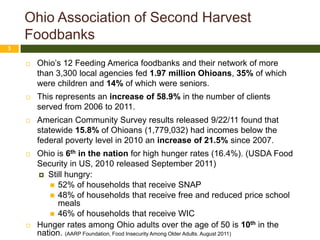

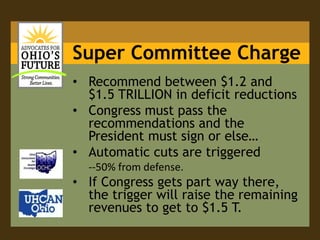

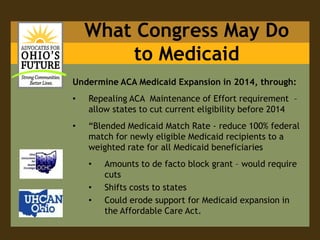

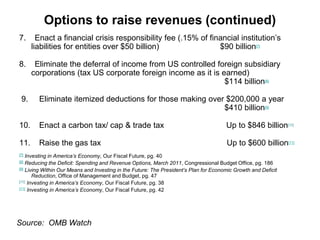

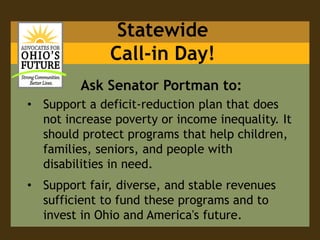

The document discusses the implications of a federal deficit reduction deal on Ohioans in need, highlighting the significant increase in hunger and poverty rates in the state, along with the vulnerabilities of various support programs such as food assistance, Medicaid, and Social Security. Key stakeholders, including advocates and organizations, emphasize the necessity of protecting benefits for vulnerable populations while proposing reforms to ensure fair revenue generation without exacerbating poverty. The document urges proactive engagement with policymakers to secure and support essential programs amid potential budget cuts.