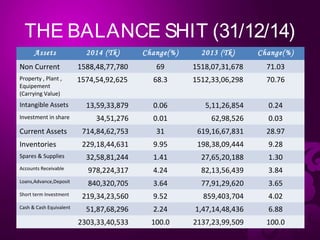

The presentation discusses a background study on Beximco, detailing its diversified industries including textiles, pharmaceuticals, and energy. It provides insights into the company's philosophy, mission, board of directors, investment decisions, rules, and financial performance analysis. Key financial data up to 2014 is presented, highlighting significant changes in assets compared to the previous year.