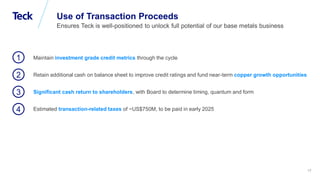

The document provides an investor presentation for a global metals and mining conference. It summarizes Teck's proposed sale of its steelmaking coal business to Glencore and other parties for total implied proceeds of $8.9 billion. Teck will retain interim cash flows from the business until the sale's expected closing in Q3 2024. Teck plans to use the proceeds to strengthen its balance sheet, return cash to shareholders, and position itself to realize value from its copper growth portfolio. The presentation also outlines Teck's strategy to focus on near-term development options for its copper assets that have lower scope and complexity than its recent Quebrada Blanca project.