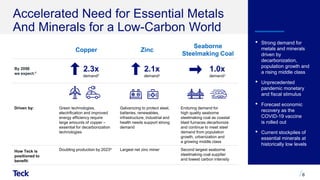

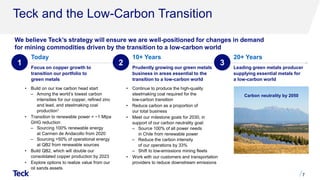

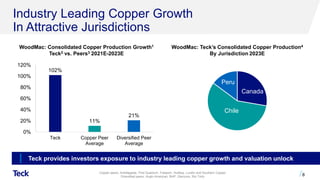

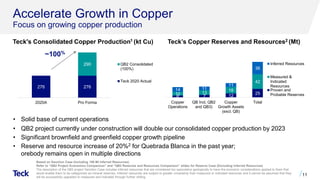

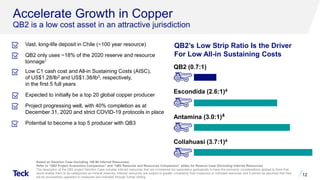

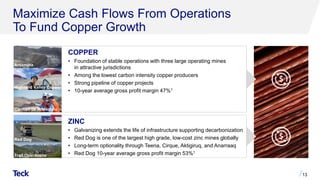

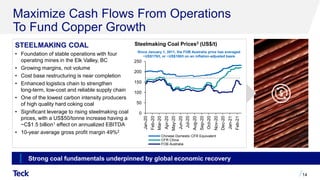

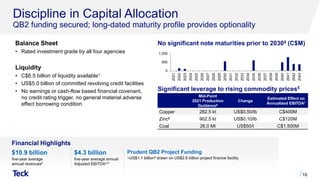

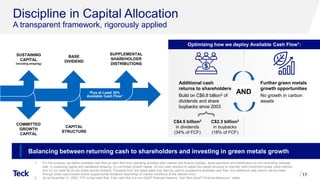

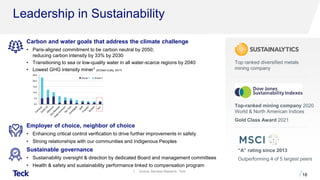

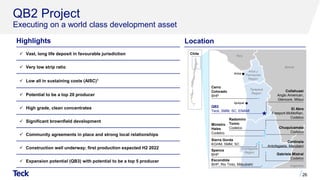

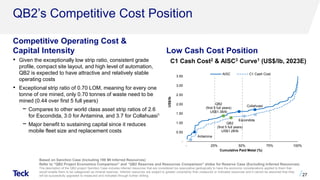

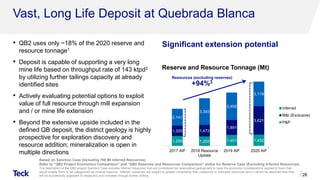

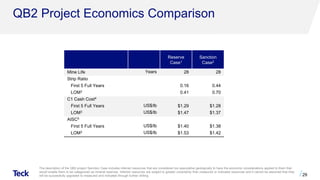

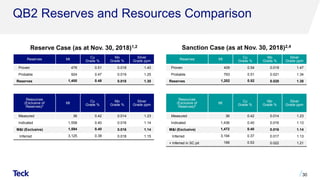

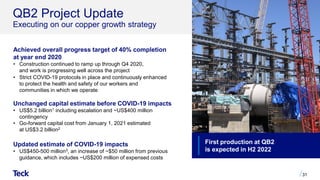

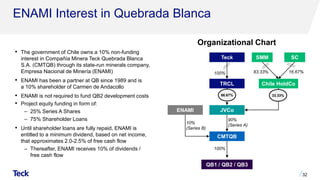

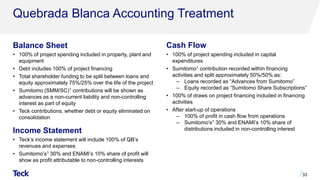

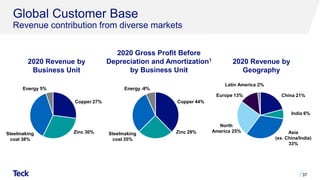

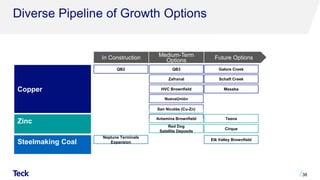

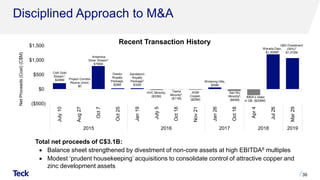

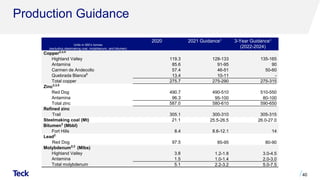

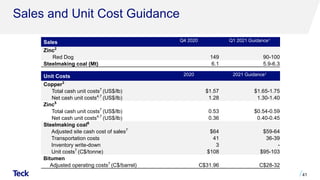

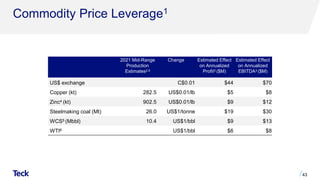

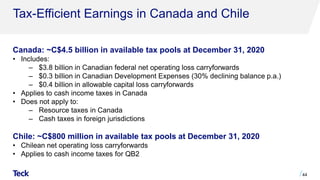

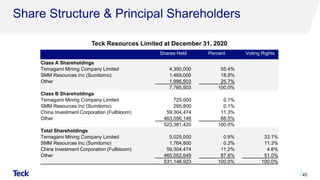

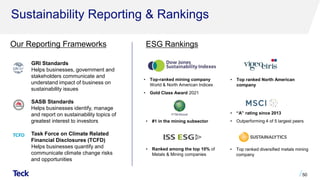

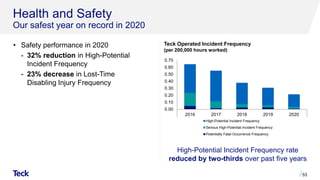

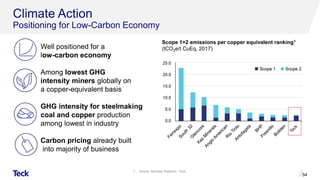

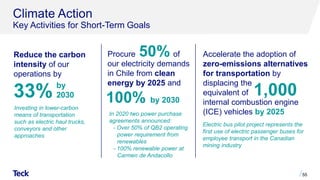

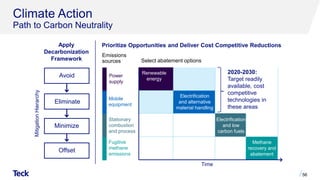

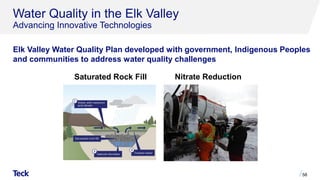

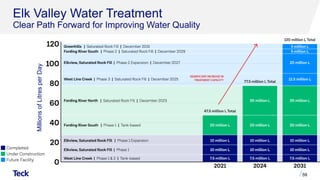

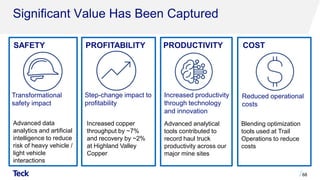

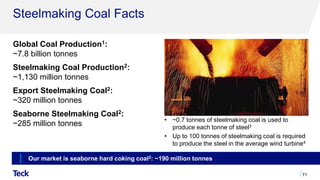

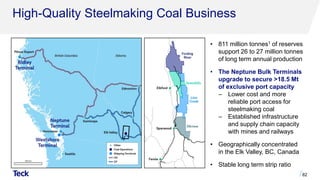

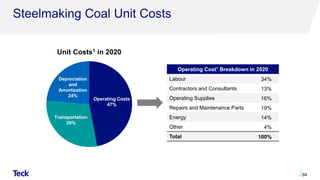

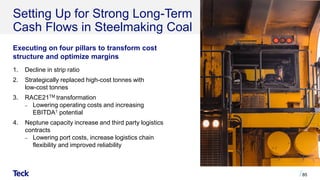

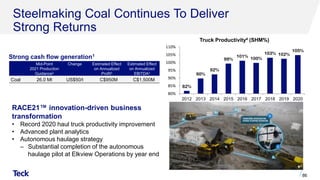

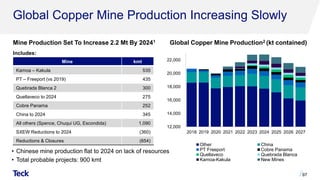

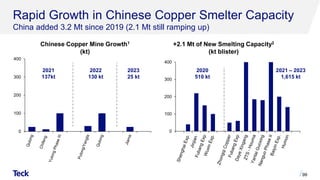

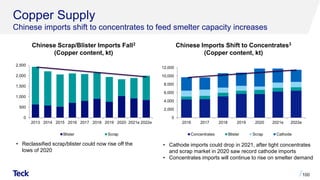

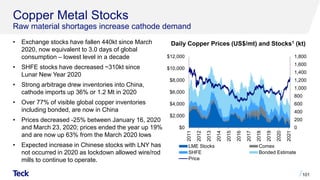

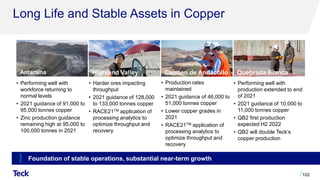

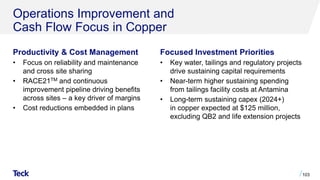

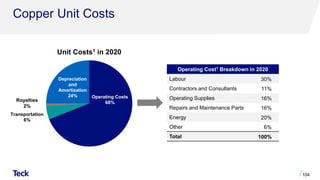

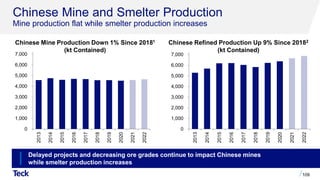

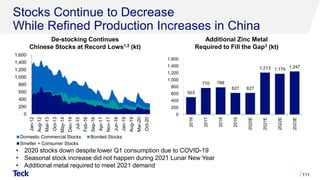

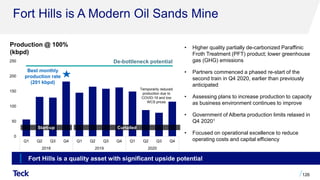

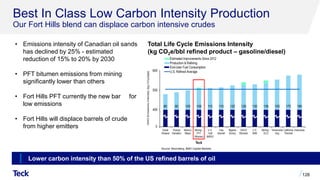

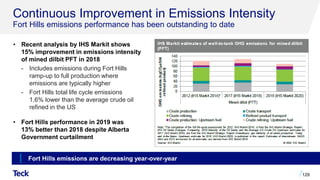

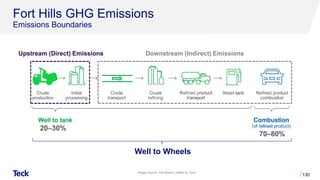

The document outlines forward-looking statements made by Teck Resources regarding their growth strategy and operations, particularly focusing on their plans to double copper production by 2023 through the QB2 project amidst various risks such as the impact of COVID-19. It highlights the significance of sustainability goals, including carbon neutrality by 2050, and positions Teck as a leader in the green metals sector with anticipated strong demand for essential commodities driven by decarbonization efforts. Additionally, the presentation emphasizes the company's operational excellence, strategic growth initiatives, and the importance of adhering to rigorous capital allocation frameworks.