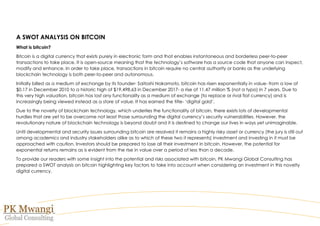

The document presents a SWOT analysis of Bitcoin, describing it as a digital currency that facilitates peer-to-peer transactions without the need for central authorities. It highlights Bitcoin's strengths, such as being a market leader and store of value, and weaknesses including unproven technology and extreme volatility. Additionally, the document outlines potential opportunities for mass adoption and threats from regulation and cybersecurity issues, while warning that investing in Bitcoin remains highly risky.