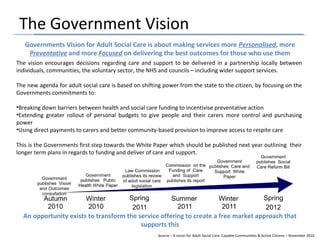

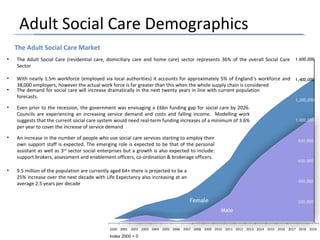

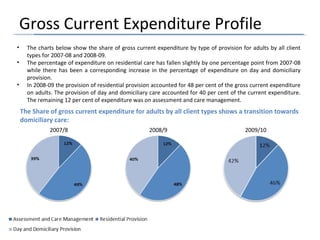

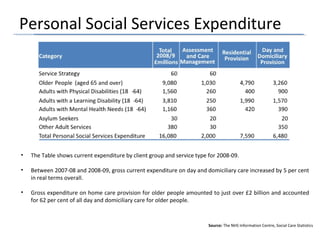

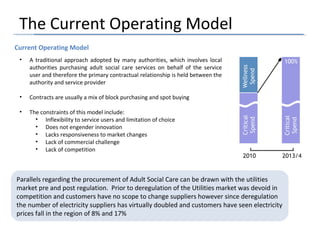

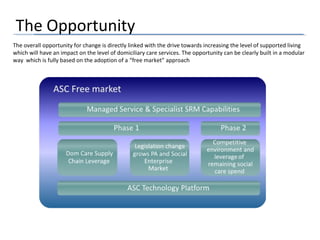

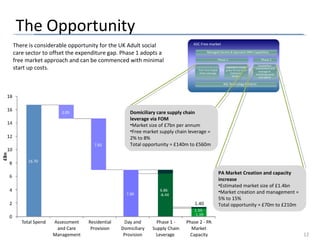

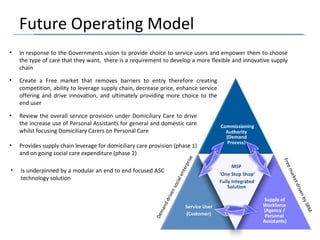

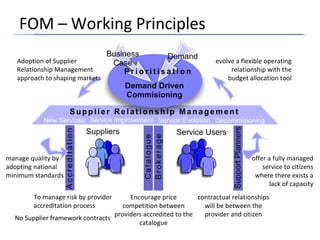

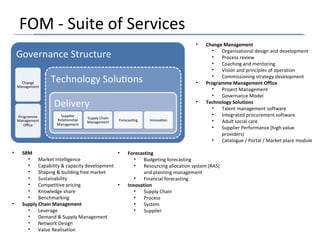

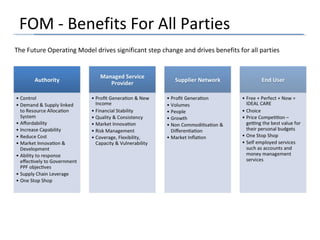

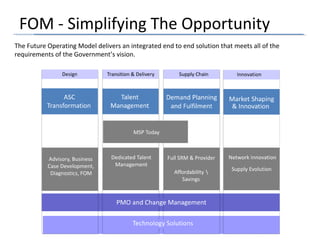

The document provides an overview of the current state of adult social care in the UK and a proposed future operating model to transform the sector. Currently, local authorities directly purchase social care services, limiting choice and innovation. The proposed model would create a free market by removing barriers to entry, increasing competition and giving citizens more control over their care. This is expected to provide supply chain leverage, decrease prices, and enhance services while giving citizens more choice.