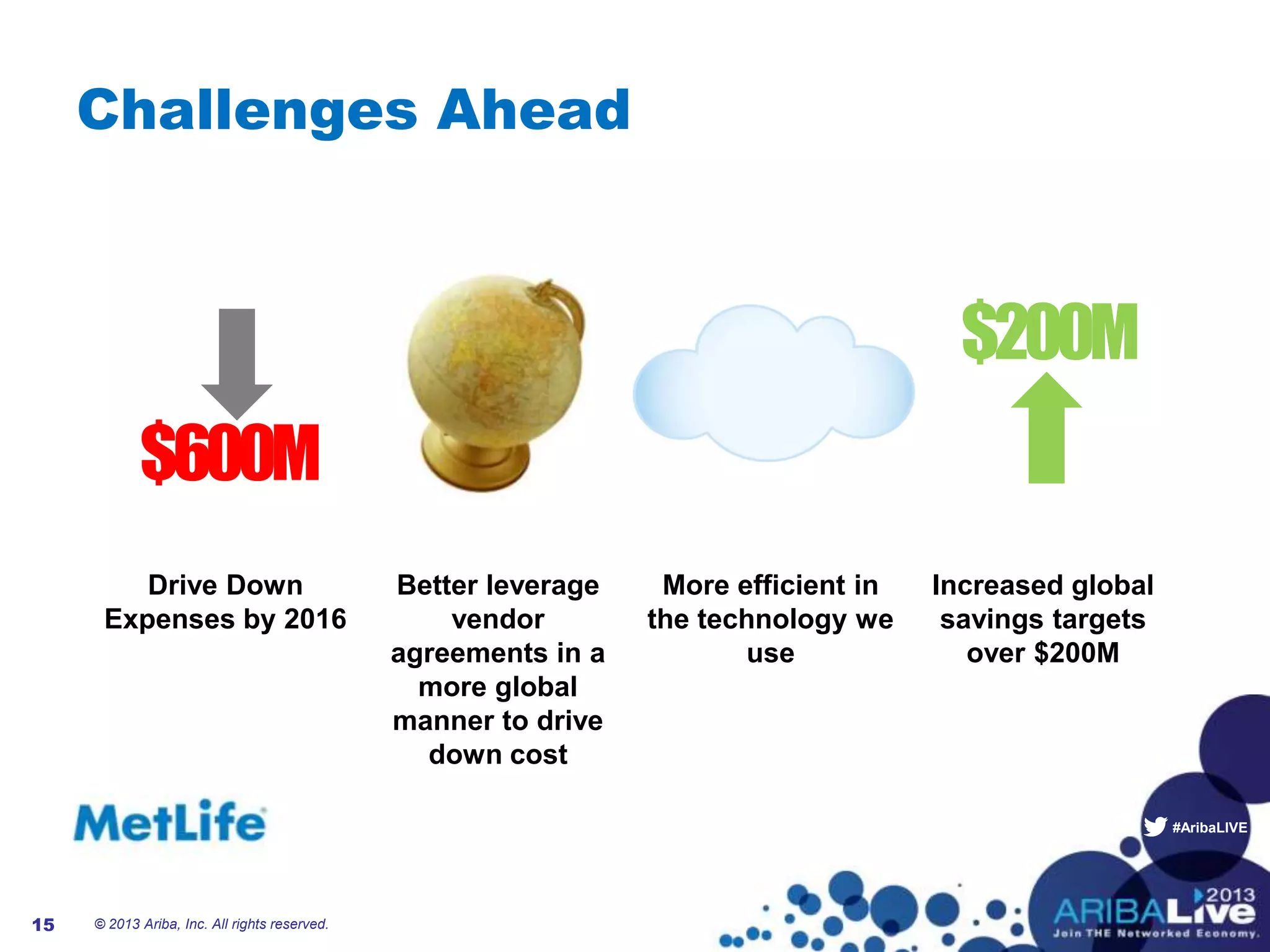

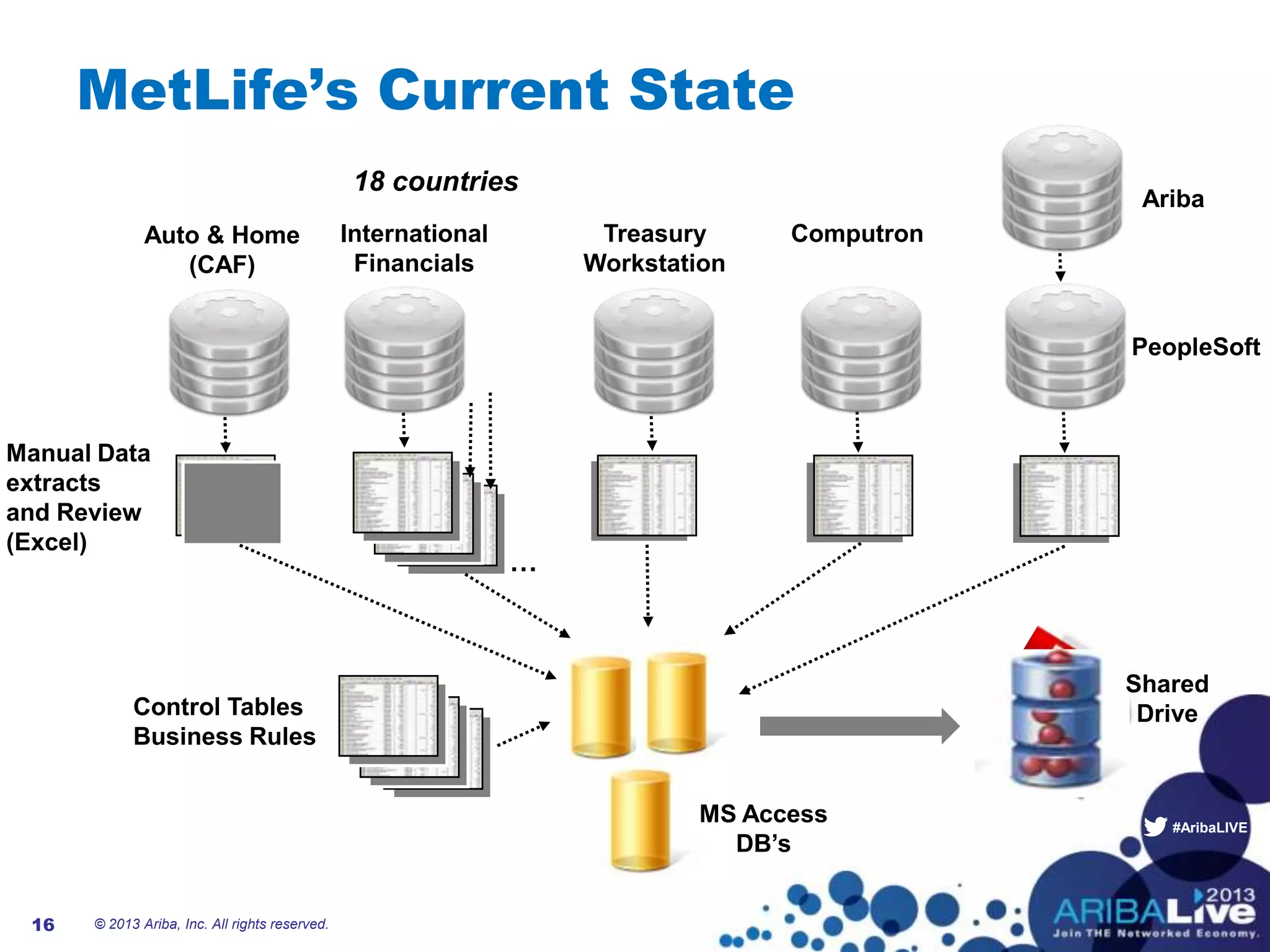

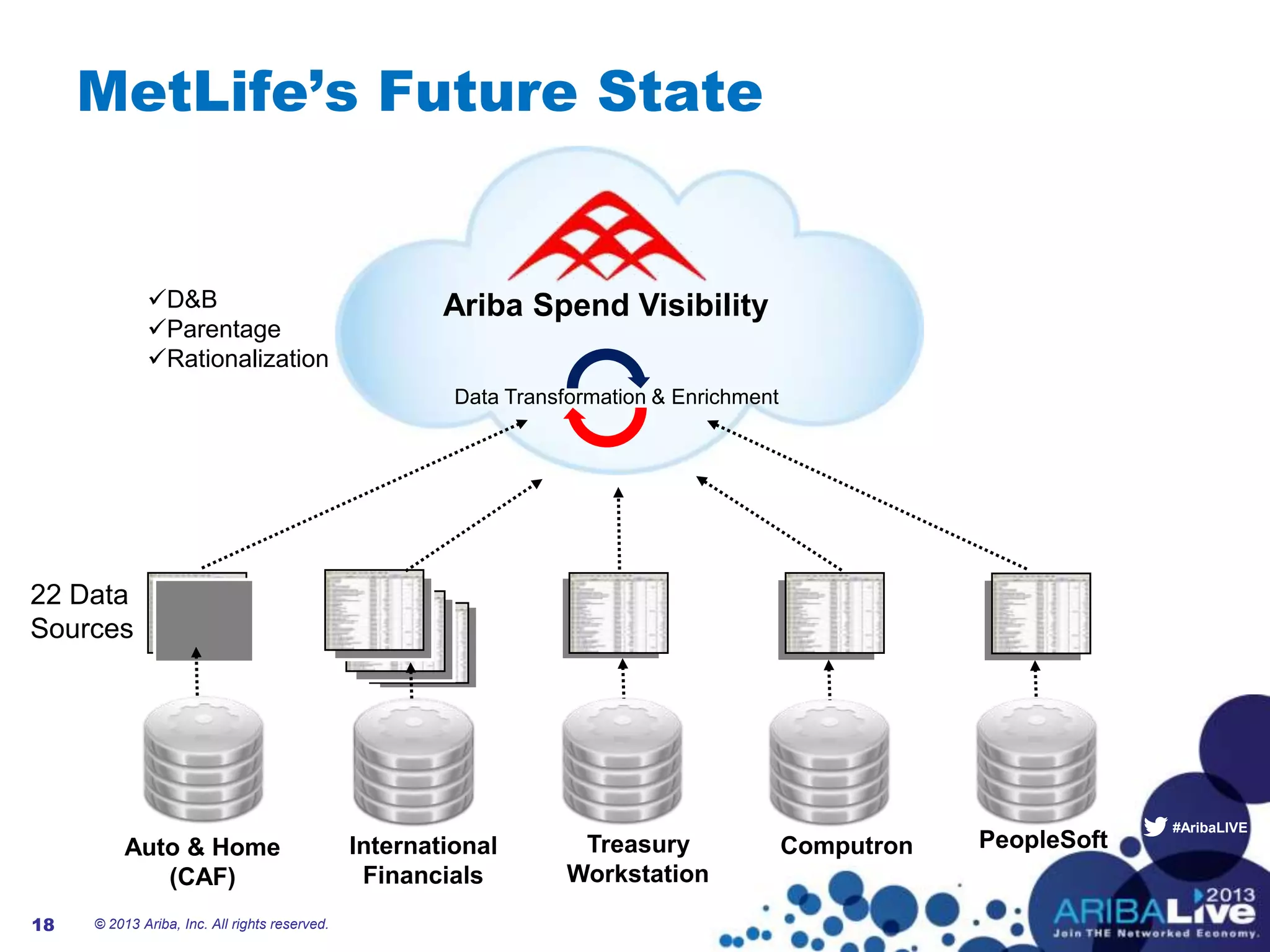

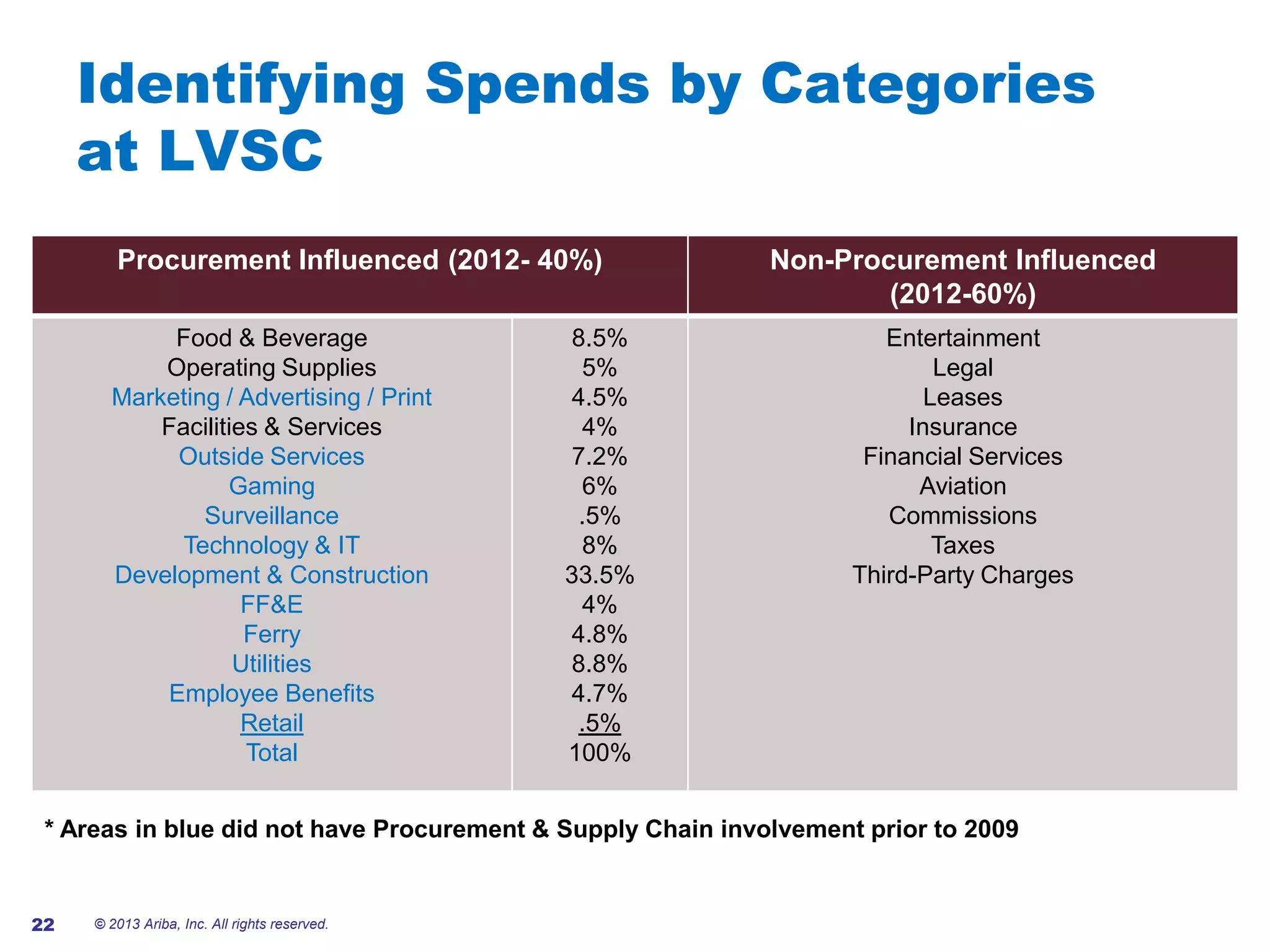

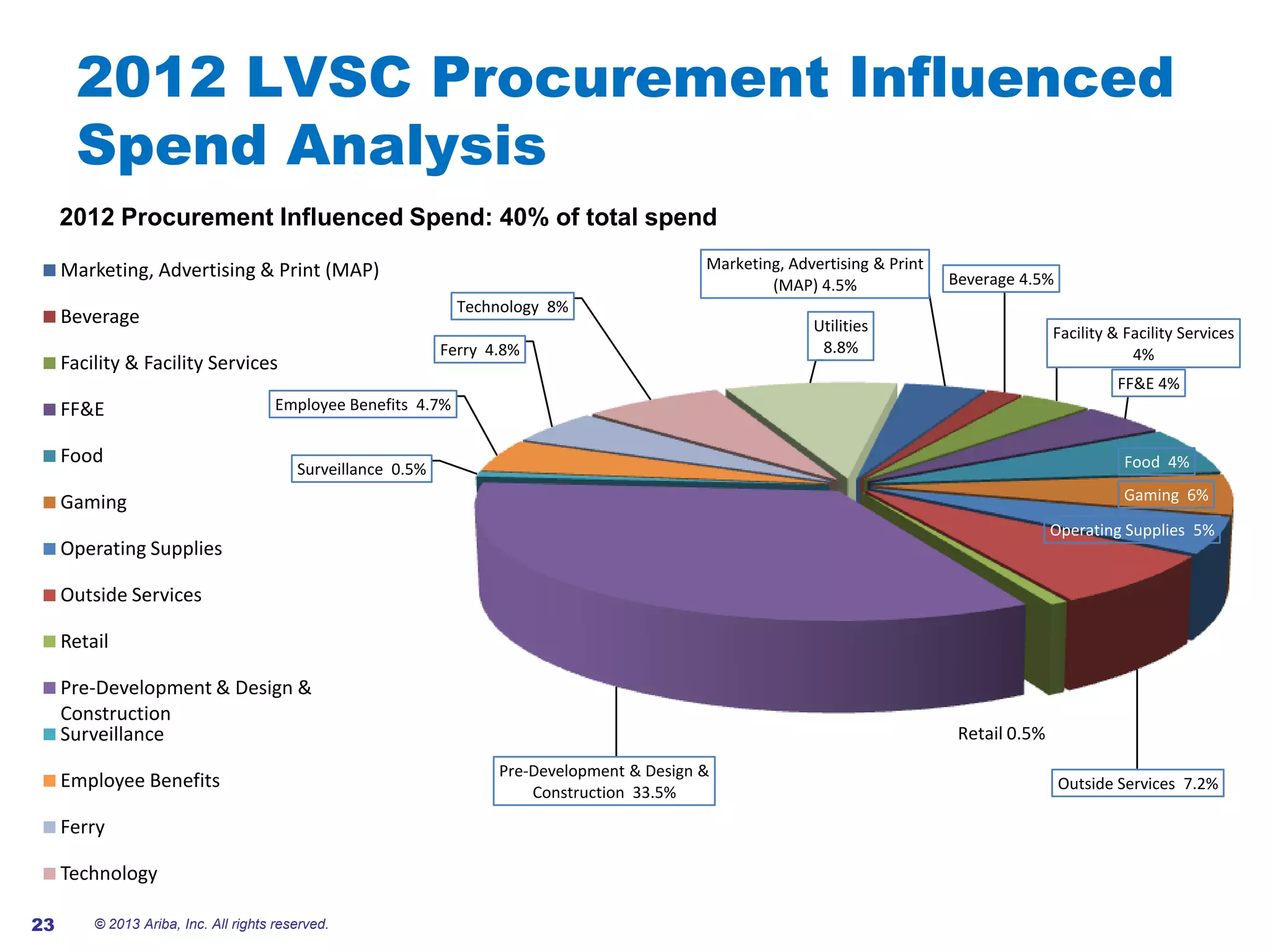

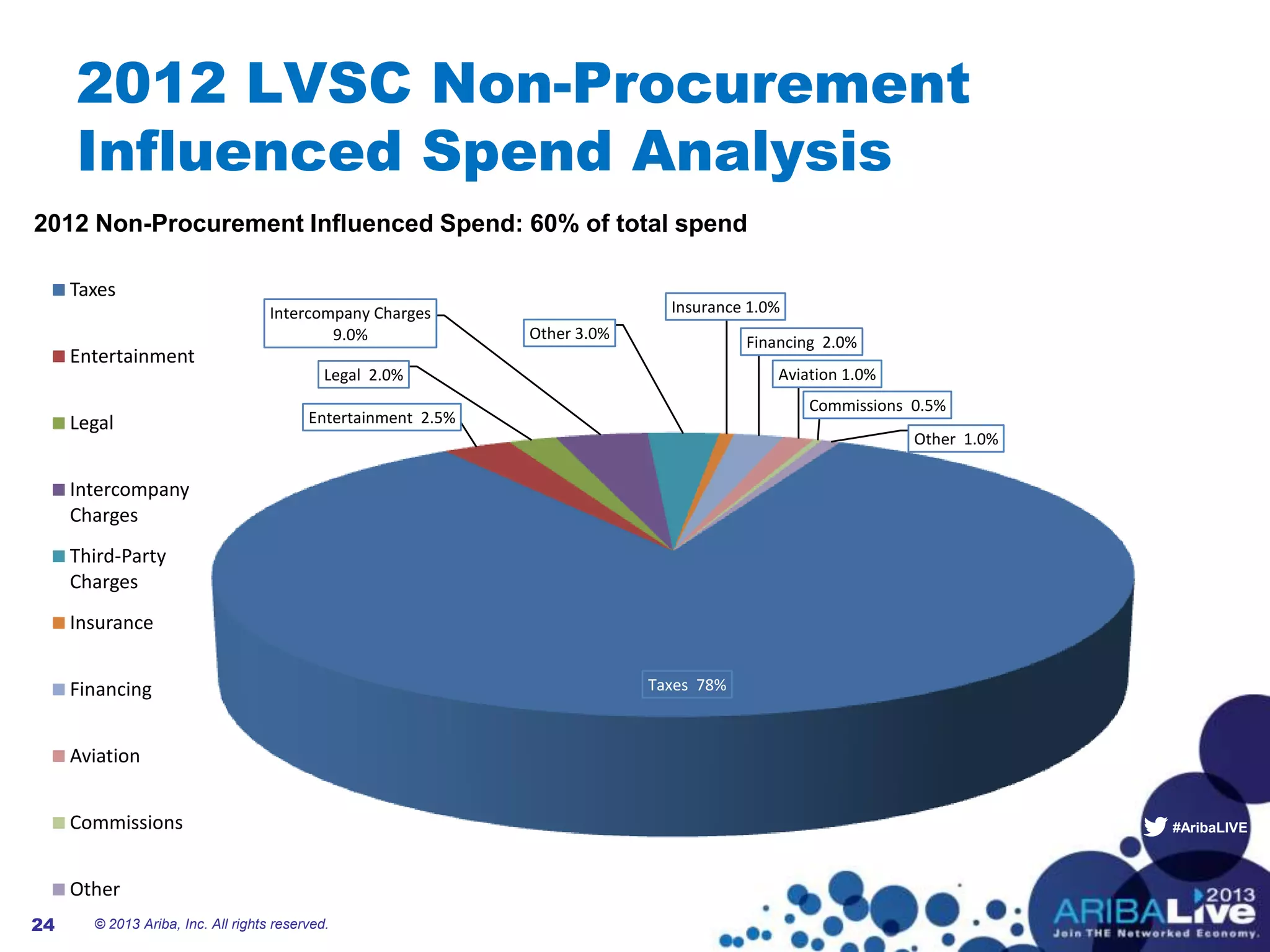

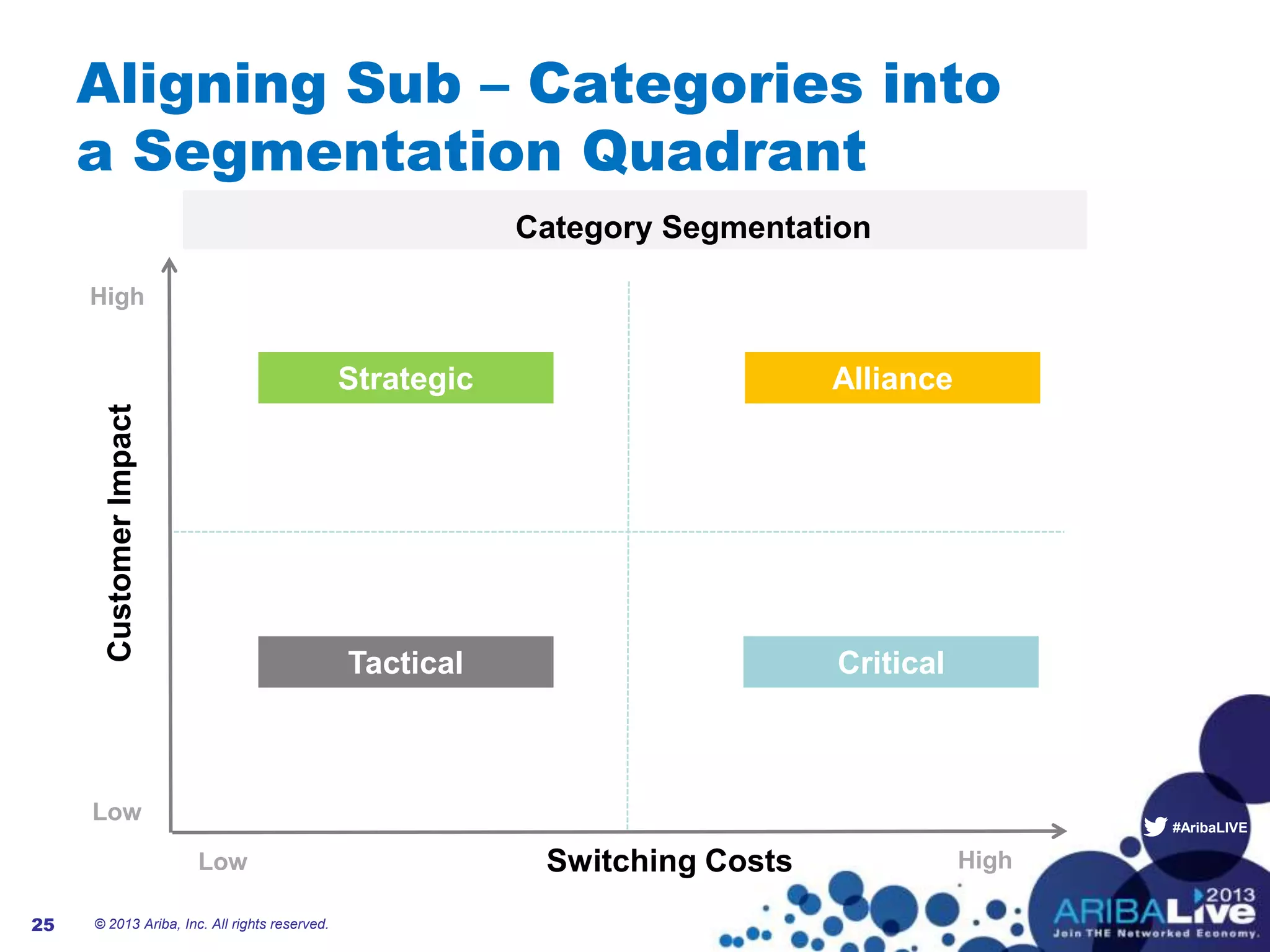

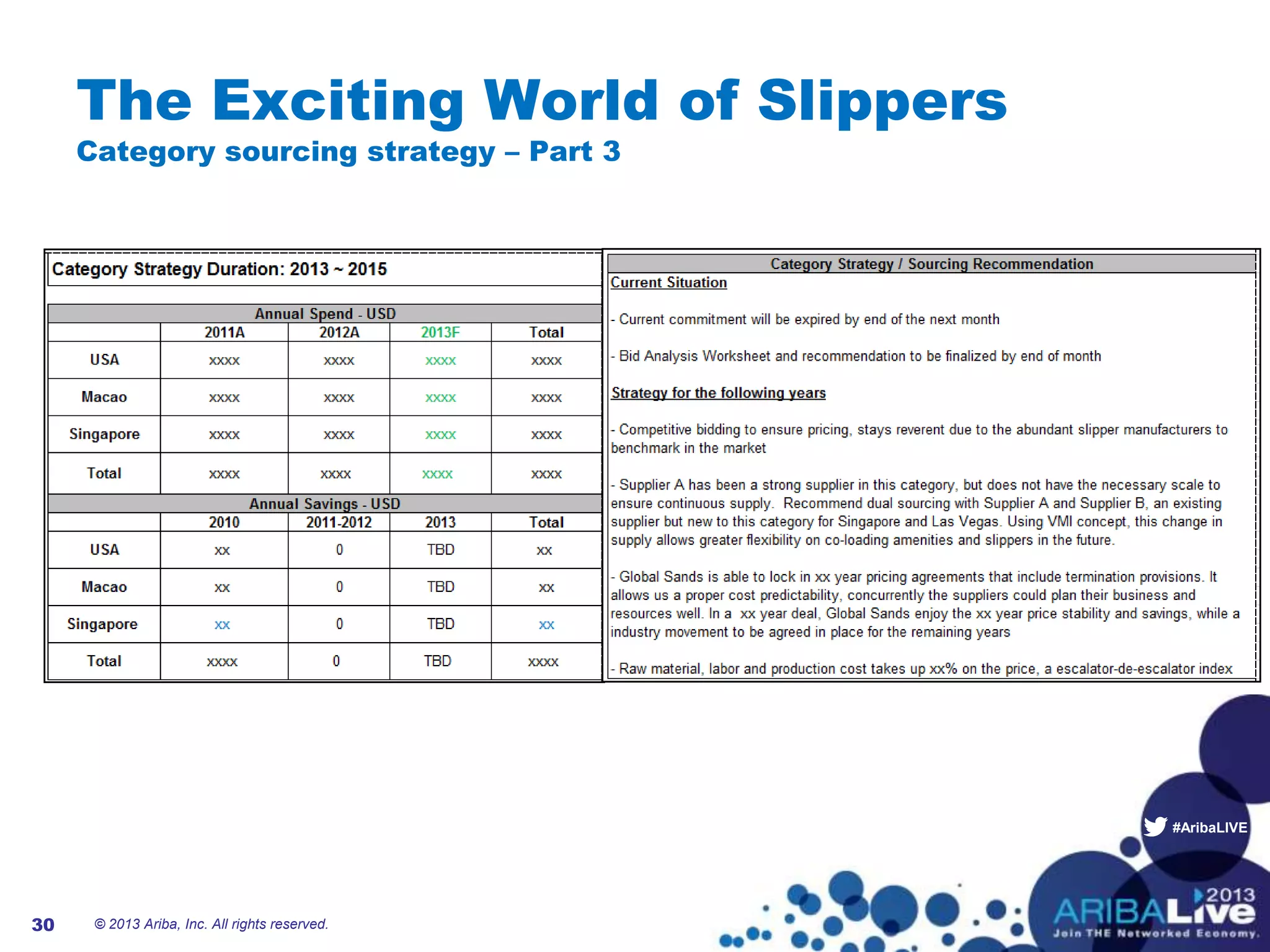

The document discusses a panel presentation on spend analysis, highlighting that global companies lost over $260 billion due to a lack of spend visibility, with only 40% having adequate insight into their spending. It includes insights from panelists from Dun & Bradstreet, MetLife, and Las Vegas Sands, focused on improving data analysis and supplier management. The importance of automating spend processes and the challenges faced in achieving comprehensive spend visibility are emphasized.