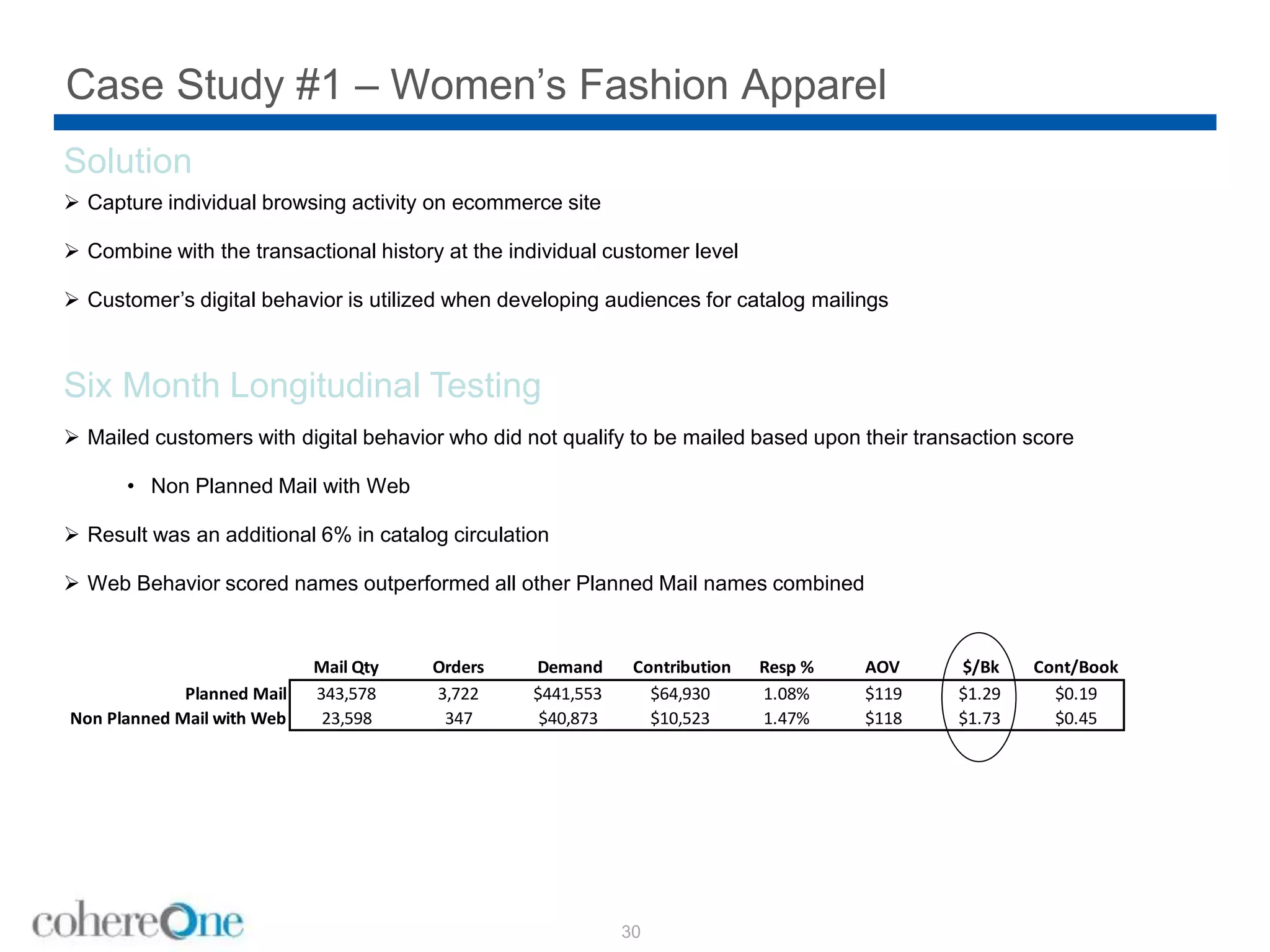

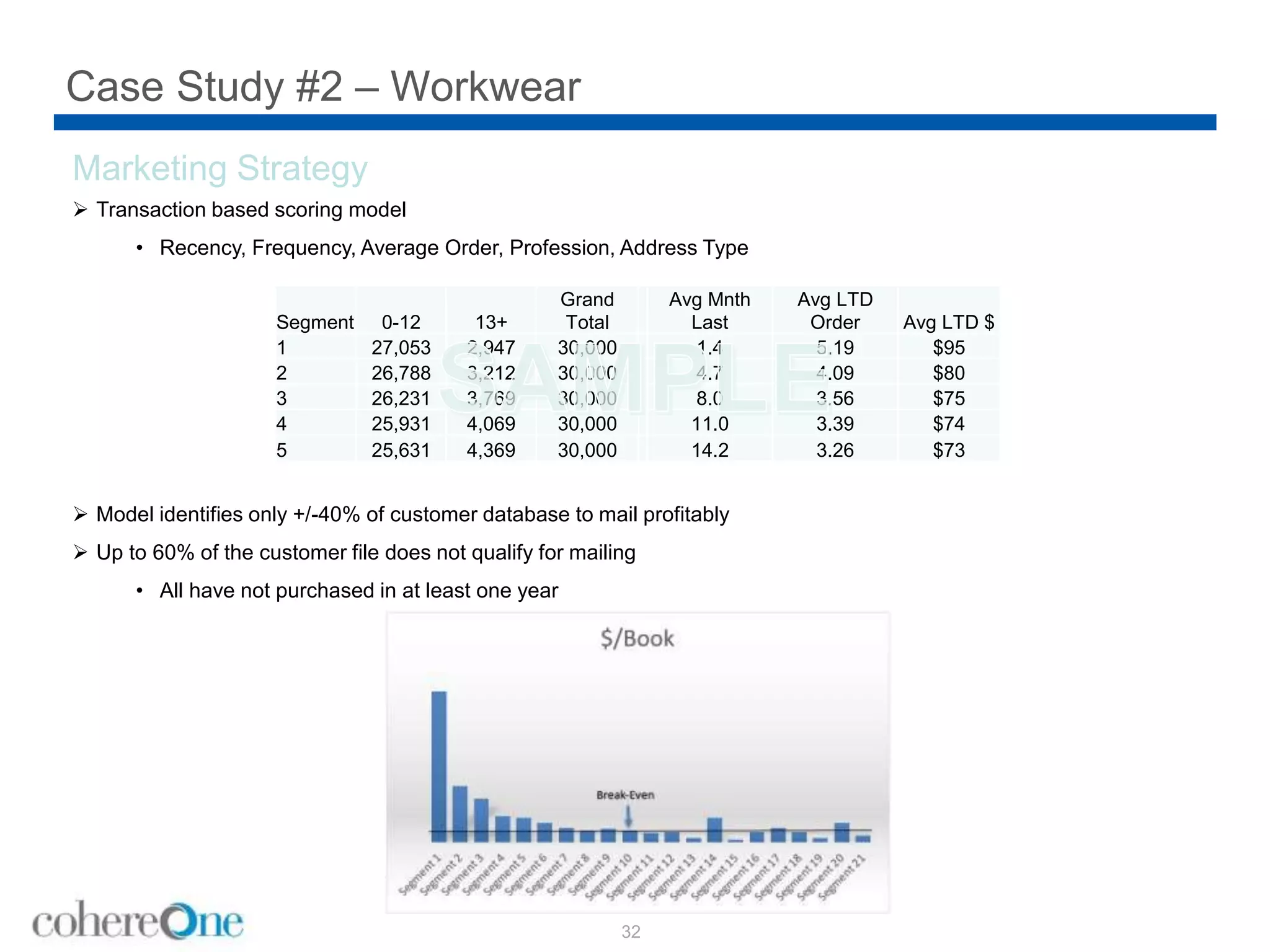

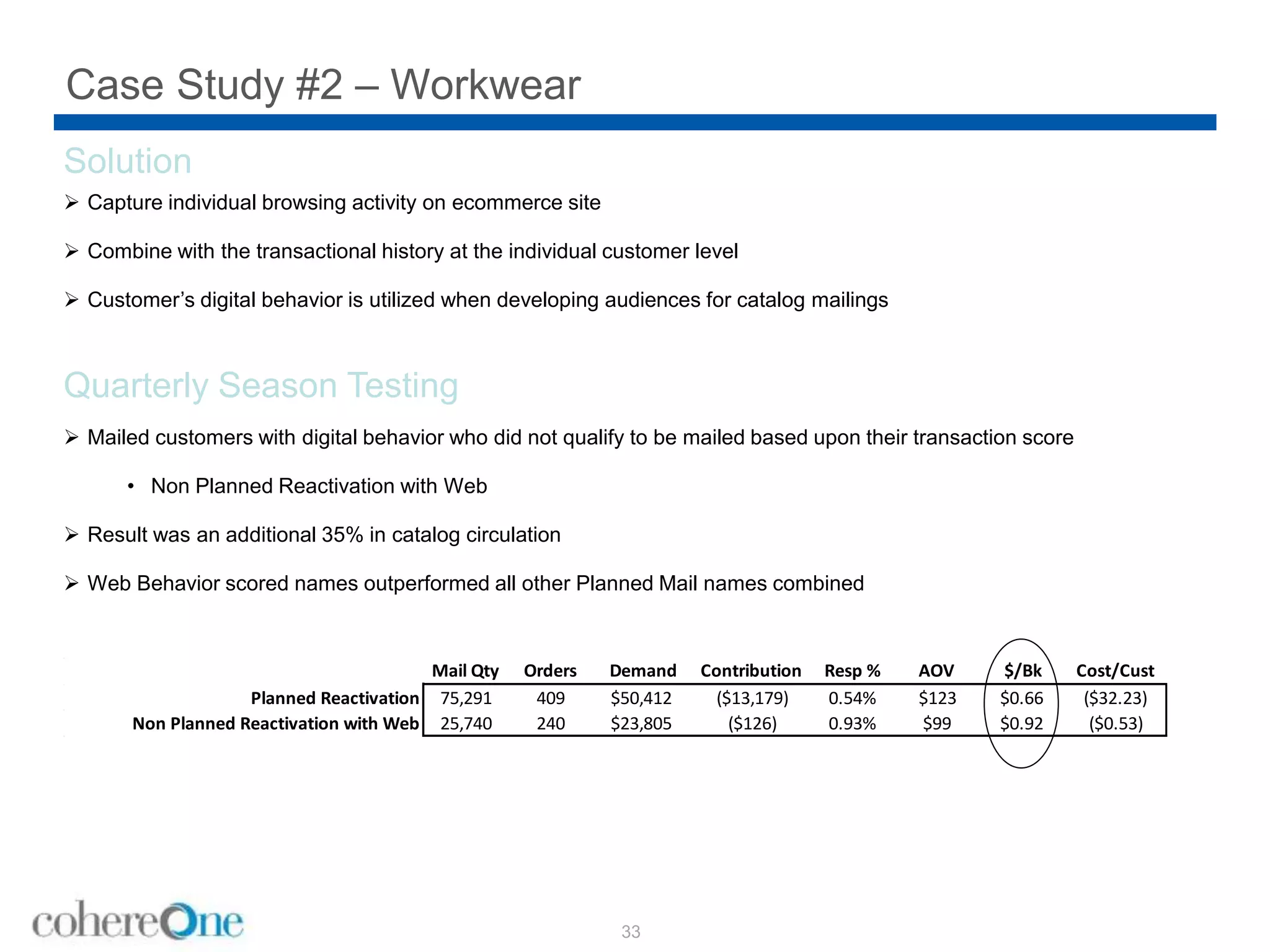

The document discusses the use of web behavior data to enhance catalog response rates in direct marketing by analyzing demographics and customer purchase history. It highlights the importance of connecting browsing data at an individual level to optimize catalog mailings and improve customer engagement through targeted strategies. Two case studies illustrate the effectiveness of leveraging digital behavior to increase catalog circulation beyond traditional transaction-based scoring methods.