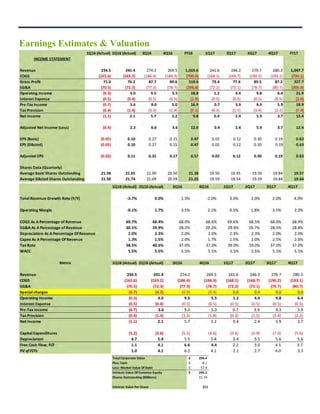

Forward View is maintaining a hold rating on Big 5 Sporting Goods (NASDAQ: BGFV) and is increasing the target price to $11 per share. The report suggests that income-oriented investors may want to consider this stock. It includes standard disclaimers regarding the accuracy of the information and the need for individual investor due diligence.