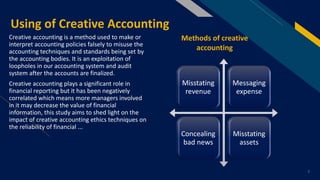

The document discusses creative accounting practices that, while technically legal, often misrepresent a company's financial status by exploiting loopholes in accounting regulations. It highlights motivations for such practices, including increased profits and management incentives, and outlines techniques used in creative accounting, such as regulatory flexibility and manipulation of financial data. The conclusion emphasizes the ethical implications and risks associated with creative accounting, advising investors to be cautious of potentially misleading financial information.

![Definition of

creative accounting

Creative accounting consists of accounting practices that

follow required laws and regulations, but deviate from what

those standards intend to accomplish. Creative accounting

capitalizes on loopholes in the accounting standards to falsely

portray a better image of the company. Although

creative accounting practices are legal, the loopholes they

exploit are often reformed to prevent such behaviors .. , but

deviate from the spirit of those rules with

questionable accounting ethics—specifically distorting results

in favor of the "preparers", or the firm that hired the

accountant.[1] They are characterized by excessive

complication and the use of novel ways of characterizing

income, assets, or liabilities, and the intent to influence

readers towards the interpretations desired by the authors.

The terms "innovative" or "aggressive" are also sometimes

used. Another common synonym is "cooking the books".

Creative accounting is oftentimes used in tandem with

outright financial fraud (including securities fraud), and lines

between the two are blurred. Creative accounting practices

are known since ancient times and appear world-wide in

various forms.[1]

3](https://image.slidesharecdn.com/bnakingchangesaftercovid-19-240418135954-7111efc5/85/Bnaking-Changdges-After-COVID-19-ppt2024x-3-320.jpg)