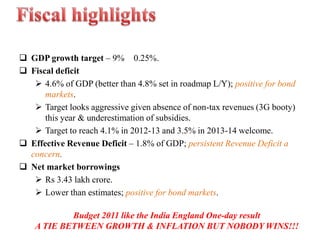

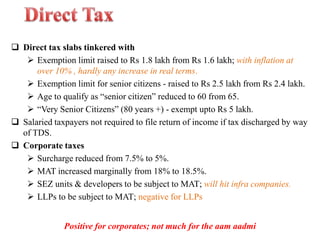

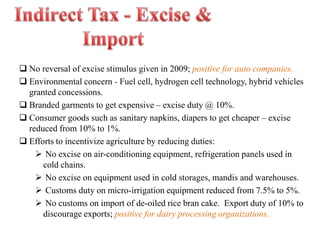

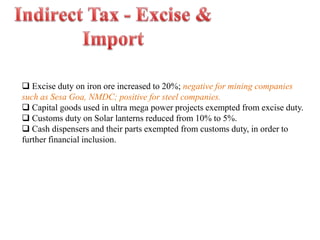

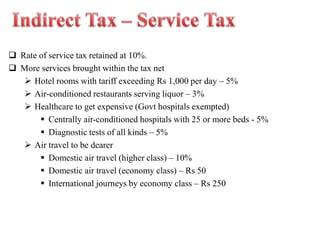

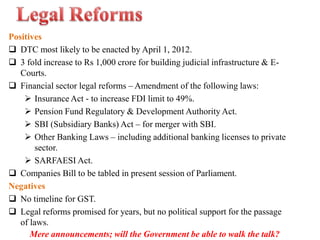

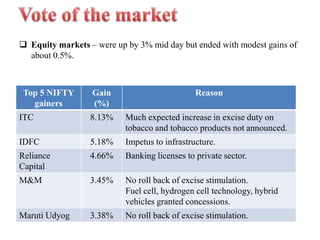

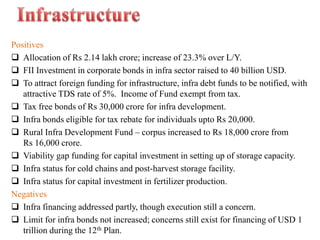

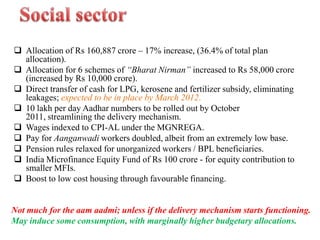

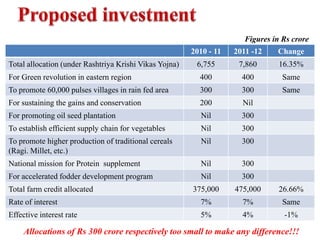

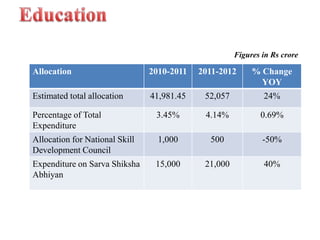

The budget document provides details on key fiscal targets and highlights from the Indian budget. The fiscal deficit target for the current year is 4.6% of GDP, which is better than the previous target but may be aggressive given other factors. Revenue deficit is a continuing concern. Some key points include reduced corporate tax surcharges, increased exemption limits for individual taxpayers, and changes to indirect taxes that will make some consumer goods cheaper and some services more expensive. Infrastructure spending saw a large increase but financing remains a challenge. Allocations to social sectors also increased substantially.