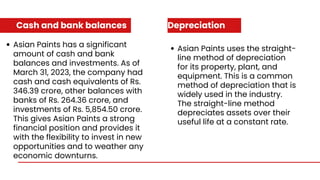

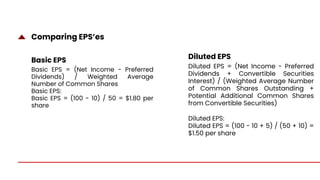

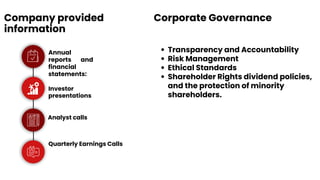

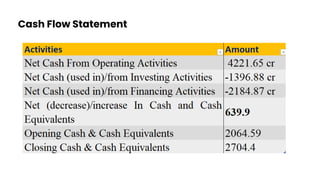

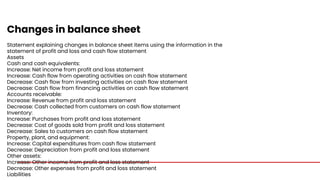

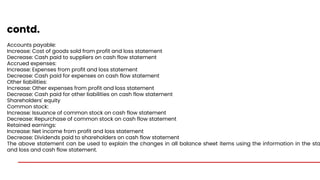

This document presents a financial statement analysis of Asian Paints conducted by MBA students for their professor. It includes an overview of Asian Paints as a leading paint company with global operations. The analysis examines Asian Paints' strong cash position, use of straight-line depreciation, calculations of basic and diluted EPS, sources of company information for analysis, and components of the cash flow statement such as operating cash flow and capital expenditures.