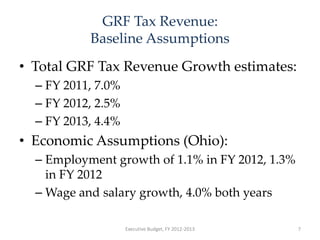

The document summarizes key aspects of Ohio's proposed FY 2012-2013 budget, including:

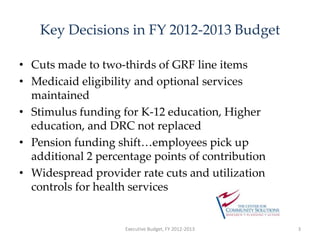

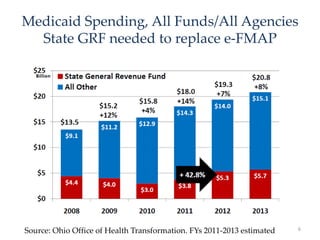

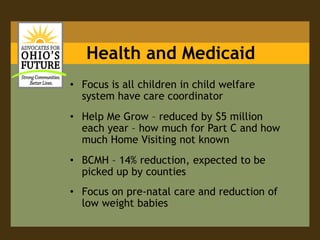

- Maintaining Medicaid eligibility but implementing rate cuts and utilization controls.

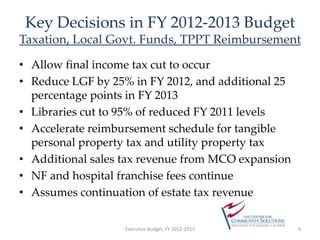

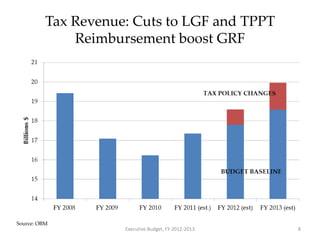

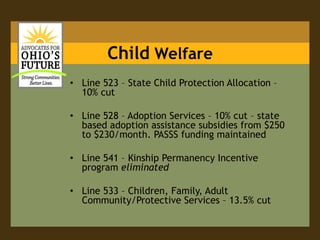

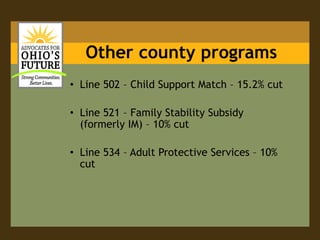

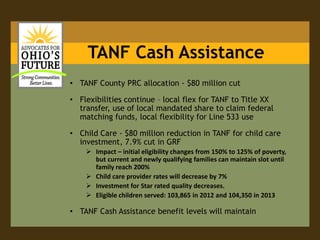

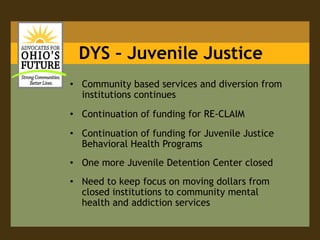

- Cuts to many state agencies and programs, including a 25% reduction to local government funds.

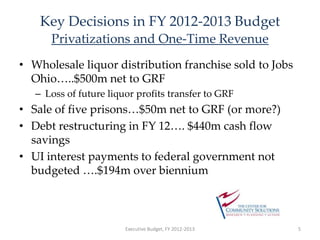

- Privatizing the wholesale liquor distribution and selling five prisons to generate one-time revenue.

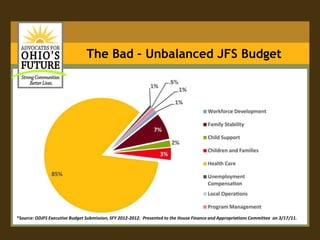

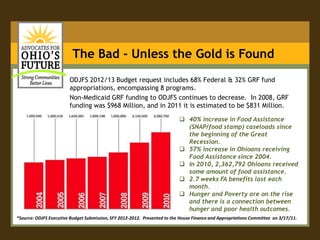

- Increases to the Job and Family Services budget are needed but reliance on federal funds introduces risk if not balanced with state funding. Overall the budget proposals are bold but could be unbalanced without additional revenue sources.