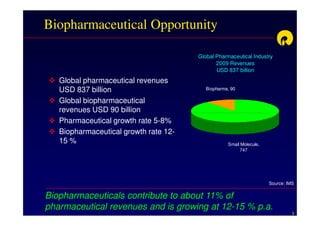

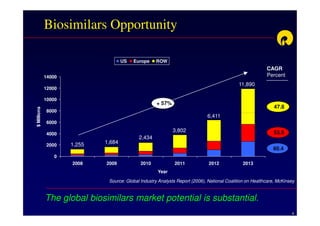

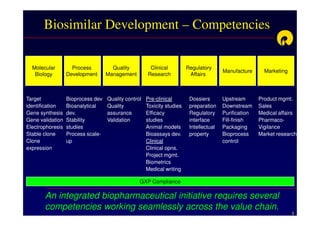

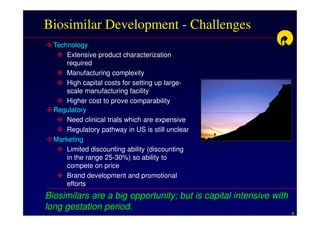

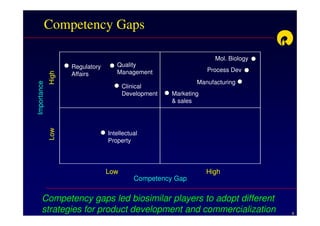

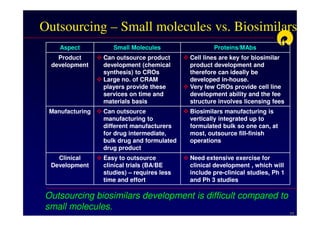

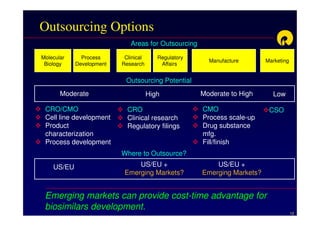

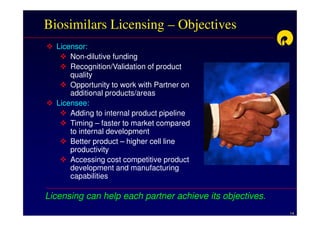

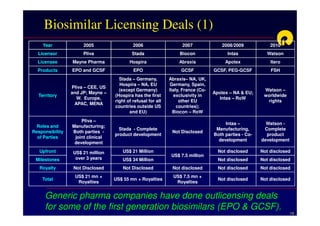

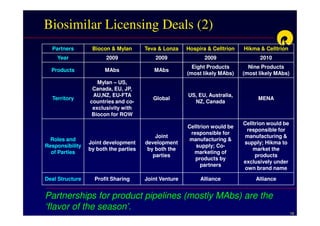

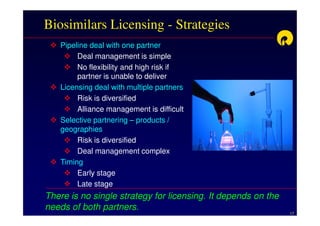

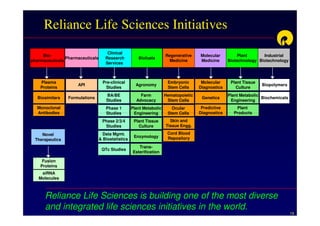

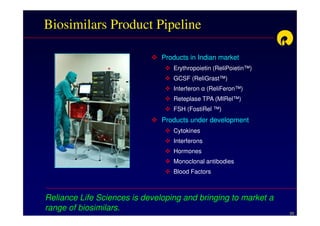

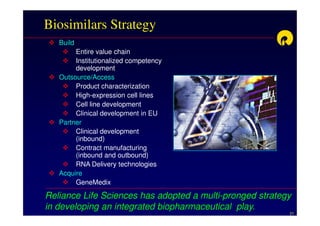

The document discusses strategies for developing biosimilars in a cost-effective manner. It notes that while the biopharmaceutical opportunity is large, biosimilar development faces significant challenges related to regulation, manufacturing complexity, and marketing limitations. Companies therefore pursue various strategies like building internal capabilities, outsourcing non-core functions, partnering, and acquisitions. The document uses Reliance Life Sciences as a case study, outlining its multi-pronged approach to developing an integrated biosimilars pipeline and capabilities through both internal investment and external partnerships and deals.