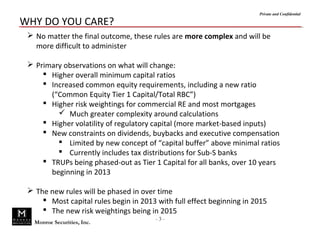

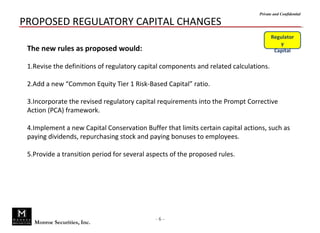

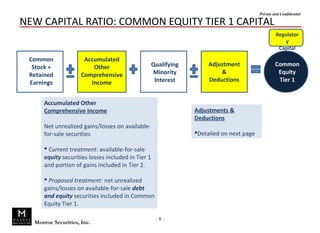

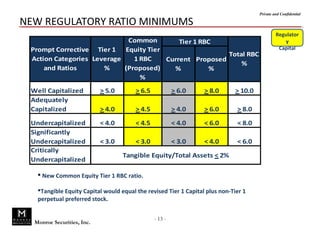

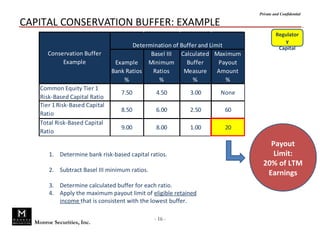

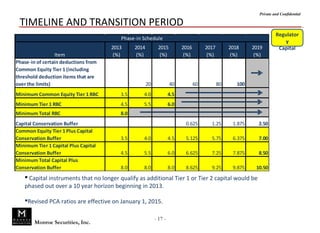

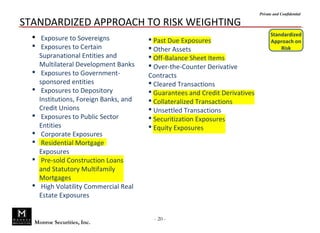

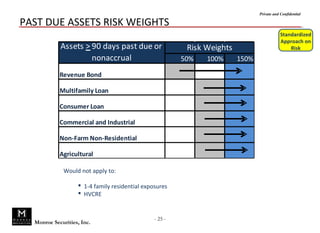

This document discusses proposed Basel III capital rules and their potential impact on community banks. It notes that while not all rules will apply, community banks will have to comply with new regulatory capital and risk weighting requirements. This will involve higher minimum capital ratios, more common equity, and increased risk weights for assets like commercial real estate and mortgages. The new rules will also limit dividends, stock buybacks, and executive pay. Overall, the changes mean capital will be more complex and difficult to manage under the new regulations.