The document discusses fraudulent conveyance principles used to overturn leveraged buyout (LBO) transactions. It notes that fraudulent conveyance laws exist to protect companies and creditors from transactions that extract value without providing reasonable value in return. When an LBO fails, parties may initiate litigation to avoid liens granted to lenders that financed the LBO and recover payments made to former shareholders. There are two types of fraudulent transfers - actual fraud which requires proving intent to defraud, and constructive fraud which looks at the underlying economics without requiring intent. Potential defendants in such cases include officers, directors, lenders, financial advisors, and former shareholders.

![Tribune Co. (cont’d)

In December 2010, Tribune ceded its rights to bring suits to the Committee,

which obtained permission to file a claim alleging intentional f d against

hi h bt i d i i t fil l i ll i i t ti l fraud i t

shareholders before the two-year statute of limitations expired.

– The bankruptcy court recently granted the Committee’s motion to dismiss claims

against former named shareholders who received less than $50,000 in proceeds

from the LBO.

The bankruptcy judge stayed the suit pending the completion of the Chapter

11 process, hoping that the various parties could find a way to settle the

charges.

The Committee let the statute of limitations lapse on the constructive

fraudulent conveyance claims in December 2010, which meant that

individual creditors could bring claims under state law, arguably beyond the

reach of the Section 546(e) safe harbor.

In March 2011 creditors sought authority from the bankruptcy court to bring

state law fraudulent conveyance actions.

25

Tribune Co. (cont’d)

Several parties objected to the state law fraudulent conveyance actions arguing that,

among other things:

– the debtor has exclusive authority to pursue the claims; and

– the prohibition on pursuing avoidance of transfers subject to Section 546(e) has preempted

state law and cannot be avoided by pursuing the claims in state court instead of bankruptcy

court.

In April 2011, the bankruptcy court issued an order allowing noteholders to file their

avoidance actions in state court, stating:

– “Because no state law constructive fraudulent conveyance claims against shareholders

whose stock was redeemed or purchased in connection with the [LBO] were commenced by

or on behalf of the Debtors’ estates before the expiration of the applicable statute of

limitations under 11 U.S.C. § 546(a), the Debtors’ creditors have regained the right, if any, to

prosecute their respective state law constructive fraudulent conveyance claims against [the

shareholders] to recover stock redemption/purchase payments made to such shareholders in

connection with the LBO.”

– The bankruptcy court, however, specifically stated that it was making no finding regarding the

standing of the noteholders or any creditors to assert the state fraudulent conveyance claims

or whether such claims were preempted or otherwise impacted by Section 546(e).

26](https://image.slidesharecdn.com/arnoldporterfraudulentconveyance-130324180741-phpapp02/85/Arnold-Porter-on-Fraudulent-Conveyance-18-320.jpg)

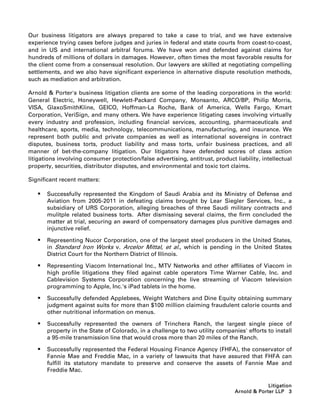

![Michael L. Bernstein

Partner Contact Information

Michael.Bernstein@aporter.com

tel: +1 202.942.5577

Michael Bernstein is chair of the Firm’s

fax: +1 202.942.5999

national bankruptcy and corporate

restructuring practice. He is consistently 555 Twelfth Street, NW

distinguished as one of the top bankruptcy Washington, DC 20004-1206

and restructuring lawyers in Washington,

DC by Chambers USA Leading Lawyers Practice Areas

for Business, which praises him as a creative and loyal Bankruptcy and Corporate

Restructuring (practice chair)

advocate whose knowledge of the Bankruptcy Code makes him

Financial Services

incredible at getting the best results for his clients’’ (2011), an

outstanding lawyer [with] fantastic analytical skills and Education

intellectual prowess’’ (2009), for being ‘‘creative and practical JD, Northwestern University

(2008), noting that he ‘‘completely understands [his client’s] School of Law, 1989

business’’ (2007), and has ‘‘an ability to assess risks in a BA, Brandeis University, 1986

meaningful way and address the tribunal in a strong and Admissions

tenacious manner’’ (2006). District of Columbia

Supreme Court of the United

He represents secured and unsecured creditors, creditors' States

committees, bondholders, investors, asset purchasers, debtors,

and other parties in a wide variety of bankruptcy and workout

matters, and in related litigation throughout the United States.

He has been involved in large bankruptcy cases, including

Chrysler, Lehman Brothers, US Airways, LandAmerica, TWA,

Adelphia, Asarco, G-1 Holdings, Mirant, Criimi Mae, Enron,

FoxMeyer Drug, Alterra Healthcare Corporation, Fruit of the

Loom and Continental Airlines, as well as many other cases

throughout the United States.

Mr. Bernstein's bankruptcy experience spans many industries,

including telecommunications, energy, real estate, finance,

mining, manufacturing, technology, retail, airline, healthcare,

and pharmaceuticals. His clients have included AOL, American

Capital, American Red Cross, Ardent Communications Creditors'

Committee, Bear Stearns, Boehringer Ingelheim, BBT, Cingular

Wireless, Criimi Mae Creditors' Committee, Dynex Bondholders

Committee, Gate Gourmet, Glaxo, Guinness Import Company,

Health Care REIT, Hilton Worldwide, Lennar Partners, Major

League Baseball, Perseus LLC, Sodexo, Texas Pacific Group, The

George Washington University, and the Washington

Corporations, among others.

arnoldporter.com](https://image.slidesharecdn.com/arnoldporterfraudulentconveyance-130324180741-phpapp02/85/Arnold-Porter-on-Fraudulent-Conveyance-27-320.jpg)