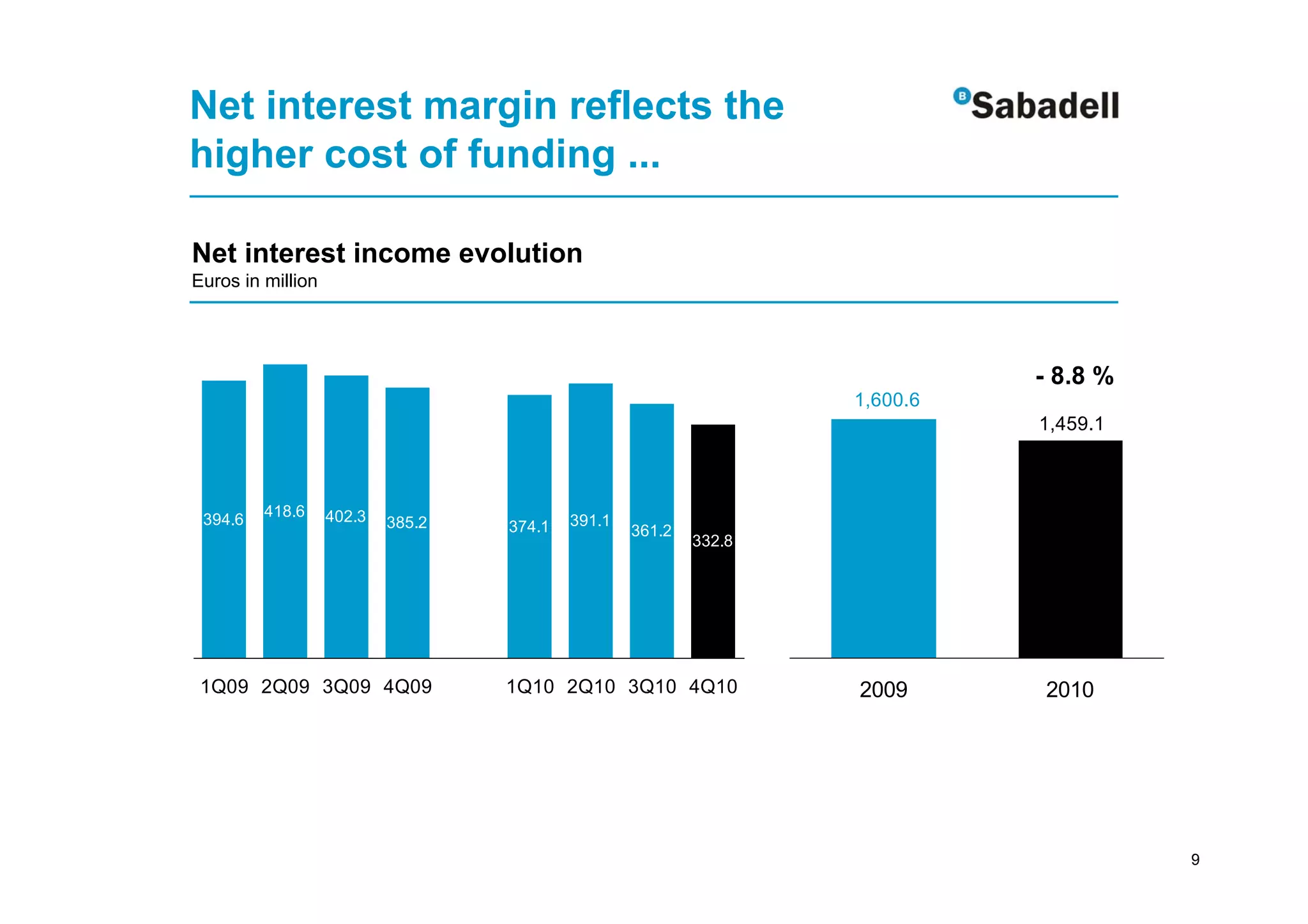

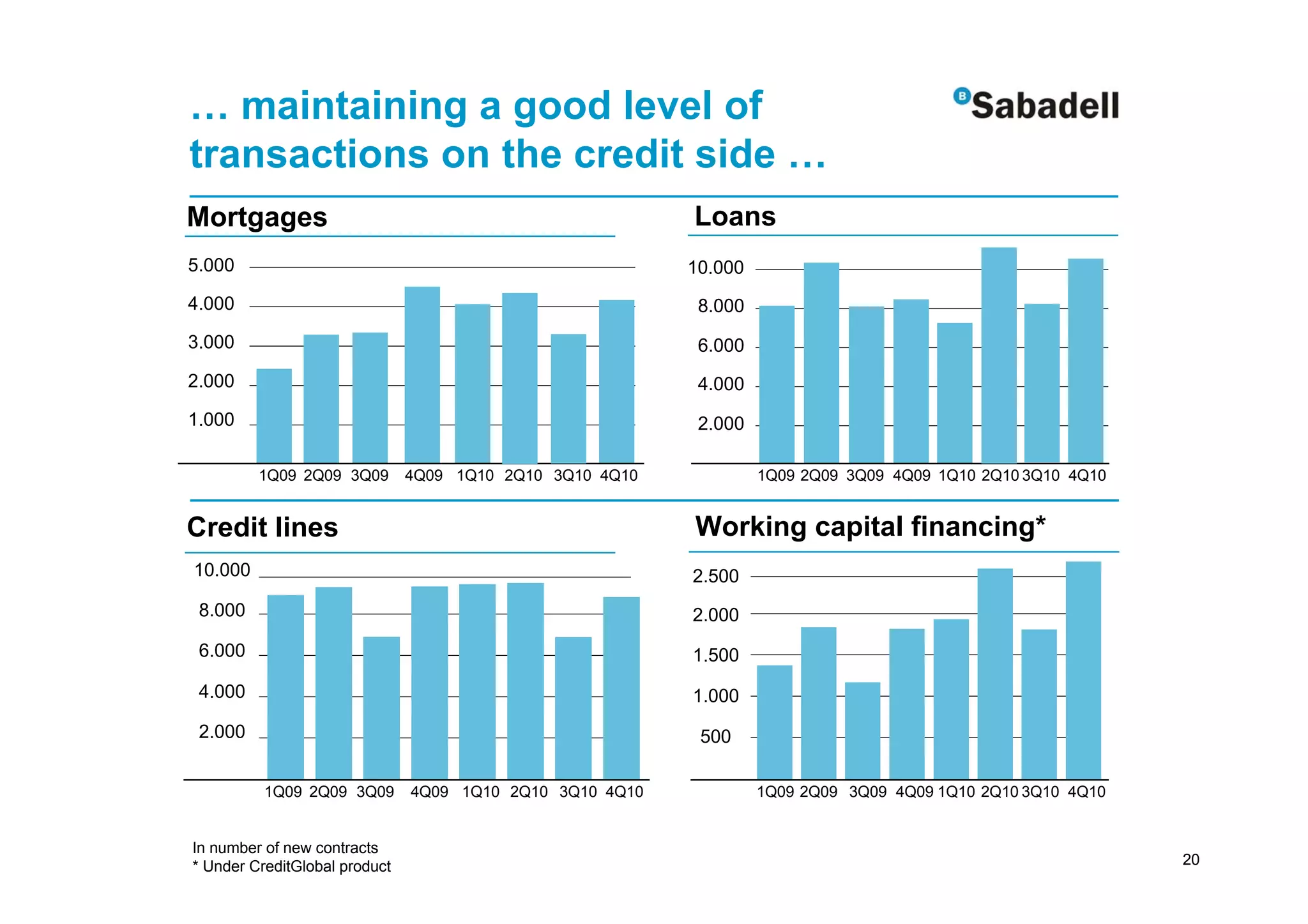

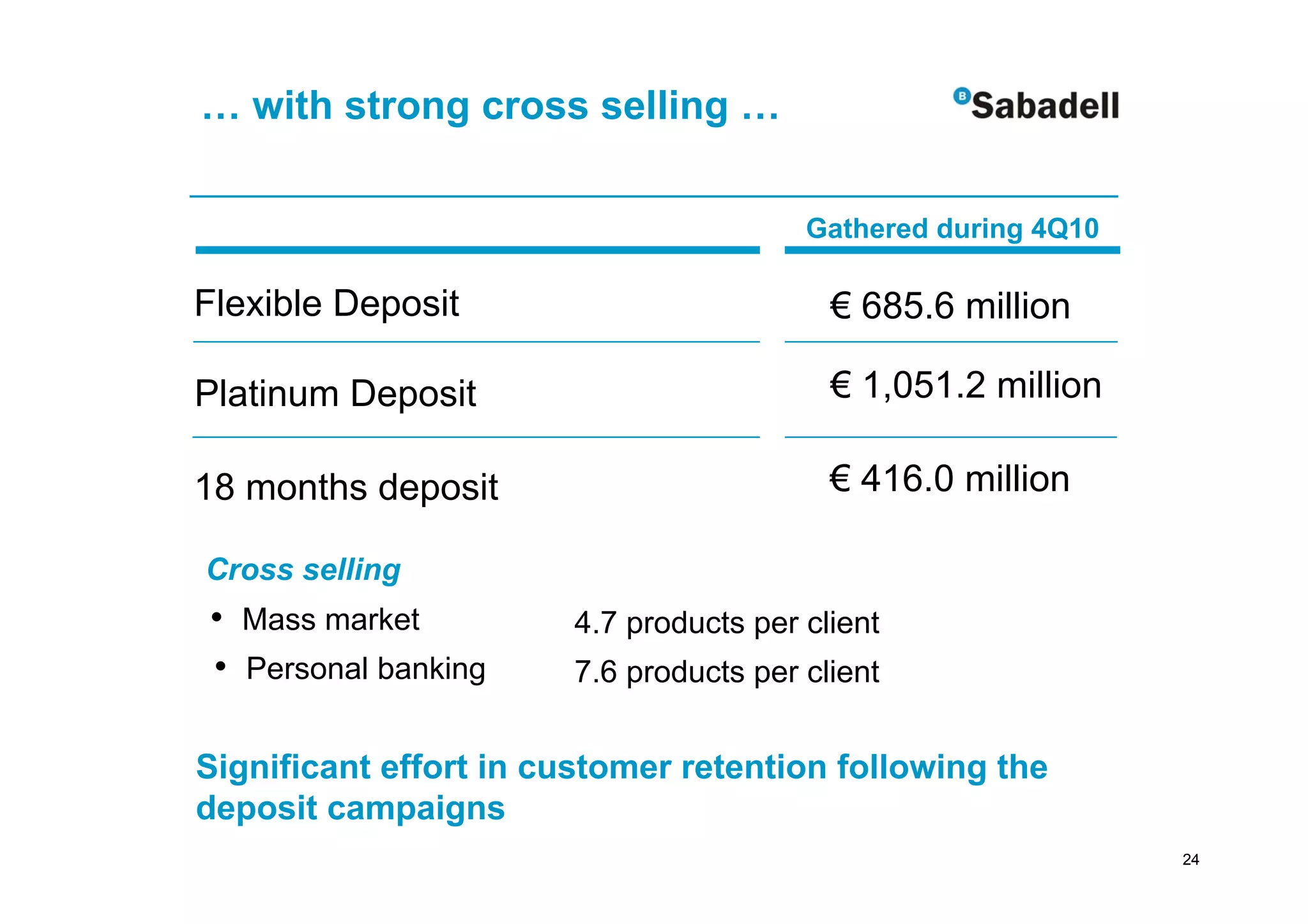

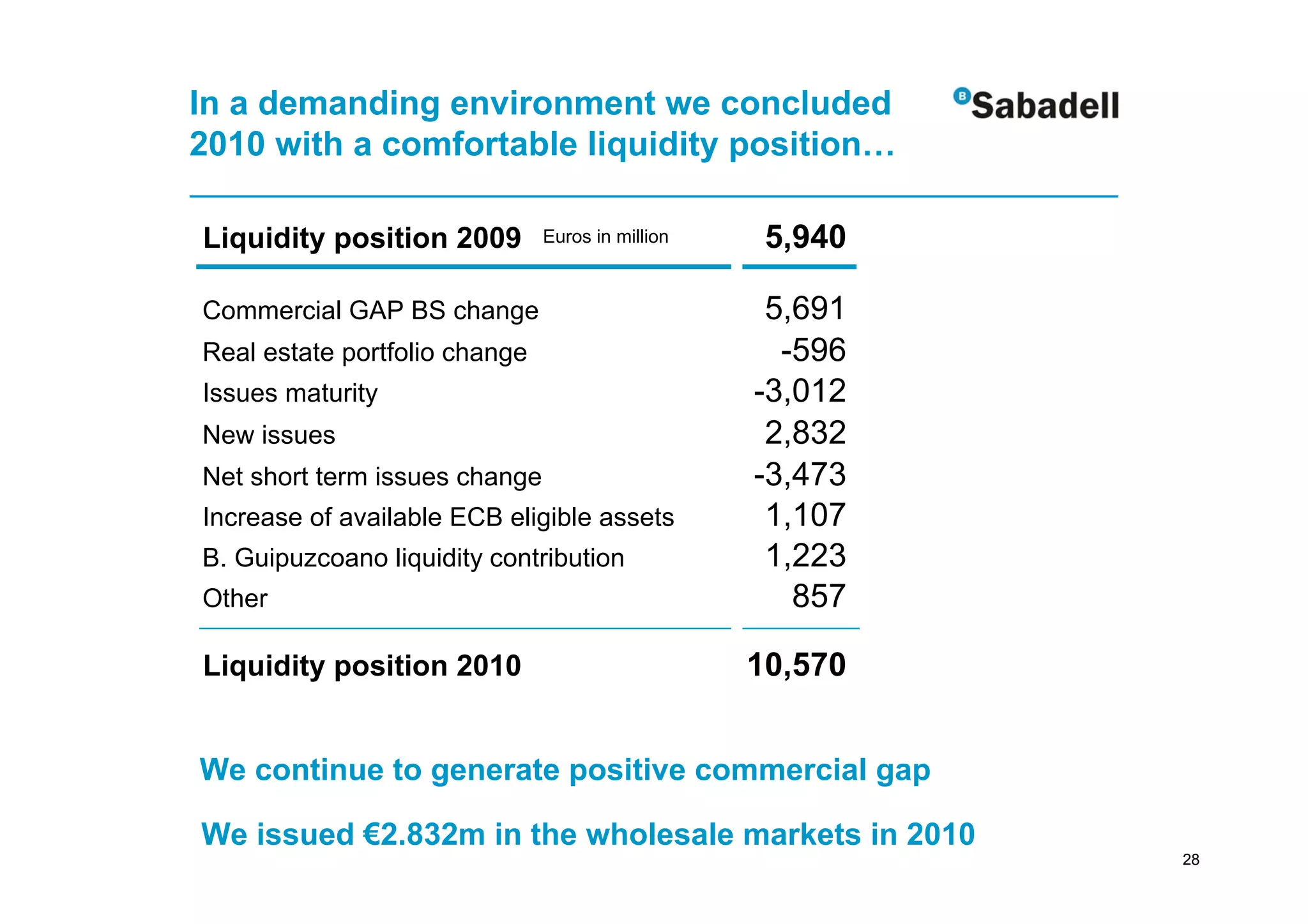

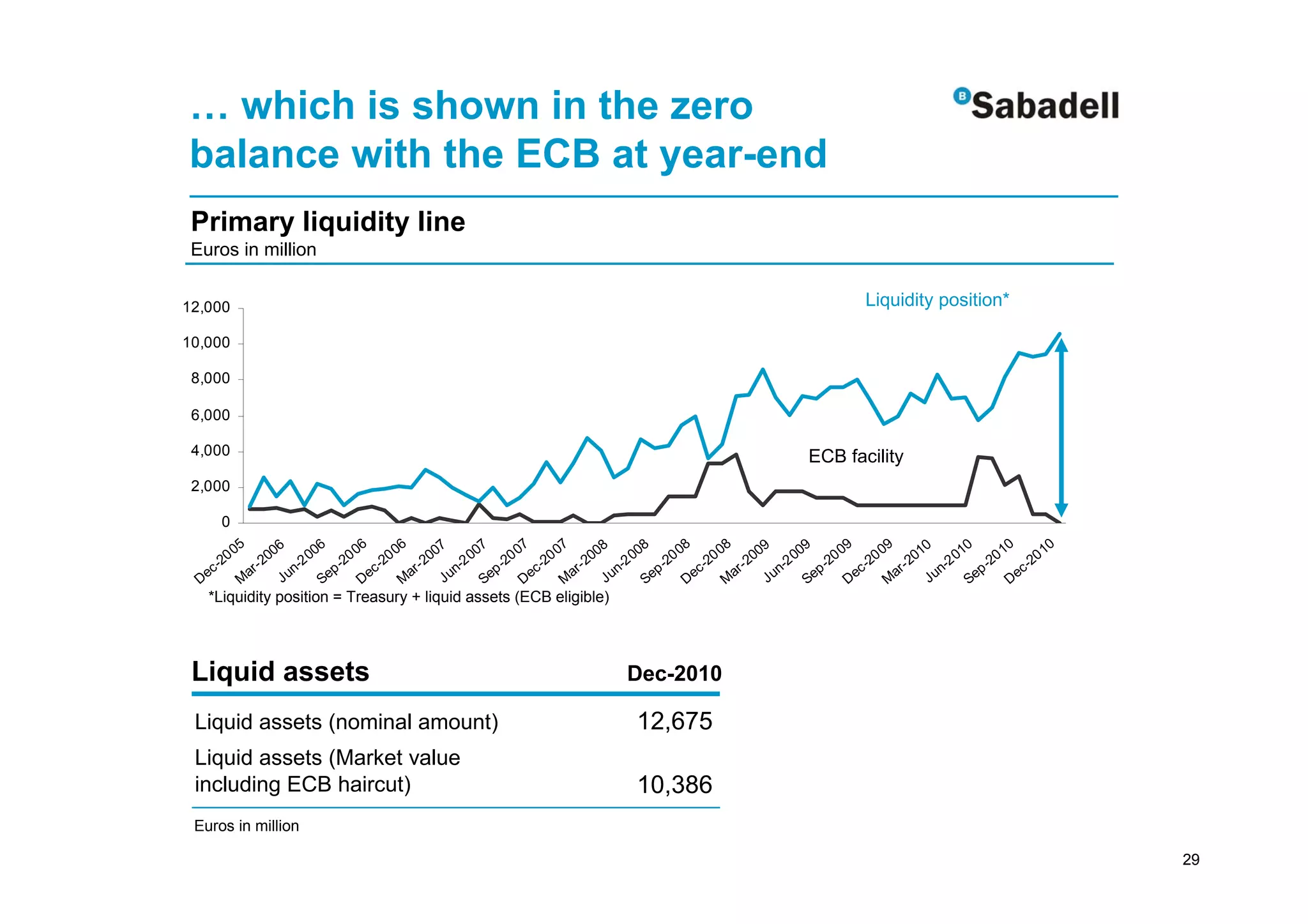

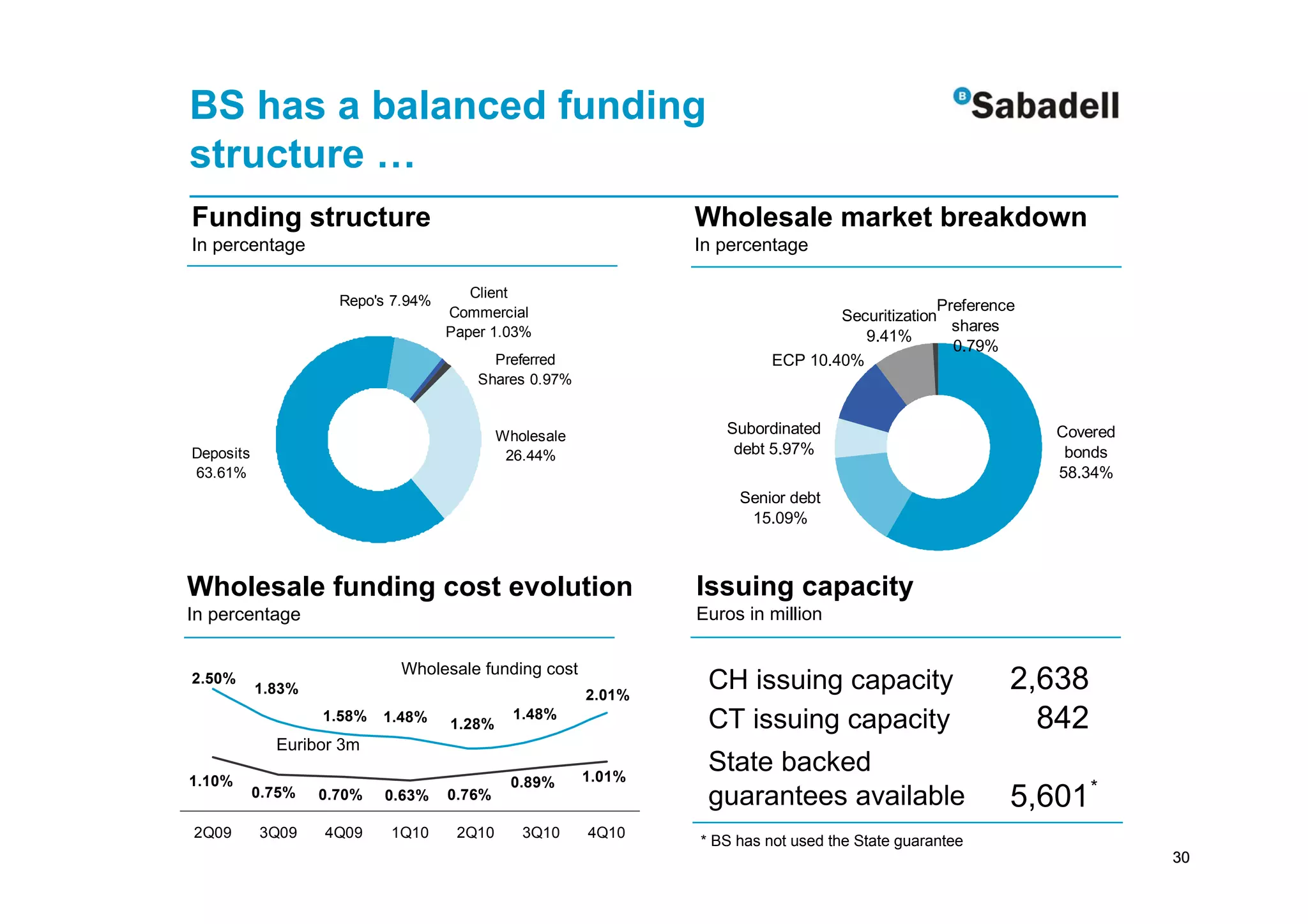

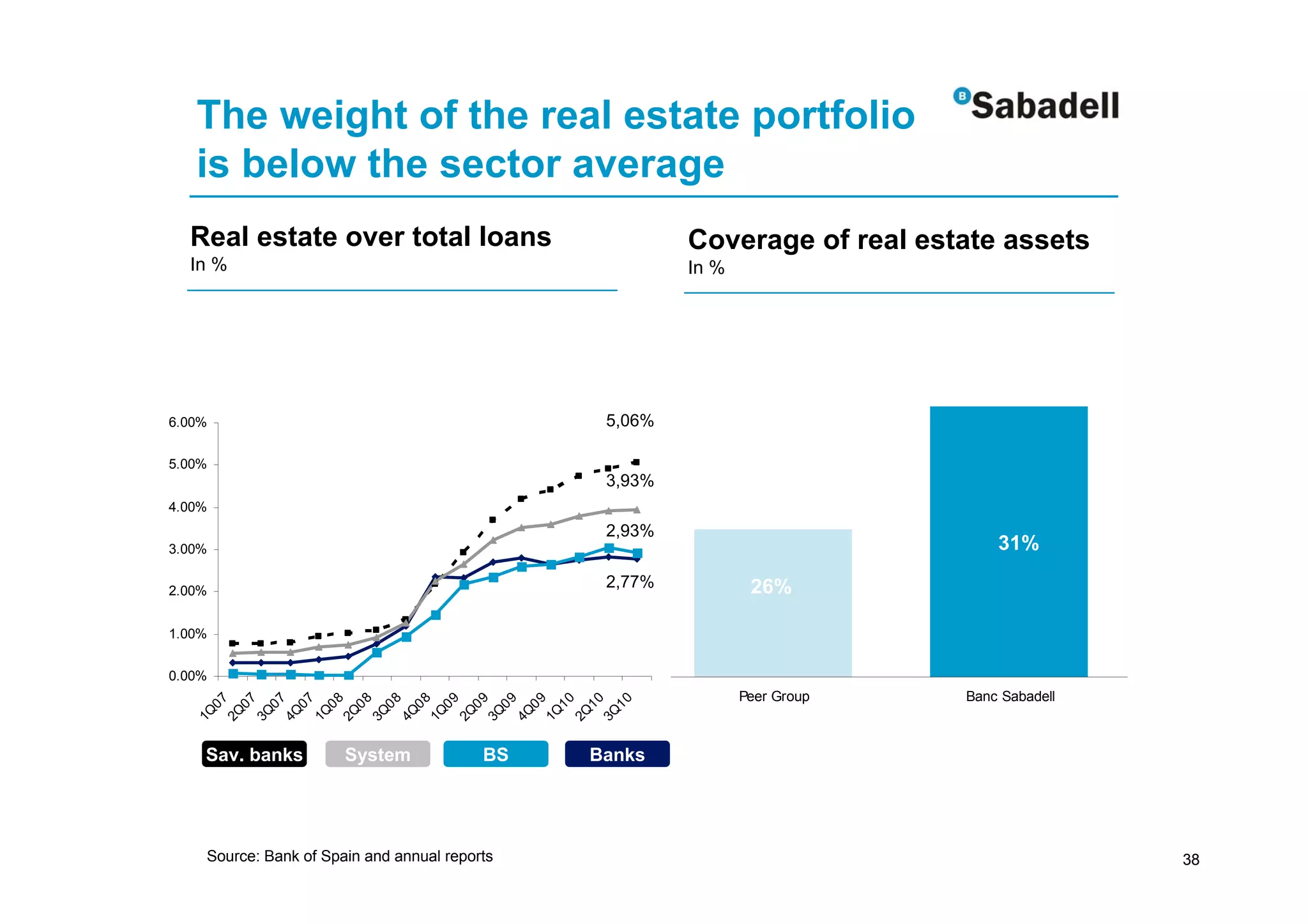

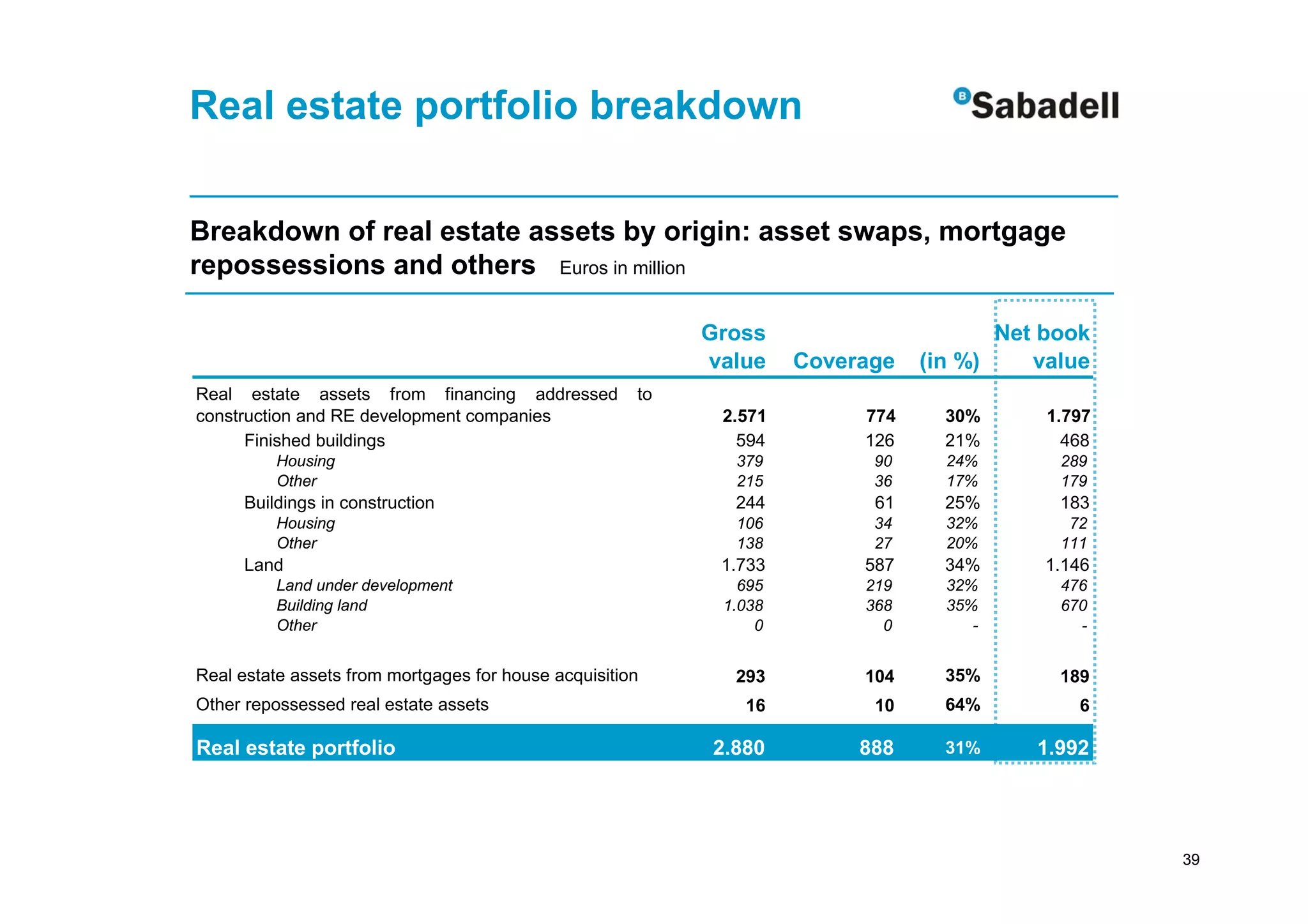

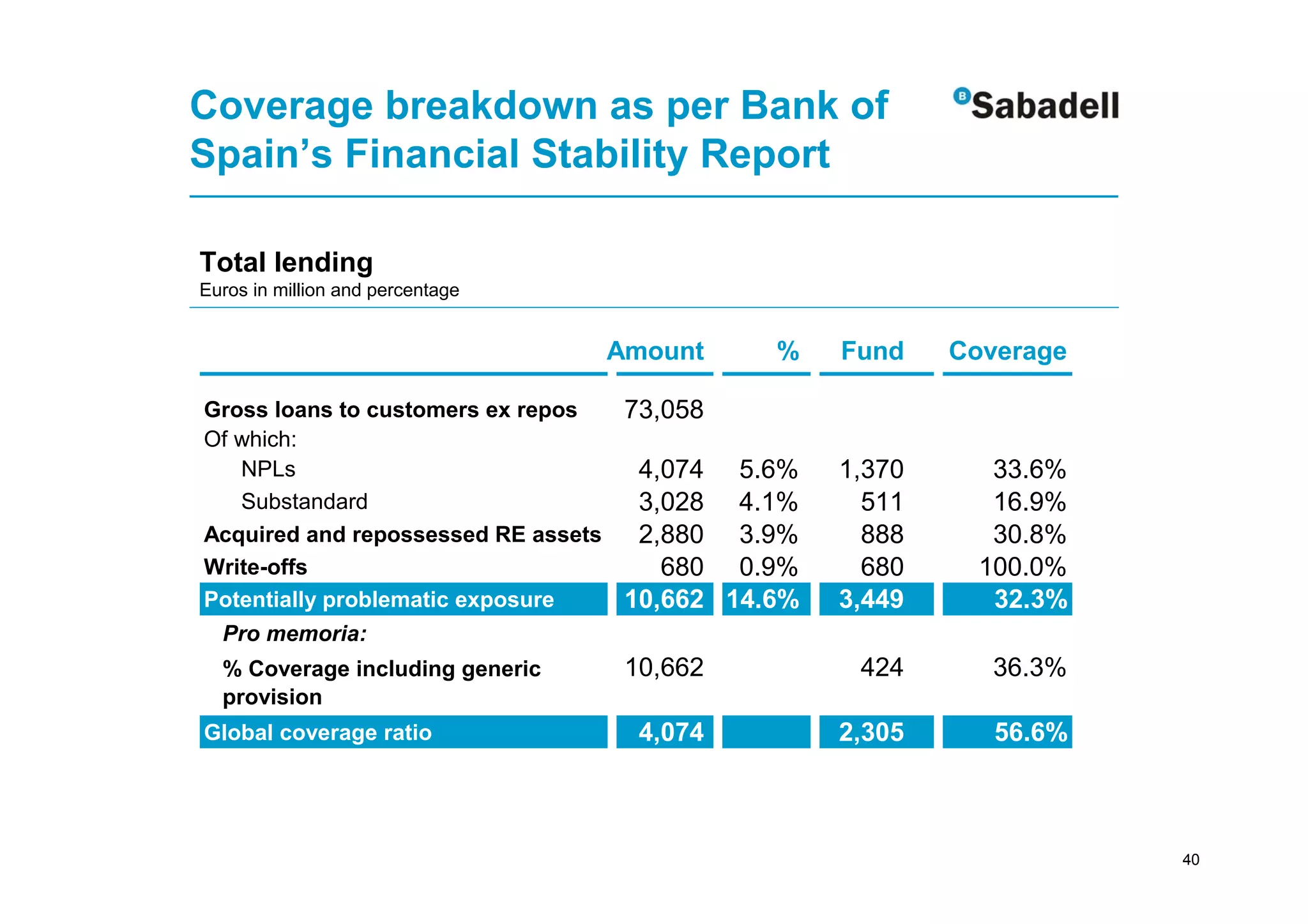

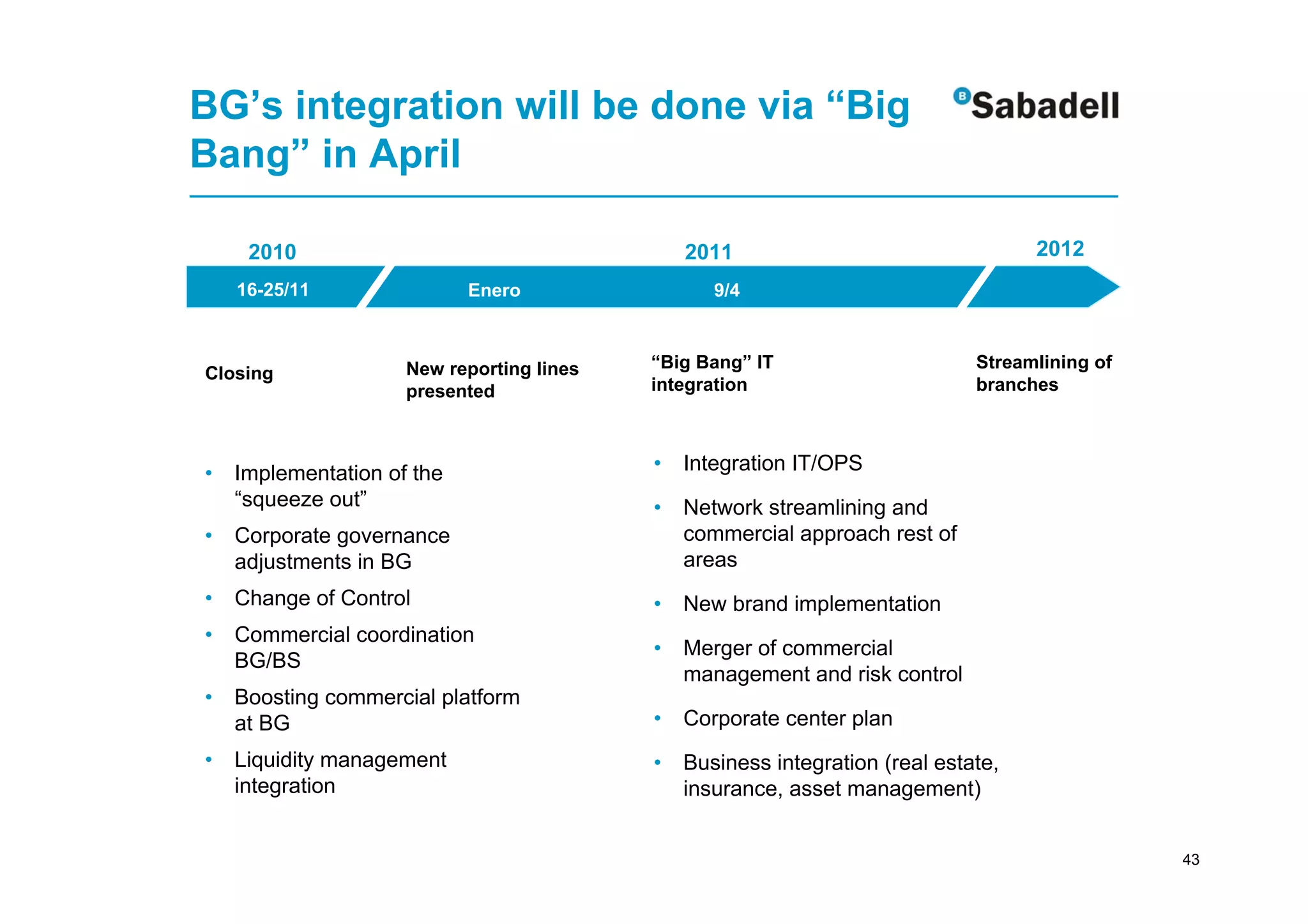

Banco Sabadell reported results for fiscal year 2010. Net interest income declined 8.8% due to a higher cost of funding, though capital ratios improved. Commercial activity generated an important GAP and liquidity remained comfortable without reliance on ECB funding. Loan growth continued alongside sustained increases in customers and deposits. Cost management was good and Banco Guipuzcoano was efficiently integrated.