This appeal challenges a third amended judgment entered against Appellants as additional judgment debtors. Appellants argue the judgment should be reversed for several reasons: (1) the underlying malpractice judgment against Gaggero that Appellants were added to is currently on appeal, so if that judgment is reversed this judgment must also be reversed; (2) Respondents failed to properly serve Appellants with their fee motion and costs memorandum, violating Appellants' due process rights; and (3) the judgment violates this Court's stay order and includes substantial non-recoverable fees and costs. Appellants request the third amended judgment be reversed.

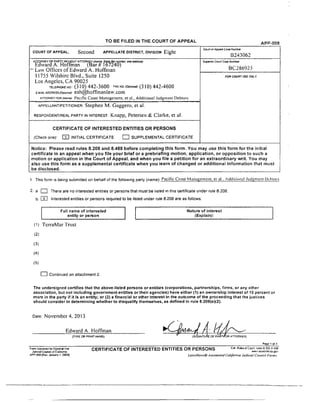

![Tanzola v. De Rita

(1955) 45 Cal.2d 1 ........................................................................................................................31

Unnamed Physician v. Board o f Trustees o f Saint Agnes Med. Ctr.

(2001) 93 Cal.App.4th 607 ...................................................................................................... 24

Wells Fargo & Co. v. City and County o fSan Francisco

(1944) 25 Cal.2d 3 7 ......................................................................................................................15

FEDERAL CASES

Anderson Nat. Bank v. Luckett

(1944) 321 U.S. 233 [64 S.Ct. 599, 88 L.Ed. 692] .............................................................. 17

Galpin v. Page

(1873) 85 U.S. 350 [21 L.Ed. 959, 18 Wall. 3 5 0 ] .................................................................16

Roadway Exp., Inc. v. Piper

(1980) 447 U.S. 752 [100 S.Ct. 2455, 65 L.Ed.2d 488] ..................................................... 17

STATE STATUTES

Code of Civil Procedure

§ 1 2 ................................................................................................................................................... 20

§ 187....................................................................................................................................................8

§ 6 3 1 .8 ...............................................................................................................................................5

§ 685.010 ...................................................................................................................................... 34

§ 685.040 ............................................................................................................................... passim

§ 685.070 ........................................................................................................................ 27,28,30

§ 685.080 ................................................................................................................................. 10,28

§ 708.110 ...................................................................................................................................... 27

§ 904.1 ...............................................................................................................................................2

§ 9 1 6 .................................................................................................................................................22

§ 923 ............................................................................................................................................... 22

§917.1 ............................................................................................................................................ 25

§ 1033.5 ........................................................................................................................................ 29

-viii](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-11-320.jpg)

![FACTUAL AND PROCEDURAL HISTORY

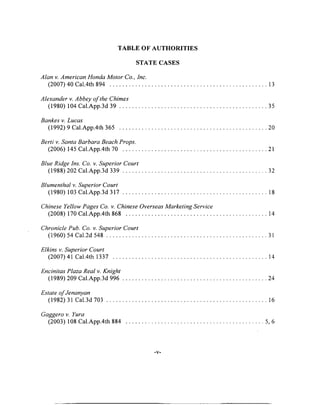

1. 1997-1998: Creating the Estate Plan.

Stephen Gaggero, a successful real estate investor and developer, hired attorney

Joseph Praske in 1997 to develop and implement an estate plan on his behalf (Trial

RT1 602-604; Trial RT5 2720; B241675 CT1 124-125; B241675 CT3 411.)- Setting

up the estate plan took several months in 1997 and 1998. (B241675 CT1 127, 152-

163; B241675 CT2 192; B241675 CT3 411.) As part of this process, Praske created

several limited liability companies (“LLCs”) and limited partnerships (“LPs”) in

which Gaggero initially owned a membership or limited partnership interest.

(B241675 CT1 129-130; B241675 CT2 190-191, 212-213.)

Appellants 511 OFW L.P., Gingerbread Court L.P., Malibu Broadbeach, L.P.,

Marina Glencoe L.P., Blu House L.L.C., and Boardwalk Sunset L.L.C. were each

created by Praske to own a distinct piece of Gaggero’s real property. (B241675 CT2

314-319, 360-B241675 CT3 370.)

Gaggero then transferred his properties to these LLCs and LPs. (B 241675 CT1

126, 162-163, 191.) He subsequently transferred his ownership in those entities into

various trusts which Praske had established, including appellants Arenzano Trust and

the Aquasante Foundation. (B241675 CT2 191-193, 360-B241675 CT3 370.) He

separately transferred his personal residence to the Giganin Trust. (B241675 CT2 ]93-

- Citations to “JA”, “Trial RT” and “Opn.” refer to the joint appendix,

reporter’s transcript and opinion from Gaggero’s appeal of the original

judgment, B207567. Citations to “CT” refer to the clerk’s transcript in the

present appeal. The three hearing transcripts in this appeal are all cited by date

(to illustrate: 10-3-12 RT 1-2). Citations to the clerk’s and reporter’s

transcripts from one of appellants’ other pending appeals start with the number

of that appeal (to illustrate: B241675 CT1 1-2). Appellants respectfully ask

the court to judicially notice the briefing and records in these related appeals

per Evidence Code sections 452, subdivision (d), and 453.

3](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-15-320.jpg)

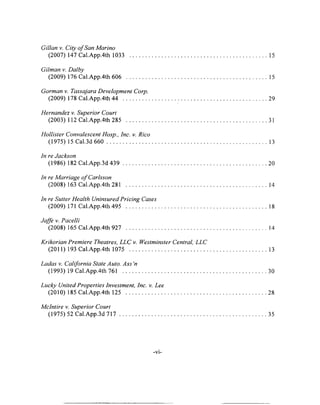

![on August 3. (CT2 246-250.)-

19. August 6, 2012: This Court Stays Further Proceedings as to

Appellants.

Appellants had filed a supersedeas petition as part o f case B241675 on July 19.

In response, the court issued a stay of all proceedings in the trial court on August 6. It

later denied the supersedeas petition and lifted the stay on August 30.

20. August 6, 2012: The Trial Court Signs the Proposed Amended

Judgment.

The trial court signed respondents’ proposed third amended judgment, without

change, the same day this court issued its stay order. (CT2 3 19-320.)— The additional

—”A notice of appeal filed after judgment is rendered but before it is

entered is valid and is treated as filed immediately after entry of judgment.”

(Cal. Rules of Court, Rule 8.104(d)(1).) The court has discretion to do

likewise where the judgment has merely been announced. (Cal. Rules of Court,

Rule 8.104(d)(2).) But it must exercise that discretion in a manner consistent

with “the well-established policy of ‘according [the] right [to appeal] in

doubtful cases ‘when such can be accomplished without doing violence to

applicable rules.’” (Alan v. American Honda Motor Co., Inc. (2007) 40 Cal.4th

894, 901, quoting Hollister Convalescent H o sp In c. v. R ico(915) 15 Cal.3d

660, 674, in turn quoting Slawinski v. Mocettini (1965) 63 Cal.2d 70, 72.)

That is true even where the appeal concerns the original judgment rather than

a subsequent amendment.

Even where no final judgment has been entered, an award of fees and

costs is appealable because it is a collateral order which directs the payment

of money and which is enforceable independent of the entry of the judgment.

(Krikorian Premiere Theatres, LLC v. Westminster Central, LLC (2011) 193

Cal.App.4th 1075, 1083-1085.)

—The August 6 document was labeled"Third Amended Judgment” but,

as we have seen, that label was incorrect. The judgment was actually amended

(continued...)

13](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-25-320.jpg)

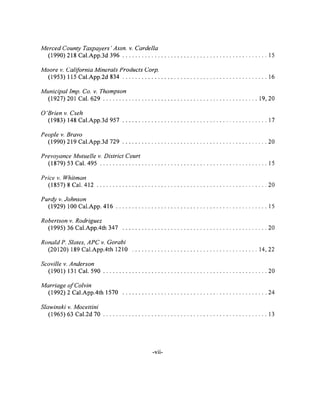

![fees, costs, and interest brought the overall amount of the judgment to $2,178,235.51.

(CT2 249-250.)

STANDARDS OF REVIEW

Denying a party notice and an opportunity to be heard is reversible per se, and

not subject to harmless-error review. (Elkins v. Superior Court (2007) 41 Cal.4th

1337, 1357; In re Marriage o f Carlsson (2008) 163 Cal.App.4th 281, 291-293.)

“The trial court’s authority to award postjudgment fees is a legal question that

we independently review.” (Ronald P. Slates, APC v. Gorabi (20120) 189

Cal.App.4th 1210, 1213; accord Jaffe v. Pacelli (2008) 165 Cal.App.4th 927. 934

[“whether the trial court had the authority pursuant to Section 685.040 to issue such an

award ... is a legal issue, which we review de novo.”].) If particular fee or cost items

are recoverable, the Court of Appeal reviews the amount of the award for an abuse of

discretion. (Chinese Yellow Pages Co. v. Chinese Overseas Marketing Service (2008)

170 Cal.App.4th 868, 885.)

ARGUMENT

I. A REVERSAL IN APPEAL B241675 WILL REQUIRE A REVERSAL

HERE.

When a judgment is reversed on appeal, all subsequent orders enforcing that

judgment fall along with it. That is what should happen here.

The orders and amended judgment which appellants challenge were entered

pursuant to the May 29, 2012 judgment which named appellants additional judgment

— (...continued)

for the third time on May 29, when the court granted the alter-ego motions.

The court was actually amending the judgment for the fourth time on August

6. For the sake of clarity, appellants will refer to the document by its title even

though that title is not accurate.

14](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-26-320.jpg)

![debtors. The trial court determined that the fees and costs it awarded were incurred to

enforce that judgment. (CT2 249-250.) Respondents were only able to obtain these

orders because they had won their prior motion to add appellants to the judgment

against Mr. Gaggero.

But appellants have appealed the May 29 judgment in case B241675. If they

win, respondents will no longer be the prevailing parties. Any relief which the trial

court awarded to them on that basis will have to be reversed. (Gilman v. Dalby (2009)

176 Cal.App.4th 606, 620.)

“Costs upon appeal are merely incidental to the judgm ent appealed from

[citation], and an order awarding costs falls with a reversal of that part of the judgment

upon which it is based [citation].” (Purdy v. Johnson (1929) 100 Cal.App. 416, 420-

421; accord Gillan v. City o fSan Marino (2007) 147 Cal.App.4th 1033, 1053 [reversal

ofjudgment “necessarily compels the reversal of the award of fees as costs to the

prevailing party based on the judgment.”]) They are incidental because they depend

upon how the court resolves the substance of the parties’ claims. (Wells Fargo & Co.

v. City and County o fSan Francisco (1944) 25 Cal.2d 37, 44.) Orders enforcing a

judgment are thus also incidental to that judgment. (La Societe Francaise d'Epargnes

et de Prevoyance Mutuelle v. District Court (1879) 53 Cal. 495, 552.) So if the

original May 29, 2012 judgment against appellants is reversed, the subsequent award

of fees, costs, and interest cannot stand. Neither can the amended judgment that

incorporated them.

“An order awarding costs falls with a reversal of the judgment on which it is

based.” (Merced County Taxpayers’Assn. v. Cardella (1990) 218 Cal.App.3d 396,

402.) A defendant who was ordered to pay the plaintiffs costs is therefore entitled to

relief from those costs when the judgment is reversed. “[T]he successful party is

never required to pay the costs incurred by the unsuccessful party.” (Purdy, supra, 100

Cal.App. at p. 421.) If appellants succeed in appeal B241675, they cannot be made to

pay respondents’ fees or costs.](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-27-320.jpg)

![II. THE THIRD AMENDED JUDGMENT VIOLATES APPELLANTS’

DUE PROCESS RIGHTS BECAUSE RESPONDENTS FAILED TO

SERVE THEM WITH EITHER THE FEE MOTION OR THE COSTS

MEMO.

The most fundamental components of due process are the right to notice and an

opportunity to be heard. As the United States Supreme Court explained 140 years ago,

“It is a rule as old as the law, and never more to be respected than now.

that no one shall be personally bound until he has had his day in court, by

which is meant, until he has been duly cited to appear, and has been afforded

an opportunity to be heard. Judgment without such citation and opportunity

wants all the attributes of a judicial determination; it is judicial usurpation and

oppression, and never can be upheld where justice is justly administered.”

(Galpin v. Page (1873) 85 U.S. 350, 368-369 [21 L.Ed. 959, 18 Wall. 350].)

Even where a court has generally obtained personal jurisdiction over a party for

purposes of a case, it only gains jurisdiction to make particular orders when the

affected parties have received adequate notice and an opportunity to be heard. (Estate

o f Jenanyan (1982) 31 Cal.3d 703, 708.) Where a court issues such an order against a

party who received no such notice or opportunity, the court lacks jurisdiction to make

the order and it is therefor void. (Moore v. California Minerals Products Corp. (1953)

115 Cal.App.2d 834, 837 [due process violation where judgment was based on point

of law raised “with no warning of counsel and no opportunity given to ward off the

blow”].)

“A fair hearing is denied where, though personal jurisdiction has been

obtained, some later step is taken without adequate notice.” (2 Witkin, Cal.Proc.5th

(2008) Jurisd, § 304, p. 916.) Appellants were denied notice o f both respondents’ fee

motion and their claim for costs. Even by itself, respondents’ failure to give them

notice entitles appellants to a reversal.

//

//

16](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-28-320.jpg)

![A. Respondents’ Failure to Serve Appellants with Either Their Fee

Motion or Their Costs Memorandum Is Fatal to the Resuiting

Judgment.

Respondents served their fee motion on counsel for Mr. Gaggero, but did not

serve anyone acting on behalf of any of the appellants. (CT2 218-220.) They likewise

served Gaggero’s counsel with the costs memorandum, but did not serve the

appellants or anyone acting on their behalf. (CT2 215-217.) These failures doom the

third amended judgment as to appellants.

The requirements of notice and an opportunity to be heard before being

subjected to a court order are fundamental to the very notion o f due process.

(Anderson Nat. Bankv. Luckett ( 1944) 321 U.S. 233, 246 [64 S.Ct. 599, 88 L.Ed.

692].) This is as true o f an award of fees and costs as any other court order. The

United States Supreme Court has held that “attorney’s fees certainly should not be

assessed lightly or without fair notice and an opportunity for a hearing on the record.1'

(Roadway Exp., Inc. v. Piper (1980) 447 U.S. 752, 767 [100 S.Ct. 2455, 65 L.Ed.2d

488].) Such notice “is mandated not only by statute, but also by the due process

clauses of both the state and federal Constitutions.” (O ’Brien v. Cseh (1983) 148

Cal.App.3d 957, 961, citing Cal. Const., art. I, § 7 and U.S. Const., 14th Amend.)

The failure to serve appellants would be fatal even if respondents had not

actually known how to serve them. But they demonstrably did know how to serve

appellants, since their alter-ego motion - which was served and filed five weeks

before the fee motion and costs memo - had pointed out that several of them had

designated Praske as their agent for service, arguing that this fact somehow showed

they were Gaggero’s alter egos. (B241675 CT1 33:6, 39:7-8.) They even supported

their alter-ego motion with copies of records containing the addresses where

appellants could be served with legal papers. (B241675 CT2 308-319.) Respondents

knew how to serve appellants. They just didn’t do it.

17](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-29-320.jpg)

![B. The Fee Motion and Costs Memorandum Were Both Filed and

Served before Appellants Became Additional Judgment Debtors.

Even if respondents had served their papers on appellants, appellants would

have had no reason to believe their rights were in jeopardy. After all, they had not yet

been added as judgment debtors. They were not parties to the case and could not be

ordered to pay the costs of enforcing a judgment that had been entered against

somebody else. (Blumenthal v. Superior Court (1980) 103 Cal.App.3d 317, 320

[motion seeking sanctions against parties could not support sanction award against

non-party attorney against whom motion has sought no relief].)

Respondents could have avoided this problem by waiting just two more weeks

before seeking fees and costs. That way, a request for relief against appellants would

at least have been procedurally proper. O f course, had respondents waited they would

also have had to serve their fee motion and costs memo on appellants. By acting

before the alter-ego motion was decided, respondents were able to avoid doing so.

C. Neither the Notice of Motion nor the Accompanying Points and

Authorities Sought Any Relief Against Appellants.

There is yet another reason why appellants would not have had proper notice

even if respondents had served them with the costs memo and the fee motion: neither

document asked for any relief against them.

A notice of motion must state what relief the moving party seeks and against

whom. (In re Sutter Health Uninsured Pricing Cases (2009) 171 Cal.App.4th 495,

514 [request for relief that was stated in motion but not in notice was ineffective].)

The notice o f respondents’ fee motion said nothing about seeking relief from any of

the (non-party) appellants. (CT1 28-30.) Neither did the points and authorities (CT1

18](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-30-320.jpg)

![29-37), or even the supporting declaration of counsel (CT1 38-42.)— So even if

respondents had served the papers on appellants, the papers would have failed to put

them on notice that their rights were at stake or that they had reason to attend the July

13 hearing.

III. THE THIRD AMENDED JUDGMENT VIOLATED THIS COURT’S

AUGUST 6 STAY ORDER IN APPEAL B241675.

This court’s stay order in B241675 was entered on August 6 - the same day the

trial court entered the third amended judgment. The record does not say which

document was entered first, and it contains no evidence that whichever court acted

second was aware of what the other court had done. Even so, this court’s stay order

takes precedence over the amended judgment. That judgment was entered in violation

of the stay, and is therefore void.

“The law takes no notice of fractions of a day. Any fraction of a day is deemed

a day unless in a particular case it is necessary to ascertain the relative order of

occurrences on the same day.” [Municipal Imp. Co. v. Thompson (1927) 201 Cal. 629.

632; accord 74 Am.Jur.2d Time § 13 [“Fractions of a day generally are not considered

in the legal computation of time; the day on which an act is done or an event occurs

are wholly included or excluded.”]) Because the third amended judgment and the stay

order were issued on the same day, the judgment cannot take precedence over the stay

regardless of which came first.

Code of Civil Procedure, section 12 and Government Code section 6800 both

state that “[t]he time in which any act provided by law is to be done is computed by

excluding the first day, and including the last, unless the last day is a holiday, and then

it is also excluded.” Courts have applied this principle in many contexts since the

— Because this information must be contained in the notice of motion,

respondents could not salvage their position even if it was hidden elsewhere

in their papers.

19](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-31-320.jpg)

![IV. THE TRIAL COURT ERRED BY AWARDING RESPONDENTS FEES

AND COSTS THAT ARE NOT RECOVERABLE.

A. Only a Small Fraction of the Awarded Fees Are Even Arguably

Recoverable.

1. The Fees for Respondents’ Alter-Ego Motion Were not

Incurred in Enforcing the Judgment.

When they opposed the motion to tax, respondents claimed amending the

judgment to add appellants was a means of enforcing the judgment, but did not even

try to explain their position. (CT Supp 96:14-97:4.) The best they could do was to

claim that the motion was “directly related to their enforcement efforts.” (CT Supp

97:2-3.) But section 685.040 says creditors may recover only “costs ^/enforcing a

judgment” (emphasis added), not costs “related to” such enforcement.

Respondents’ position was simple to the point of being simplistic. To them,

anything they did after obtaining the original judgment had to qualify as enforcing that

judgment. (CT2 239:14-15 [arguing that, because the judgment had already been

entered, “the only remaining task was to enforce the ju dgm en t emphasis in

original].) That is a logical fallacy. That a task is performed after a judgment has

been entered does not make it a means of enforcing the judgment. (Berti v. Santa

Barbara Beach Props. (2006) 145 Cal.App.4th 70, 77.)—

— Opposing an appeal is but the most obvious example ofpost-judgment

legal work that does not involve enforcement. After all, enforcement of a

judgment is often stayed while an appeal is pending. (Sections 916-923.) If

opposing an appeal was a type of enforcement, then it would be forbidden

when a stay was in place. That stays of enforcement do not prevent judgment

creditors from opposing an appeal demonstrates that such work is not a type

of enforcement. So does the fact that many appeals —including this one -

(continued...)

21](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-33-320.jpg)

![Section 685.040 also says that enforcement costs must be both “reasonable and

necessary” for that purpose in order to be recoverable. Since the judgment was

against Gaggcro, only enforcement efforts directed at Gaggero could possibly qualify

as reasonable or necessary. Trying to amend the judgment to add new debtors was an

effort to change the judgment, not to enforce it. Only after the judgment had been

changed could respondents take steps to enforce it against appellants - such as

obtaining the receiver and assignment orders which appellants have challenged in case

B245114.

That respondents may have found it useful to amend the complaint does not

make the costs of doing so recoverable. In Ronald P. Slates, APC v. Gorabi (2010)

189 Cal.App.4th 1210, this court held that the costs of litigating against a different

creditor over who had priority were not recoverable because they were about the risk

that the judgment debtor would be unable to pay - an “uncertainty in the judgm ent’s

value” which “rests on the happenstance o f [the debtor’s] wealth.” (Id. at p. 1215.) As

the court explained, “Were [the debtors] wealthier, with assets sufficient to satisfy

both judgments, [the] battle over priority would have been unnecessary. It seems

unlikely that the Legislature intended a section 685.040 postjudgment fee award to

turn on whether the judgment debtor had sufficient assets to satisfy all judgments

against him. More plausibly, the Legislature envisioned the propriety of an attorney

fee award as turning on the judgment debtor’s postjudgment conduct, with the

Legislature intending that the judgment debtor’s possible liability for postjudgment

fees serve as encouragement for the debtors cooperation in satisfying the judgment.”

(Id.)

Moving to amend the judgment to add creditors other than Gaggero was not an

effort to enforce it against Gaggero. It also was not an effort to enforce the judgment

-(...continued)

proceed after a judgment has been paid. And so does the fact that some

respondents are actually judgment creditors rather than judgment debtors.

2 2](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-34-320.jpg)

![A trial court has no authority to award fees incurred in a pending appeal. After

all, until the appeal has been decided, there is no prevailing party. While those fees

and costs might later have become recoverable, they could not be awarded unless and

until respondents prevailed in this court.

With few exceptions, only the party that prevails in an appeal is eligible to

recover associated costs - including fees where allowed. (Cal. Rules of Court, Rule

8.278(a)(1).) The Court of Appeal has discretion to make the prevailing party bear its

own costs. (Cal. Rules of Court, rule 8.278(a)(5).) “Alternatively, the court can

apportion costs between opposing parties[.]” (Ahart, California Practice Guide:

Enforcing Judgments and Debts (Rutter 2012) 14:65.) It may even order a

successful respondent to pay the costs of an unsuccessful appellant. (Unnamed

Physician v. Board o f Trustees o f Saint Agnes Med. Ctr. (2001) 93 Cal.App.4th 607,

632.) The decision was this court’s to make, and even this court couldn't make it until

the appeal was over. The trial court had no authority to make it while the appeal was

in progress.

In addition to seeking fees they were not yet entitled to ask for, respondents

followed the wrong procedure by asking for them as costs of enforcing the judgment

under section 685.040. A prevailing party that wishes to recover fees incurred on

appeal must file a memorandum of costs in the superior court “within 40 days after the

clerk sends notice o f issuance of the remittitur”. (Cal. Rules o f Court, rule 8.278(a)(1);

accord Ahart, supra, ^ 14:98.) The claim must wait until the remitittur has been

issued, and even then it has nothing to do with section 685.040.

“Attorney fees recoverable on appeal ... generally may be requested from the

appellate court while the appeal is pending or from the trial court after the remittitur

has issued.” (Ahart, supra, U 14:115.) The Court of Appeal may forbid the trial court

to award appellate attorney fees even to the prevailing party (Encinitas Plaza Real v.

Knight (1989) 209 Cal.App.3d 996, 1003-1004) or may order it to delay ruling on any

such claim until after other related appeals have been decided. (See Marriage o f

24](https://image.slidesharecdn.com/ca2db243062-02-160920062528/85/Ca2-db243062-02-36-320.jpg)