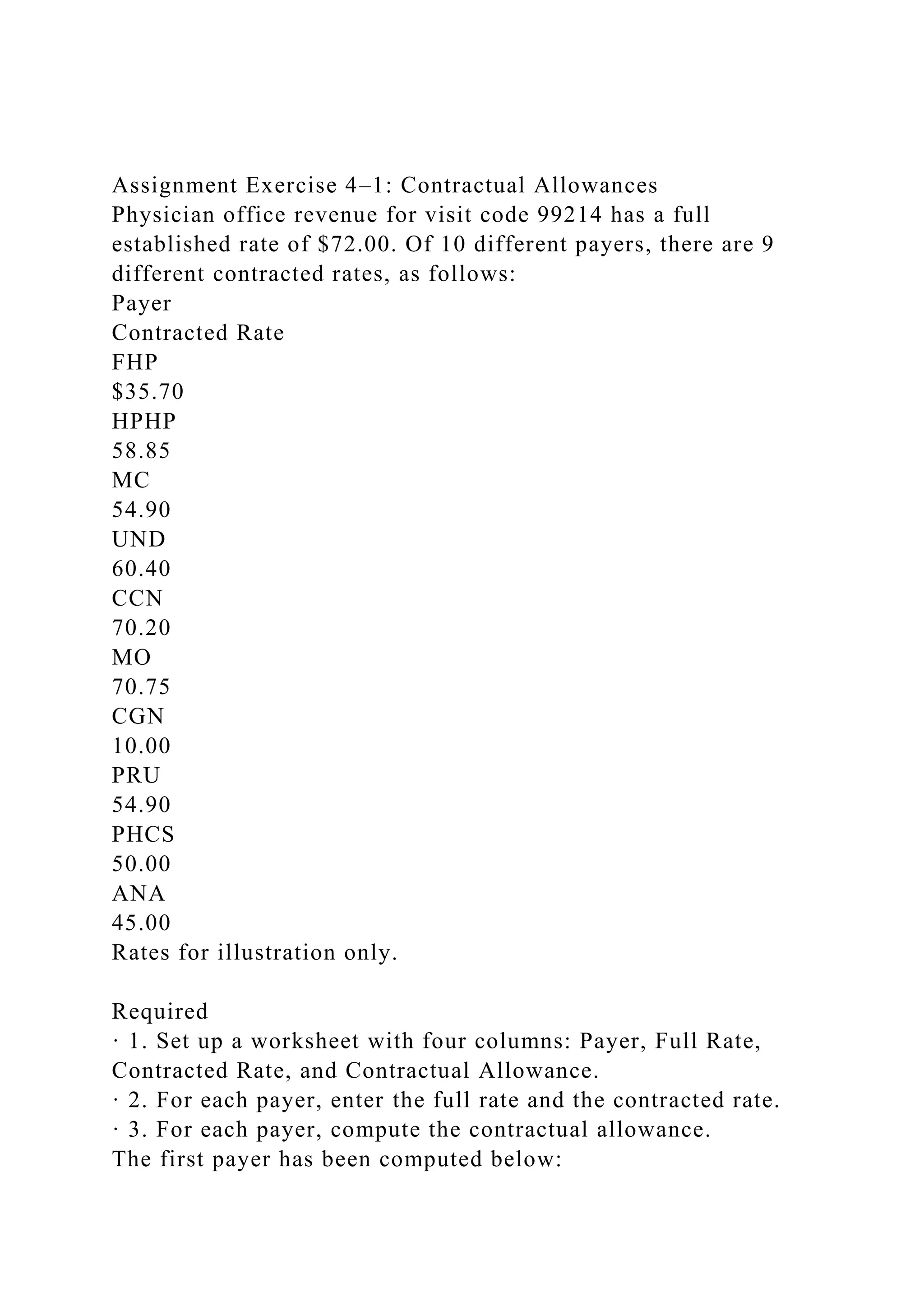

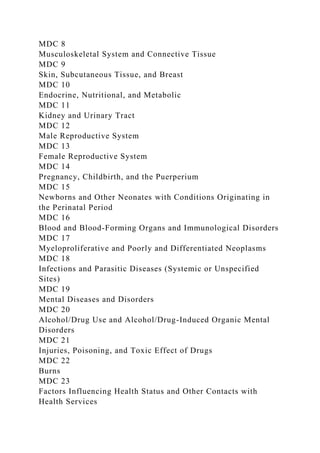

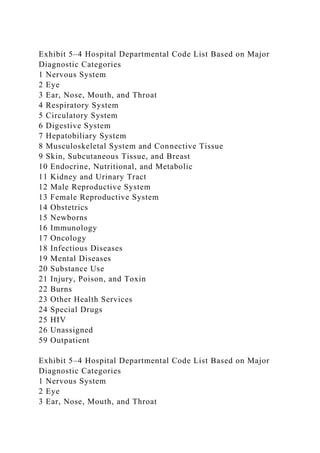

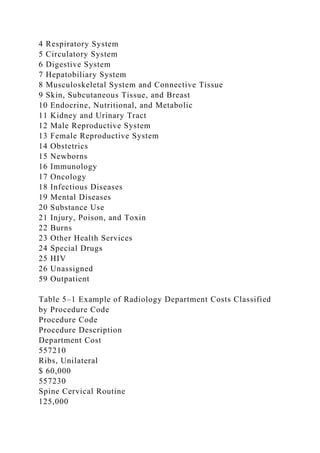

The document outlines exercises related to healthcare revenue, specifically focusing on contractual allowances for physician office revenue and grouping revenue sources by payer. It provides detailed examples and required tasks, including setting up worksheets to compute contracted rates and categorize revenue sources for various services. Additionally, it discusses the grouping of expenses by diagnoses and procedures with references to major diagnostic categories and departmental codes.