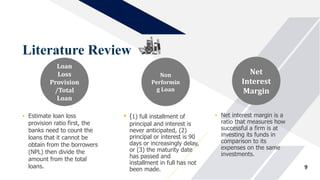

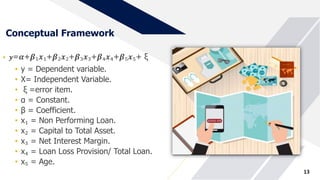

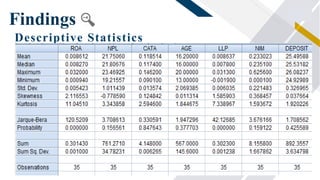

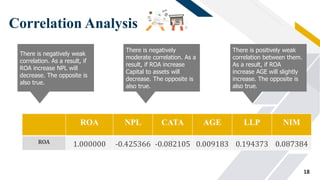

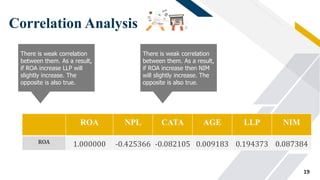

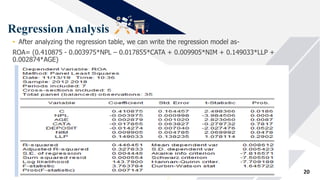

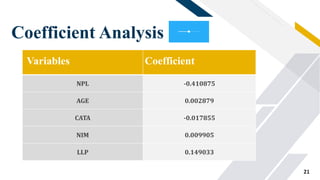

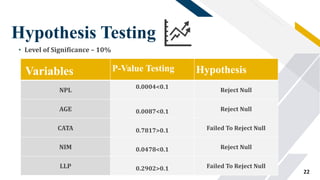

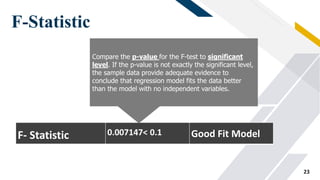

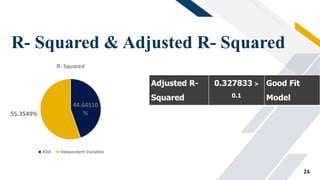

This document analyzes the profitability of the banking sector in Bangladesh. It discusses the various banks that operate in the country, including the Bangladesh Bank, state-owned commercial banks, private commercial banks, and Islamic banks. It then outlines some of the key challenges faced by different types of banks, such as non-performing loans, low capital adequacy, and lack of modern technology. The methodology section describes the research design, data collection process, sample selection, and conceptual framework. Statistical analysis is performed including correlation analysis and regression analysis to understand the relationship between profitability and various independent variables. The findings suggest that profitability is negatively correlated with non-performing loans and positively correlated with net interest margin.