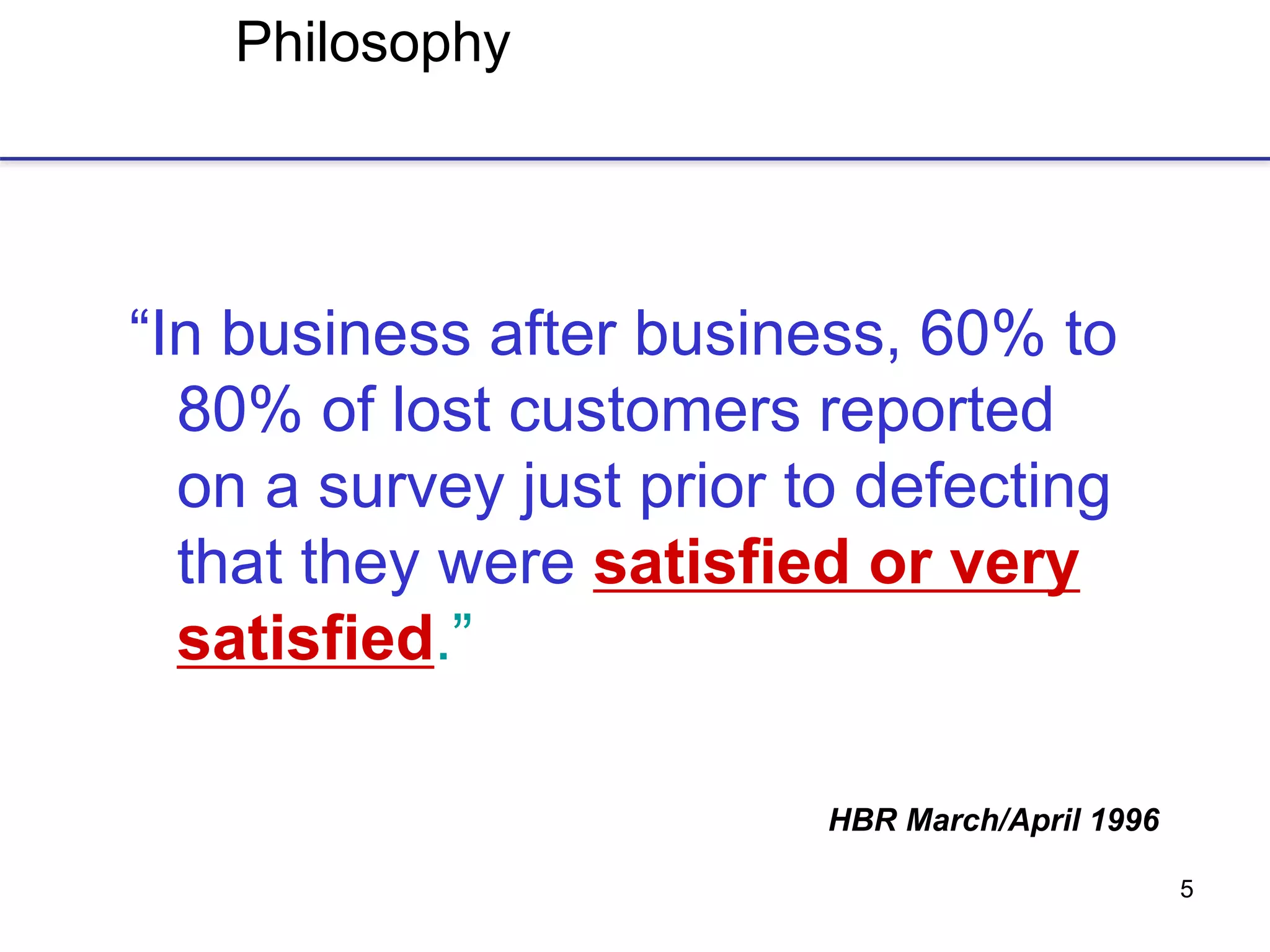

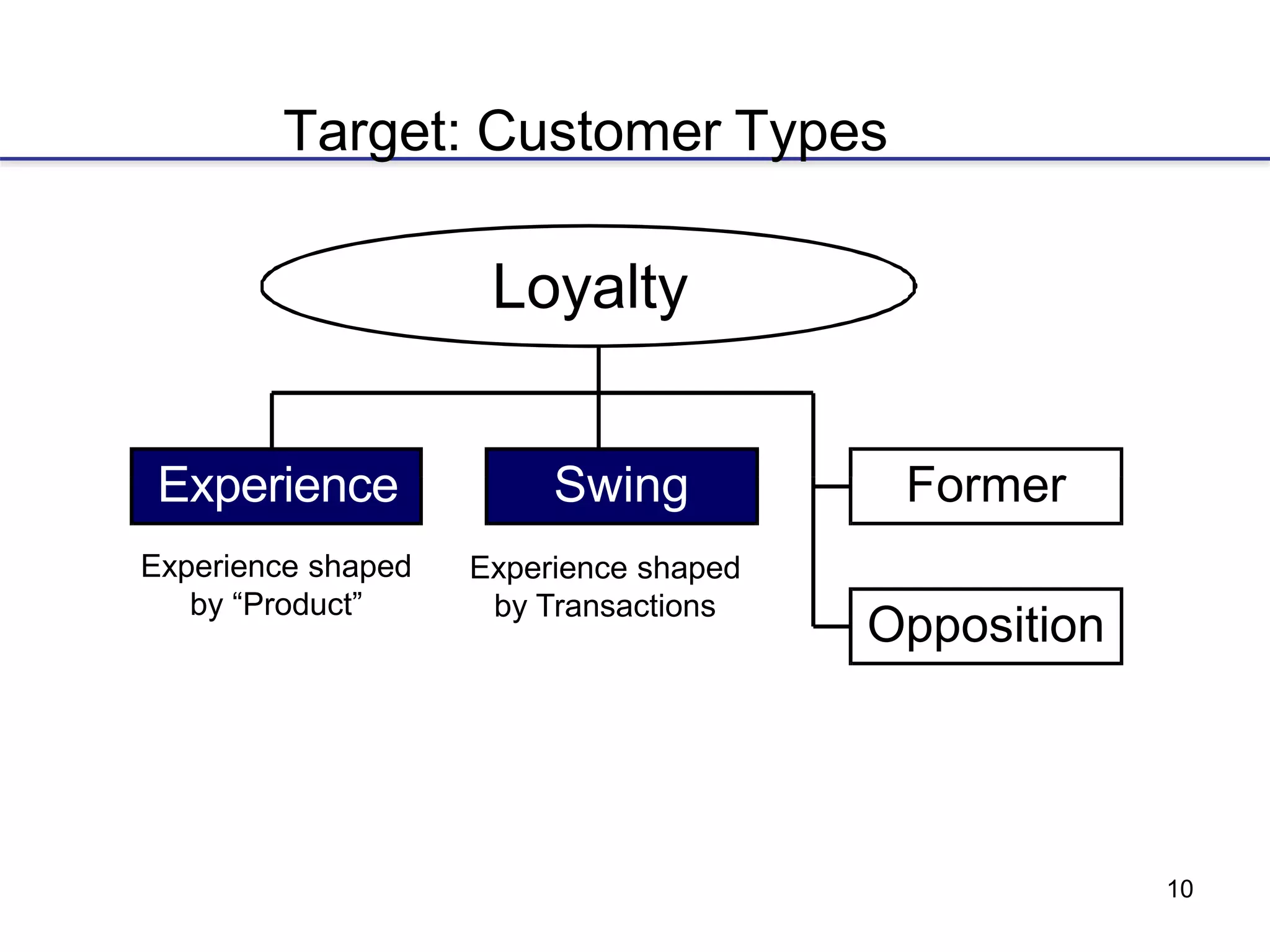

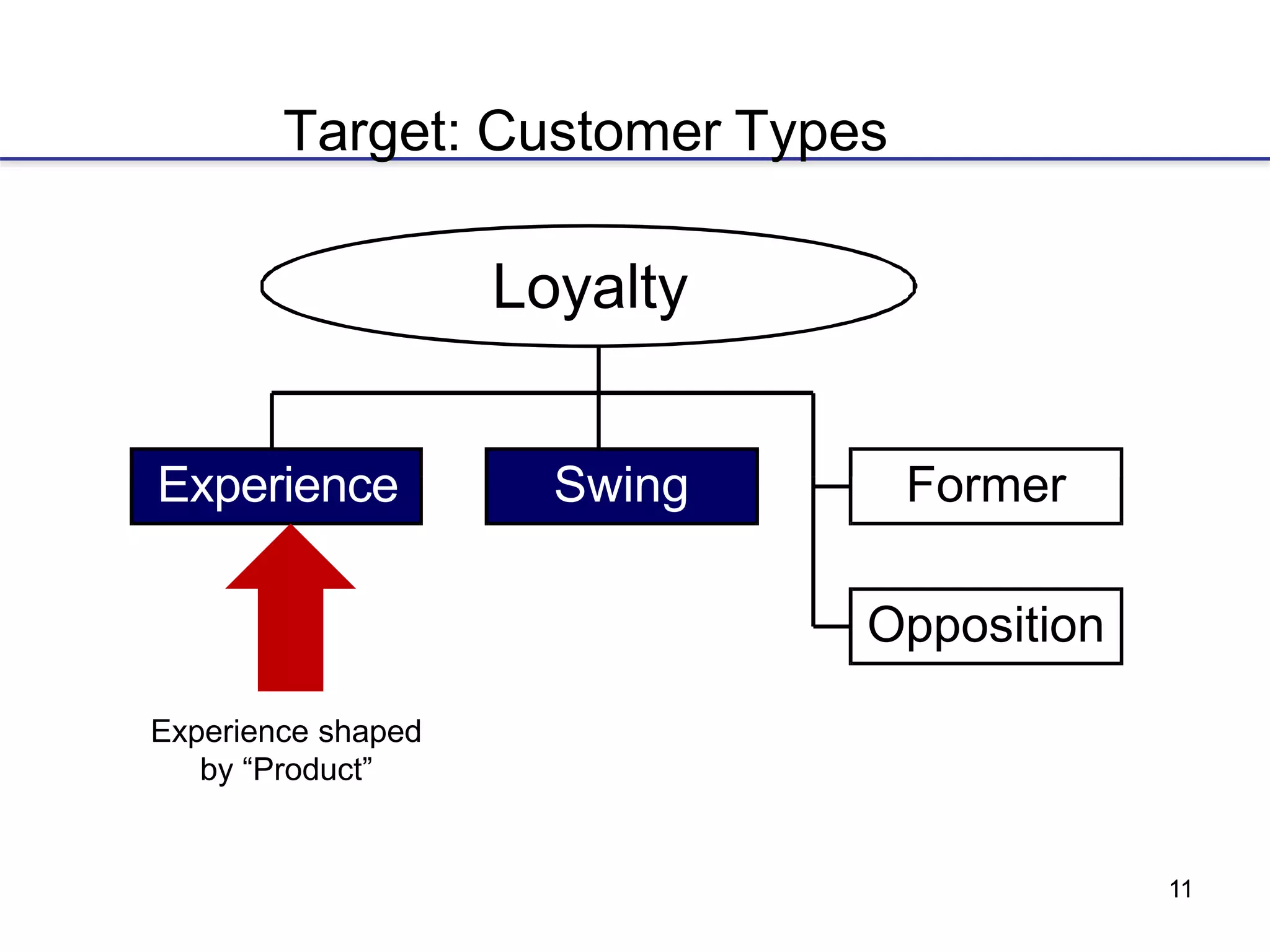

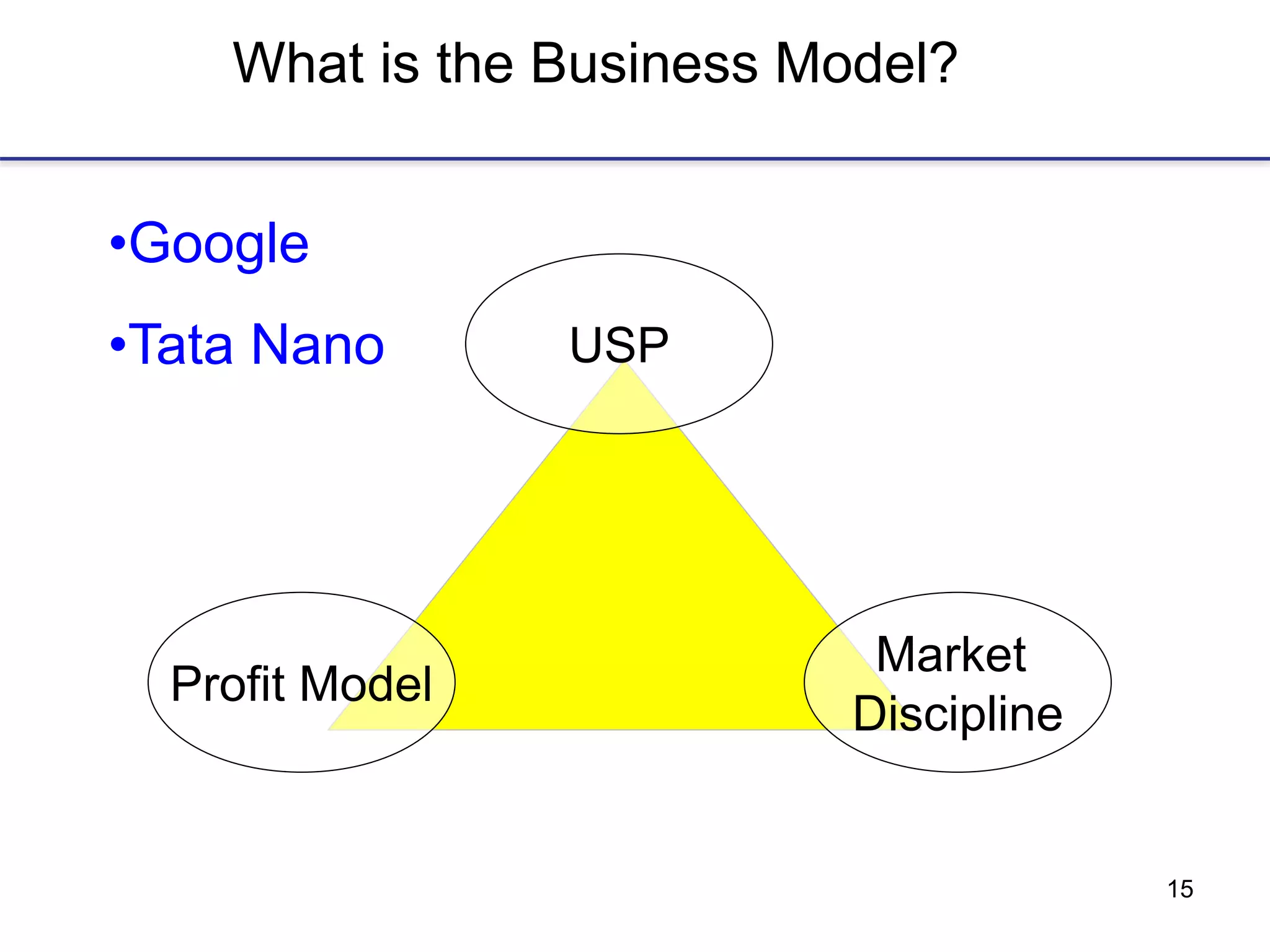

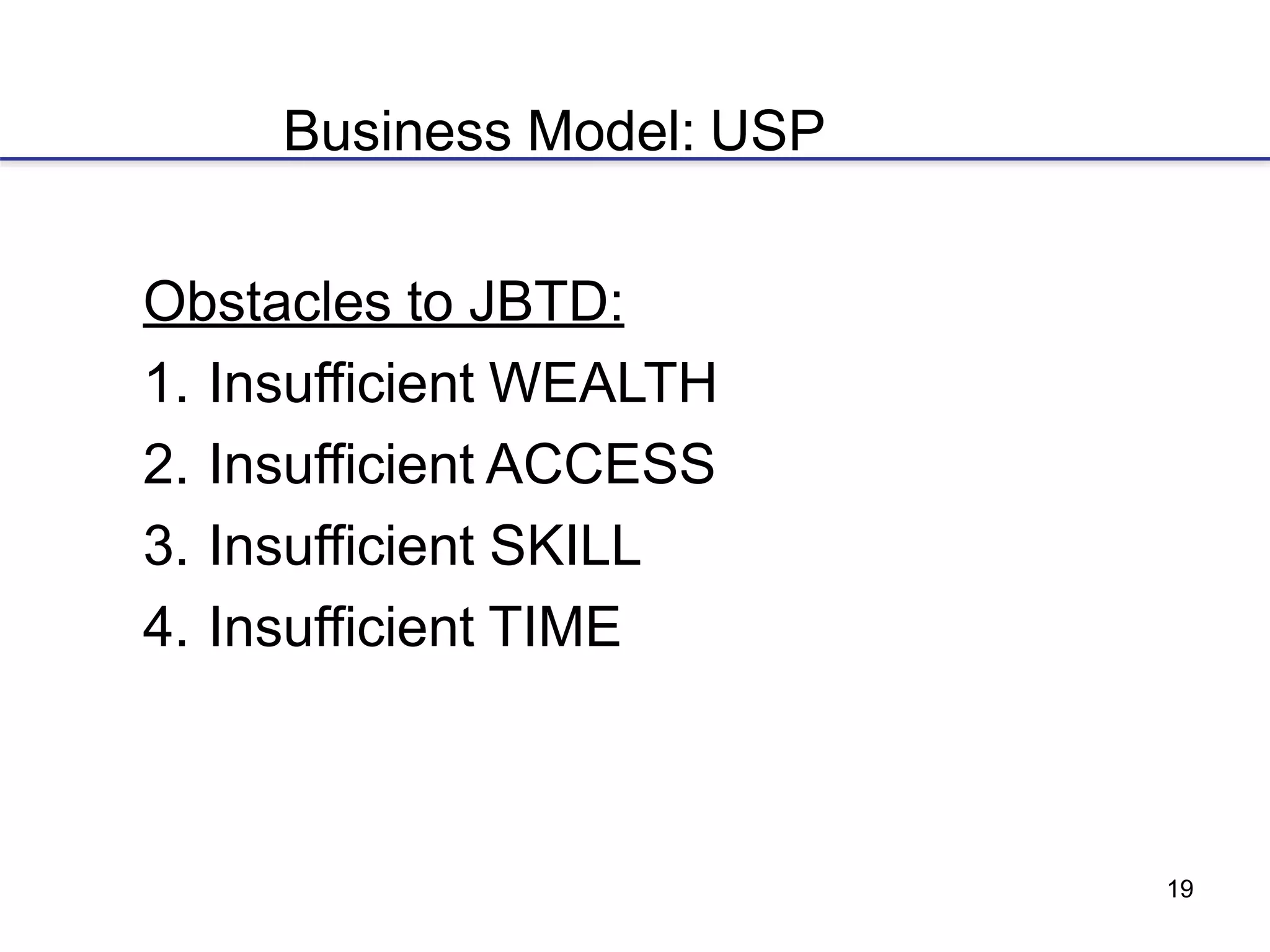

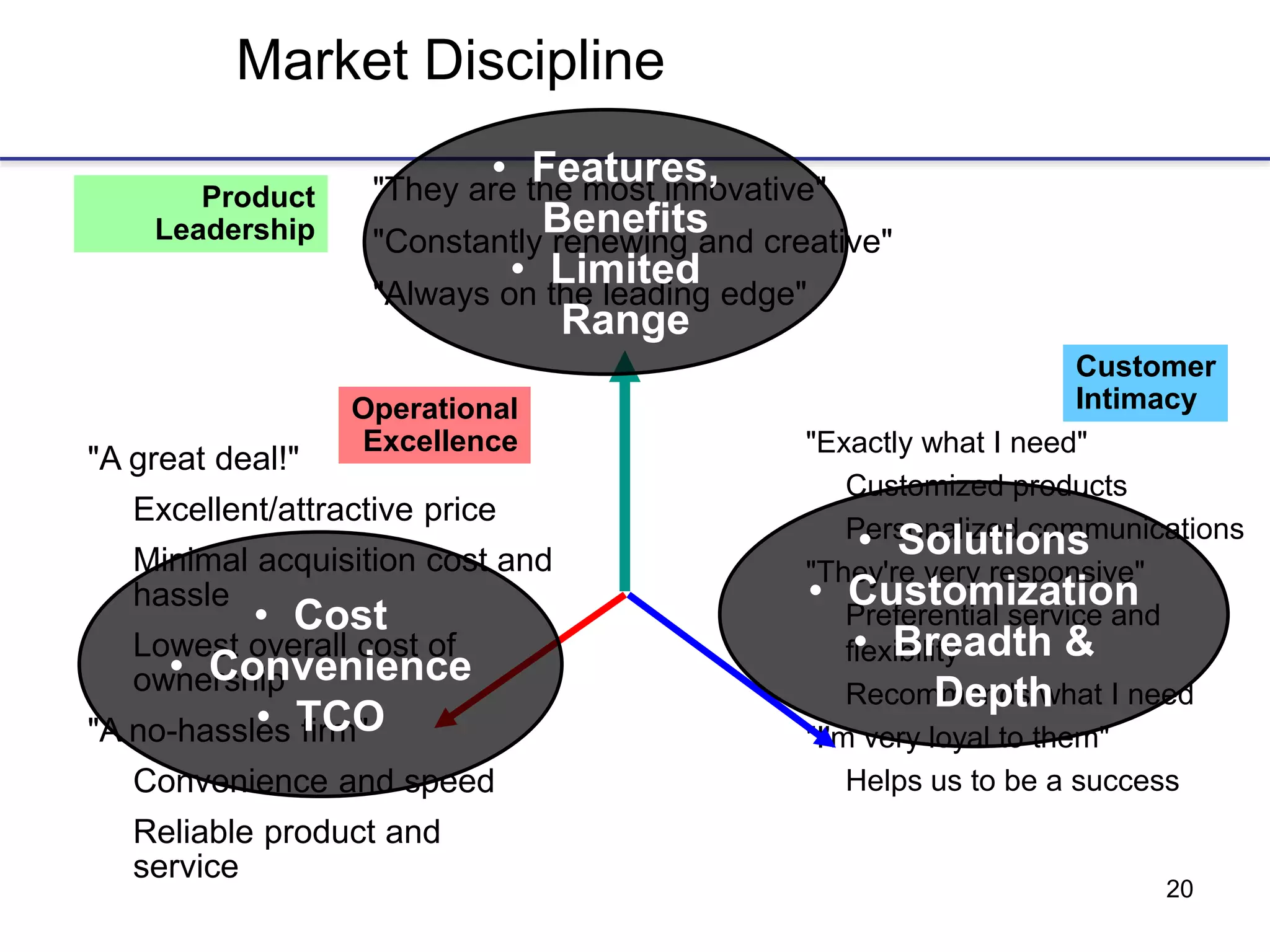

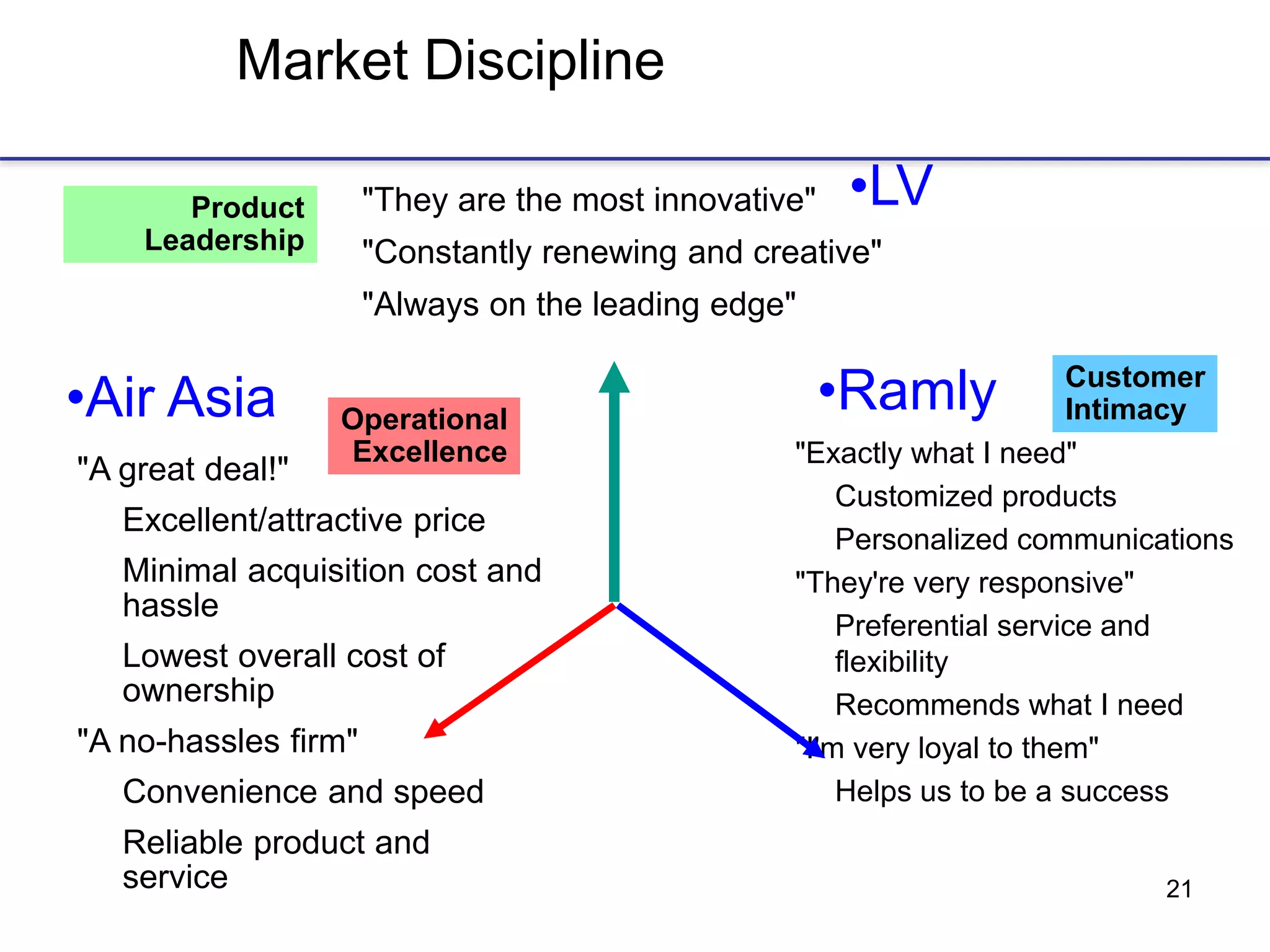

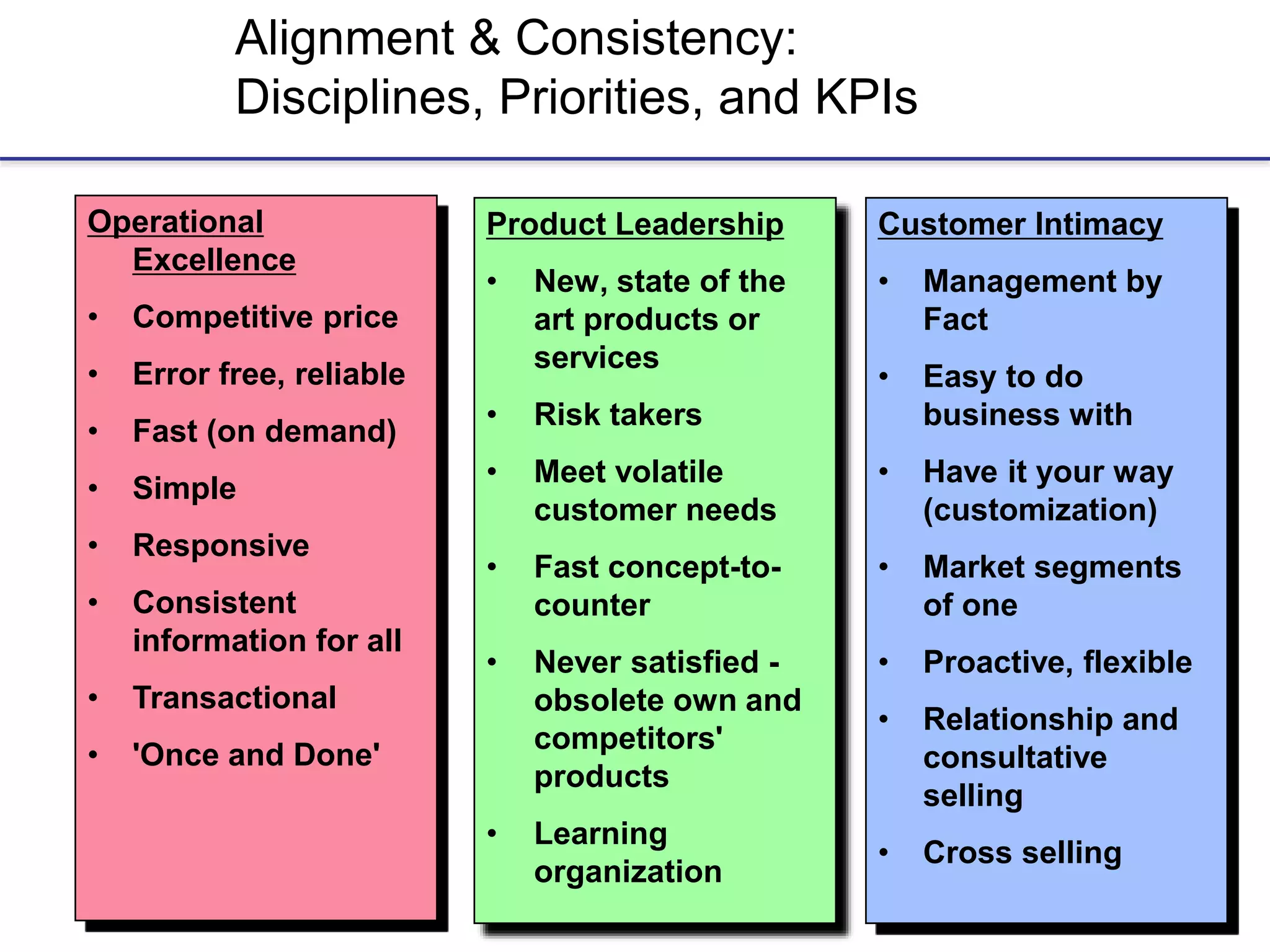

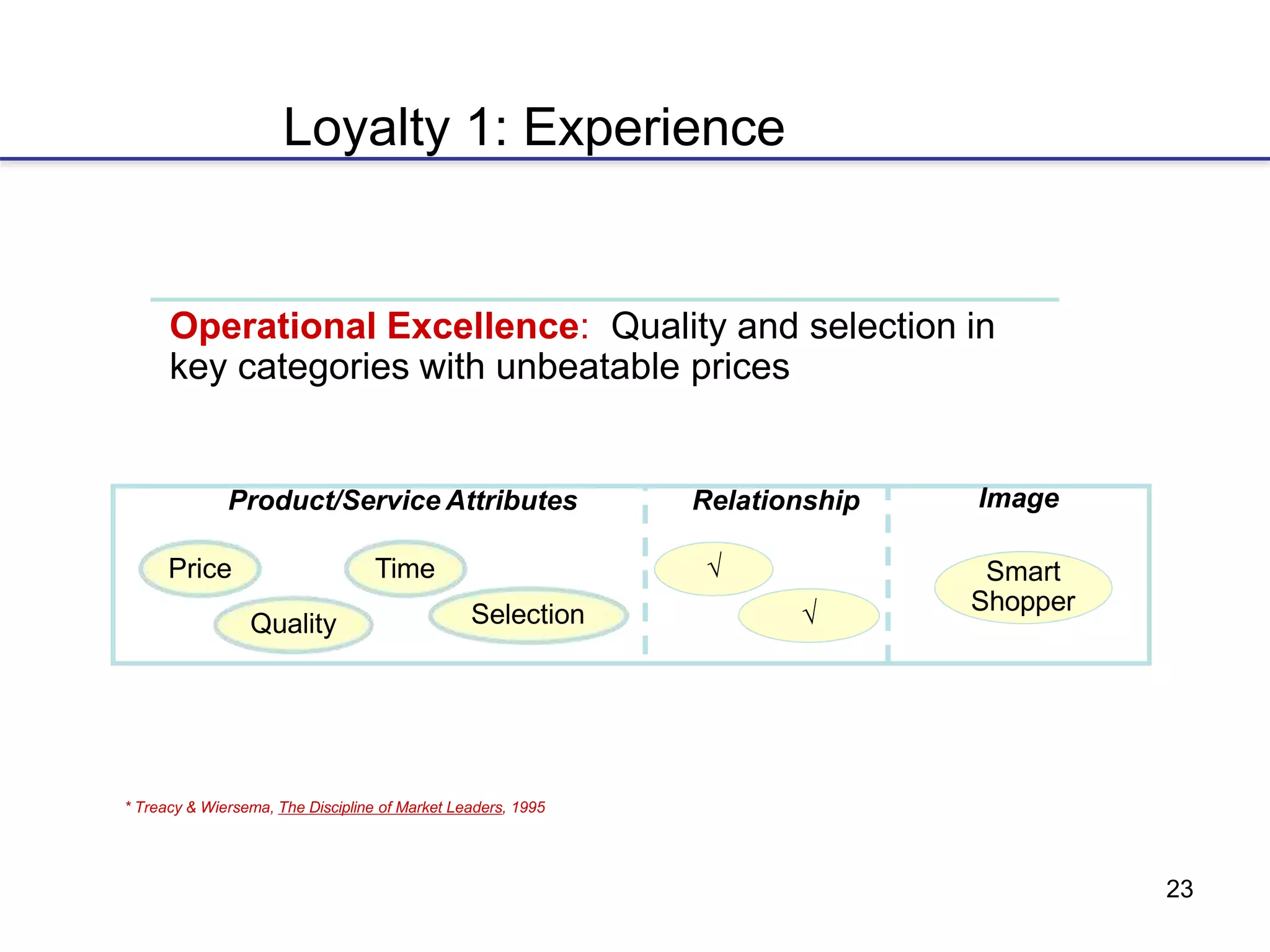

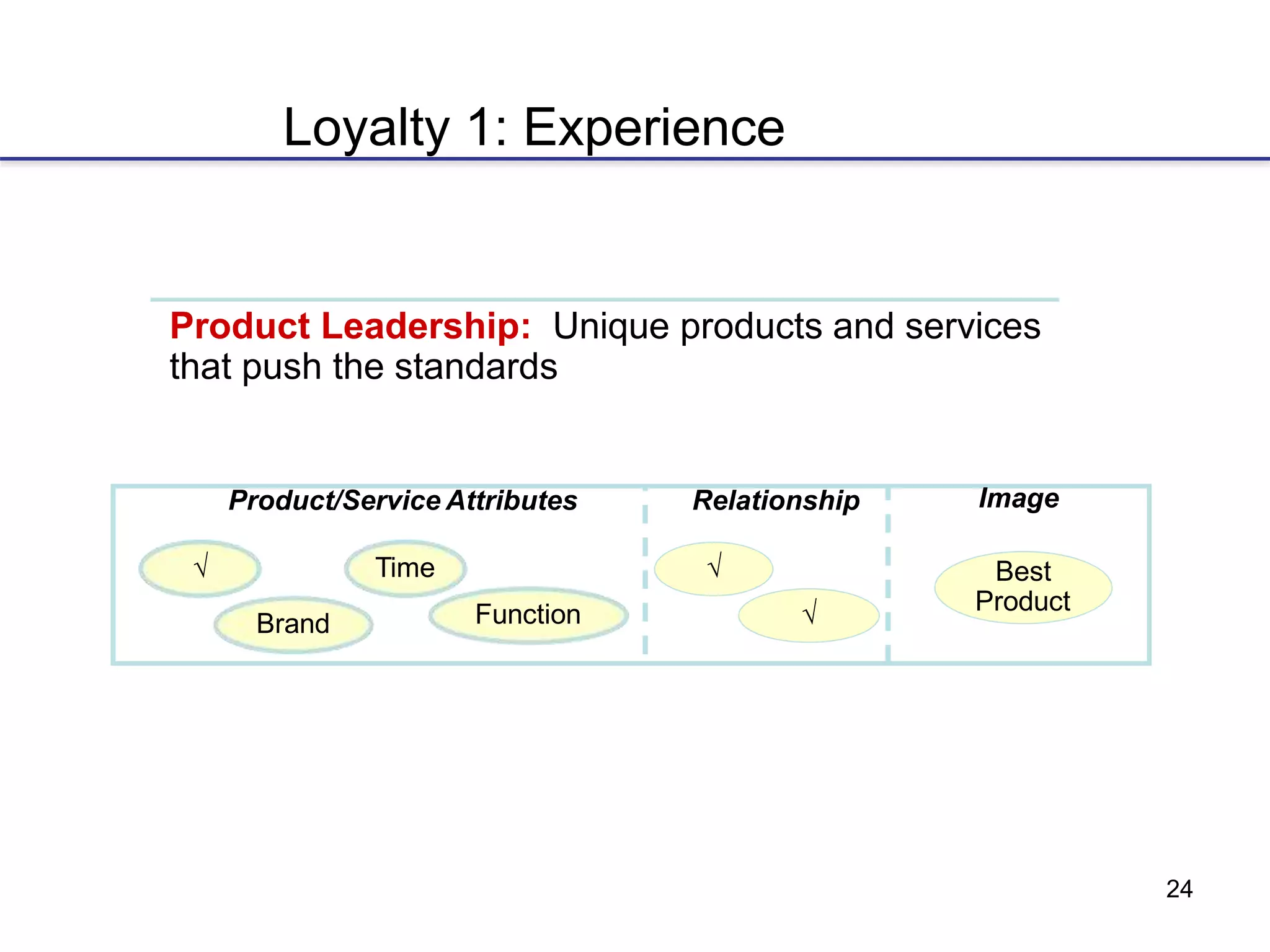

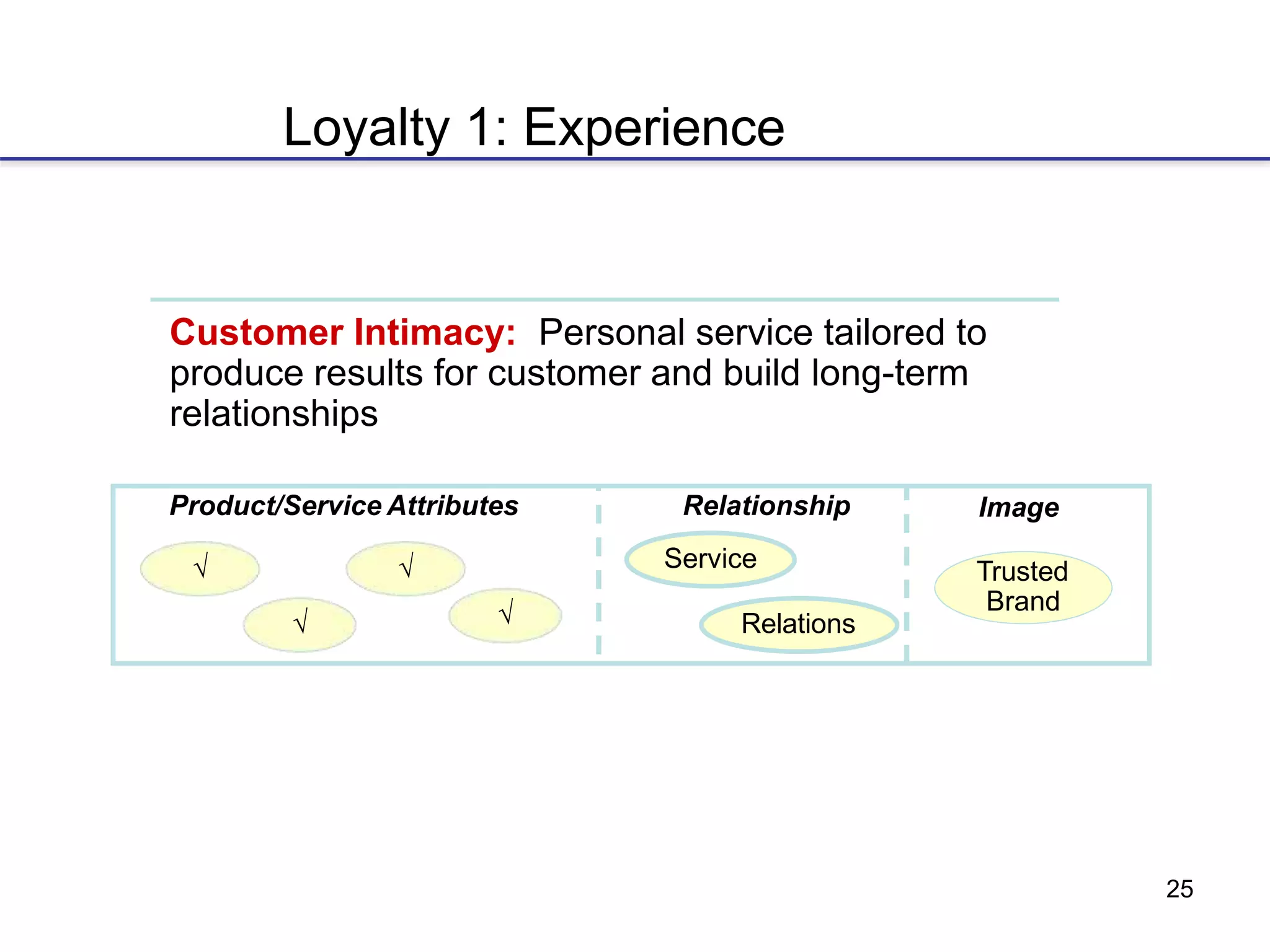

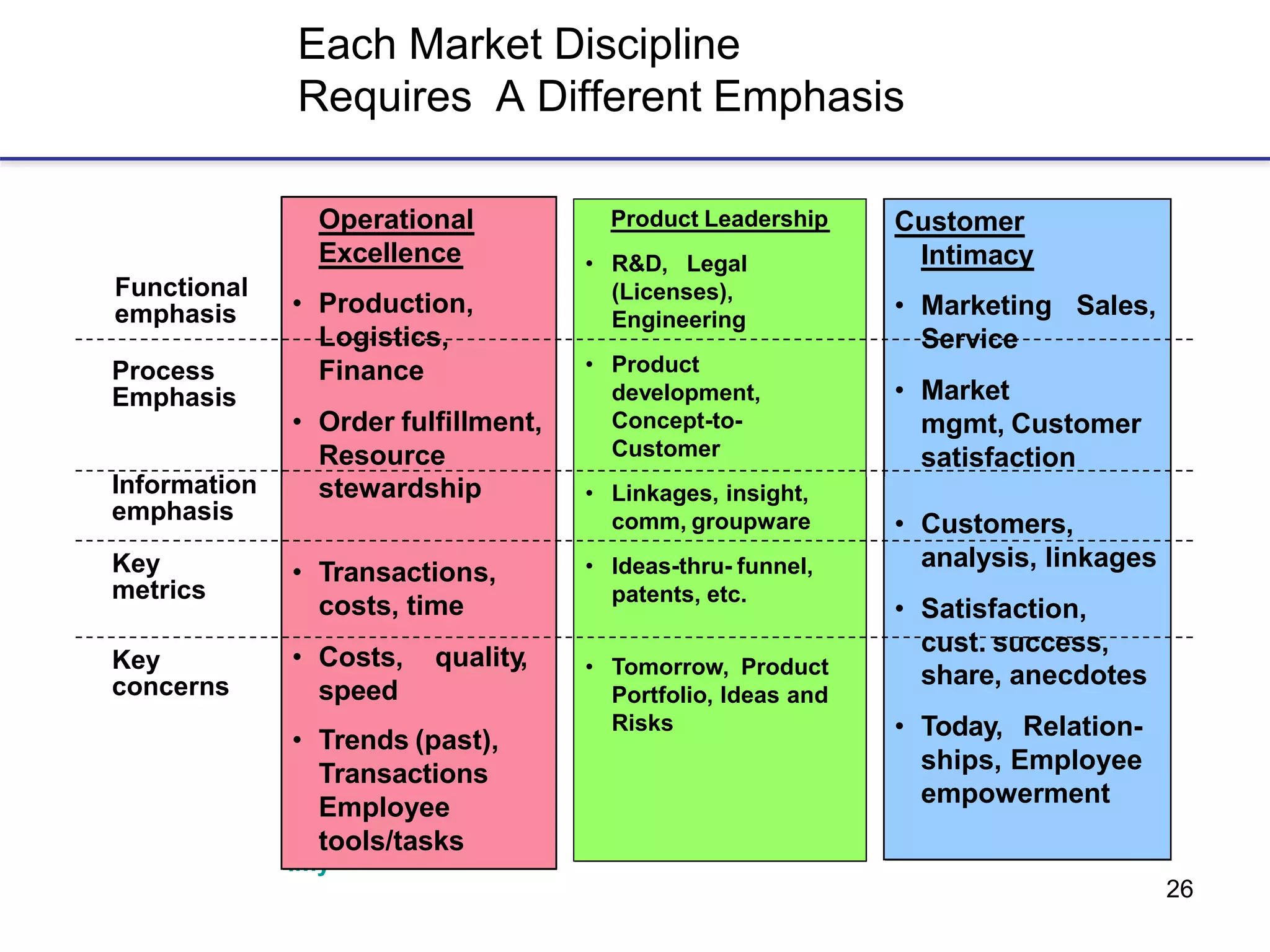

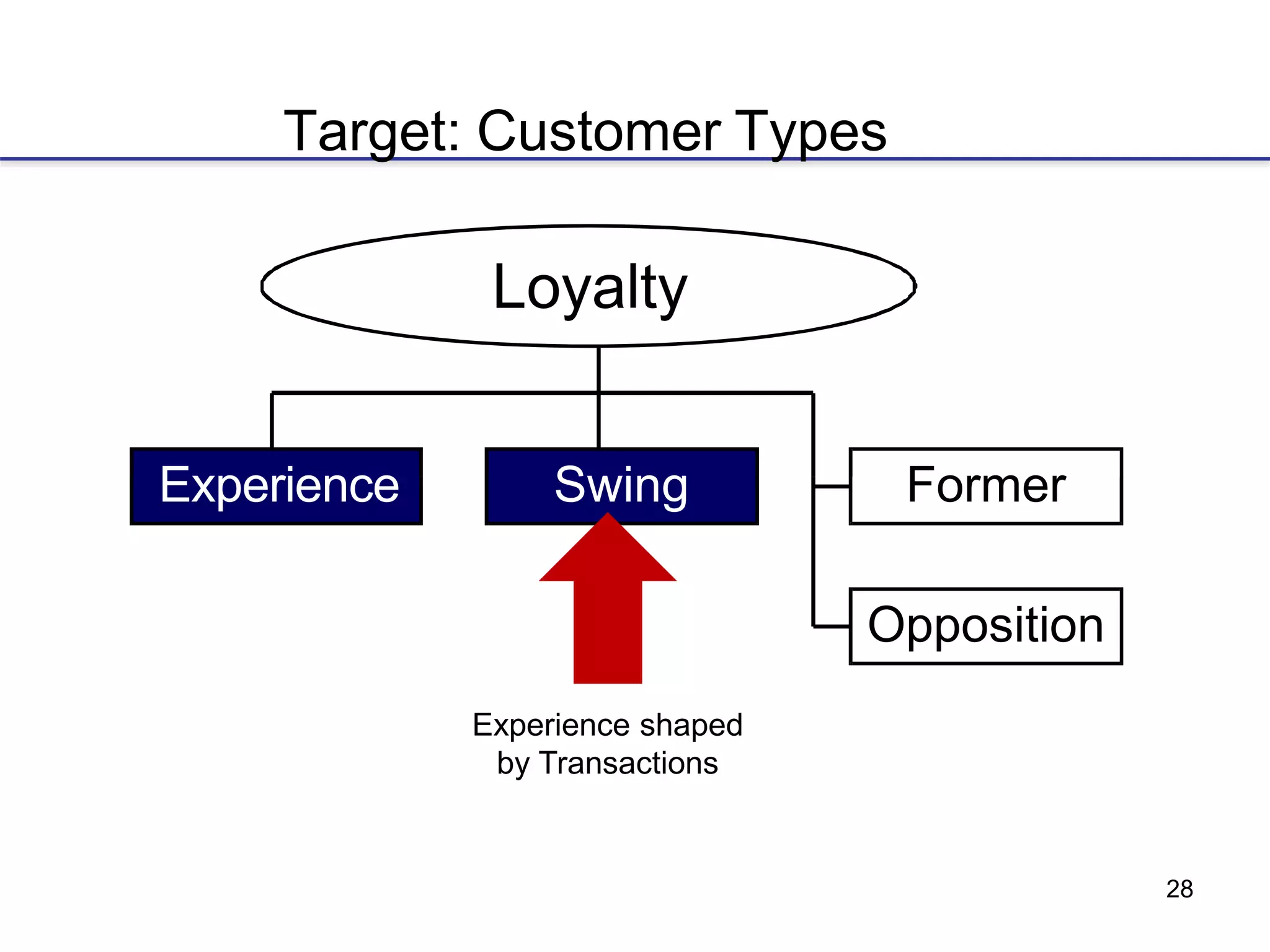

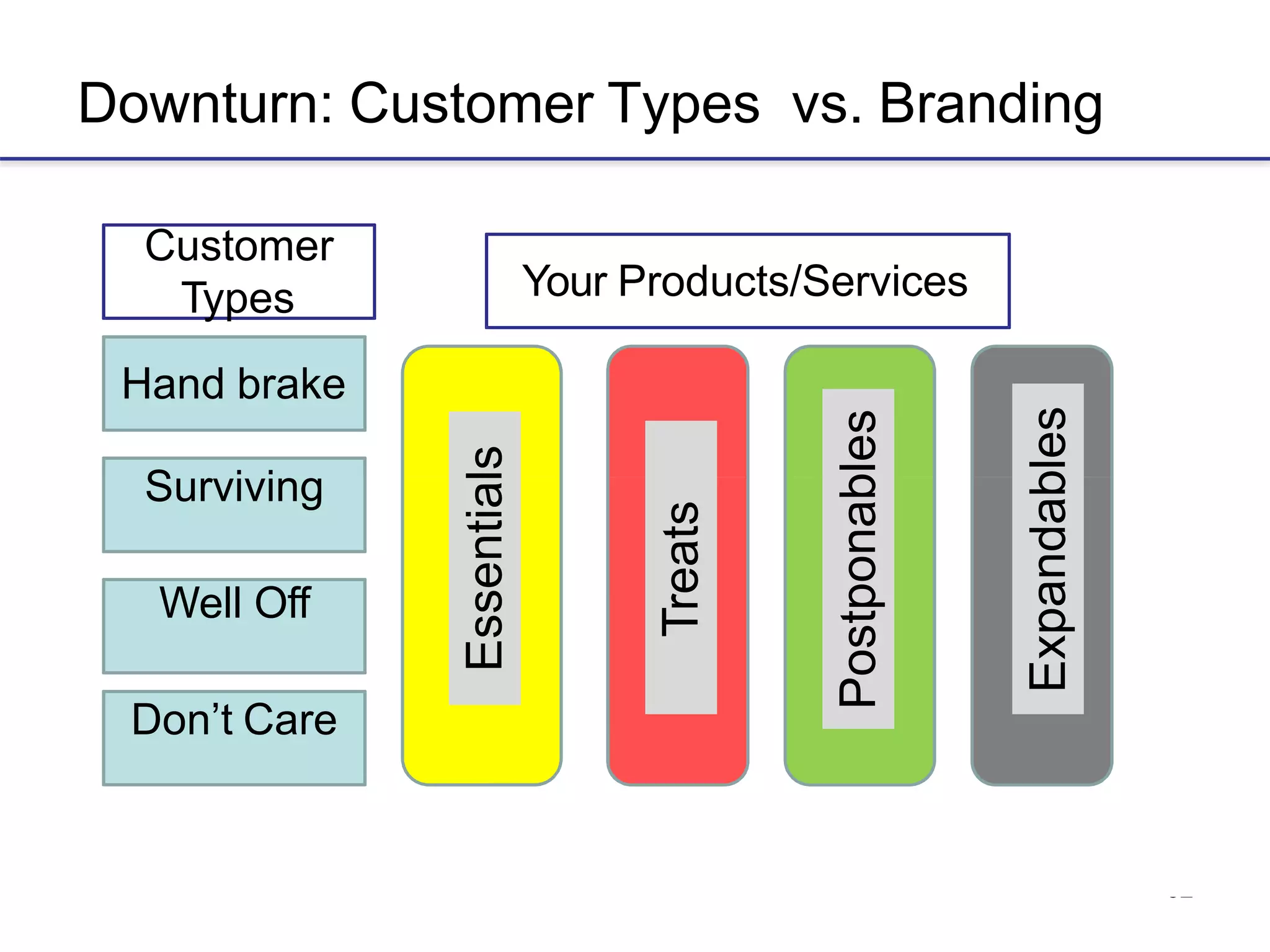

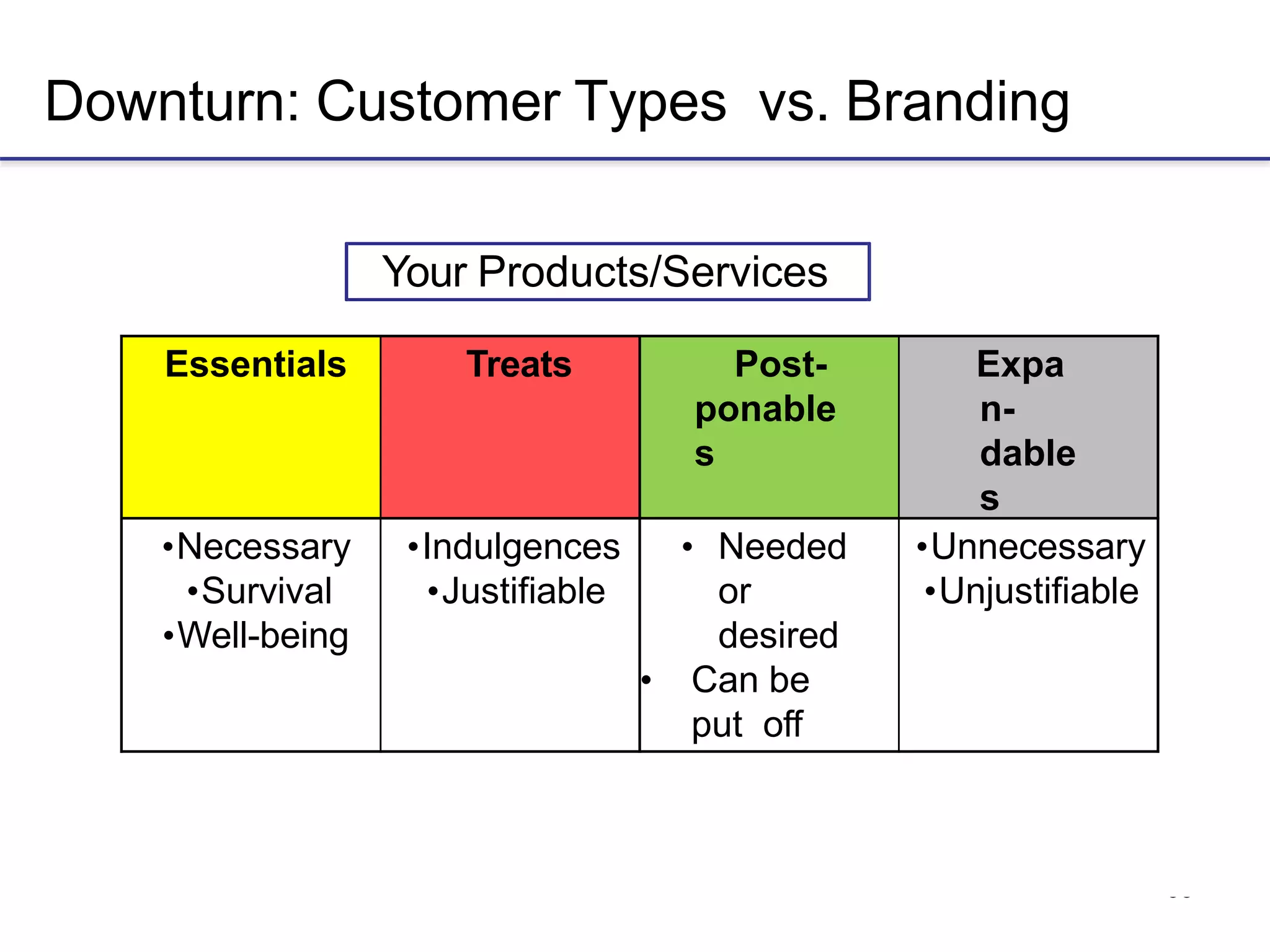

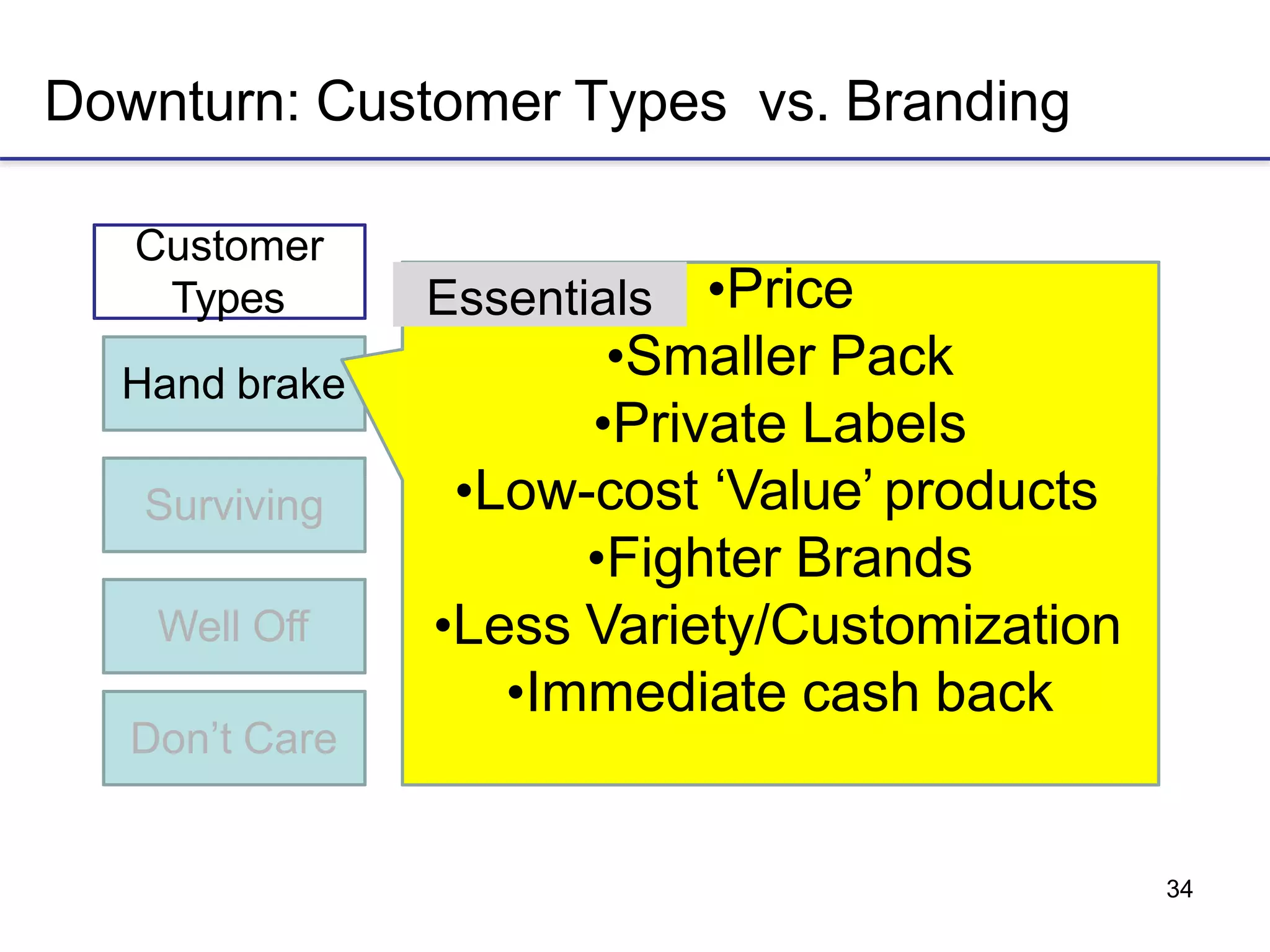

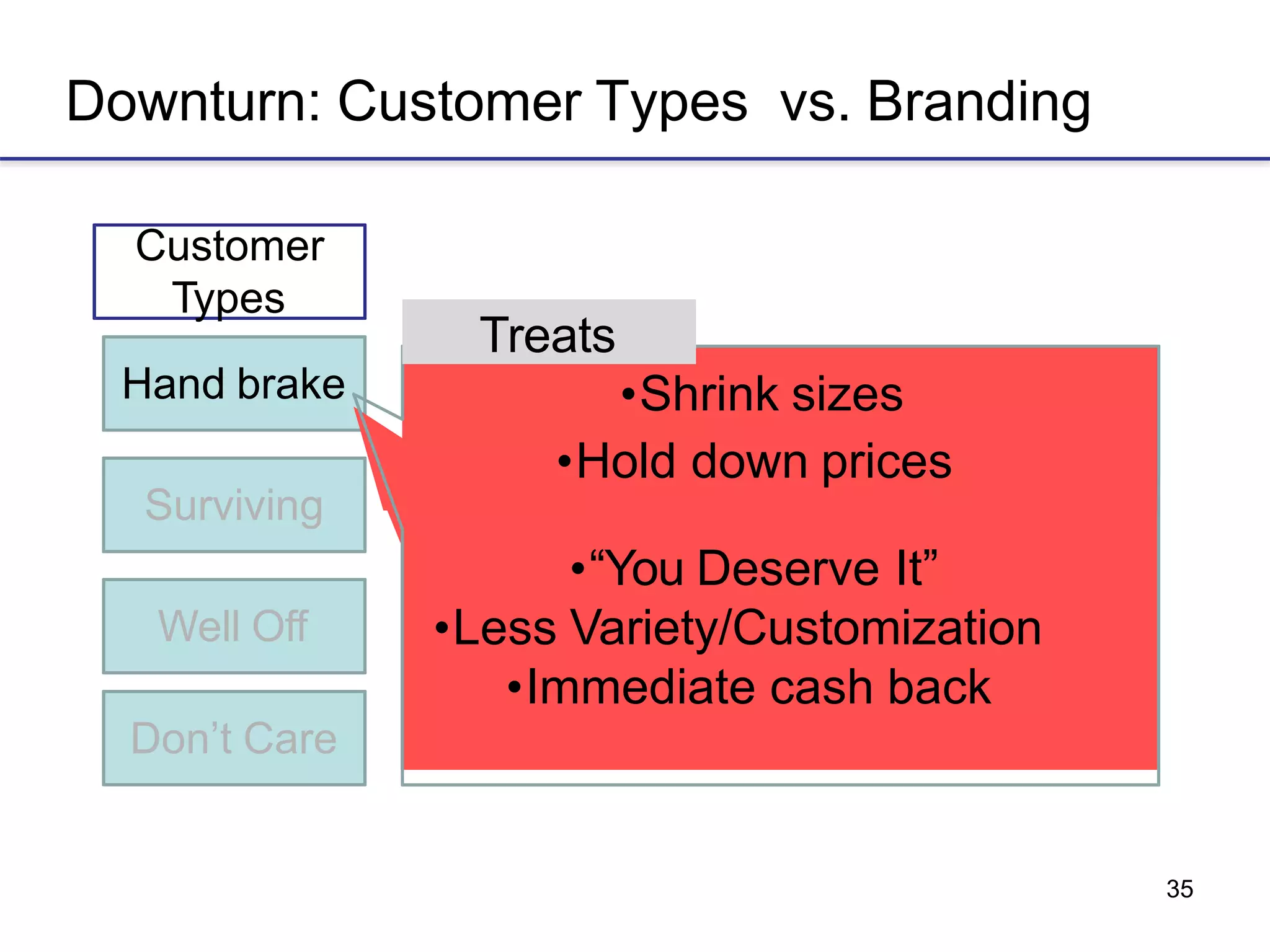

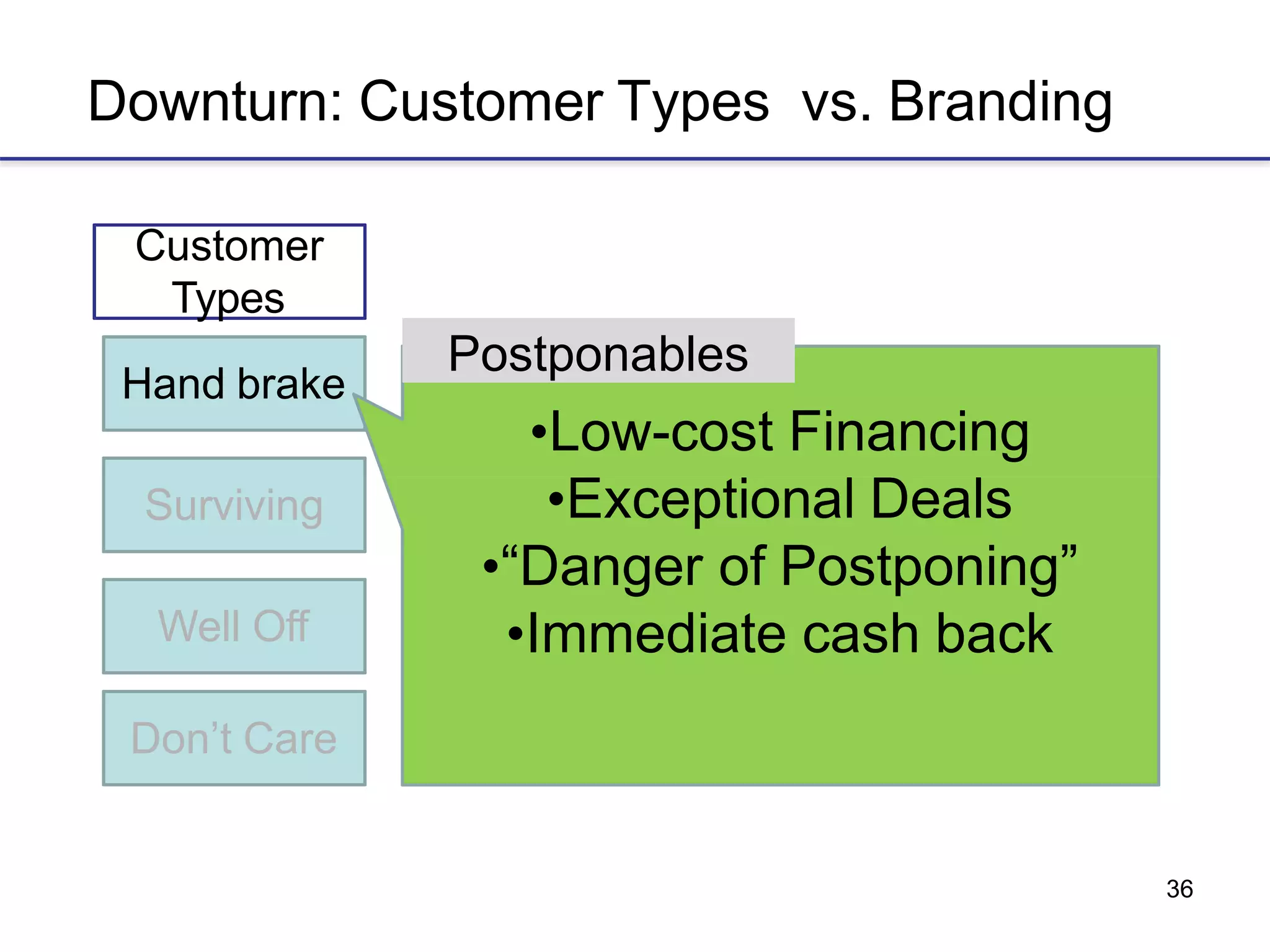

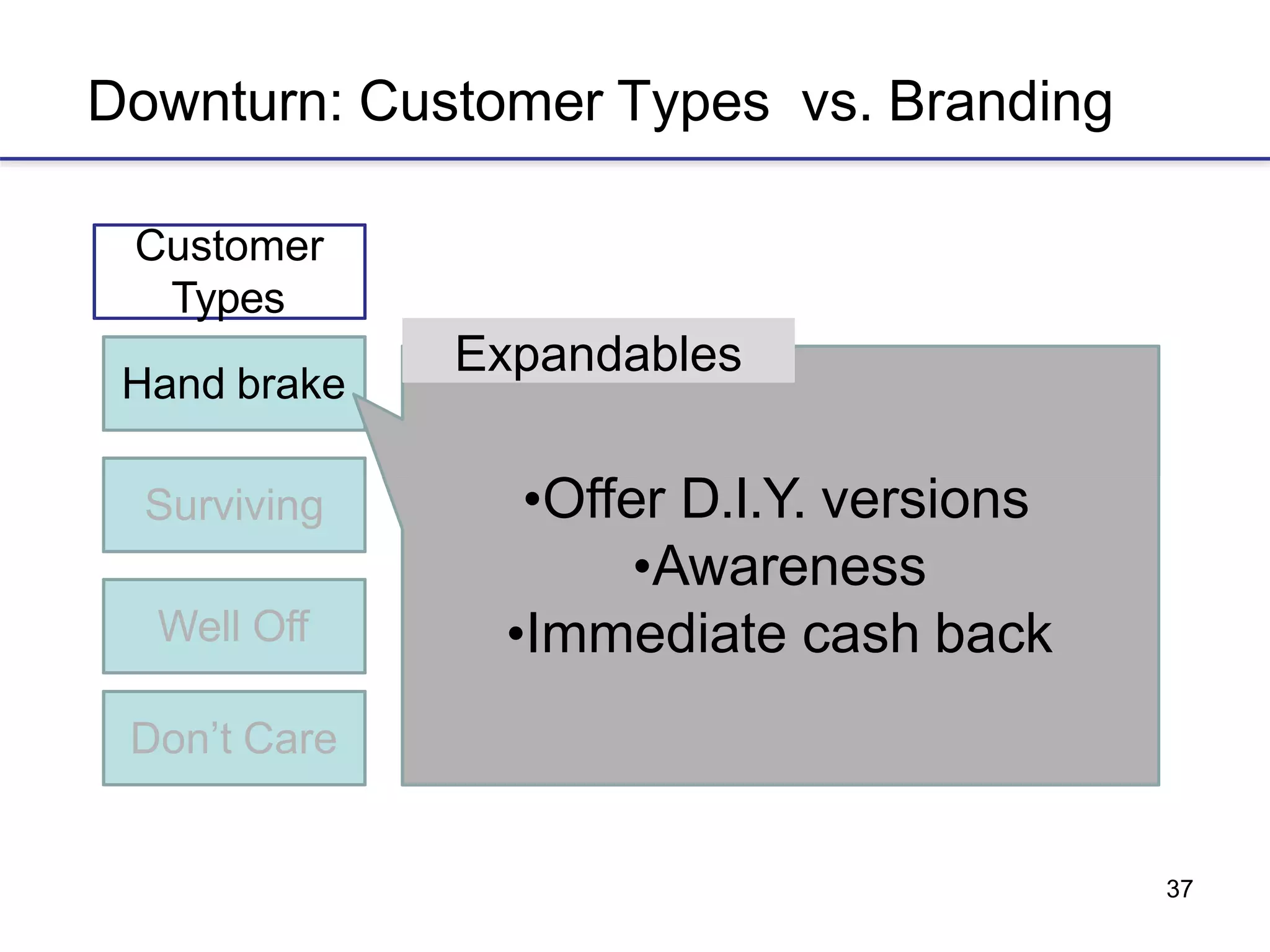

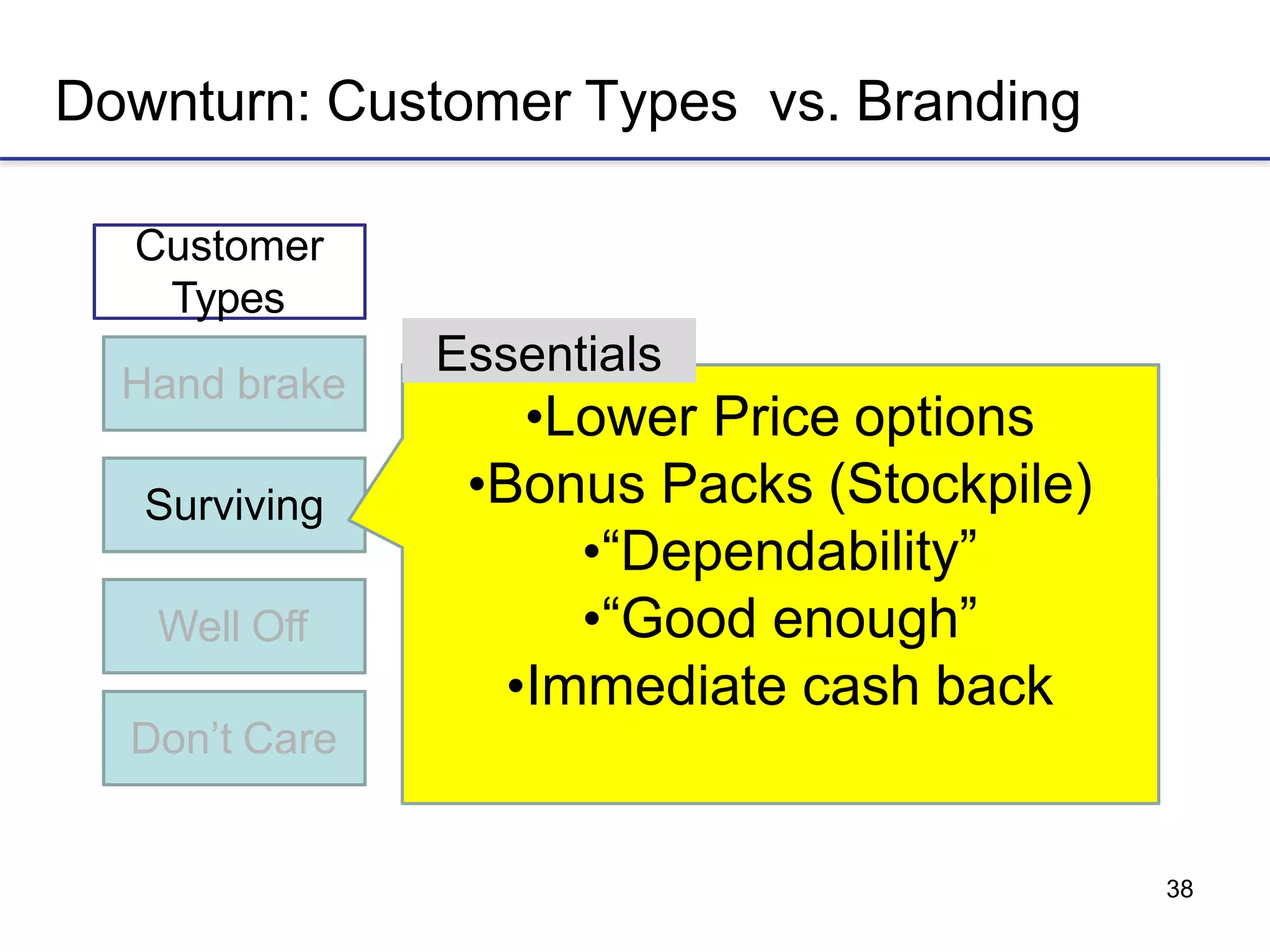

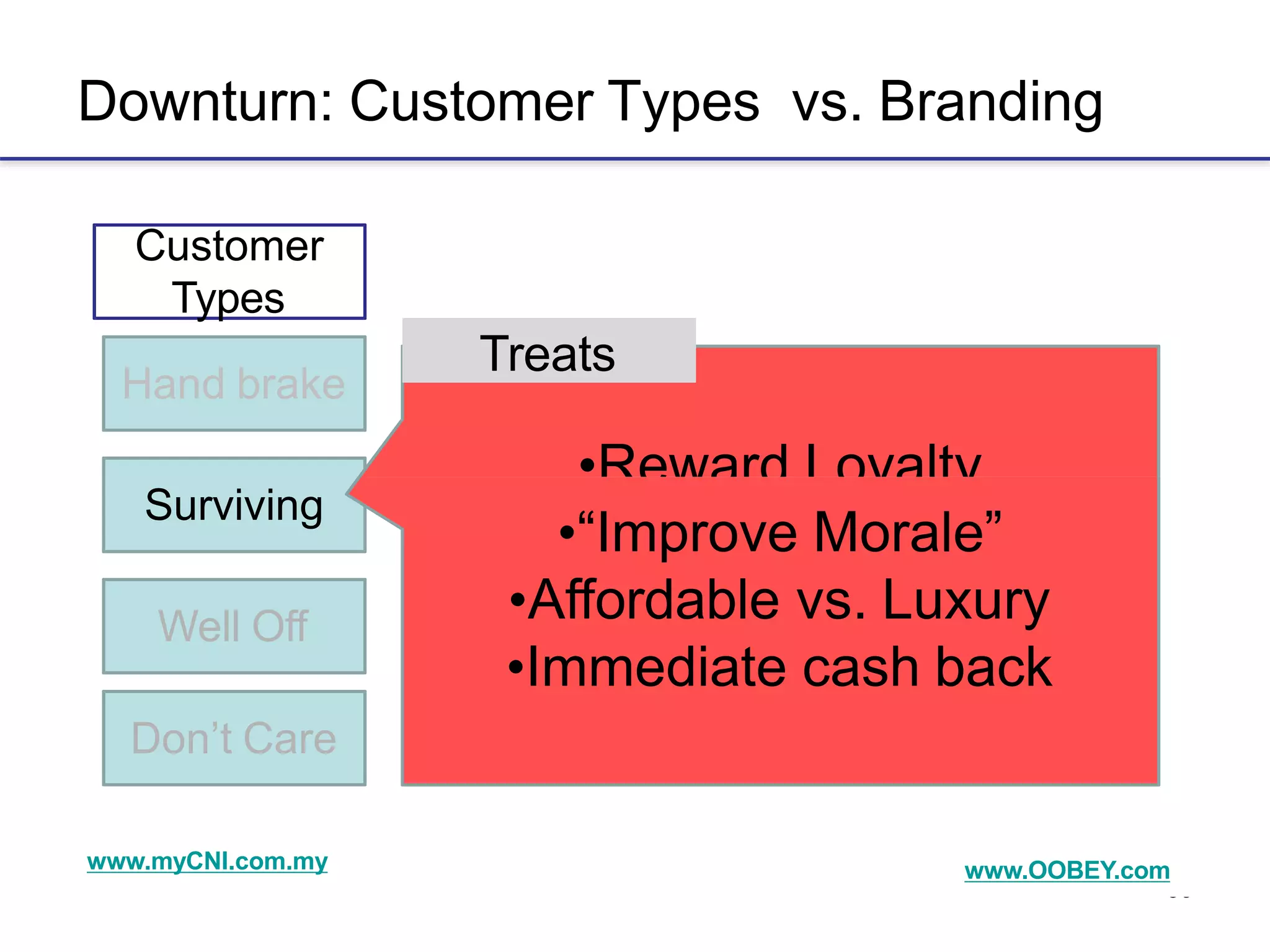

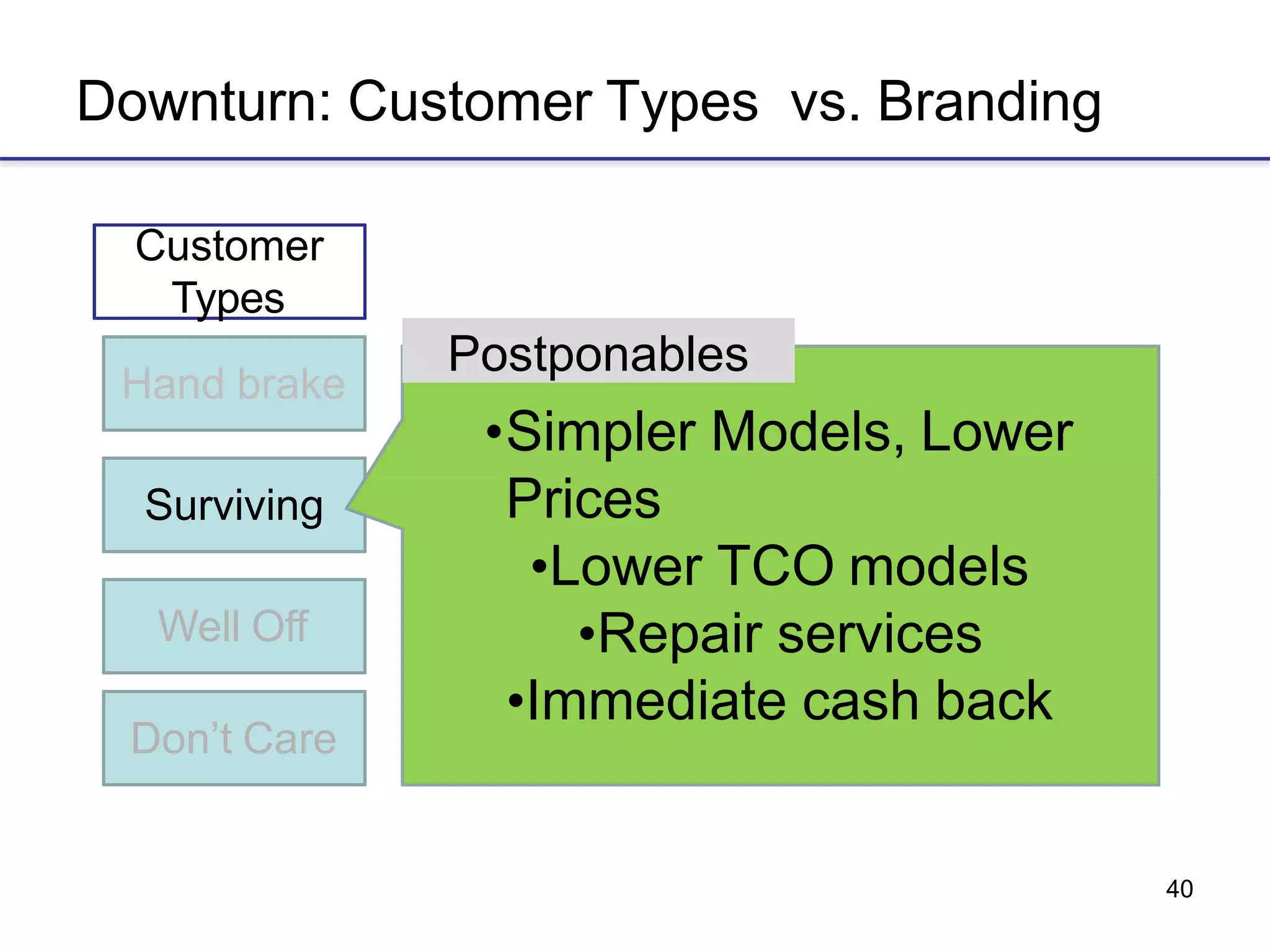

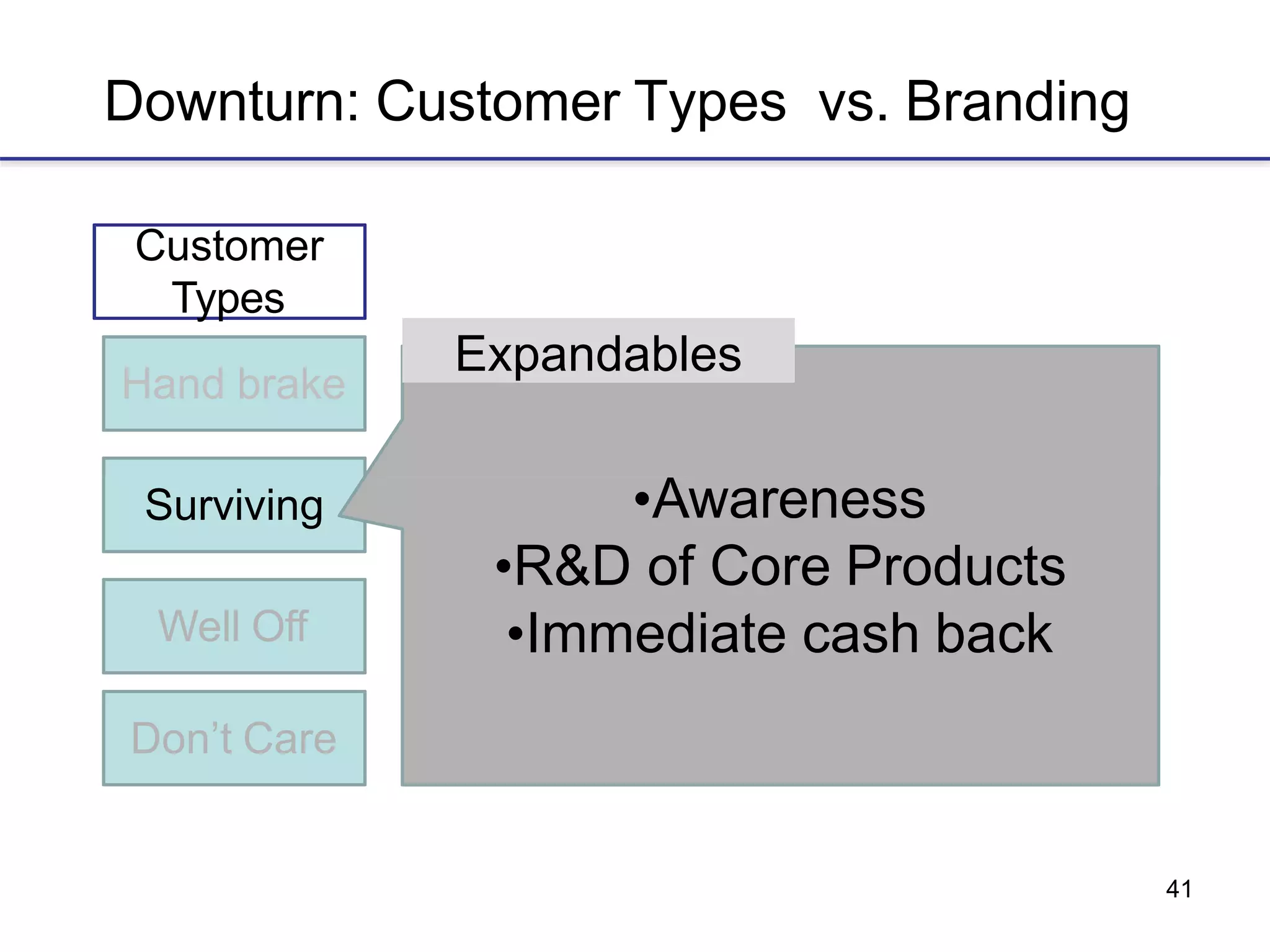

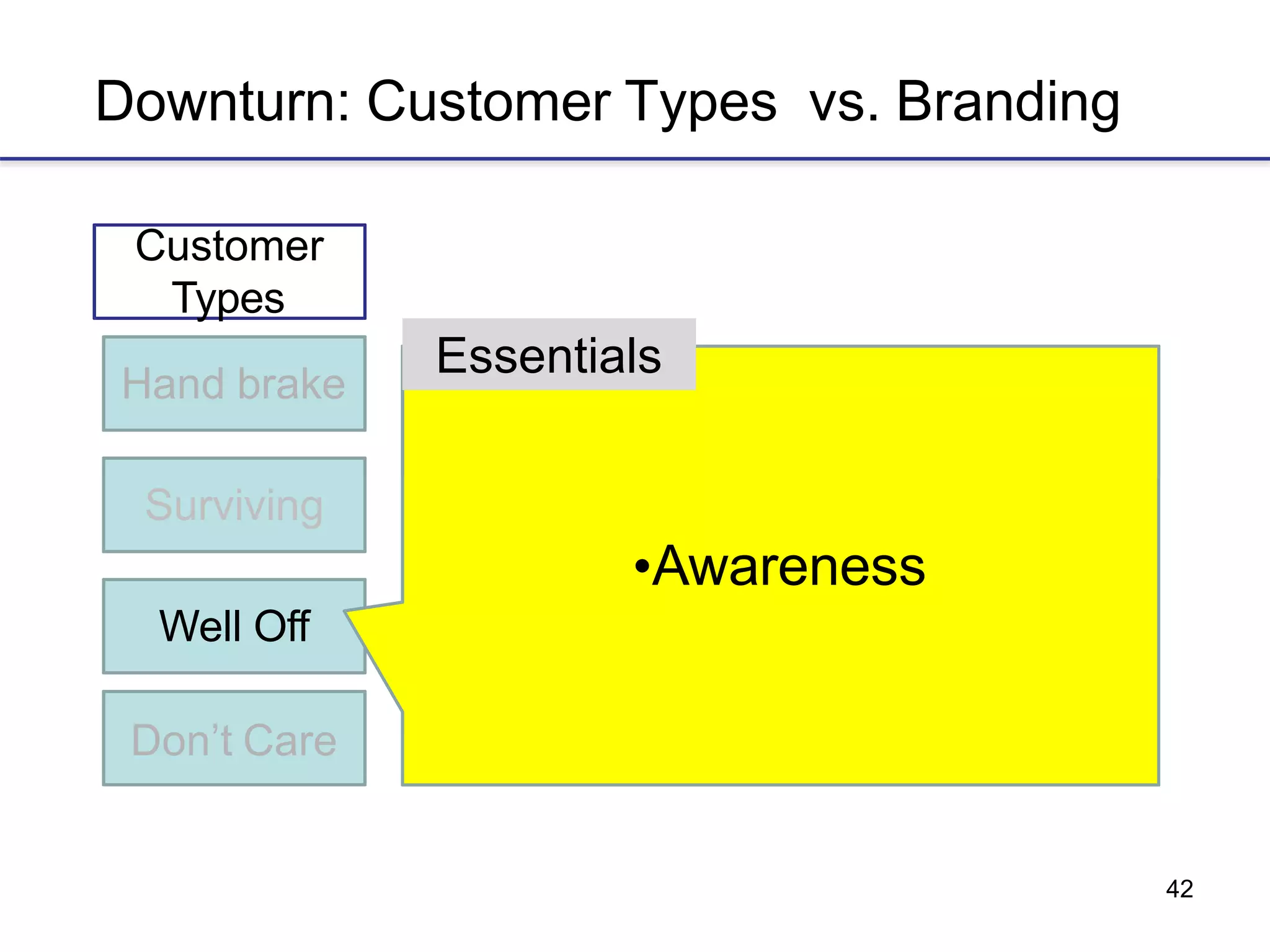

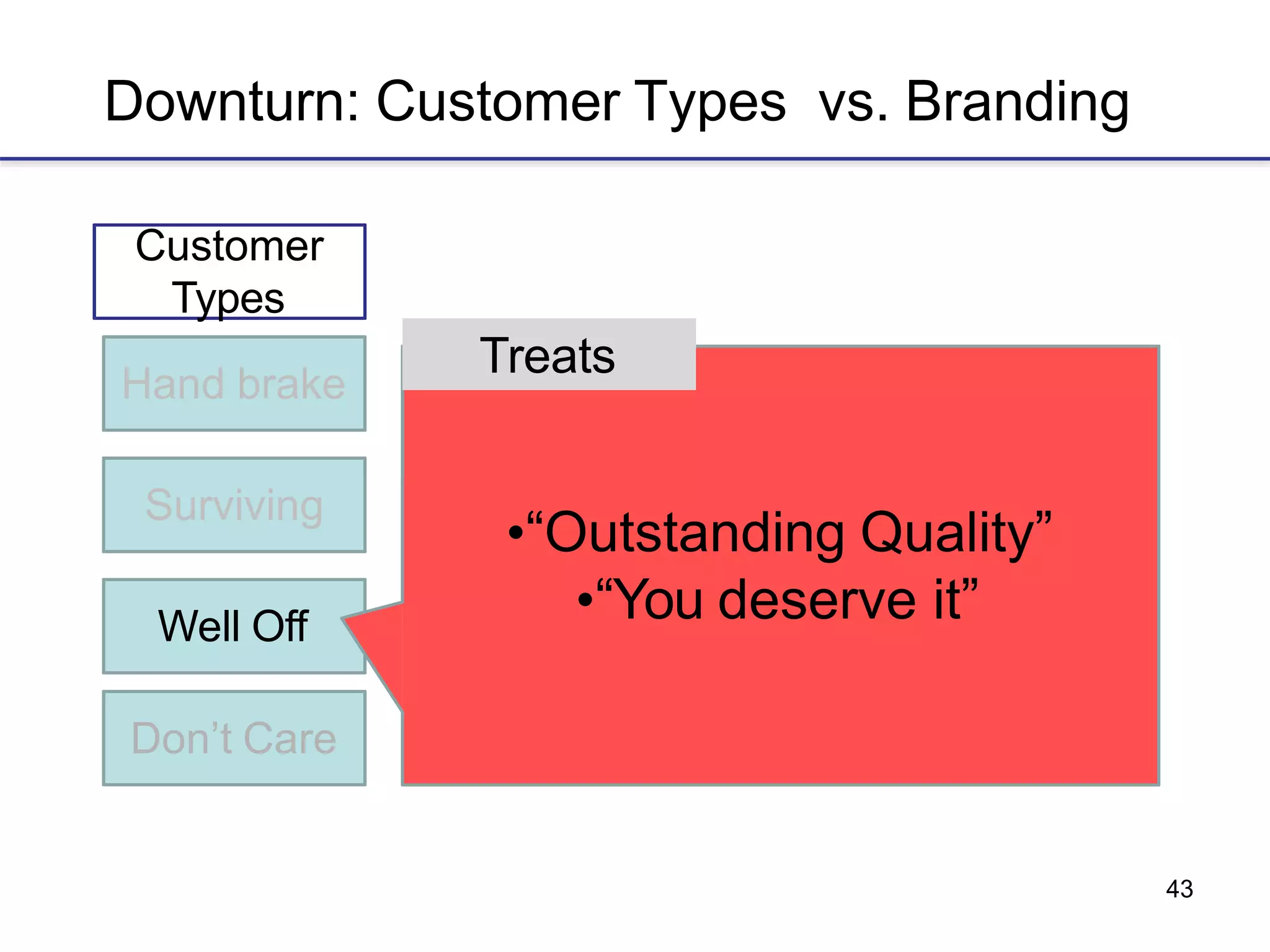

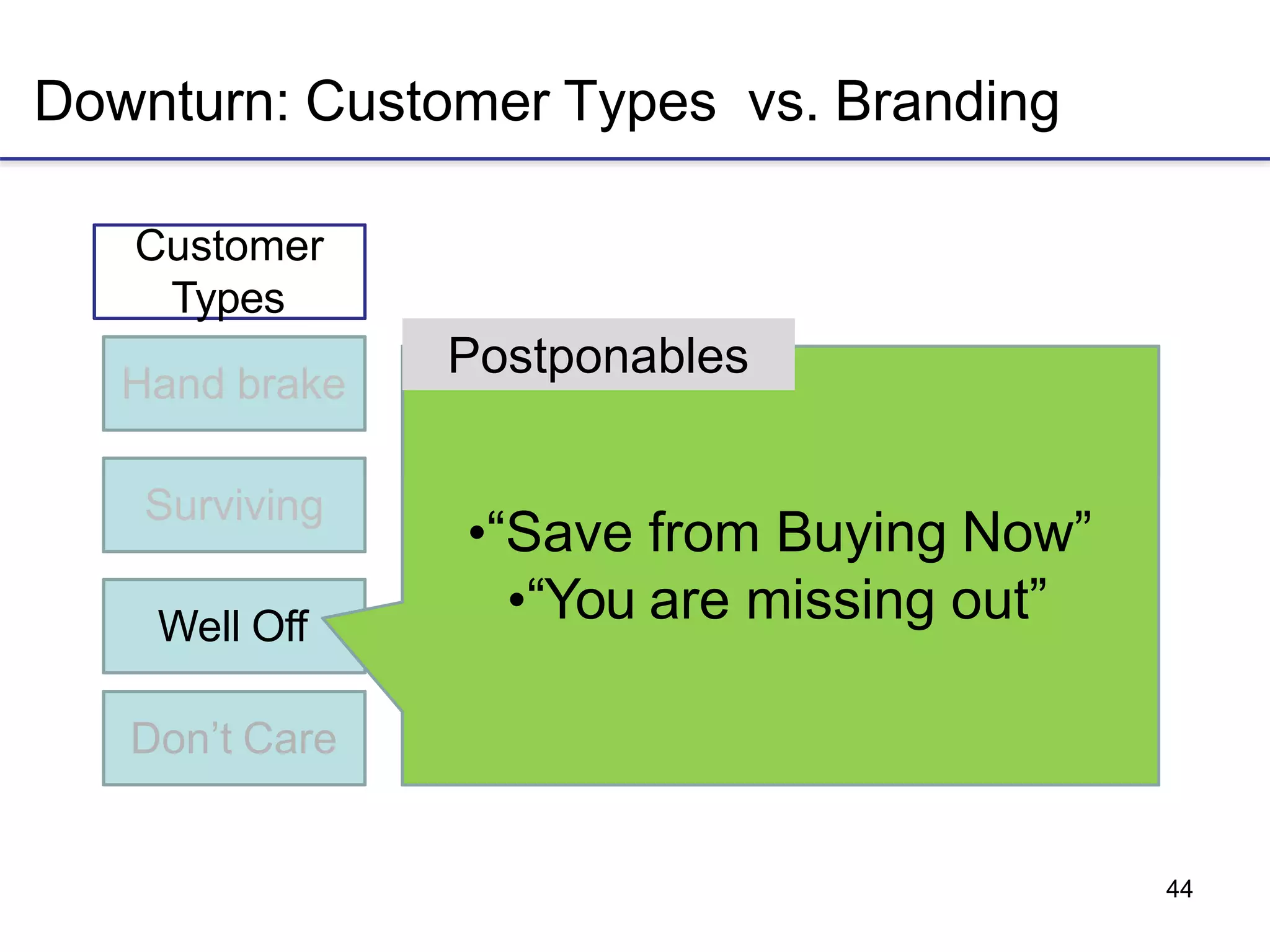

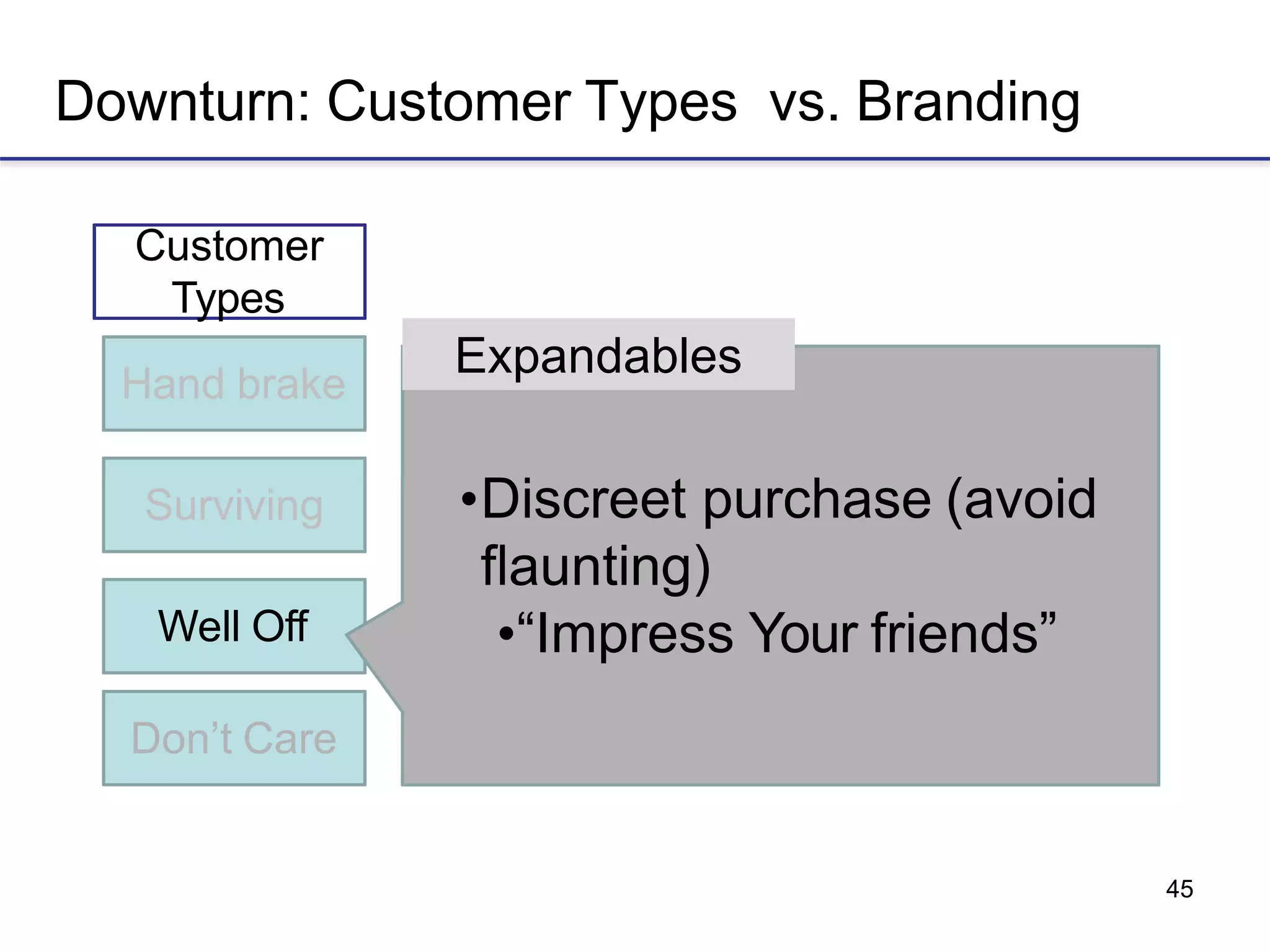

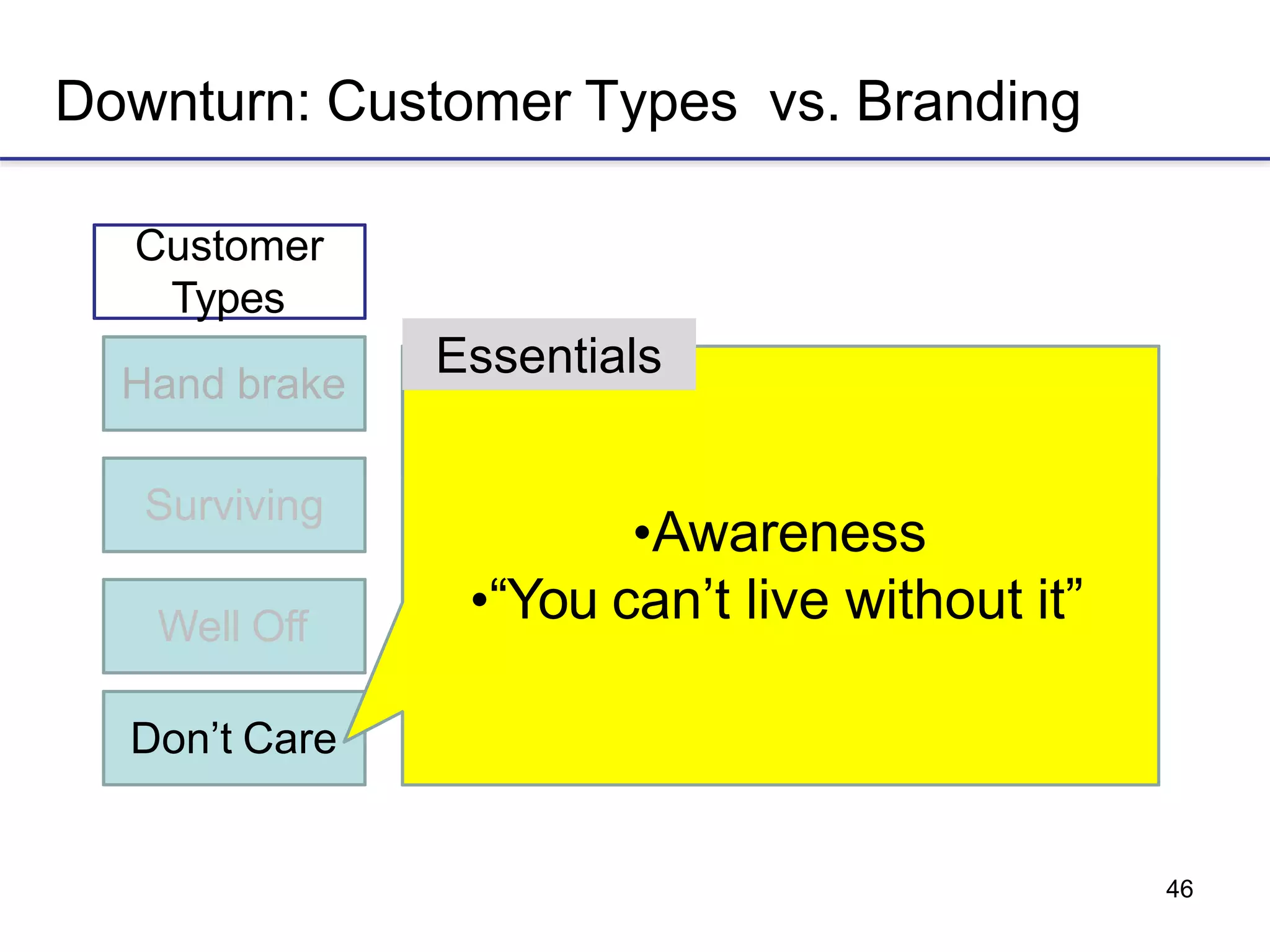

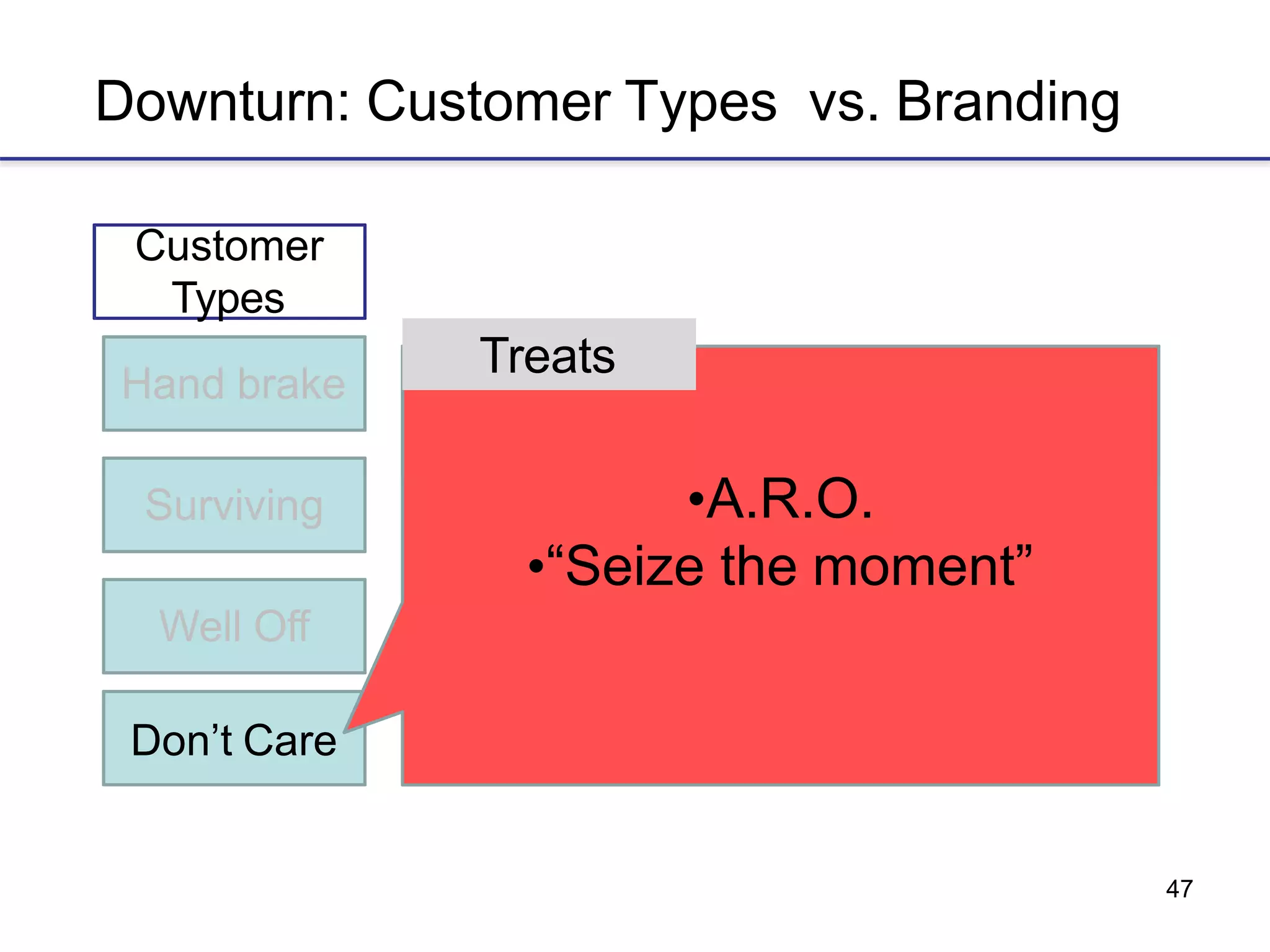

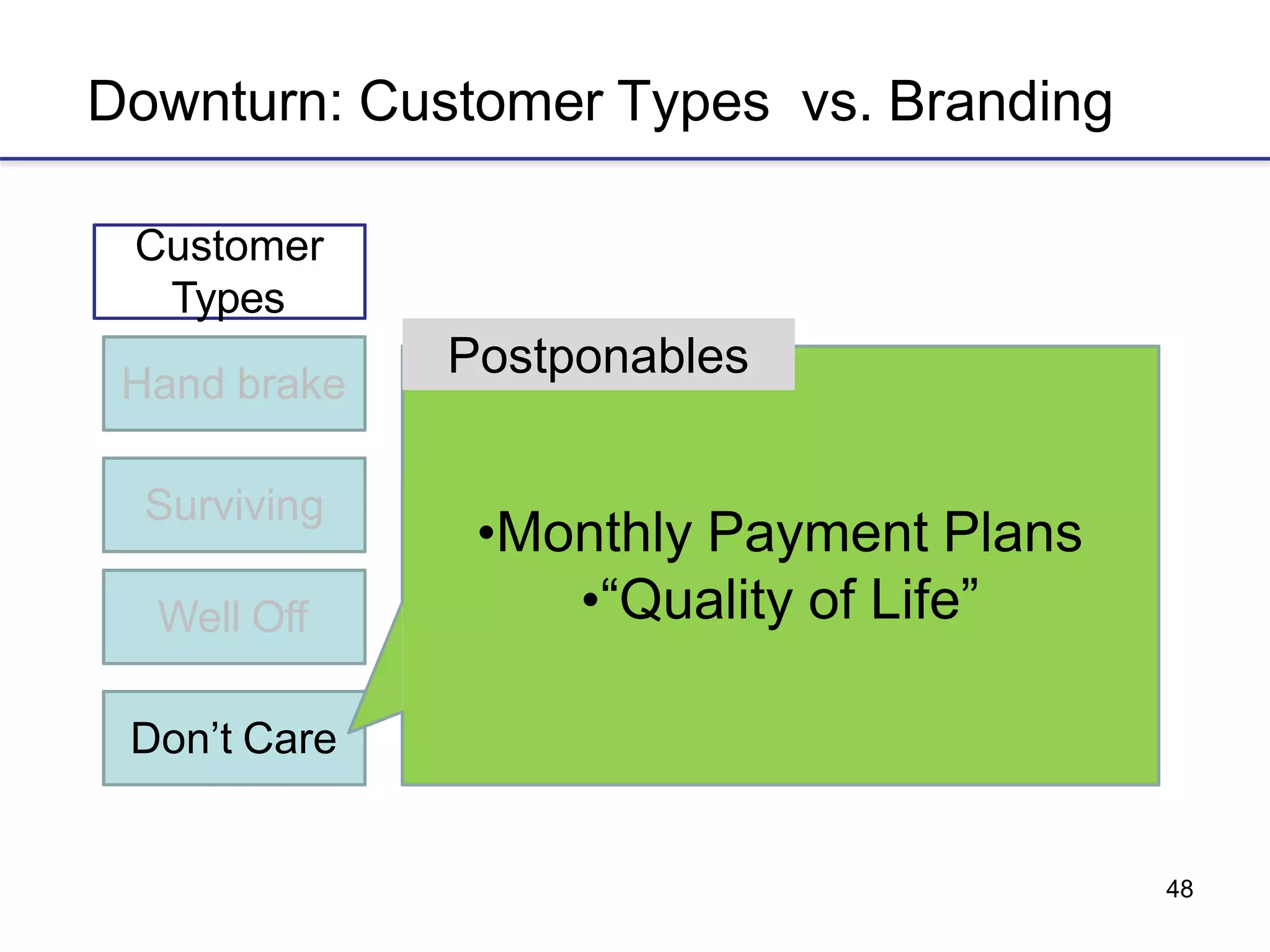

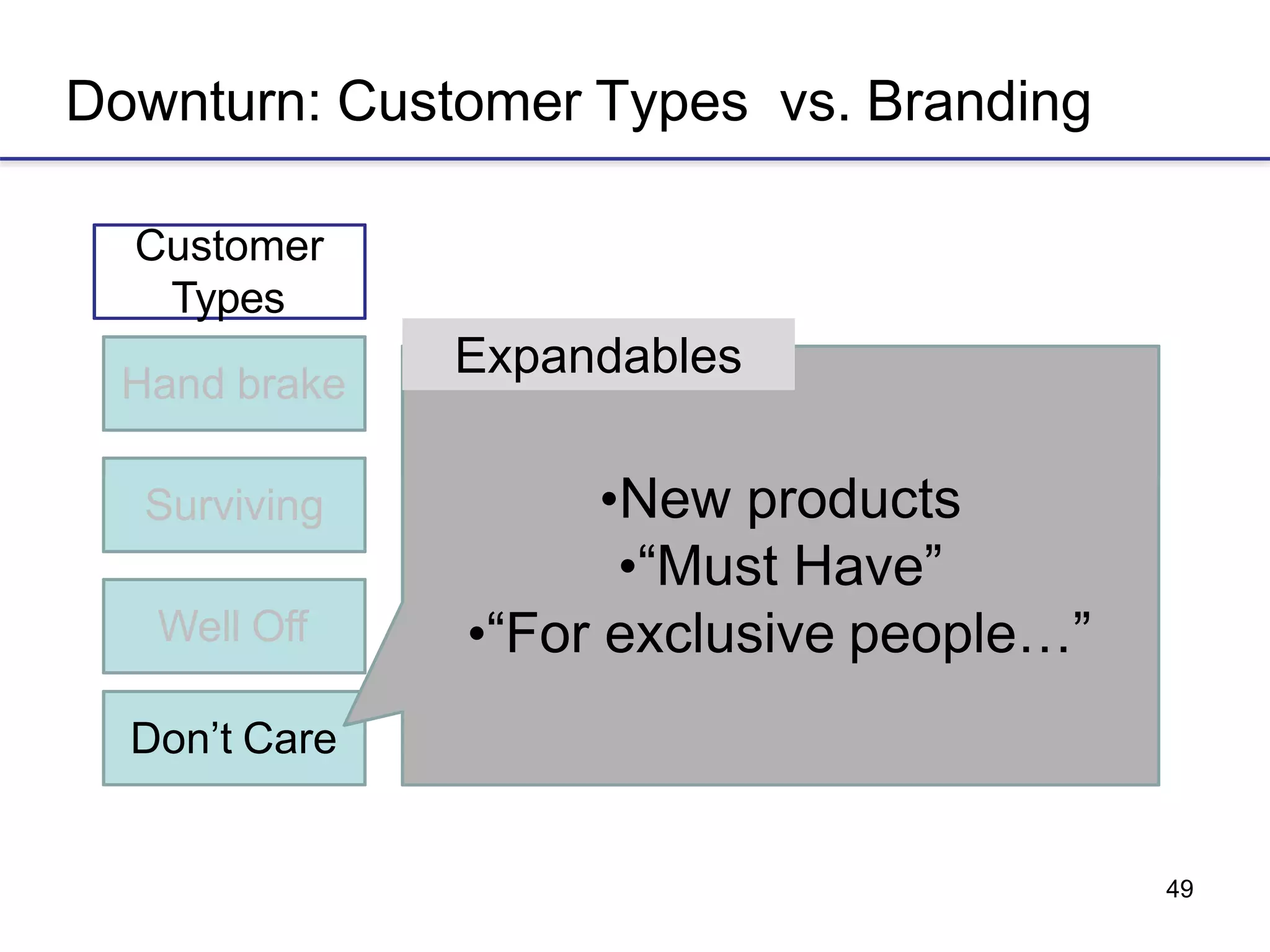

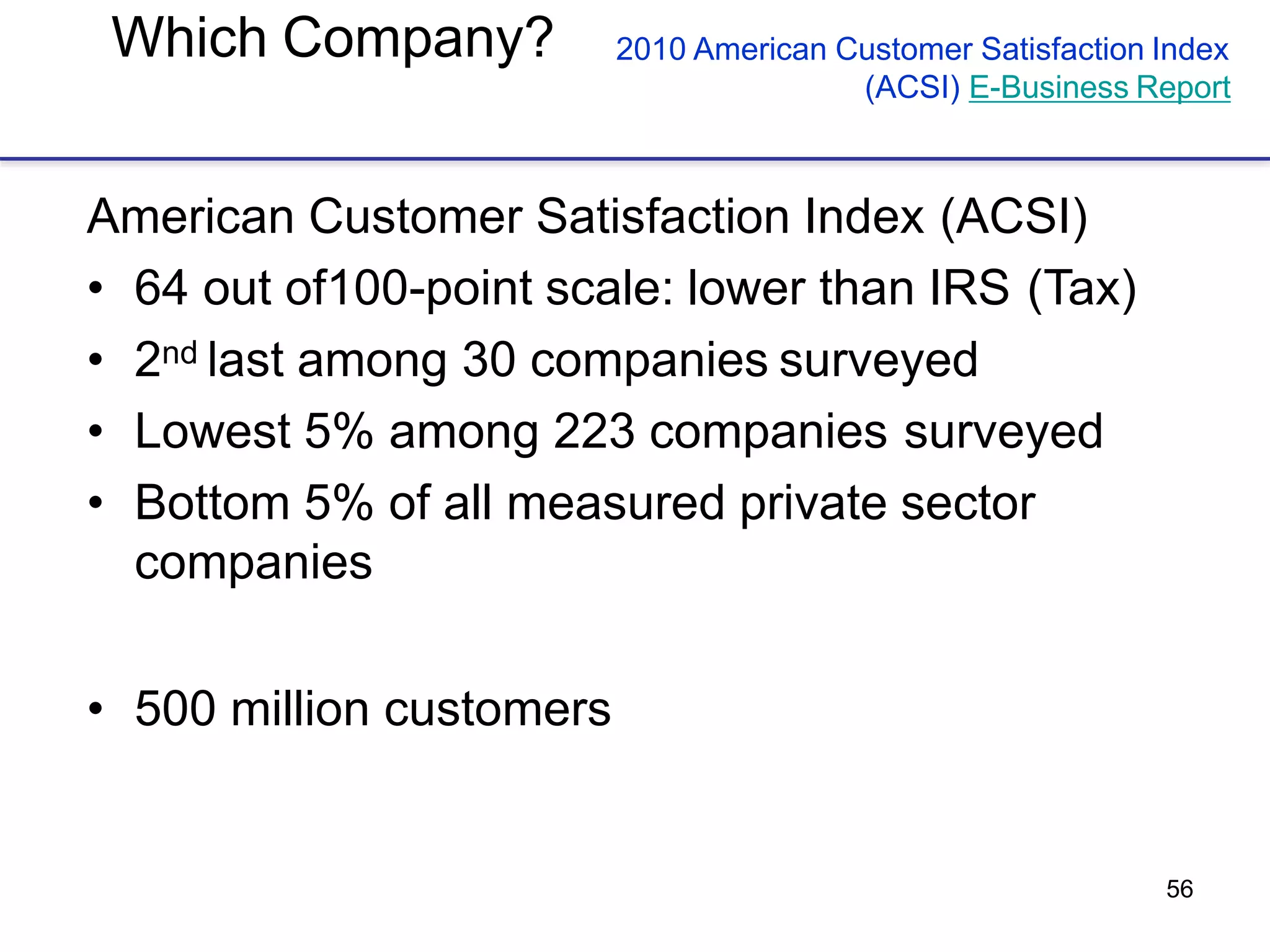

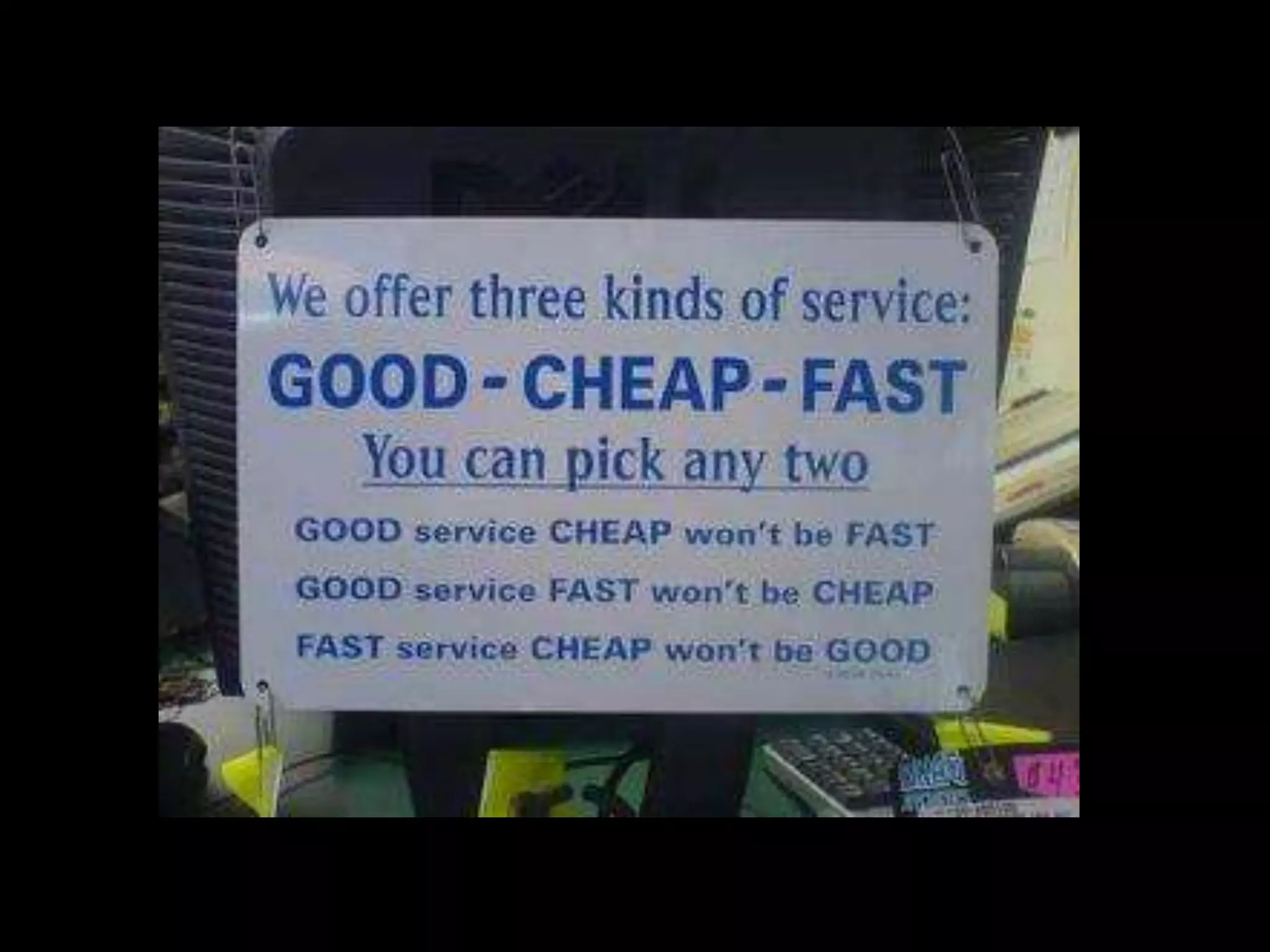

The document discusses the importance of understanding customer loyalty and retention strategies, emphasizing that customer satisfaction does not always equate to loyalty. It outlines various customer types and the business model's unique selling propositions required to meet their needs, focusing on operational excellence, customer intimacy, and product leadership. The document ultimately argues that effective customer relationships lead to increased sales and long-term success.