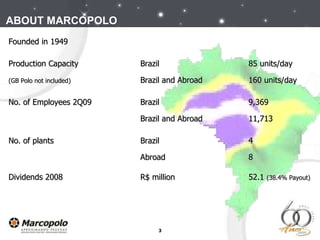

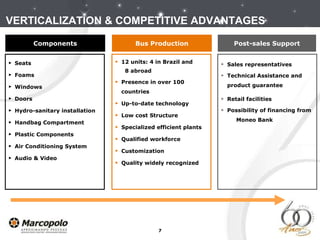

This document provides an overview of Marcopolo S.A., a Brazilian bus and coach manufacturer. Some key points:

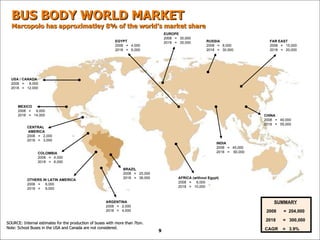

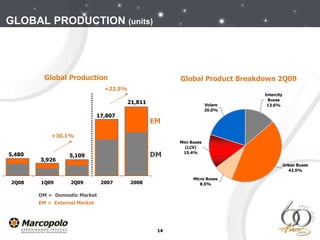

- Marcopolo has a global presence with production facilities in Brazil, Argentina, Colombia, Mexico, South Africa, China, India, and Russia.

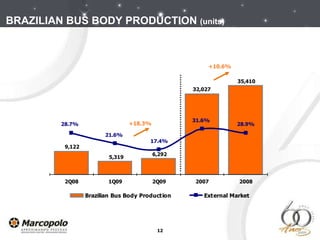

- In Brazil, Marcopolo has a 40% market share and is one of the largest bus body manufacturers in the world.

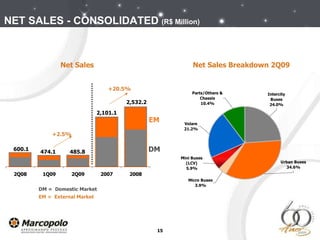

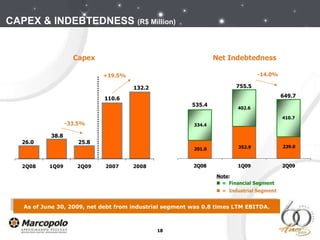

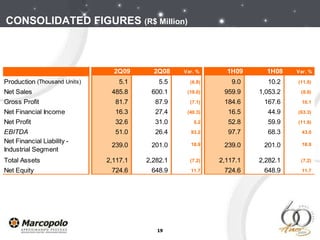

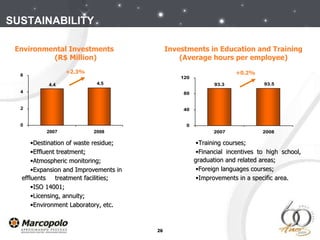

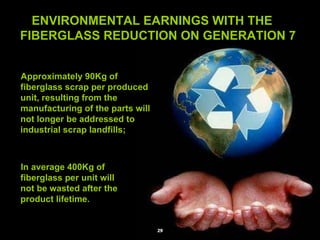

- The presentation discusses Marcopolo's financial figures, market outlook, product lines, sustainability efforts, and corporate governance practices. It provides an introduction to the company's Generation 7 bus models that aim to reduce environmental impact.

![Carlos Zignani Investor Relations Director [email_address] Phone: +55 54 2101.4115 Thiago A. Deiro Investor Relations Manager [email_address] Phone: +55 54 2101.4660 www.marcopolo.com.br/ri_eng [email_address] INVESTOR RELATIONS CONTACT](https://image.slidesharecdn.com/apresentacaoing-090914080035-phpapp02/85/Apresentacao-Ing-36-320.jpg)