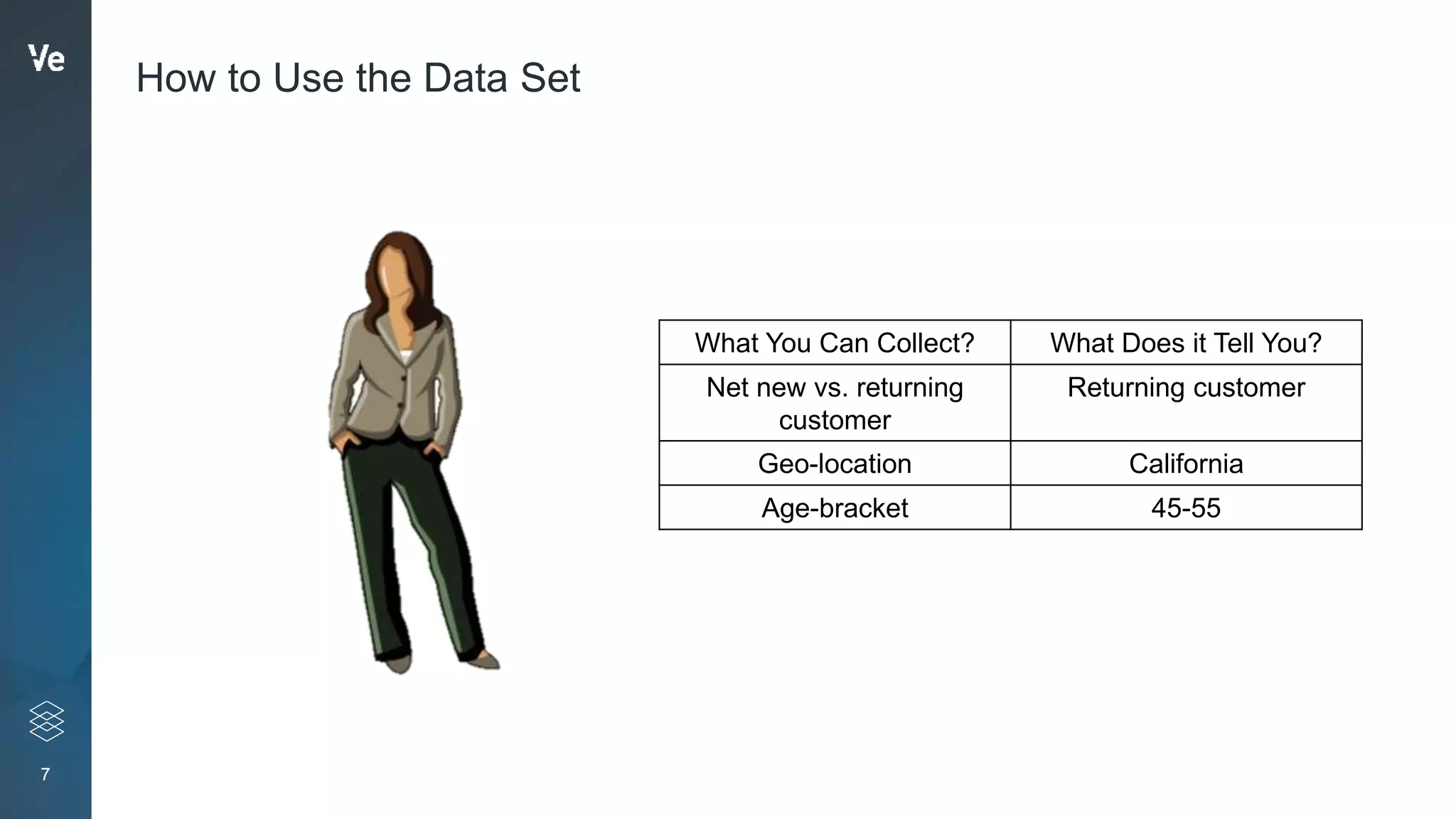

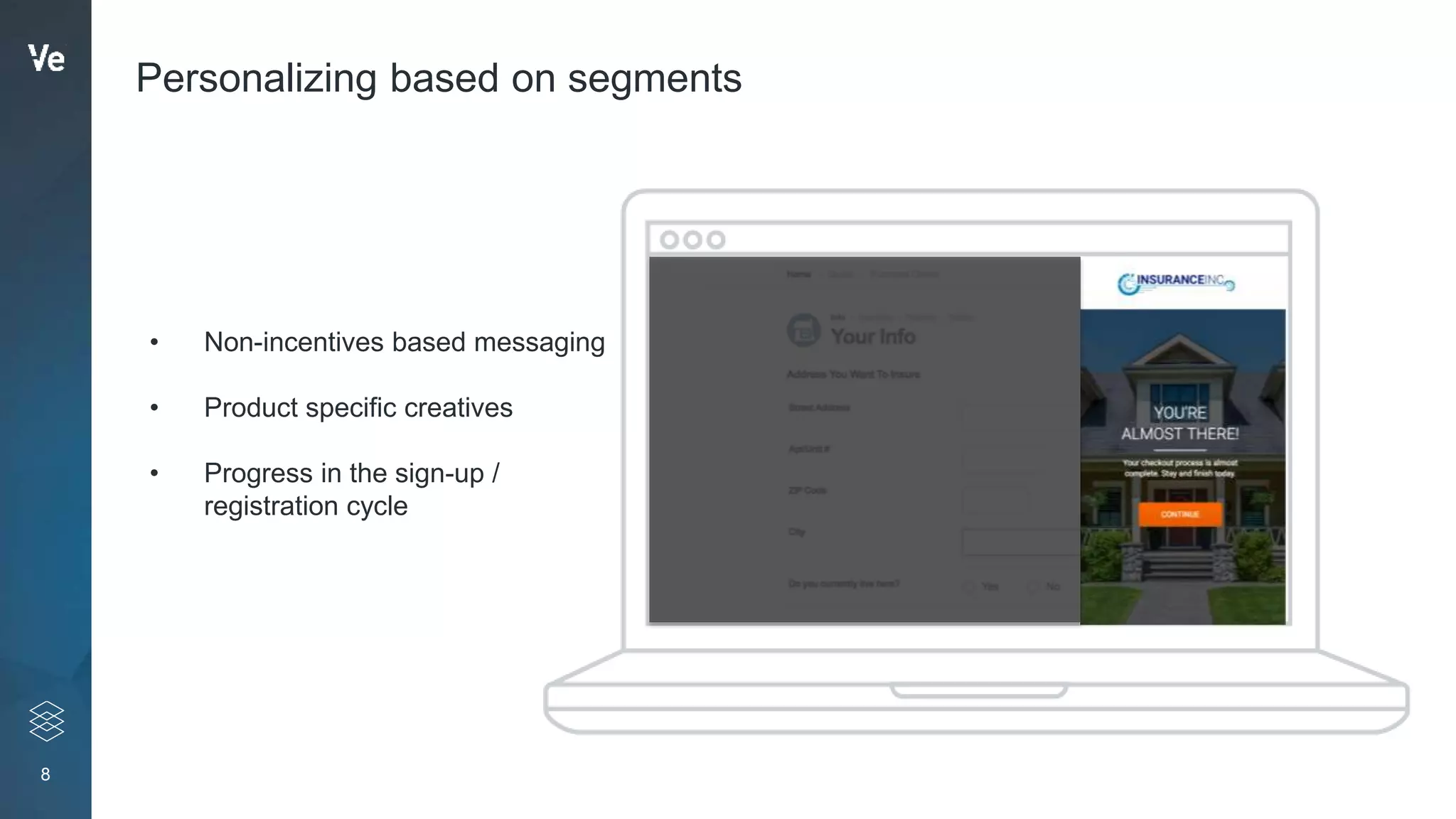

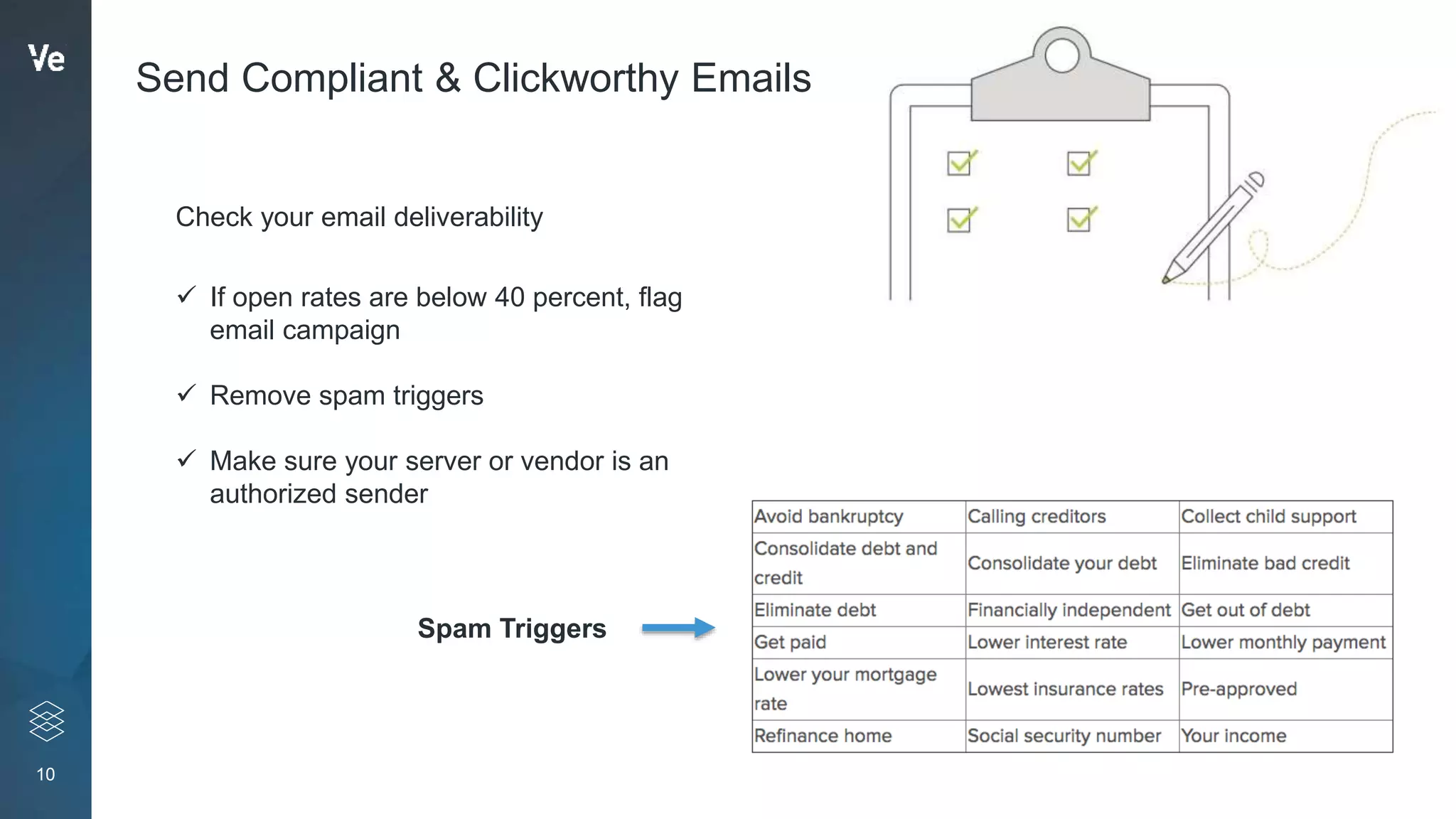

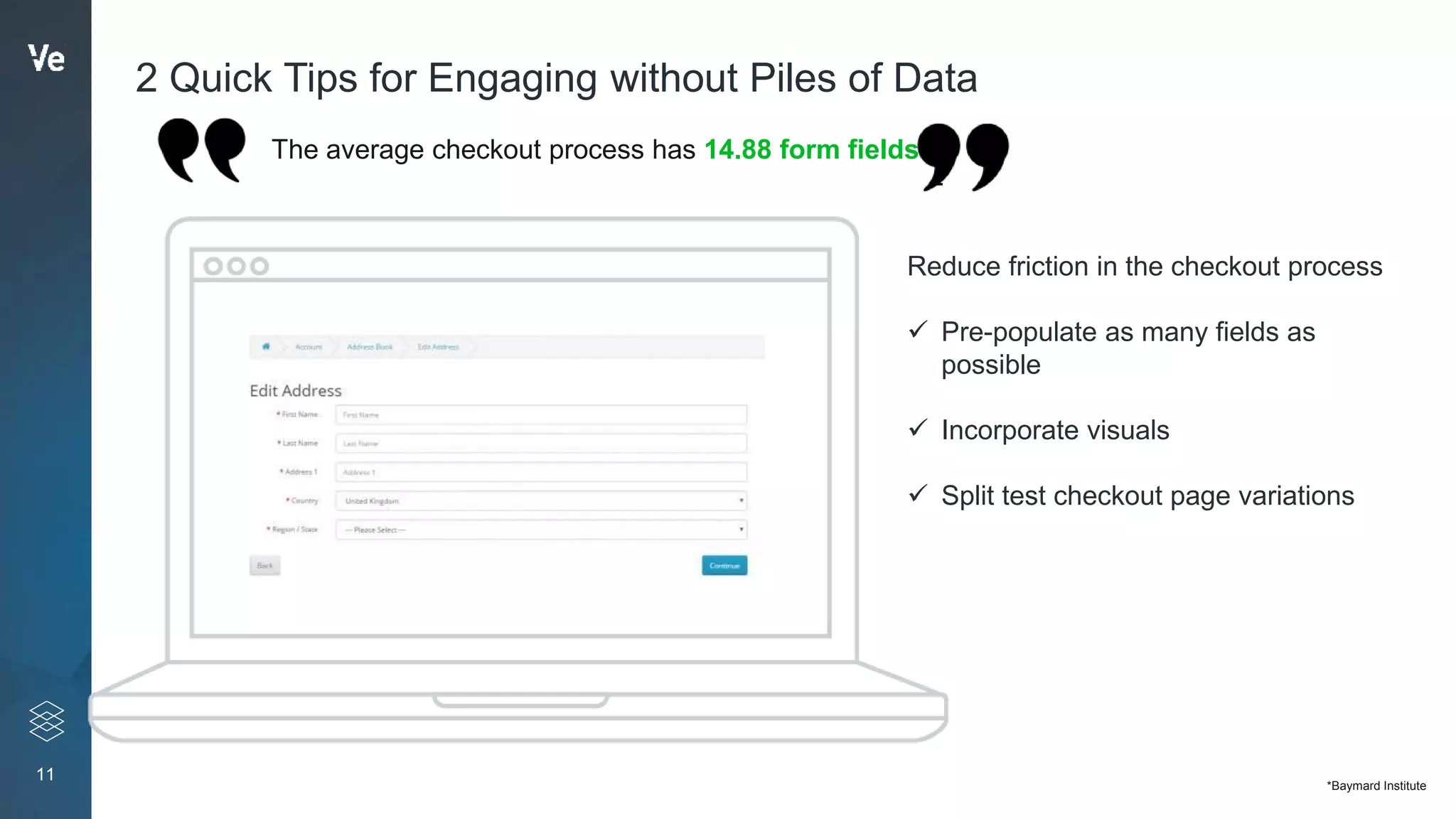

The document covers strategies for capturing and utilizing customer data in marketing while prioritizing privacy. It discusses the importance of personalizing marketing efforts based on different segments, as well as tips for improving email engagement and optimizing the checkout process. Key points include adopting a mobile-first approach and ensuring email deliverability to enhance customer experience and campaign effectiveness.