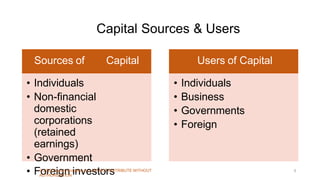

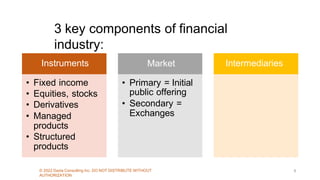

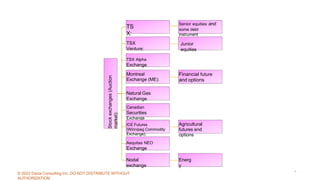

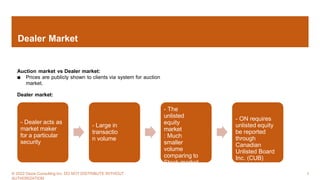

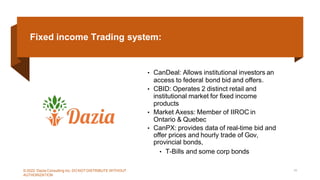

This document presents condensed study material for the Canadian Securities Course, focusing on the capital market and related concepts. It outlines the sources and users of capital, various market components including stock exchanges and trading systems, and the impact of economic policies on capital allocation. The material is developed by Dazia Consulting Inc. and is not affiliated with the Canadian Securities Institute.