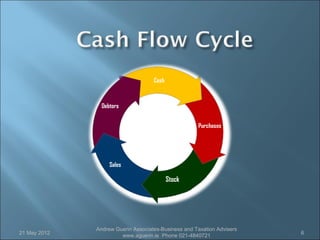

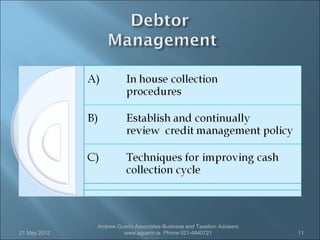

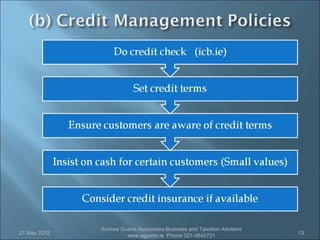

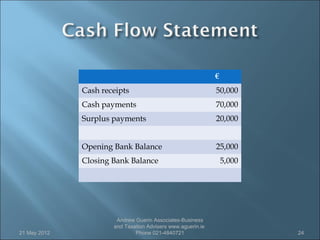

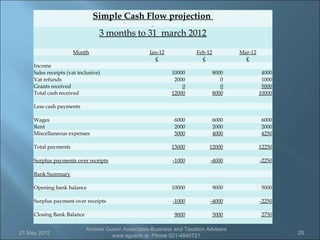

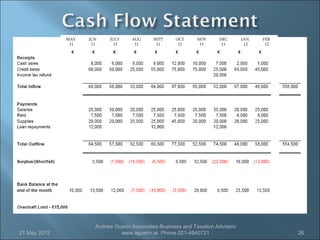

The document discusses cash flow management for businesses. It provides tips on managing cash flow through debt collection, payment of suppliers, monitoring inventory levels, and reducing costs. The document emphasizes creating a cash flow forecast to anticipate potential cash shortages. Overall, the document provides advice to businesses on improving cash flow through better management of sales, debtors, inventory, costs and financial planning.