This document summarizes recent discussions of a potential merger between two of China's top law firms, Jun He Law Offices and Zhong Lun Law Firm. If approved, the merger would create one of the largest law firms in China with nearly 1,300 lawyers. The merger is seen as a strategic response to the growing reputation of rival King & Wood Mallesons, which has established itself as China's first international law firm through its own merger. While some see benefits to increased scale and synergies from the merger, others note cultural differences between the two firms and challenges with integrating large Chinese firms. The implications of the merger for the competitive landscape and future consolidation in the Chinese legal market are also discussed.

![peterparks/gettyimages

border work, one Beijing partner with a

Chinese firm notes that that practice has

recently slowed down. “That could be

a bottleneck for Jun He, and it may feel

the need to work on developing domestic

practice.”

Zhong Lun, in contrast, is primarily

known for its expertise in domestic mat-

ters, especially in real estate, says this

lawyer. “It has recently started to get in-

volved in more international transactions,

but still not to the extent of King Wood,

Jun He or Fangda [Fangda Partners is an-

other leading Chinese firm].”

Local lawyers believe the proposed

merger may well be a response to the

growing reputation of King Wood,

which has been widely hailed as the first

“Chinese” international law firm. King

Wood Mallesons is

itself the product of

a 2012 merger be-

tween China’s King

Wood and Aus-

tralia’s Mallesons

Stephen Jaques.

Last year, it also

moved to acquire

London’s SJ Ber-

win, thus further

enhancing its global

brand.

Though Jun He,

at least, has been

vocal about not wanting to expand over-

seas, the proposed merger with Zhong

Lun would clearly help Jun He lawyers

raise their profile as well.

“This could be a defensive response,”

agrees another Beijing lawyer. “The three

[firms] used to be more equal, but then

King Wood [Mallesons] merged and

created this ‘superpower.’ The other two

might want to strike a balance.”

Local lawyers have mixed views on

whether a combination between Jun He

and Zhong Lun would give them a signifi-

cant competitive edge.

Zhong Lun WD’s Lin contends that

larger Chinese companies, including

state-owned enterprises, tend to prefer

big law firms, both domestic and inter-

national, because they think they have a

more stable track record. But he thinks

privately owned small and medium-sized

companies are more open to working with

smaller firms and boutiques. “Both will

find their place in the market,” Lin says of

boutiques and large firms.

Even if Zhong Lun and Jun He merge,

it will not be the largest firm in China.

Dacheng Law Offices and Yingke Law

Firm already count 3,000 and 2,400 law-

yers, respectively. Yu Xugang, a Beijing

partner at Dacheng, says large firms gen-

erally are better, even at providing spe-

cialized advice. The smaller size of bou-

tiques, he says, means partners have to

take on more and different types of mat-

ters, hampering their ability to focus on

one practice area.

“I think this is good news for China’s

legal profession if they merge,” Yu says of

the talks between Zhong Lun and Jun He.

“The combination will create a stronger

individual firm, which means within the

firm, particularly in the noncontentious

area, each practice group will be strength-

ened by more law-

yers. For the industry

as a whole, we will

see more specialists.”

Anthony Qiao, a

Zhong Lun partner,

said in a late March

interview that he

expects a wave of

mergers among Chi-

nese firms over the

next decade as the

country’s economy

and legal market con-

tinue to grow and its

domestic law firms emerge as major inter-

national players. He points out that, even

if Zhong Lun merges with Jun He, the

combined firm would still be considerably

smaller than Western firms such as Skad-

den, Arps, Slate, Meagher Flom, which

has over 1,700 lawyers. “Compared to

them, we are only midsize firms,” he says.

Broad Bright’s Liu believes that many

Chinese firms also have some catching up

to do in terms of management and infra-

structure, so that they can actually reap

the benefits from greater scale. “Firms like

Skadden and Clifford Chance have a very

different expansion approach than some of

the Chinese firms,” he says. “They have a

more centralized management, so even

with 2,000 lawyers they are able to cooper-

ate smoothly within the firm.”

Liu says that many Chinese firms who

have engaged in mergers, often with firms

in other cities, haven’t done much to in-

tegrate. “Many times it’s just a change of

brand name on the door,” he says.

—Anna Zhang

opening statements

theasianlawyer.com | Summer 2014 | 1110 | Summer 2014 | theasianlawyer.com

The

Churn

Despite the hype, law firms are seeing limited upside so far

from the new Shanghai Free Trade Zone.

china

A Long Way From Liberalization

W

hen the Chinese government

announced last August it was

opening the country’s first

Free Trade Zone in Shanghai, Premier

Li Keqiang said the move would help

turn the city into a world-class financial

center on par with New York and Hong

Kong. Companies that opened there

would enjoy free convertibility of China’s

currency, the renminbi,

and streamlined customs

and administrative pro-

cedures.

Put on a fast track,

the FTZ opened in Sep-

tember. But, over nine

months later, the ben-

efits of locating there

are still far from clear for

many businesses, includ-

ing law firms.

Many law firms had

hoped the FTZ would

bring some easing of re-

strictions that bar foreign

law firms from practicing Chinese law. In

January, China’s Ministry of Justice ap-

proved a plan to test two models for co-

operation between Chinese and foreign

law firms in the FTZ: joint ventures and

mutual secondments.

Local officials hailed the move as

a step toward the full liberalization of

China’s legal market. But to some foreign

lawyers working in China, the policies

don’t seem all that groundbreaking.

The problem with the FTZ, says Wan

Li, a Seyfarth Shaw partner in Shanghai,

“is that, at the mo-

ment, it doesn’t offer

you anything you can’t

do outside the FTZ.”

Though foreign

firms are barred from

practicing Chinese

law, they are allowed

to advise on “the Chi-

nese environment,”

which can mean vir-

tually anything short

of appearing in court,

signing official forms

or issuing legal opin-

ion letters. Wan notes

that international firms have been hir-

ing Chinese lawyers—who must sur-

render their practice licenses when they

join foreign firms—for decades now.

The trouble with

the FTZ, says a

Seyfarth Shaw

partner, “is that,

at the moment,

it doesn’t offer

anything you

can’t do outside

the FTZ.”

shanghai’s

new ftz

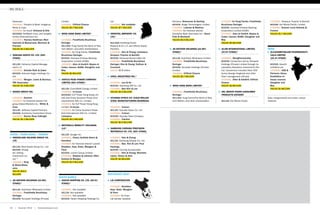

hong kong

singapore

melbourne

tokyo

philip hyde

from

Hogan

Lovells

to

KL

Gates

The former head of the Tokyo finance prac-

tice for Hogan Lovells, Hyde will also work in

KL Gates’ Hong Kong office.

sheela moorthy

from

DLA

Piper

to

Norton Rose

Fulbright

Ex-head of DLA Piper’s Singapore corporate

practice, Moorthy focuses on cross-border

MA in Southeast Asia and India.

wayne mcmaster robert cooper

from

King Wood

Mallesons

to

Minter

Ellison

The pair led a 10-lawyer intellectual property

team from King Wood Mallesons, where

McMaster was formerly Australia IP head.

albert cho

from

Kirkland

Ellis

to

Weil

Gotshal

Cho advises on the formation of private

equity and venture capital funds across the

region, especially in Korea.

john Moore

from

Morrison

Foerster

to

Slaughter

and May

Capital markets specialist Moore became

Slaughter and May’s first-ever lateral partner

and also its first U.S. law practitioner.

perth

steven mccomish

from

Allens

to

Jones

Day

The litigator launched a Perth office for Jones

Day in April, focusing on projects and project-

related disputes in the energy sector.

david blumental

from

Vinson

Elkins

to

Latham

Watkins

Energy partner Blumental has worked on

several cross-border deals for Chinese

state-owned oil companies.

kate allchurch

from

White

Case

to

Ashurst

Finance specialist Allchurch relocated to

Singapore from White Case’s London

office in 2009.

mabel lui

from

DLA

Piper

to

Winston

Strawn

Lui had served as DLA Piper’s Asia corporate

head and holds the same position for

Chicago’s Winston Strawn.

maurice burke

from

Herbert Smith

Freehills

to

Hogan

Lovells

Before moving to Hogan Lovells, Burke head-

ed the Southeast Asia dispute resolution

practice for Herbert Smith Freehills.

matchmakers: Zhang Xuebing (left), managing part-

ner of Zhong Lun, and Jun He chief David Liu](https://image.slidesharecdn.com/a24fbb2c-b116-4cd3-b8f5-58c9cc6becae-160818155151/85/AsianLwyr-4-320.jpg)

![opening statements

roslanrahman/gettyimages

theasianlawyer.com | Summer 2014 | 1312 | Summer 2014 | theasianlawyer.com

The new secondment regime

would allow foreign and local firms

to exchange lawyers. But though a

Chinese lawyer seconded to a foreign

firm would still be able to provide a

legal opinion, the lawyer would be

required to do so under the Chinese

firm’s name. Moreover, Wan thinks

most foreign firms would prefer Chi-

nese legal opinions to be drafted by

senior partners, who are unlikely to

be seconded.

“How much do you trust [the

secondee]’s legal opinion?” he asks.

Another Shanghai partner with a

U.S. firm agrees that a secondment

regime would not be very attractive,

compared to just seeking out individu-

al Chinese lawyers when needed. “It’s

an interesting idea, but at this point, it

is not clear how much value [second-

ment] would add to the Chinese and

international firms,” he says.

Likewise, this lawyer doesn’t think

there will be much interest in joint

ventures. Firms are already allowed to

have strategic alliances, but not many

have pursued them, he says, because

international firms prefer to work with

several different Chinese firms.

Chinese firms, on the other hand,

seem more eager to take advantage of

the FTZ’s opportunities for cooperation.

Shanghai’s Co-effort Law Firm, which

has more than 200 lawyers, has already

opened an office there. You Minjian,

the Chinese firm’s managing partner,

says Co-effort Law is looking to form a

“close association” with a foreign firm.

Henry Huang, Shanghai office

managing partner for Beijing-based

Grandall Law Firm, which has more

than 1,000 lawyers, says his firm is

also interested in partnering with

a foreign firm. But Huang says the

firm is still awaiting more specifics

about how the FTZ initiatives for law

firms will work. A detailed plan by the

Shanghai Bureau of Justice, including

specific regulations and procedures,

was originally scheduled to be re-

leased by the end of the first quarter.

But at press time the government had

yet to make a further announcement.

A key question is whether the

FTZ’s benefits will extend beyond the

FTZ itself. It officially covers four ar-

eas in the outer suburbs of Shanghai,

far away from the glittering office tow-

ers of Nanjing Road West or Pudong’s

Lujiazui financial district, where most

international firms have their offices.

For now, firms must be located with-

in the FTZ to take part in either the

secondment or joint venture schemes.

“International firms are generally in-

terested and pleased by the relaxation of

regulations,” says a Hong Kong partner at

one global firm. “But if it’s going to be a

nightmare that we’d have to move every-

one around, we’d have to think twice.”

—Anna Zhang

S

ingapore’s government has long

sought to enhance the island

nation’s status as a hub for the

global financial and legal services in-

dustries. But that goal is potentially

coming into conflict with populist sen-

timent against increased immigration

by foreign workers.

Though foreign lawyers and firms

have so far not been specifically tar-

geted, a number who have lived and

worked in Singapore for years say they

are worried the profession will eventu-

ally be affected by more general mea-

sures being implemented in response

to the public outcry.

It’s believed that immigration

politics may have been a factor in the

government’s recent tough stance on

renewal of Qualifying Foreign Law

Practice (QFLP) licenses, which allow

designated foreign firms to practice lo-

cal law in certain areas. In exchange,

those firms agreed to recruitment and

revenue targets for their Singapore

offices, targets that some apparently

failed to meet.

A rising anti-immigrant tide in Singapore is putting international law firms on edge.

singapore

The New Nativist Normal

“You do sense a greater degree of

nationalism creeping in,” says the head

of one global firm’s Singapore office.

“Going forward, it might be more dif-

ficult to bring people here from else-

where in the network.”

The Singapore-based lawyers who

spoke to The Asian Lawyer uniformly

requested anonymity because of the

political sensitivities involved. Some are

with firms that hold QFLP licenses.

Though discontent with the im-

migration-friendly policies of the rul-

ing People’s Action Party has been

long-simmering, a government pro-

posal earlier this year to counteract

the country’s low birthrate and aging

demographic profile by boosting popu-

lation to 6.9 million in 2030 from 5.3

million today has become a rallying cry

for the political opposition. It has also

sparked a series of large protests in a

country long known for its social order.

As elsewhere in the world, much of

the anger is focused at low-skilled mi-

grant workers, who are seen as a drain

on social services. But there is also bit-

terness directed at highly skilled expa-

triates from the West and elsewhere in

Asia, who are believed to be driving

up living costs for everyone else and

taking well-paid jobs that might other-

wise go to locals. That group includes

foreign lawyers, whose numbers have

almost doubled in the past six years to

more than 1,000 today. The number

of local lawyers has also grown in that

time but at a much lower rate.

In September, the Singaporean gov-

ernment announced new rules requir-

ing companies to “consider Singapor-

eans fairly” before applying for permits

for foreign workers. Starting next Au-

gust, employers will need to advertise

positions on a government-sponsored

website before giving jobs to expats,

and their hiring patterns will be scru-

tinized and benchmarked against simi-

lar companies to see if they are acting

in a discriminatory manner.

One Singapore managing partner

says seniors lawyers are unlikely to be

affected, as jobs that pay a base salary of

more than $9,560 a month are exempt

from the advertising requirement. But

support staff and some junior associates

could be a different story.

Another partner with an interna-

tional firm echoed that worry. “We are

concerned that the next time we apply

for work passes for some of our support

staff, this will be an issue,” he says.

Still, many lawyers say Singapore

has been committed for so long to

turning itself into a leading interna-

tional legal and financial center that

they simply can’t see the government

letting things go too far.

“I’m really not too worried,” says

the Asia managing partner for one

U.K. firm. “Singapore is still very much

in the business of encouraging profes-

sionals to operate there.”

Four of the six international law

firms that were given the first QFLP

licenses in December 2008—Allen

Overy, Clifford Chance, Latham

Watkins and Norton Rose Fulbright,

received renewals for another five

years in February. But White Case

was given a one-year conditional re-

newal and Herbert Smith Freehills de-

cided not to reapply.

In December, Singapore’s Min-

istry of Law responded to questions

about its review of firms’ QFLP li-

censes with the following statement:

“The QFLP licenses were awarded

based on the firms’ proposals and

commitments, which include man-

power commitments for their Singa-

pore office. The fulfillment of their

manpower commitments will be one

of the factors taken into account to-

gether with other commitments made

by the firm when the QFLP licence is

due for renewal.”

—Anthony Lin

“You do sense a

greater degree of

nationalism creeping

in,” says one interna-

tional lawyer. “Going

forward, it might be

more difficult to bring

people here.”

An anti-immigrant

rally last February in

singapore.](https://image.slidesharecdn.com/a24fbb2c-b116-4cd3-b8f5-58c9cc6becae-160818155151/85/AsianLwyr-5-320.jpg)

![eign companies would like to build those

too. Last June, the government award-

ed Norway’s Telenor Group and Qatar

Telecom Myanmar’s first two telecom

licenses. Plus, the government has put

out a $1 billion tender for construction of

a new airport outside Yangon.

The country’s banking sector is also

attracting interest. The government will

soon auction licenses for foreign banks

to operate in the country. At press time,

details of the bidding had yet to be

released, but more than 30 foreign banks

have already opened representative offic-

es in Myanmar; they could all be com-

peting for as few as five licenses.

Though law firms say they receive

lots of inquiries about Myanmar, they

acknowledge relatively few of these lead

to actual deals. “There’s a lot more hype

than reality,” says Makinson.

Christopher Hughes, Baker

McKenzie’s Yangon managing partner,

estimates that about 85 percent of his

time in the first quarter was spent talking

to investors about possible deals, versus

15 percent on live transactions. He’s hop-

ing it moves to more of a 60-40 split in

the coming months.

What’s holding investors back? Finding

reliable, reputable business partners

isn’t easy. In the energy sector, the bid-

ding process has been run by the state-

owned Myanma Oil and Gas Enterprise

(MOGE), whose non-transparent finan-

cials have long fueled suspicions that it

serves as a slush fund for the regime, at

the expense of the nation’s citizens. Suu

Kyi and Western human rights activists

urged multinationals not to do business

with MOGE for those reasons. The bid-

ding rounds were postponed from 2012

to 2013 after some global oil companies

expressed concern about possible corrup-

tion in the process, and the government

said it took extra steps to ensure transpar-

ency at each step.

Many potential partners in other

sectors are on the U.S. Treasury

Department’s blacklist of Specially

Designated Nationals (SDN) with whom

U.S. citizens are barred from doing busi-

ness. These are individuals or organiza-

tions that have been involved in activities

deemed illegal by the U.S., such as arms

deals with North Korea or drug traf-

ficking—Myanmar is the second-larg-

est source of heroin in the world after

Afghanistan. Some government officials

formerly on the SDN list have been

removed, but many of their cronies in

the country’s business sector are still

blacklisted. The potential penalties for

working with them are stiff: up to a $1

million in fines and 20 years in prison.

“The sanctions for U.S. investors in

particular are still very much an issue and

something [investors] need to be aware of

and careful in how they approach things,”

Hughes says. “That is very high on their

list of concerns when they’re looking at

Myanmar.”

Makinson says SDNs often hide

behind relatives and front companies.

Just the investigations necessary to ferret

them out have provided a stream of work.

“You have to know who works with who

and who has relationships with who,” he

says. “It’s quite complex.”

And just because a potential business

partner isn’t on the SDN list doesn’t

mean he or she won’t raise anticorruption

compliance issues.

Robert Ashworth, Asia managing

partner of Freshfields, which covers

Myanmar out of its Hong Kong, Tokyo

and Hanoi offices, says clients often have

to educate their potential Myanmar part-

ners about their responsibilities under

the U.S. Foreign Corrupt Practices Act

or the U.K. Bribery Act.

“It all turns on finding the right part-

ner,” he says. “Whether there’s enough to

satisfy investor appetite, time will tell.”

Takeshi Mukawa, a partner at Mori

Hamada Matsumoto in Singapore,

says anticorruption compliance is a para-

mount concern for his clients, and they

let their Myanmar business partners

know that. “If they say no, we will not

make investment,” he says. “But normally

they say yes.”

After they find suitable partners,

potential investors must still confront

Myanmar’s antiquated legal system.

British rule bequeathed the country with

a common law legal system, but it fell out

of use during the dictatorship. Most of

the laws on the books are long outdated,

such as the companies law from 1914

and the arbitration law from 1944. In an

effort to accommodate foreign investors,

Myanmar’s parliament has been racing

to pass new legislation. A foreign invest-

ment law went into effect early last year,

while a new telecommunications law was

passed last October, three months after

the country awarded licenses. “Change

has to be made one step at a time,” says

Hughes. “You don’t start with, ‘OK, how

do we have a fully functioning, perfectly

integrated legal system?’ It’s more like,

‘We need to get mobile phones in peo-

ple’s hands, what kind of laws do we need

to make around that?’”

Working with clients in such condi-

tions is “almost advising in the dark,” says

Krishna Ramachandra, Yangon manag-

ing partner of Duane Morris Selvam.

He notes that drafts of the telecom law

were circulated before its final pass-

ing but many questions remained unan-

swered. “We had to sound out a few

people we knew just to get a steer on how

those licenses would be awarded and

what the touch points would have been

for the government,” says Ramachandra.

Implementation of the law also remains

inconsistent. On its face, a new law may

appear to permit an activity, explains

Hughes. But actually getting authoriza-

tion can prove difficult, or at least time-

consuming. “It’s a much more dynamic

discussion that you have with the regula-

tors here than in other places,” he says.

The challenges have put off many inves-

tors. “Many people have realized over the

past two years the difficulties in this sys-

tem, whether it’s the legal system or for-

eign investment restrictions, and they’ve

given up,” says Mori Hamada’s Mukawa.

The uncertainties ahead may be

one reason why the Yangon offices

launched by international firms are all

fairly small, typically staffed by only one

partner and a couple of associates. Some

don’t even have a partner—Allen Overy

only has associates, with partners flying in

on occasion from Bangkok or Singapore.

Among those international firms that are

targeting the market from other Asian

offices are Freshfields; Milbank; Herbert

Smith Freehills; Linklaters; Clifford

Chance; and White Case.

One obstacle for firms thinking about

opening in the country is the dearth of

Myanmar-qualified lawyers—there was

little demand for them under military

rule and the universities to train them

were frequently shut down in the past

two decades to quell student dissent.

Those who managed to earn degrees and

theasianlawyer.com | July 2014 | 2726 | July 2014 | theasianlawyer.com

Myanmar maven;

cheah swee gim,

yangon director

for singapore’s

kelvin chia

Their Man in

Yangon: Baker

McKenzie’s

christopher

hughes](https://image.slidesharecdn.com/a24fbb2c-b116-4cd3-b8f5-58c9cc6becae-160818155151/85/AsianLwyr-11-320.jpg)

![Hong Kong offerings available to U.S.

institutional investors under Rule 144A

of the Securities Act. As a result, U.S.

firms have tended to get the most plum

role on Hong Kong IPOs—drafting the

prospectus.

For many of the Wall Street firms,

it wasn’t worth competing for the less

lucrative Hong Kong piece against the

top London firms, which had long prac-

ticed local law in the former British

colony. Thus, on many of the biggest

deals for Chinese companies, a U.S. firm

usually worked in tandem with a Magic

Circle firm advising on Hong Kong law.

For instance, on both the $21.9 billion

IPO of Industrial and Commercial Bank

of China in 2006 and the $22.1 billion

IPO of Agricultural Bank of China in

2010, Davis Polk advised the issuer along

with Freshfields Bruckhaus Deringer.

From roughly 2000 on, some U.S.

firms—such as Skadden, Arps, Slate,

Meagher Flom; Paul Hastings; and

Sidley Austin—made the move into

Hong Kong law, but others remained

comfortable with the division of labor

with U.K. firms. After all, moving into

Hong Kong law would require the hiring

of lateral partners. Along with some of its

New York peer firms, including Simpson

Thacher and Cleary Gottlieb Steen

Hamilton, Davis Polk has lockstep com-

pensation, in which partners are paid

strictly according to seniority rather than

revenue generation. Their strong finan-

cial sector client bases make them less

dependent on rainmakers for business.

Lateral partners are generally avoided

because of the difficulty of slotting them

into the lockstep, although Davis Polk’s

healthy profits per partner—$2.9 million

in 2013—makes that calculus easier.

The Magic Circle firms are lockstep

too, but their early focus on going global

has accustomed them to the necessity

of lateral hiring. British firms have also

prided themselves on taking a more stra-

tegic view of overseas markets and their

often challenging economics; many have

different pay scales to help account for

the lower fees. New York firms, hailing

from the most lucrative legal market in

the world, have tended to worry much

more about the dilutive impact of inter-

national expansion. Cravath, Swaine

Moore, famously closed its Hong Kong

office in 2003 because the firm couldn’t

earn the same kinds of margins on work

there as it could back home. Others,

such as Paul, Weiss, Rifkind, Wharton

Garrison and Debevoise Plimpton,

have deliberately kept their offices in the

region small, with two and three partners

in Hong Kong, respectively.

But while cultural concerns and short-

term economics weighed against launch-

ing a Hong Kong law practice, Davis Polk

partners began to grow concerned that

failing to do so could cause them to lose

all they had built in the market.

One of Davis Polk’s major goals in

Hong Kong (and London) is to be a lead-

er in the world’s top three financial cen-

ters in its core capital markets, MA and

financial regulatory practices. It also has

a goal specific to Hong Kong: to become

a go-to firm for China’s rising corpora-

tions and banks, just as it is for America’s.

“There’s no other place in the world

where there’s an opportunity to develop

new relationships with clients that may

become global players,” says Barron.

By the mid-2000s, a dozen years after

opening in Hong Kong, Davis Polk had

racked up an impressive record advising

those kinds of companies on big transac-

tions. Barron credits the fact that the

firm was able to attract a critical mass of

Chinese-speaking U.S. associates in the

first half of the decade. Some, including

James Lin and Miranda So in Hong Kong

and Li He in Beijing, eventually became

partners.

By the second half of the decade

though, the firm’s progress seemed in

jeopardy. Large Chinese state-owned

enterprises had stopped listing in the

U.S., put off by Sarbanes-Oxley and other

regulatory requirements. Listing in Hong

Kong alone was becoming the norm for

Chinese companies that wanted to tap

foreign capital—but Davis Polk didn’t

want to be in a position of drafting a

Chinese company’s Hong Kong IPO pro-

spectus and then having to hand off the

client to other firms for all subsequent

work, says Barron.

“Those companies are now listed on

the Hong Kong Stock Exchange,” he

points out. “If you want to do work for

them in the future as they become global

players, are you going to be able to if you

can’t advise them on Hong Kong Stock

Exchange issues?”

The Hong Kong office’s record on big

deals helped move the needle in New

York. “[ICBC and Agricultural Bank]

were the biggest IPOs in the world—

they tend to get people’s attention,” says

Barron. “And if you tell people that the

world is moving in such a way that, if you

don’t practice Hong Kong law, you aren’t

going to be able do that kind of transac-

tion, that gets their attention.”

When Barron invited Bonnie Chan,

then senior vice president and head

of the IPO department for the Hong

Kong Stock Exchange, out for coffee to

chat about the firm’s possible plans, she

assumed that he just wanted her advice

as someone who knew the market well.

She agreed that it made a lot of sense for

the firm to launch a Hong Kong practice,

given how the competitive landscape had

been shifting.

But then he invited her again, and

again. “By the fifth or sixth time, I began

to think he wanted more than to just pick

my brain,” she recalls. “So I said, ‘Bill,

why are we having so much coffee?’”

In August 2010, the firm announced

that Chan and Dapiran, then a partner

theasianlawyer.com | July 2014 | 3332 | July 2014 | theasianlawyer.com

into a deep freeze in the second half of

2011—just as Davis Polk had embarked

on major expansions in the Asian finan-

cial capital, launching a local law practice

for the first time. The market began to

turn around toward the end of 2013, but,

as of this writing, the failed IPO of meat

processor WH Group in April had raised

fears of a renewed slowdown.

The downturn put the brakes on other

firms’ plans for growth in the region—

but not Davis Polk’s. Since 2009, the

firm has more than tripled the size of

its Hong Kong office, to 89 lawyers from

26. Hong Kong is the 810-lawyer firm’s

largest overseas office now by far and one

of the largest offices of any U.S. firm in

Hong Kong, starting to approach the his-

torically larger offices of the Magic Circle

in size. The scale of the expansion has

surprised many in the market, especially

given Davis Polk’s conservative reputa-

tion; the firm, which has long avoided the

recruitment of lateral partners, added

five partners in Hong Kong in the space

of four years.

By all accounts, the firm’s partners,

both lateral and homegrown, are an

exceptionally strong team. Among Davis

Polk’s standouts are office head and high-

yield bond specialist William Barron,

Hong Kong IPO lawyers Bonnie Chan

and Antony Dapiran, U.S. capital markets

partner James Lin, MA stars Kirtee

Kapoor and Paul Chow, and financial

regulatory litigator Martin Rogers.

The risk is that many clients in China

will still settle for less. Top-tier New York

firms that can command super-premium

fees back home have long been frustrated

by their inability to get better pricing for

their work in Asia. That’s a major factor

in why they’ve limited their footprints in

the market to date.

With its expansion, Davis Polk has

clearly broken with that thinking. As

Chinese companies become global play-

ers, the reasoning goes, they will do more

complex deals for which they will be

wiling to pay higher fees. Davis Polk has

primed itself to be the first firm they call.

Now, it just needs some good luck.

Barron and Reid downplay the

scale of Davis Polk’s expansion. Reid

says it’s comparable to the English law

practice the firm launched in London in

2012, also with a number of high-profile

lateral partners. Davis Polk’s Hong Kong

office is still substantially smaller than

those of Magic Circle firms Clifford

Chance and Linklaters, which respec-

tively count 154 and 150 lawyers—and

Barron points out that those firms also

have offices in Singapore, Shanghai and

Seoul. Davis Polk has a 17-lawyer Beijing

office led by MA partner Howard

Zhang to share the load on China work

but covers Southeast Asia, India and

Korea out of Hong Kong.

Still, among Davis Polk’s major U.S.

competitors, Simpson Thacher Bartlett

and Sullivan Cromwell each have fewer

than half the lawyers that Davis Polk has

in Hong Kong, although those firms

expanded into Hong Kong law practice at

around the same time. Kirkland Ellis,

which recruited eight lateral partners in

Hong Kong in one big push in 2011, now

counts 46 lawyers there.

All of those firms previously only prac-

ticed U.S. law in the market. Until rela-

tively recently, there was little pressing

reason to do otherwise. When Chinese

companies started raising overseas capi-

tal in the late 1990s and early 2000s,

they mostly sought it in the U.S., either

by actually listing on the New York Stock

Exchange or Nasdaq or making their

Cultural concerns and short-term economics weighed

against launching a Hong Kong practice. But partners grew

concerned about the consequences of doing nothing.

Davis Polk’s William Barron (left) recruited capital markets partner

Bonnie Chan (middle) from the Hong Kong Stock Exchange, while

corporate partner Miranda So came up through the ranks.](https://image.slidesharecdn.com/a24fbb2c-b116-4cd3-b8f5-58c9cc6becae-160818155151/85/AsianLwyr-14-320.jpg)

![at Freshfields, would be first on board

in Davis Polk’s Hong Kong law practice,

both focusing on capital markets. Barron

says that the two were exactly the kind of

partners the firm was looking for: highly

respected for their skill and experience

but not the type of egotistical “stars”

the firm feared would clash with its

culture. Chan had a background as an

exchange officer and as former head of

legal for Morgan Stanley’s Asia invest-

ment banking division. Dapiran, a fluent

Mandarin speaker, had worked alongside

Davis Polk on the massive ICBC and

Agricultural Bank IPOs.

A few months later, Davis Polk

announced another incoming Hong

Kong partner, MA specialist Paul Chow

from Linklaters. Chow had headed the

Magic Circle’s Beijing office, where he

led the team advising state-owned China

Telecom on its $16 billion acquisition in

2008 of a wireless network from another

telecom state-owned enterprise.

A Hong Kong-based senior in-house

counsel with a major U.S. investment

bank says the quality of Davis Polk’s Hong

Kong law hires stood out. “They were very

thoughtful about it,” he says. “They looked

around at the market and asked ‘Who can

get us above the rest of the pack?’ and

they had the foresight to pick Bonnie,

Antony and Paul.” Chan’s stock exchange

background set her apart, he says: “Would

you rather have that or just another law

firm partner?”

Over the next few months, Davis Polk’s

biggest New York competitors quickly

followed suit, snatching leading Hong

Kong partners from the Magic Circle

and other British firms. Cleary brought

aboard Freeman Chan from what is now

Norton Rose Fulbright; Simpson Thacher

hired Celia Lam and Christopher Wong

from Linklaters and Freshfields, respec-

tively; and Sullivan Cromwell wel-

comed Kai Ian Ng and Gwen Wong, both

from Freshfields. Kirkland Ellis made

a splash in August 2011 with its hiring of

eight Hong Kong partners from Skadden,

Latham Watkins and Allen Overy.

But almost as soon as all the firms had

their people in place, the bottom fell out

of the Hong Kong IPO market. In late

2011, IPO activity slid on concerns over

China’s overheated property market and

a host of other structural issues in the

Chinese economy. At the same time,

IPOs for Chinese companies in the U.S.

practically came to a halt as investors

digested claims of accounting fraud at

Chinese companies that had listed in the

U.S. through reverse mergers, the prac-

tice of acquiring U.S. companies solely to

acquire their listing.

Barron says that Davis Polk’s Hong

Kong office remained profitable during

the downturn, with the rise in bond

offerings somewhat making up for the

drop in equity capital markets activity.

And the firm got a good share of the

listings that did take place. Last year,

Davis Polk topped Bloomberg’s league

table of Asia-Pacific IPO advisors on

the issuer side by value, after ranking

second in 2012. MA activity helped

too. In 2012 and 2013, the firm’s Beijing

and Hong Kong partners played a major

role counseling China National Offshore

Oil Corp. in its $15 billion acquisition of

Canadian energy company Nexen Inc.,

the largest ever overseas MA deal by

a Chinese company. Davis Polk also

advised private Chinese conglomerate

Dalian Wanda Group on its 2012 acqui-

sition of U.S. movie theatre chain AMC

Entertainment Holdings Inc. for $2.6 bil-

lion, one of the largest Chinese outbound

deals in the consumer sector.

And the firm hadn’t finished growing.

Last year, Davis Polk brought aboard

partners Martin Rogers and James

Wadham from Clifford Chance to start

a Hong Kong litigation practice. Barron

says Davis Polk would not have launched

that practice if Rogers, who had led

Clifford Chance’s Asia disputes prac-

tice, and Wadham had not joined the

firm. The Asia disputes team has already

grown to 22 lawyers since they did.

There’s no question the firm has

been busy lately. Rogers and Wadham

have advised several other banks on

their Asia hiring practices follow-

ing the U.S. Securities and Exchange

Commission’s probe into JPMorgan

Chase Co.’s recruitment of the chil-

dren of high-ranking Chinese officials,

the so-called princelings, to try to win

deals. Last year, among other deals,

Chan and Dapiran advised on the $2.5

billion Hong Kong IPO of Cinda Asset

Management, the Chinese “bad bank”

meant to absorb nonperforming loans

from other state-owned financial institu-

tions. They also worked on the $1.1 bil-

lion listing of Chinese brokerage China

Galaxy Securities Co. Ltd., and Dapiran

advised on the $3 billion offering of

China Everbright Bank. Chow recently

represented Chinese department store

chain Intime Retail Group Co. Ltd. on a

$692 million investment by e-commerce

giant Alibaba Group Holding Ltd.

Alibaba ruled Davis Polk out as its

IPO counsel because of the firm’s previ-

ous work for its competitors. Simpson

Thacher got that prized assignment

instead. But Davis Polk has advised

Alibaba archrival Tencent Holdings

Ltd. on a series of big deals and, in

May, served as underwriter’s counsel on

the $1.78 billion IPO of online retailer

JD.com, the biggest Chinese listing in

the U.S. ever, at least until Alibaba bows

later this year.

A partner at a Magic Circle firm thinks

Davis Polk’s Hong Kong partners are

excellent across the board but isn’t sure

that will ultimately translate into insti-

tutional relationships. “I sometimes just

feel Asian clients are less loyal,” he says.

A major reason for that, he explains,

is that large Asian companies, a major-

ity of which are state-owned or closely

held, don’t face the kind of risks on

deals that U.S. corporations do. Though

regulators in the region like Hong Kong’s

Securities and Futures Commission are

becoming more active, they still lack the

resources and range of penalties avail-

able to the U.S. Securities and Exchange

Commission. Activist investors are even

less of a concern. “You don’t have activist

shareholders,” says Lin. “You don’t have

Carl Icahns who can come in. The Hong

Kong corporate world is very different

that way.”

In the absence of such risks, it’s hard

for many clients to see paying some firms

far more than others. “It’s an incred-

ibly fee-conscious environment,” says

the in-house investment banking lawyer.

“[Davis Polk] has a higher-quality prod-

uct and reasonably wants to charge a

higher fee, but there are reputable firms

that can get the deal done, maybe not

to the very highest standard, but good

enough. There are lots and lots of deals

where the issuer dictates to the under-

writing syndicate who to go with, mainly

based on price.”

Back home, Davis Polk rarely competes

with firms that are merely good enough.

It and its Wall Street peers can charge

far more than other Am Law 100 firms

on the biggest deals because clients don’t

want to take a risk on a firm with less

experience. But it’s different when the

risk factor is lower. Hogan Lovells,Sidley

Austin and Reed Smith are not usually

the firms that Davis Polk goes up against

for capital markets assignments in the

U.S., but Chan found those were exactly

the firms she was competing with in a

recent pitch meeting in Beijing for an

issuer’s counsel role.

“I’m sure that, if you were in New

York, going for a bake-off, you wouldn’t

see that lineup.” she says, “and there are

times when we don’t get it and it might be

hard for an outsider to understand why.

But it makes life more interesting.”

Many firms in Asia deal with price

competition in the region by paying

local lawyers less. But Davis Polk pays

all its Hong Kong associates the same as

their New York counterparts. Otherwise,

says Barron, “it would create divisions

in our office that wouldn’t be healthy

for our culture.” However, its leverage

in Hong Kong—seven nonpartners for

every partner—far outstrips its firmwide

leverage of approximately four nonpart-

ners to every partner. One associate in

Hong Kong says he doesn’t see the local

ratio shifting soon. “It’s a New York pric-

ing model and a New York profitability

model imposed in Asia, where you can’t

get the same kind of revenue on deals, so

you have to chase more work to generate

it,” the associate says. “You need to have

a more highly leveraged team.”

Reid and Barron say the firm is in the

region for the long term, and there’s little

doubt that a firm as profitable as Davis

Polk can afford to invest in the future,

though preferably one in which its strong

platform in the region begins to allow it

to charge more. “With the quality of the

team we have,” Reid predicts confidently,

“the price pressure will get better.”

Given how important China has

become to the global economy, Barron

is also confident the firm has made the

right move, and he doesn’t think Davis

Polk could have done it any other way.

“It was actually an obvious and natural

progression the way the world has gone,”

he says. “And, once we decided were

going to do it, we weren’t going to do it in

a half-hearted way.”

theasianlawyer.com | July 2014 | 3534 | July 2014 | theasianlawyer.com

Capital markets partner James Lin says that activist

shareholders aren’t a risk in Hong Kong deals:

“You don’t have Carl Icahns who can come in.”

Many firms deal with price competition in Asia by paying local

lawyers less. But Davis Polk pays its Hong Kong associates the

same as their New York counterparts.](https://image.slidesharecdn.com/a24fbb2c-b116-4cd3-b8f5-58c9cc6becae-160818155151/85/AsianLwyr-15-320.jpg)