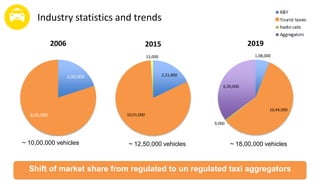

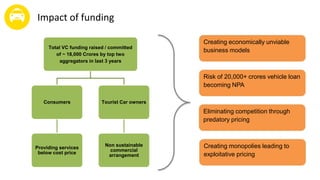

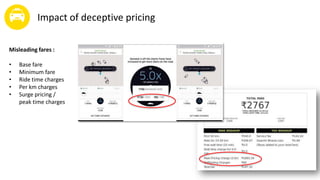

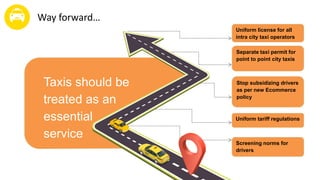

The document presents a case study on the taxi industry in India, highlighting the fragmented nature of the market and regulatory challenges faced by both regulated and unregulated taxi services. Key issues include advancements in technology raising consumer expectations, the impact of significant venture capital funding, and the risks posed by predatory pricing and deceptive fare structures. The document suggests the need for uniform tariff regulations, separate permits, and improved screening norms for drivers to ensure quality and safety in taxi services.