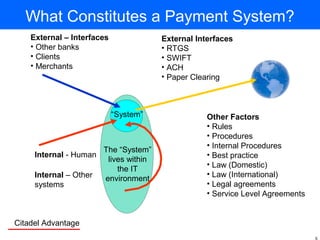

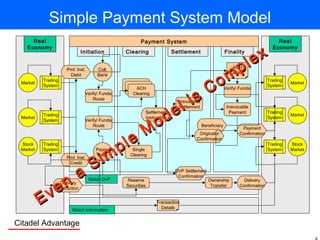

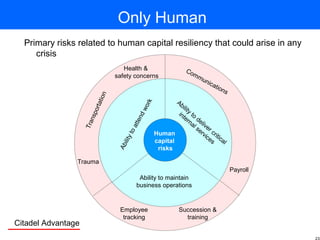

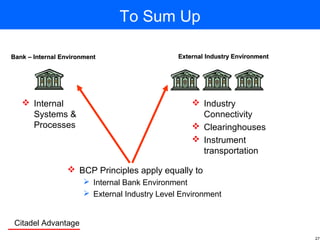

The document is a presentation by Citadel Advantage discussing the impact of the September 11, 2001 attacks on the financial and payment systems, highlighting the extensive operational disruptions and loss of infrastructure experienced in New York City. It emphasizes the need for improved business continuity planning, as many organizations were unprepared for such wide-area disasters, leading to significant financial losses and operational failures. Key lessons include the interdependence of financial systems and the necessity for redundancy in critical operations.