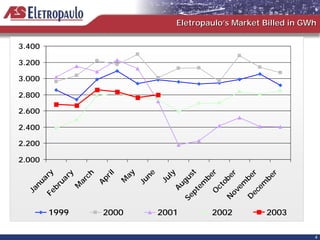

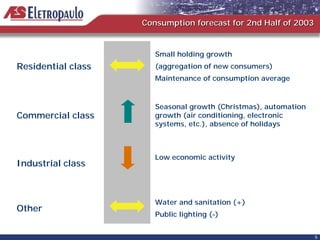

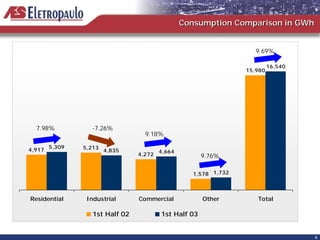

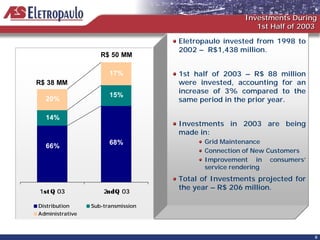

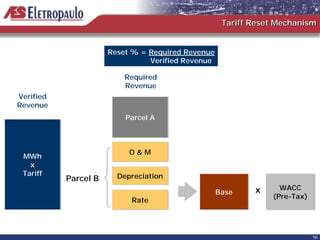

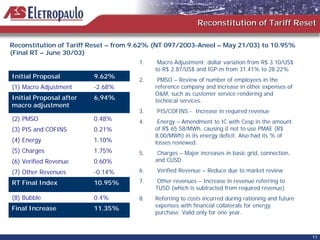

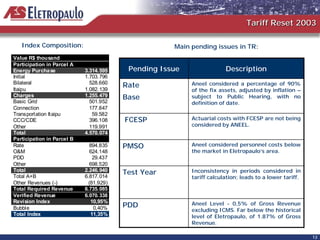

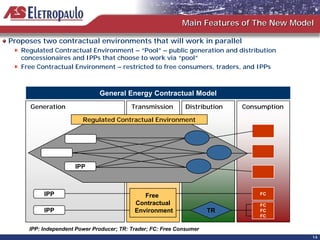

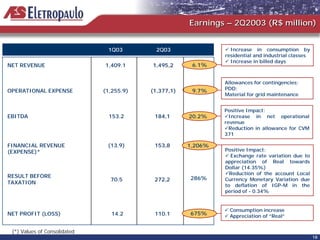

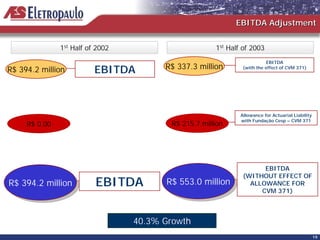

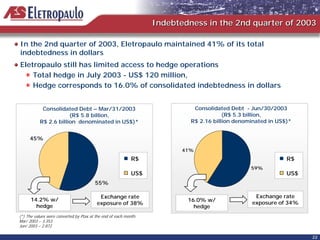

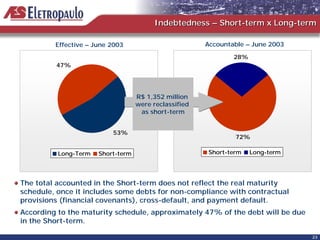

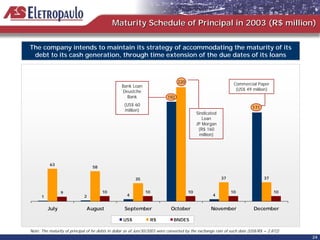

This document summarizes Eletropaulo's 2nd quarter 2003 earnings presentation. It discusses key topics like the company's market performance, investments, tariff reset process, and financial indicators. Consumption increased 9.69% compared to the prior year, with investments of R$88 million in the 1st half of 2003. The initial proposed tariff reset of 9.62% was adjusted to 10.95% after considering various factors in Eletropaulo's required revenue calculation. Key pending issues in the tariff reset included determining the asset base, actuarial costs, operating expenses, and the test year used.