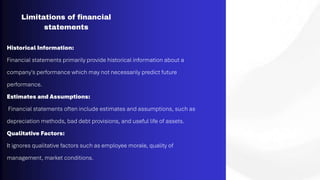

Financial reporting involves communicating an organization's financial information to external stakeholders to aid in decision-making, primarily through key components like balance sheets and income statements. Audit reports provide opinions on the fairness of these financial statements, and creative accounting can manipulate this information to present a more favorable view, raising ethical concerns. However, financial statements have limitations, such as historical focus, reliance on estimates, and challenges for non-experts in interpretation.