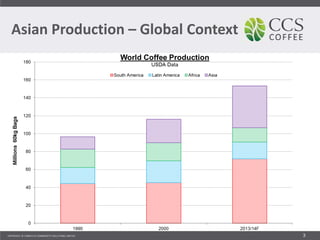

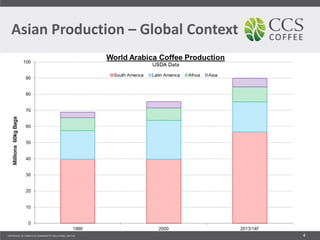

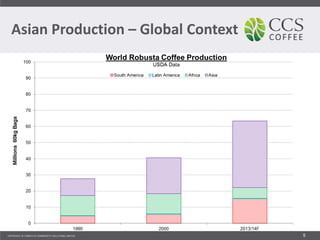

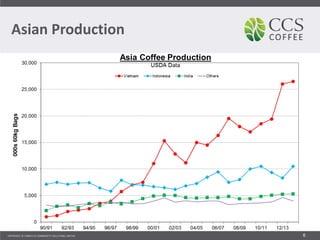

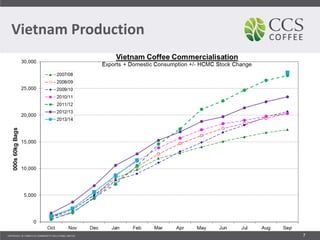

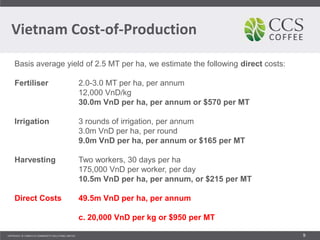

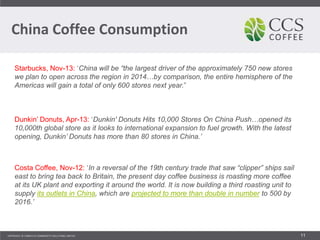

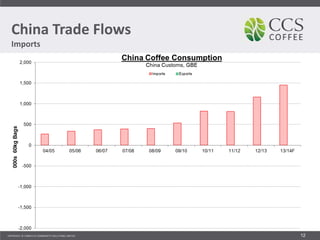

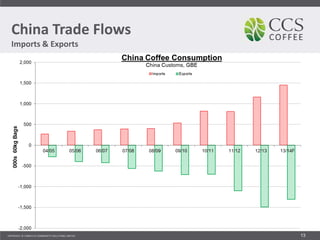

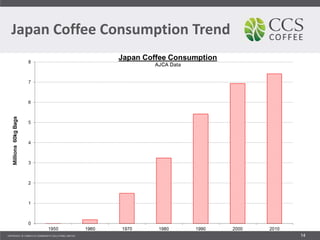

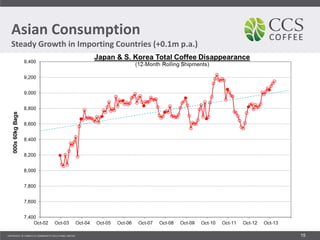

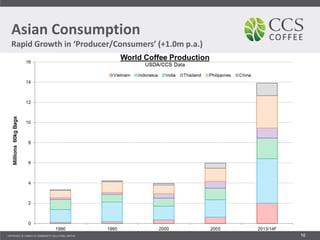

The document discusses trends in the Asian coffee market, highlighting Vietnam as a major producer and the growth potential of China as a consumer. It notes that Vietnam contributes significantly to robusta coffee exports and emphasizes the rise of 'producer/consumers' in Southeast Asia, which are growing rapidly. Additionally, the piece cautions about the concentration risks in the coffee market and the early stages of China's consumption growth compared to Japan.