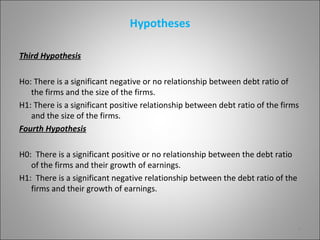

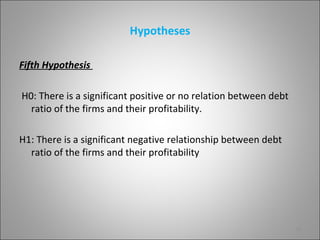

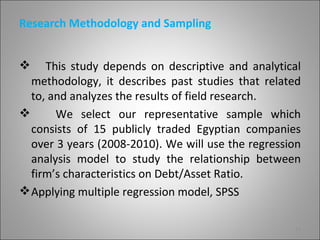

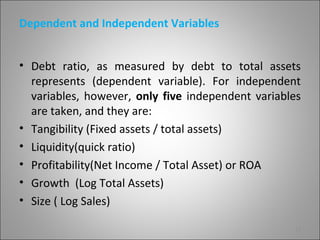

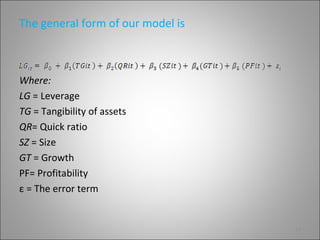

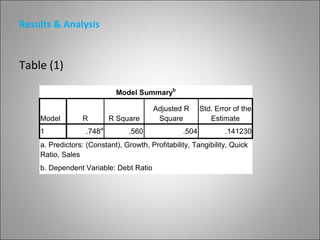

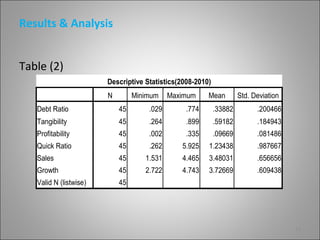

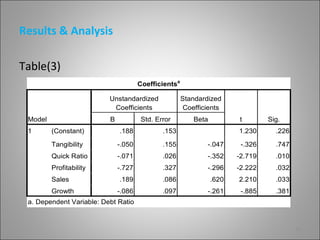

This study examines the determinants of capital structure for 15 publicly traded Egyptian companies over 3 years from 2008-2010. Multiple regression analysis was used to analyze the relationship between debt ratio (dependent variable) and five independent variables: tangibility, liquidity, profitability, growth, and size. The results found a significant negative relationship between debt ratio and liquidity, as measured by quick ratio. No other significant relationships were found between debt ratio and the other independent variables. The study contributes to understanding capital structure determinants in the Egyptian market.