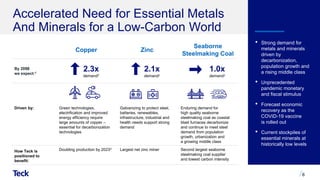

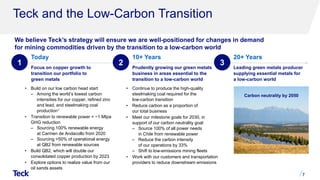

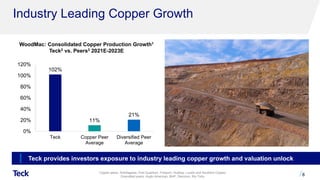

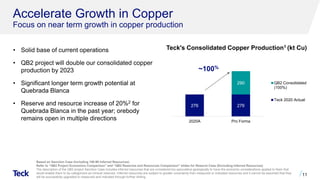

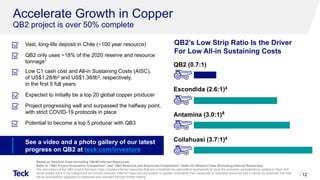

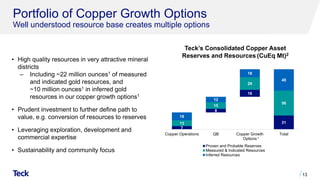

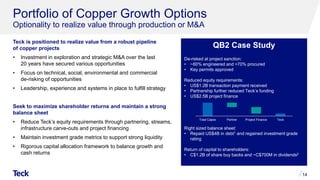

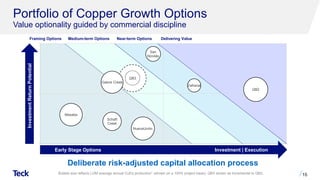

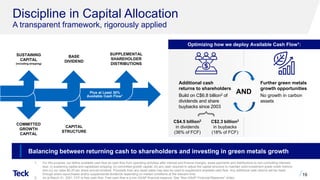

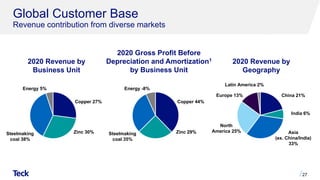

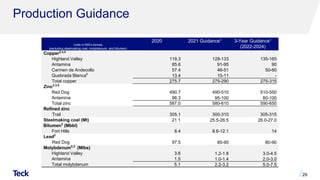

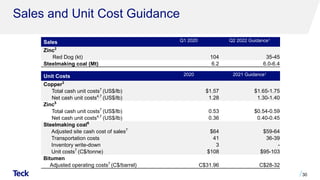

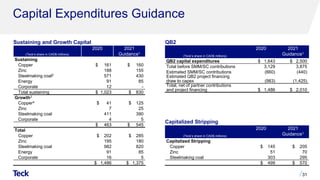

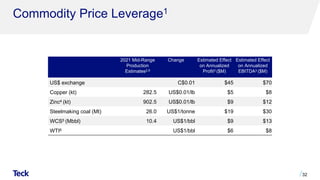

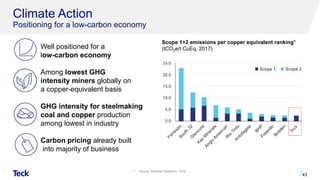

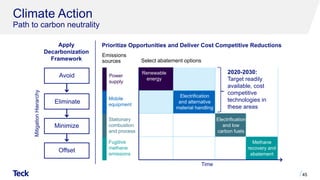

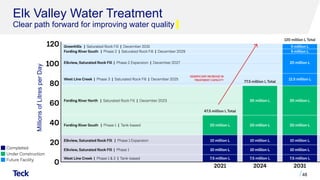

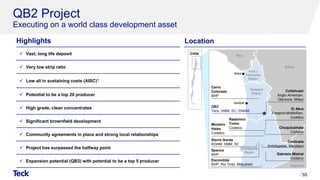

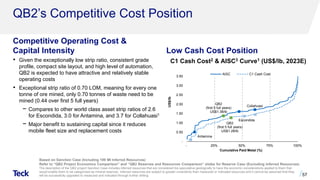

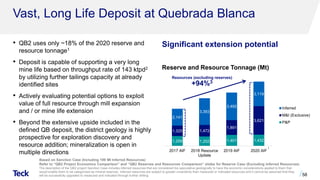

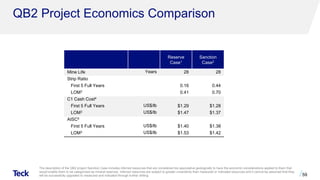

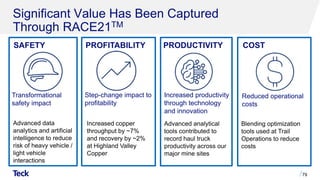

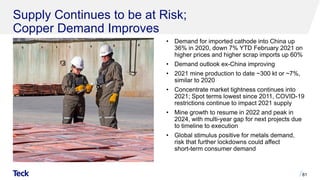

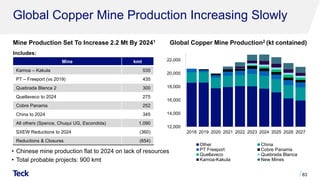

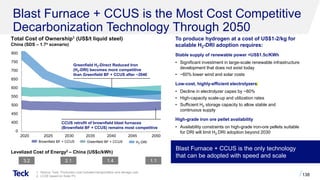

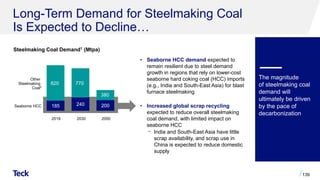

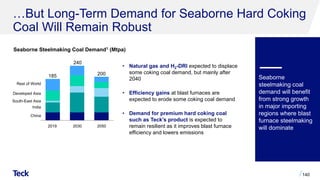

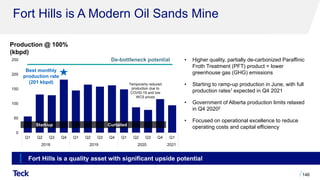

Teck Resources is hosting a global basic materials conference to discuss its strategy of doubling copper production by 2023 through the development of the Quebrada Blanca Phase 2 (QB2) project. The presentation outlines Teck's focused strategy, including its low-carbon portfolio, proven operational excellence, and significant copper growth potential through QB2 and other projects. Teck notes that demand for copper, zinc, and steelmaking coal is expected to increase due to their role in decarbonization technologies and trends like electrification, renewable energy, and infrastructure growth.