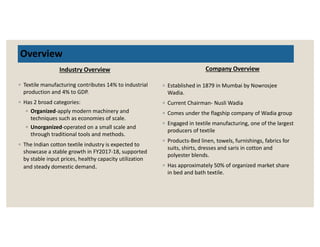

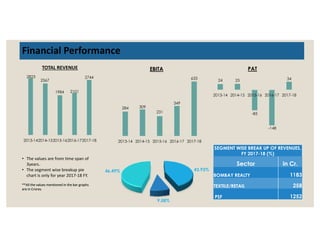

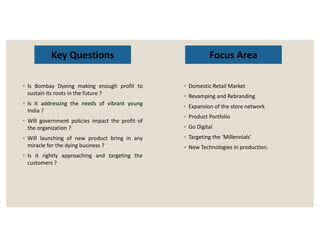

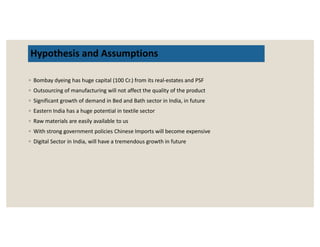

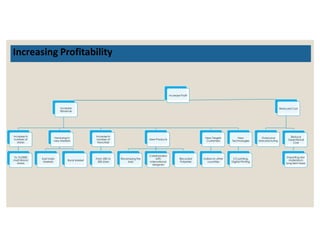

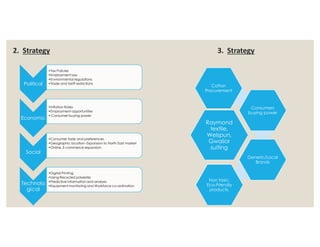

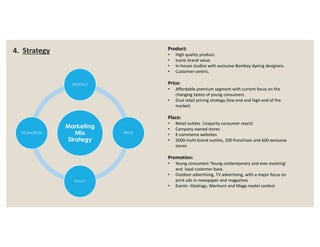

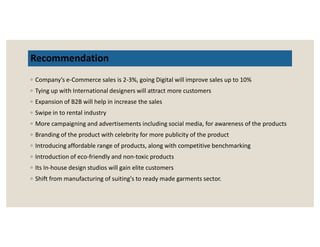

The document discusses Bombay Dyeing's business overview, financial performance, key questions, hypotheses, strategies and recommendations. It provides an industry and company overview of Bombay Dyeing. It analyzes the company's financial data from 2013-2018, including revenues, profits, assets/liabilities. It identifies key questions around future profitability and addressing young customers. It lists hypotheses around capital, demand growth and raw materials. It outlines strategies like expanding stores, new products and markets. Recommendations include increasing digital sales, international designer partnerships and ready-made garments.