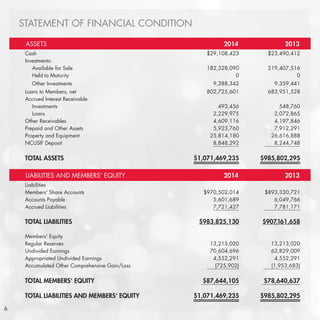

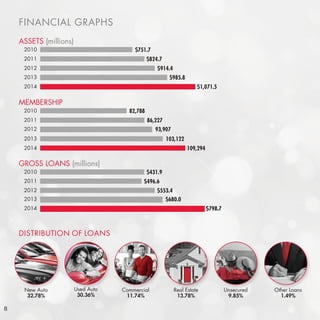

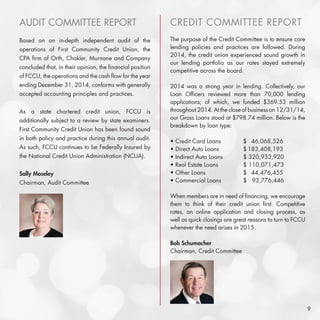

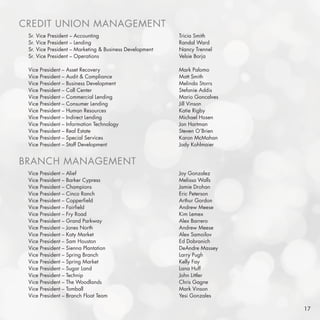

The document is the 2014 annual report for First Community Credit Union. It discusses the credit union's strong financial performance in 2014, including growth in membership, loans, and assets. It highlights initiatives like opening a new branch location and improving digital banking options. The report contains messages from the Chairman and CEO, financial statements and graphs, and summaries of the audit and credit committees. It also celebrates the credit union's 60th anniversary and provides an overview of its real estate and commercial lending services.