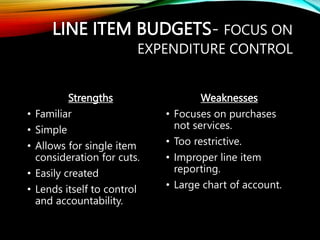

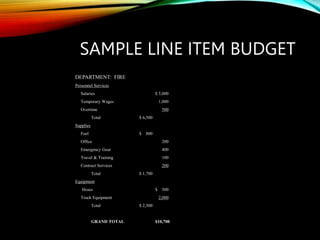

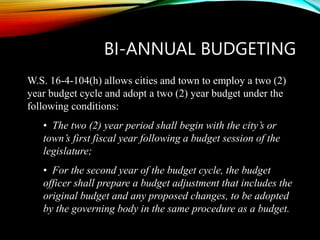

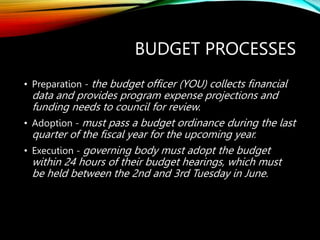

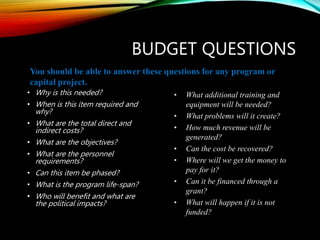

This document provides an overview of municipal budgeting. It defines what a budget is, explains why budgets are important for accountability, planning, evaluation, and information. It describes the key components a budget should show, including proposed expenses and revenues. The document outlines different budget types like line-item, program, lump sum, and multi-year budgets. It provides examples and discusses the strengths and weaknesses of each type. Finally, it offers guidance on budget preparation, adoption, execution, common mistakes, and presenting budgets.