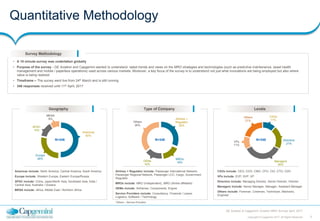

The document summarizes the results of a survey on innovation and digital disruption in the aviation MRO industry. Some key findings include:

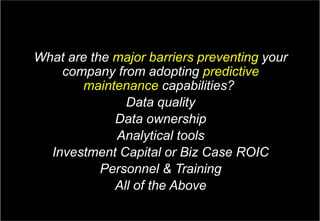

- Over 73% of airline and MRO executives agree that data volume from aircraft sensors and operations exceeds their ability to drive business value.

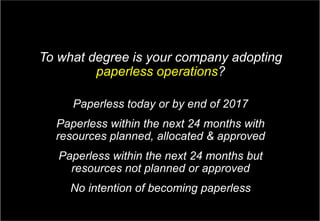

- Nearly 79% of executives plan to have paperless operations within 24 months, but less than half have allocated resources.

- Only 4.8% of companies currently use machine learning/AI technologies despite its benefits.

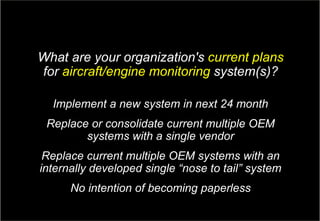

- Around 26% plan to implement new aircraft health monitoring systems or replace existing ones within 24 months.

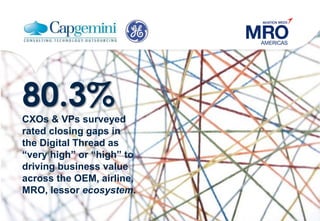

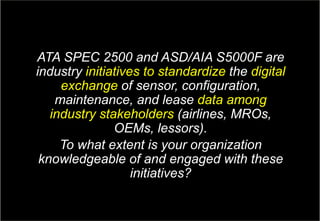

- Most executives see high value in closing gaps in the digital thread across the aviation industry ecosystem.

- Lack of