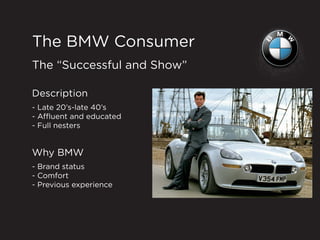

This document provides an overview of BMW's global strategy, including its product lines, key consumer segments, challenges, competitors, and recommendations. It discusses BMW's revenues, vehicle and motorcycle sales, market share, employees, and dealership reach. Two main consumer segments are described as "Successful and Show" and "Go-Getters and Big Dreamers." Challenges include expanding into new markets, meeting emissions standards, and competing with tech-focused automakers. Competitors discussed are Mercedes, Audi, Tesla, Google, and Faraday. The future is predicted to include connected cars, customized lighter vehicles, and the rise of Asia Pacific and self-driving technologies. Recommendations center on investing in new markets,