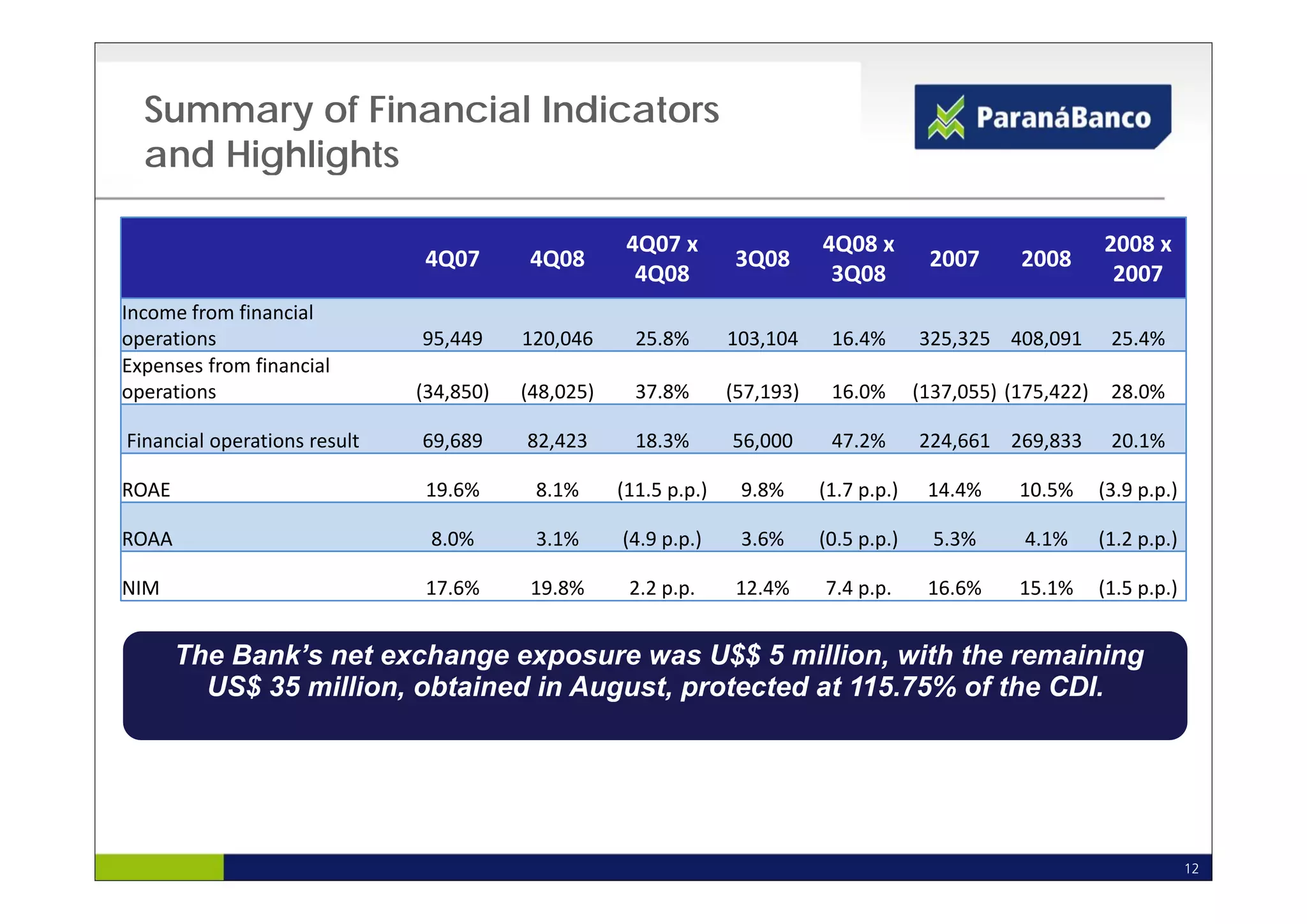

Paraná Banco reported its financial results for 4Q08 and full year 2008. Key highlights include:

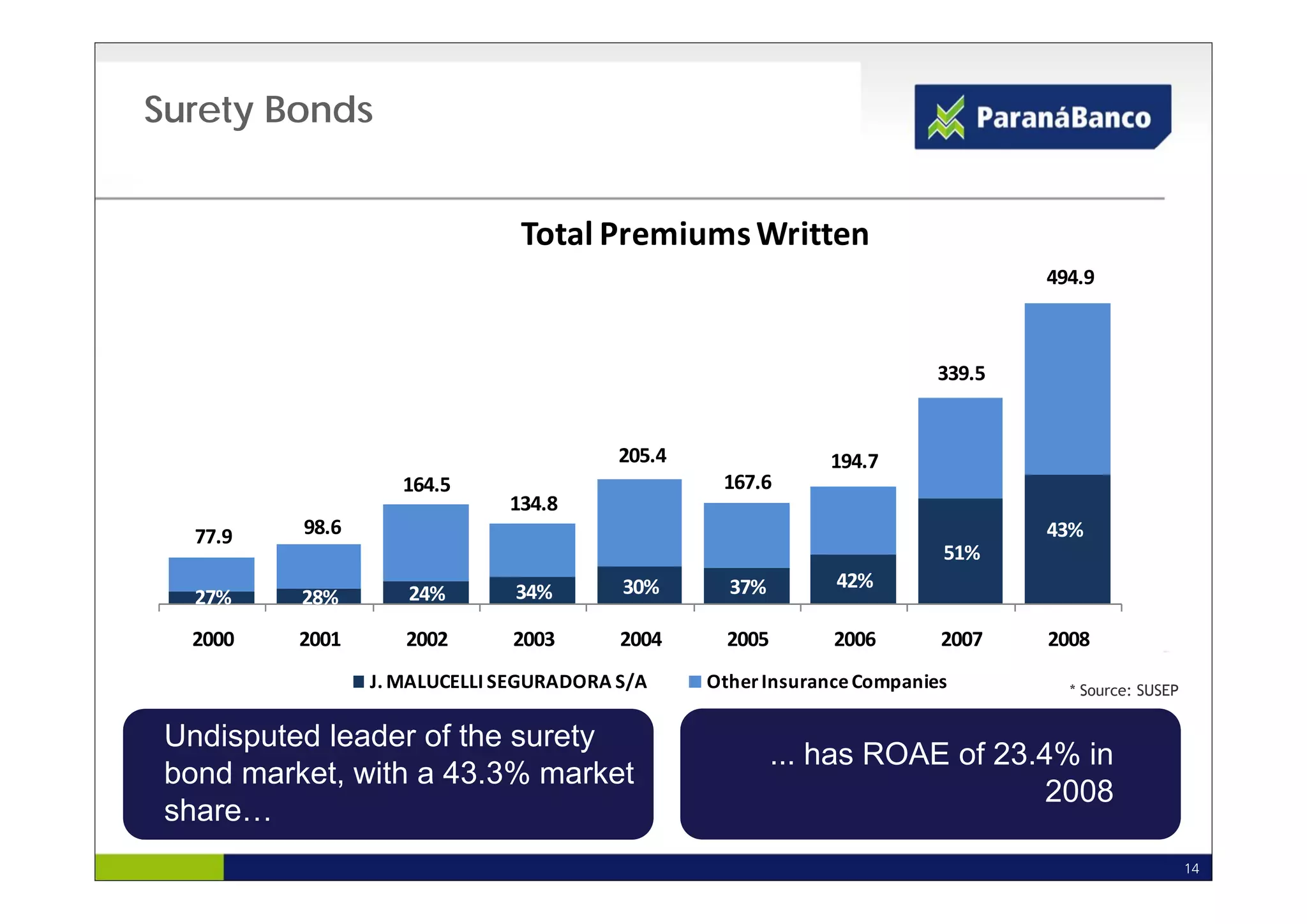

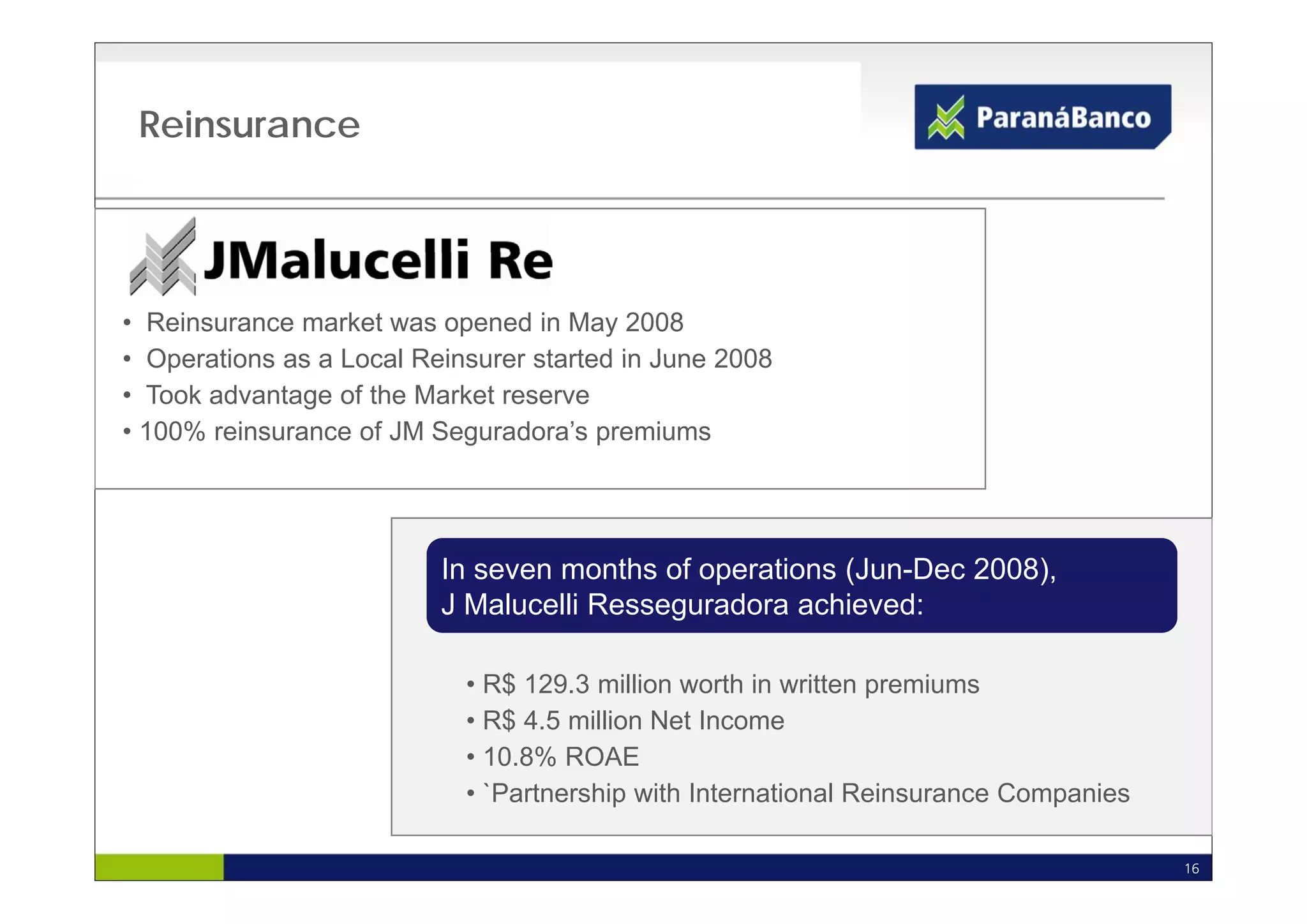

- Net income of R$84.1 million in 2008, with the insurance sector contributing 27.2%

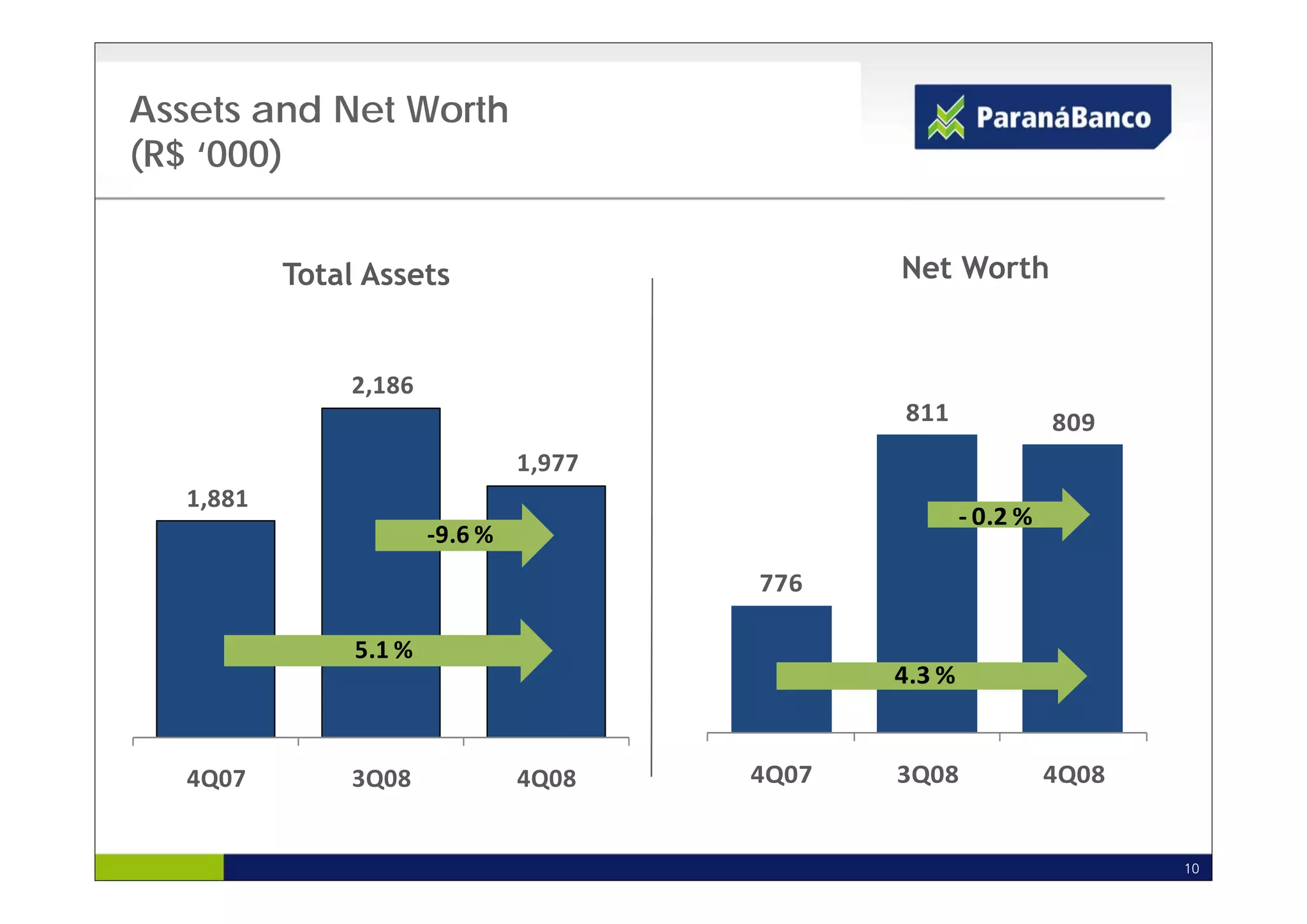

- Total assets of R$1.9 billion, growing 5.1%

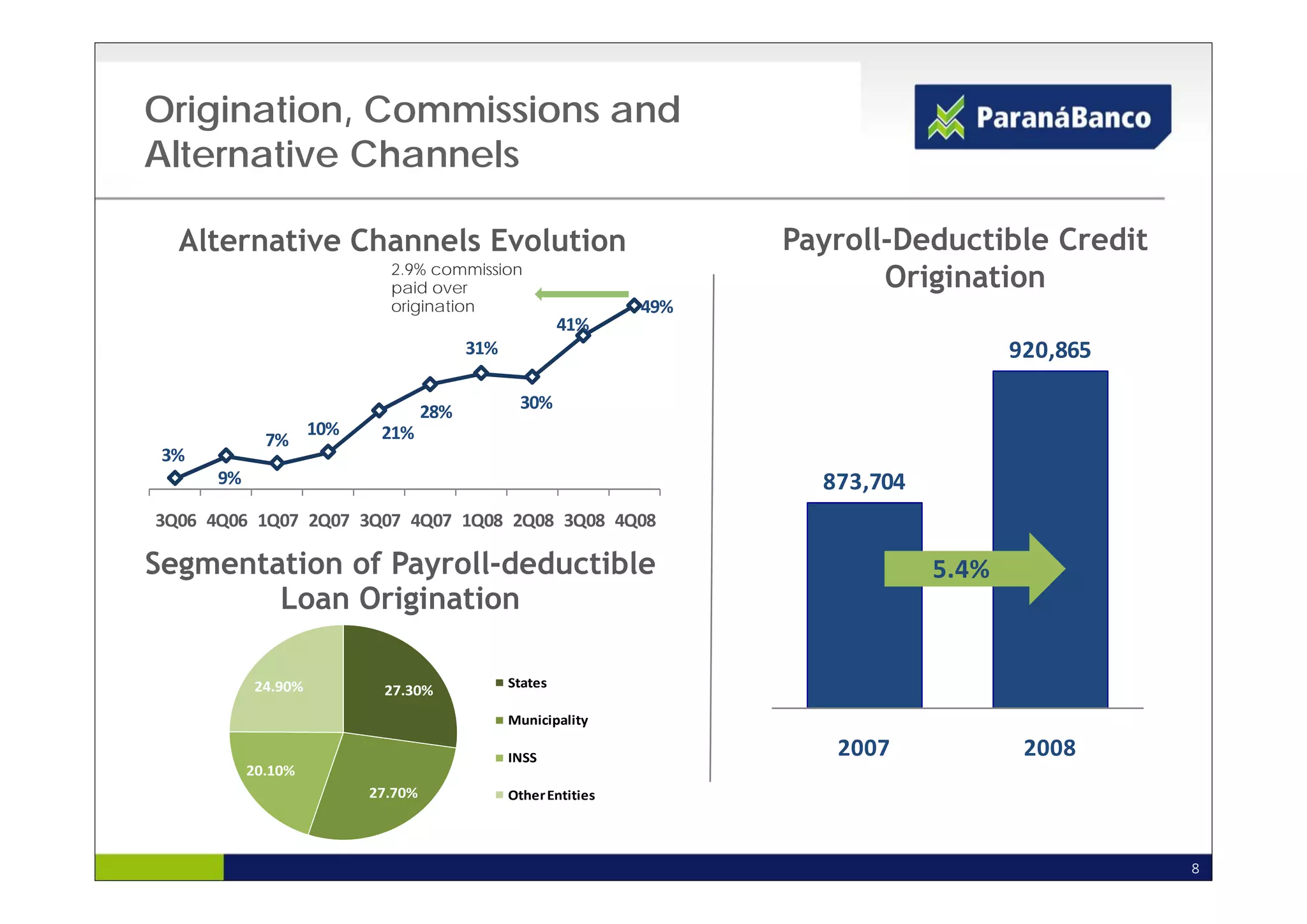

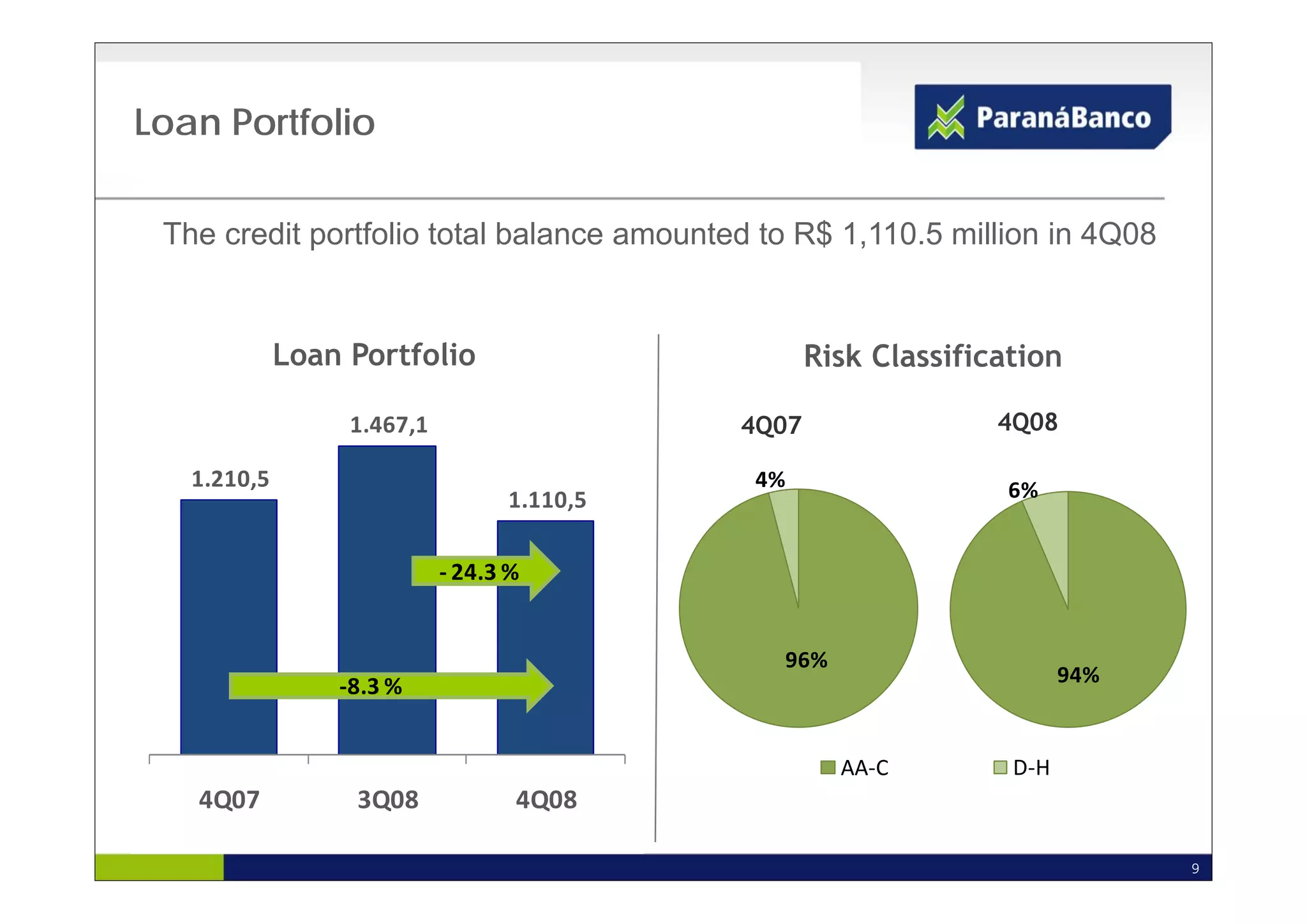

- Origination of payroll-deductible