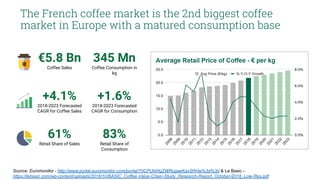

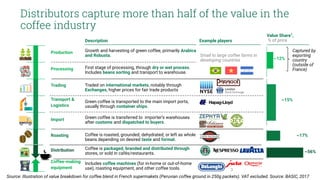

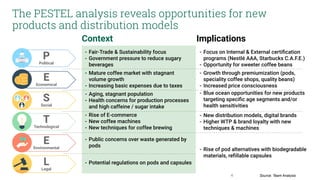

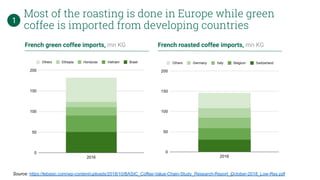

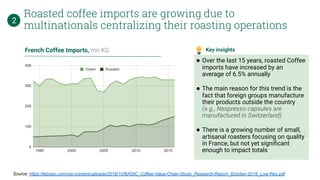

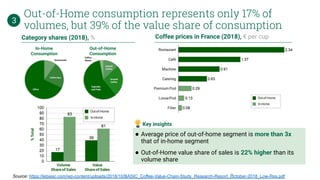

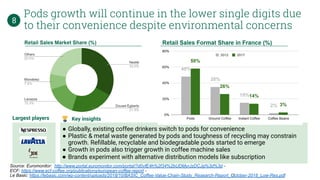

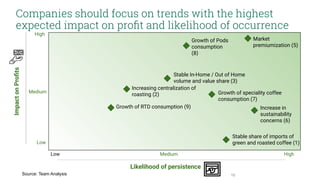

The French coffee market is the 2nd biggest in Europe with €5.8 billion in annual sales and growing at a forecasted 4.1% CAGR through 2023. Distributors capture over half of the total industry value. Major trends shaping the market include premiumization through specialty coffee and pods, sustainability certification offering price premiums, and growth of ready-to-drink coffee due to health concerns. The industry is attractive due to these trends but highly competitive with generally low barriers to entry.