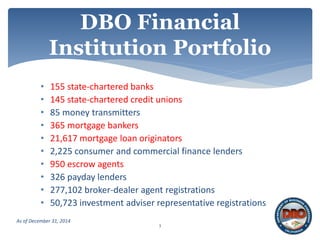

The California Department of Business Oversight (DBO) regulates a variety of financial institutions and oversees licensing under the California Residential Mortgage Lending Act (CRMLA). Recent updates include the requirement for DBO-licensed lenders to file a 2015 residential mortgage loan report and the availability of online submissions for the CRMLA annual report. The DBO also emphasizes its mortgage education outreach program to support homeownership and inform borrowers of their rights.